I guess it depends on how much of your portfolio you have in each, and exactly what in. And it also depends on what you need from your portfolio right now (i.e. if you're retired and you anticipate doing a 4% annual withdrawal soon).

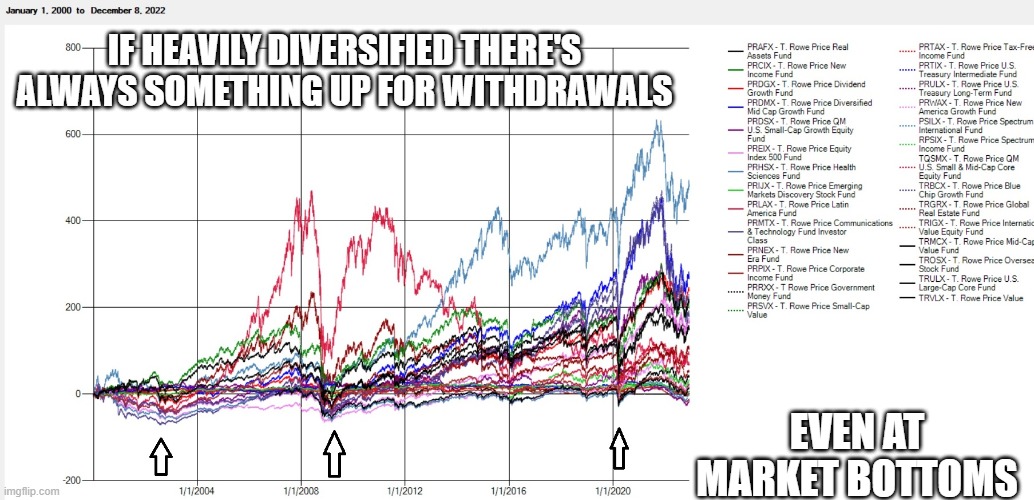

A diversified portfolio of 75% in many equity mutual funds (in at least 30 asset classes) and 25% bond funds (again well diversified, like a fund for long-term treasuries, and a fund for short term treasuries, and a fund for large long term corporate bonds, etc.). See the comment here on FR at https://freerepublic.com/focus/news/4114743/posts?page=51#51 with this graph:

Basically even at the worst of times, there's always something up in your portfolio you can withdraw from to live off of. Now it may be that your overall balance is way down, but you don't need your entire portfolio at any given moment. As long as something is up among those many asset classes it's a dependable income stream.