Posted on 05/24/2025 11:54:22 AM PDT by E. Pluribus Unum

In a sharp escalation of trade negotiations with the European Union (E.U.), Trump took to social media. on Friday and announced that he is “recommending a straight 50% tariff on the European Union, starting on June 1, 2025.”

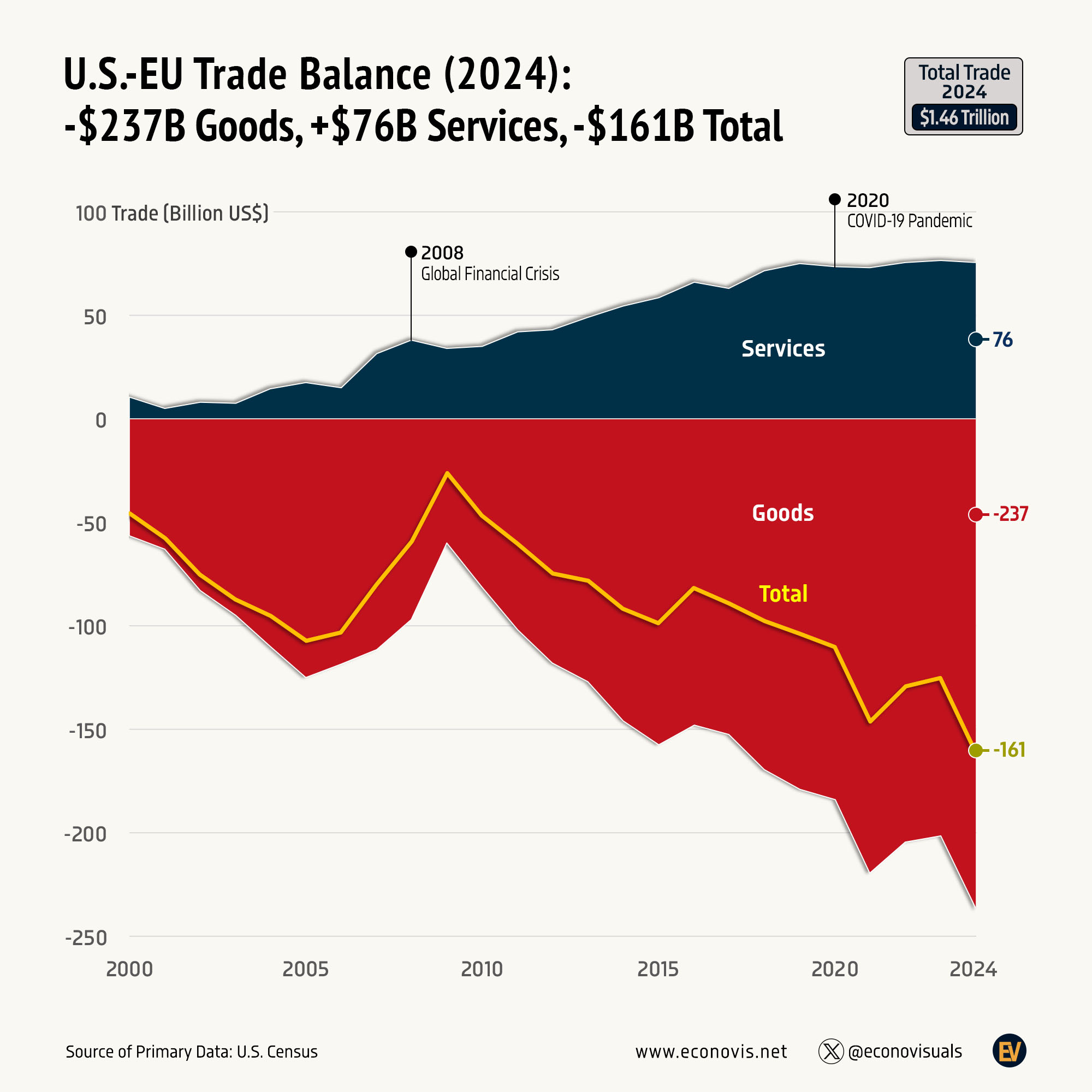

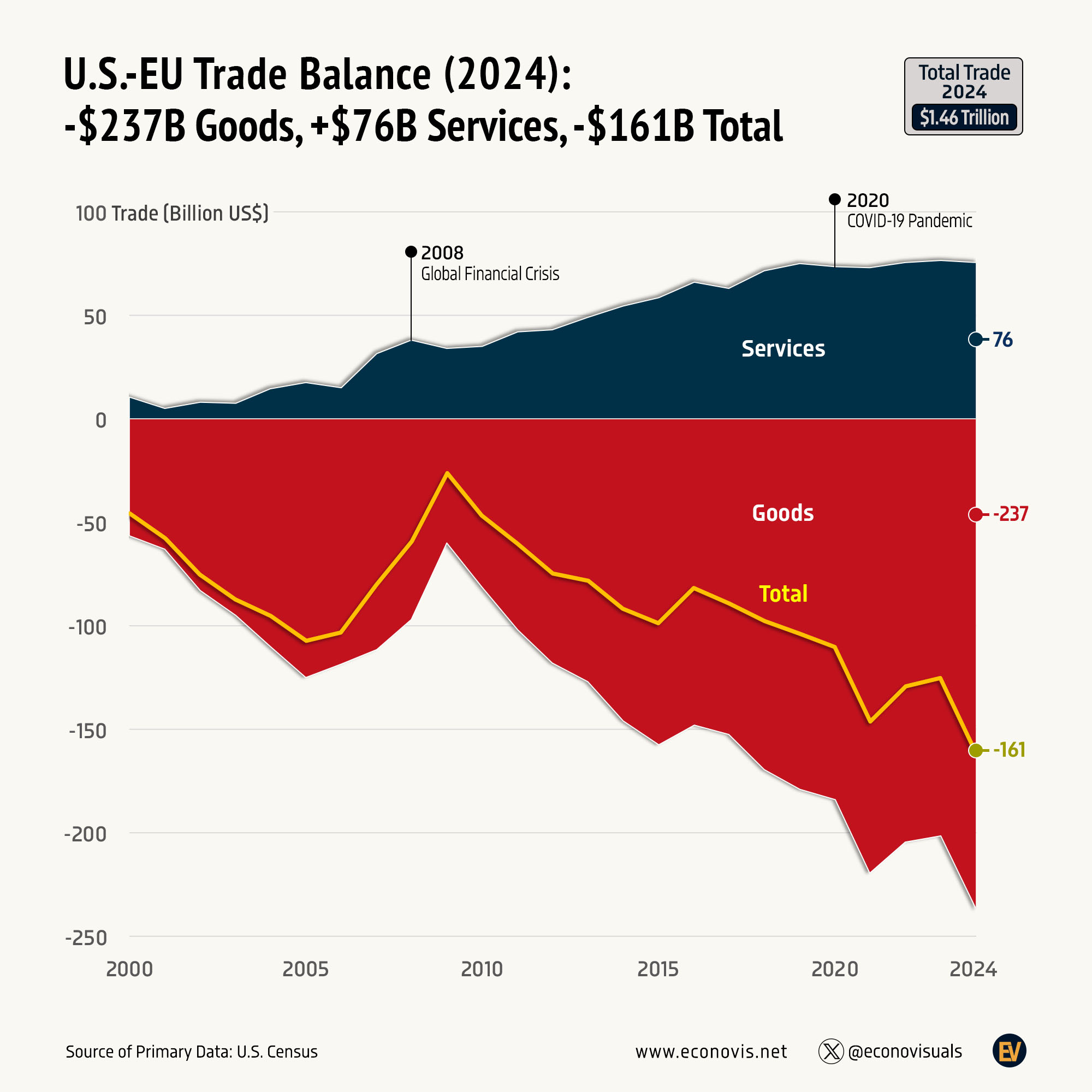

“The European Union, which was formed for the primary purpose of taking advantage of the United States on TRADE, has been very difficult to deal with,” Trump claimed. “Their powerful trade barriers, VAT taxes, ridiculous corporate penalties, non-monetary trade barriers, monetary manipulations, unfair and unjustified lawsuits against Americans companies, and more, have led to a trade deficit with the U.S. of more than $250,000,000 a year, a number which is totally unacceptable. Our discussions with them are going nowhere!”

