Skip to comments.

Dow declines after Fed increases rates and forecasts more hikes through next year

CNBC ^

| 12/14/2022

| Carmen Reinicke

Posted on 12/14/2022 11:22:11 AM PST by Tell It Right

The Dow Jones Industrial Average fell 140 points, or 0.4%. The Dow was higher by 287 points earlier in the day. The S&P 500 declined 0.7%, while the Nasdaq Composite lost 1%.

The Fed delivered a widely-anticipated 50 basis point rate hike at the conclusion of its December policy meeting. It’s a smaller bump from the prior four consecutive rate hikes of 75 basis points. A basis point is equal to one-hundredth of one percent.

(Excerpt) Read more at cnbc.com ...

TOPICS: Business/Economy; Front Page News; Government; News/Current Events

KEYWORDS: fed; fedrate; interest; rates; stockmarket

Navigation: use the links below to view more comments.

first previous 1-20, 21-22 last

To: Tell It Right

What if someone has within an IRA stocks, bonds, and mutual funds?

21

posted on

12/14/2022 1:38:14 PM PST

by

WildHighlander57

((the more you tighten your grip, the more star systems will slip through your fingers.) )

To: WildHighlander57

"What if someone has within an IRA stocks, bonds, and mutual funds?"

I guess it depends on how much of your portfolio you have in each, and exactly what in. And it also depends on what you need from your portfolio right now (i.e. if you're retired and you anticipate doing a 4% annual withdrawal soon).

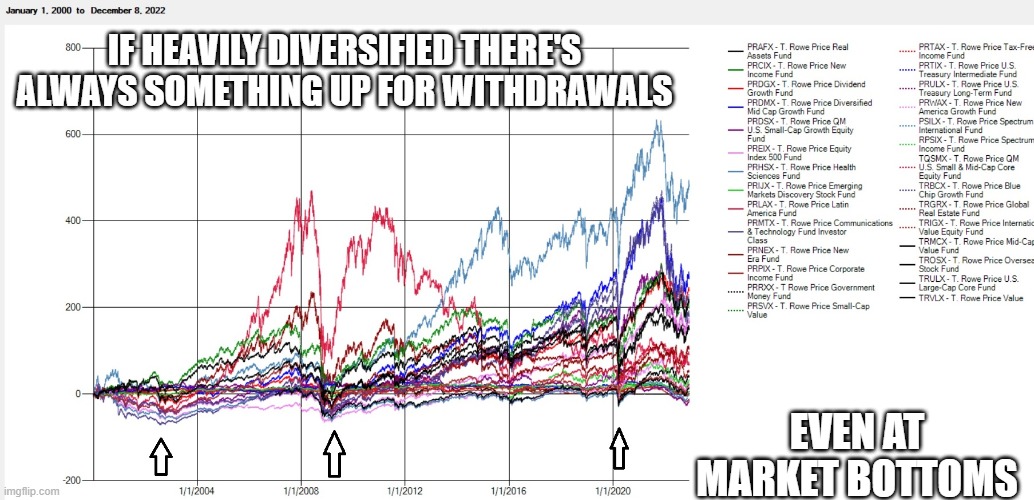

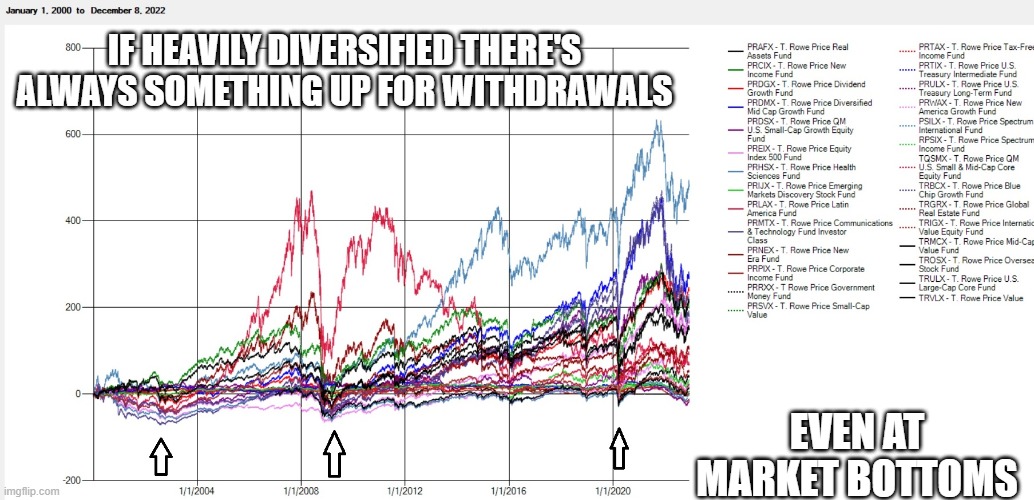

A diversified portfolio of 75% in many equity mutual funds (in at least 30 asset classes) and 25% bond funds (again well diversified, like a fund for long-term treasuries, and a fund for short term treasuries, and a fund for large long term corporate bonds, etc.). See the comment here on FR at https://freerepublic.com/focus/news/4114743/posts?page=51#51 with this graph:

Basically even at the worst of times, there's always something up in your portfolio you can withdraw from to live off of. Now it may be that your overall balance is way down, but you don't need your entire portfolio at any given moment. As long as something is up among those many asset classes it's a dependable income stream.

22

posted on

12/14/2022 3:10:02 PM PST

by

Tell It Right

(1st Thessalonians 5:21 -- Put everything to the test, hold fast to that which is true.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-22 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson