This is one of his favorites.

Posted on 05/08/2006 7:43:07 PM PDT by Leisler

ESTIMATES of the growing pile of non-performing loans (NPLs) in China appear to have caught many by surprise, especially because Beijing's efforts to clean up its rickety state-owned banks were thought to have greatly reduced NPLs and the risk of a full-blown financial crisis.

According to Ernst & Young, the accounting firm, bad loans in the Chinese financial system have reached a staggering $US911 billion ($1.18 trillion), including $US225 billion in potential future NPLs in the four largest state-owned banks.

This equals 40 per cent of gross domestic product and China has already spent the equivalent of 25-30 per cent of GDP in previous bank bail-outs.

The revelation shows that half-hearted reforms have addressed merely the symptoms of China's financial fragility. Poor business practices are blamed for NPLs but the real source is political. As long as the communist party relies on state-controlled banks to maintain an unreformed core of a command economy, Chinese banks will make more bad loans.

Systemic economic waste, bank lending practices, political patronage and the survival of a one-party state are inseparably intertwined in China. The party can no longer secure the loyalty of its 70 million members through ideological indoctrination; instead, it uses material perks and careers in government and state-owned enterprises (SOEs). That is why, after nearly 30 years of economic reform, the state still owns 56 per cent of the fixed capital stock. The unreformed core of the economy is the base of political patronage.

Government figures show that, in 2003, 5.3 million party officials held executive positions in SOEs. The party appoints about 80 per cent of the chief executives in SOEs and 56 per cent of all senior corporate executives. Recent corporate governance reforms, Western-style on paper but not in substance, have made no difference. At 70 per cent of the large and medium-sized SOEs ostensibly restructured into Western-style companies, members of party committees were appointed to the boards. Painful restructuring appears to have spared this elite. China has shed more than 30 million industrial jobs since the late 1990s but few party officials have become jobless.

The economic costs of maintaining this patronage system are not limited to perks for individual party members. Since these members are expected to prove their managerial competence, they must deliver or appear to deliver economic results.

This in turn requires the party to provide access to capital, chiefly bank loans, even if these officials undertake non-viable projects.

The result is systemic waste. In particular, because mid-level Chinese officials are under pressure to hit fixed growth targets quickly (the average tenure of a mayor is about three years), they favour projects that may embellish their short-term performance but have dubious long-term value. The proportion of misguided investment is considerable.

The World Bank estimated that in the 1990s about one-third of fixed investments made in China were wasted. The Chinese central bank reported that during 2000-01 politically directed lending accounted for 60 per cent of NPLs. Such disregard for economic efficiency has bred a culture of irresponsibility and unaccountability in Chinese banks. In a survey of 3500 bank employees in 2002, 20 per cent reported that no action was taken against managers even when their mistakes resulted in NPLs; an additional 46 per cent said their banks made no efforts to uncover bad loans.

More than 80 per cent said corruption in their branches was either prevalent or took place quite often.

Banking reform of the past few years has failed to address these flaws. Its five main features - write-off of NPLs, capital injection, flotation in Hong Kong, minority stakes for Western strategic investors and improvement of corporate governance at headquarters - do not alter the defining characteristics of China's capital allocation system.

Nearly all senior bank executives are appointed by the party, which maintains an extensive organisational network within the financial system. That is why an IMF study finds no evidence that these reforms have improved risk management and credit allocation by banks.

The writer, author of China's Trapped Transition, is a senior associate at the Carnegie Endowment for International Peace in Washington

The wife owned some Chrysler stock, and now, apparently, I'm German.

This could be bad... Depending on how medieval the current Communist leadership is, this may be the trigger to a new wave of Chinese expansion, which would mean World War III... Although China would be alone on its side, unless Russia throws in with the giant to its south, and if Russia pulls a Stalin - we'd end up bailing them out... again.

Get ready to invest in Defense.