As he has said elsewhere, Trump went on to add: “There is no tariff if the product is built or manufactured in the United States.”

The U.S. Treasury Secretary Scott Bessent said on Fox News that he hopes Trump’s tariff threat renews negotiations with the E.U., which he maintains have been moving at a slower pace compared to others.

“I would hope this would light a fire under the E.U,” he said. “The E.U. has a collective action problem here. It’s 27 countries but they’re being represented by this one group in Brussels. Some of the feedback I’ve been getting is that the underlying countries don’t even know what the E.U. is negotiating on their behalf.”

Trump’s initial April 2 "Liberation Day" tariffs included a blanket 10% tariff on nations doing business with the U.S., plus additional “reciprocal” tariffs for some. The E.U. was hit with a 20% reciprocal tariff.

In response, Ursula von der Leyen, president of the European Commission, the E.U.’s executive arm, issued a strong statement, calling the move “a blow to...

(Excerpt) Read more at time.com ...

Did Trump mean to say $250,000,000,000.00 per year?

In 2024, the U.S. goods trade deficit with the European Union was $235.6 billion, with exports at $370.2 billion and imports at $605.8 billion. For services, the U.S. had a surplus of approximately $110 billion in 2023, based on Eurostat data, though exact 2024 figures are unavailable. Combining these, the overall trade deficit (goods and services) is estimated at around $125–126 billion for 2024

Go ahead, Bitch. Let's see if you need US markets more that the US needs the EU markets. Let's see who blinks first.

No way tariffs with EU will ever go above 10%.

Screw the EU, Slap ‘em with 100% tariffs!

Give their manufacturers a good reason to move to the USA.

Question: Does anyone here know if a foreign company sells a product here are they taxed if that company has a plant in the USA that produces the same product, or claims to?

The achelliez heal of international trade is the interdependence upon it for the participating countries. President Trump is trying to free the US from being one of dominos that will inevitably topple if they don’t become self sufficient from A to Z and soon.

Rebecca from Slime magazine. Has this been fact checked?

Not if they want to retain their good reputations for engineering and production. A BMW plant in NC and Mercedes plant in Al have measurably lower quality ratings than the factories in Germany.

A Honda engine built in Japan is superior to those made in the USA.

The EU confederation is thirty-one years old.

As our six-year old non-government under the Articles of Confederation showed, decisive executive actions by committee are practically impossible.

Does the EU apply tariffs to “imported” services?

Are these supposed deficiencies permanent? Unavoidable? Inevitable?

NFN, but you’ve got somewhat of a “Debbie Downer” thing goin’ on.

No fun at parties.

The EU goes after our tech companies, they subsidize the hell out of companies like Airbus. They regulate the Hell out of what we send over there, like cars and SUVs. And our military is their protectorate while they go on their multiple vacations and give free healthcare to their newly arrived Jihadi immigrants.

There will be tariffs on anything that is imported into the United States whether their parent company is the United States or in the United Kingdom.

No, the EU does not typically apply tariffs to “imported” services in the same way as it does to goods.

Foreign companies are not taxed and won’t be taxed.

Let’s take a hypothetical case: BMW makes a car in Germany, 100% in Germany (not really possible as parts are made by different companies from all over the world). Say it costs $100 (i said this was hypothetical!).

They send it to a dealer in the USA. The dealer pays the tariffs and adds the tariff to the price of the car, so say the selling price becomes $121 (a 10% tariff and a 10% profit).

If the company has a plant in the USA that makes the same car in the USA of 100% parts made in the u(again, not really possible), and they sell it in the USA then the price is $110(10% profit).

Now in both cases the dealer pays a tax to the USA.

In the first case the company pays corporate tax to Germany. In the second case it pays corporate tax to the USA.

Do the "lower quality ratings" in Germany you mention include global warming BS?

Would you be happier if the US adopted EU standards in general?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.