(I place Chinese expansion and civil war as equally possible. Both would be bad in terms of casualties, but the latter is infinitely better for us than the former. Except that a Chinese civil war might result in nuclear proliferation on a scale the Russians haven't been able to achieve, though not for lack of trying.)

This is one of his favorites.

"Politics blamed for China's trillion-dollar bad debts"

No problem Chi-coms... Print more money!

Here is an article in Chinese that talks about the "vassals economy" China is in now. What happens in China is that they now have de facto economic federalism as the regional Communist governments don't listen to voices from Beijing. What Hu Jintao and Wen Jiabao say can't even reach outside Zhongnanhai (the Communist and executive power compounds in Beijing).

http://www.epochtimes.com/b5/6/4/7/n1280307.htm

What happened is that the high GDP growth is financed by provinces and municipalities (cities) getting foreign investments via subsidized lands (they didn't need to pay anything to buy the land, and even teh governments would pay the costs of developing plants!), and Beijing promoted public infrastructures growth to increase economic activities (classical Keynesian policy).

These two policies interwine with the problem that the banks are controlled by Beijing BUT the regional heads are appointed and managed by the provincial and municipalities governments. In this way the regional governments can raise debts over subsidizing foreign investments and new civil engineering projects, and then it is Beijing's turns to pay the debts. The results are what the original article outlines.

And don't forget neither of the regional provincial, municipalities governments, nor the central government in Beijing is in black. All are accuring massive deficits themselves.

I think the official figure for the richest province, Guangdong, officially managed to break over US$10,000 only last year. And add to it only Shanghai, Zhejiang, Beijing, and Fujian are prosperous. These areas comprise about 20% of the populations. All other provinces is about 1/3 or even 1/2 lower than the wealthy areas' levels. This is why I think the $6,300 figure sounds a bit too high.

Also I know some non-politically related people who are starting to feel well off, but they would be considered pretty poor even by Malaysian or Thai standards. Most of the wealth is concentrated in party opfficials and their cronies (dai quans).

Great tagline, btw.

The CIA uses Purchasing Power Parity. I'm not so sure that's the best way to measure per capita GDP or the size of their total GDP. China's per capita GDP is more likely $1,200 while the US has a per capita GDP of more than $36,000.

That's the way I read it.

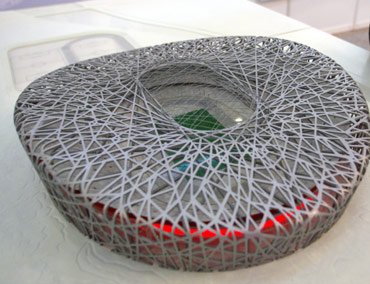

The original olympic stadium became soo expensive and over the top, they ended up scrapping many of its features, but the initial design and metal work is still happening.

What they are still building (nicknamed the birds nest):

I believe they are already migrating into Russia and eying that area.

Mankind, the World, humanity because of science can now, by and large, feed and meet the basic material needs of people for the first time in history. Furthermore, the scientific, computers, modern agriculture and basic health have only begun to have their effects. The big problem that can ruin this is politics. Communism is false, untrue delusion. It is a lie.

China has given up on the shinning illusion of Communism, kept the worst parts and embraced the energies of capitalism, good and bad. With out open, honest politics, central political control and greed will produce malignant monsters.

Hope for the best.

It looks like an upside-down sombrero.

A lot of their growth is fake growth and their economy is becoming more and more pumped and bubble like. Much of it is based on massive currency manipulation.

There is a massive recession looming on the horizon for them. Could make what happened in Japan look small by comparison.

Interesting China *ping*

Cheers!

Thats very true they are so poor that they can go up for a long time. In real terms they are only about 1/30th of America's per capita gdp. So even with very serious problems like non-performing loans they still can grow. They don't even need to invent, just copy what other nations already do.

I think their political system is an asset for them at this stage of development. As they can do long term deep reform that would not be possible in a democracy. The main thing they have to do however is deal with corruption, and institutionalize things like property rights.. That to me is the real strength of the anglo-saxon nations.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.