Skip to comments.

Biden to Announce $36 Billion for Ailing Teamsters' Pension Fund

MSN.com ^

| 08 December 2022

| Akayla Gardner

Posted on 12/08/2022 4:41:40 AM PST by zeestephen

The White House said the Central States bailout would help 40,000 workers and retirees in Michigan, 40,000 in Ohio and 22,000 in Wisconsin...

(Excerpt) Read more at msn.com ...

TOPICS: Culture/Society; Front Page News; Government; News/Current Events; US: Michigan; US: Ohio; US: Wisconsin

KEYWORDS: 2022election; akaylagardner; bailout; biden; billittothegrandkids; billittothekids; election2022; kickback; michigan; ohio; teamsters; union; unions; wisconsin

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 next last

To: zeestephen

This is probably the tip of the ice berg. It appears most public employees’ pension plans are underfunded. I wonder who will bail them out?

“Why Are Public Pensions Often Underfunded?”

“Look at the state of Illinois’ public sector pension plan. The reason their plans are so poorly funded is because they just don’t put sufficient money in. It’s very simple. They keep making promises, and they don’t fund them.”

To: Toespi

Re: "Trump talks about suspending the constitution, Joe simply does it."

Perfectly stated!

42

posted on

12/08/2022 6:39:22 AM PST

by

zeestephen

(43,000)

To: Wally_Kalbacken

"The problem with the PBGC is that the premiums are not risk based."

I believe the PBGC's flat rate premium (fixed dollar amount per retiree) is assuming the pension has something like 50% or 60% of the portfolio in bonds. Anything less than that (which means more in equities) puts the pension into the variable rate premium with a rider based on portfolio allocation.

43

posted on

12/08/2022 6:39:59 AM PST

by

Tell It Right

(1st Thessalonians 5:21 -- Put everything to the test, hold fast to that which is true.)

To: zeestephen

“Help for working families” “when families sit around the kitchen table” “My dad always told me, ‘Joey, take every chance you get to squander the people’s money’” blah blah blah

44

posted on

12/08/2022 6:48:55 AM PST

by

j.havenfarm

(21 years on Free Republic, 12/10/21! More than 5000 replies and still not shutting up!)

To: T.B. Yoits

“ These blue states need to be reduced to territories and lose their voting rights until they become solvent, if ever. ”

They’re such a huge liability I think a new America would be better off without them. They can turn into the 3rd world crapholes they’re already becoming

Save the others that still care about a country

45

posted on

12/08/2022 6:58:34 AM PST

by

NWFree

(Somebody has to say it 🤪)

To: woodbutcher1963

Are you a white non union person?

If yes, the 1st of never…

46

posted on

12/08/2022 7:09:16 AM PST

by

EEGator

To: Tell It Right

I think you’re out of your mind recommending to retired people that sort of high risk mix more suited for young investors.

When everything crashes like now they can end up screwed.

The trick to retired,ent is being able to live strictly off cash DIVIDENDS and never have to sell a thing especially like now when the markets have all tanked.

My close ended income funds pay even more in dividends during volatility and provide even more cash dividends to get me through even the worst periods of inflation.

Preservation of original investment is a must for me and it’s worked well so far

47

posted on

12/08/2022 7:09:27 AM PST

by

NWFree

(Somebody has to say it 🤪)

To: Tell It Right

In fact I can live on less than half of my monthly dividends and reinvest the other half at my pleasure when the market heads back up.

Never have to sell a single share of *anything* and I’m not even old enough to get SS yet

48

posted on

12/08/2022 7:20:15 AM PST

by

NWFree

(Somebody has to say it 🤪)

To: woweeitsme

It’s how democrats get big voter blocks the Teamsters and teachers union are two of the biggest donors.

Nothing is on the up and up with the democrat party.

49

posted on

12/08/2022 7:36:12 AM PST

by

Vaduz

(LAWYERS )

To: ZOOKER

The money tree behind the white house. The tooth fairy provided some as well.

50

posted on

12/08/2022 7:44:57 AM PST

by

pas

To: NWFree

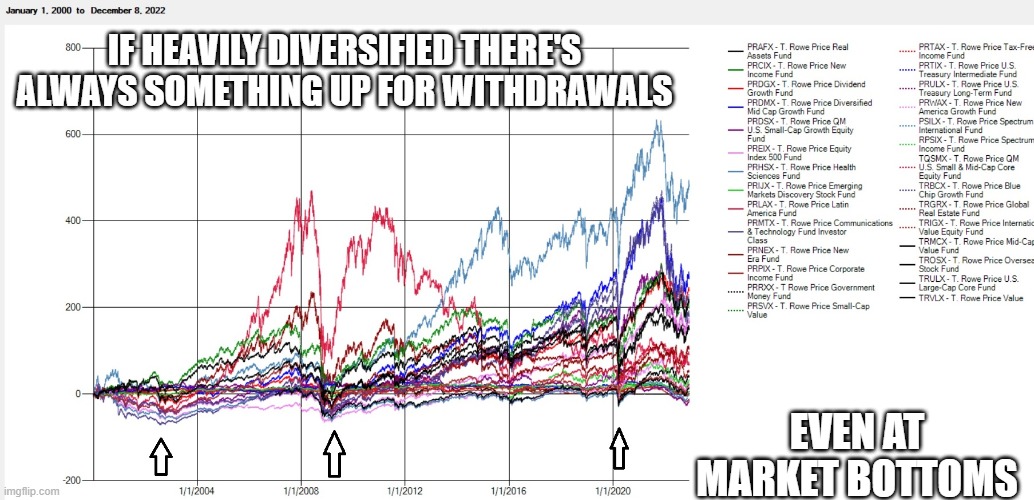

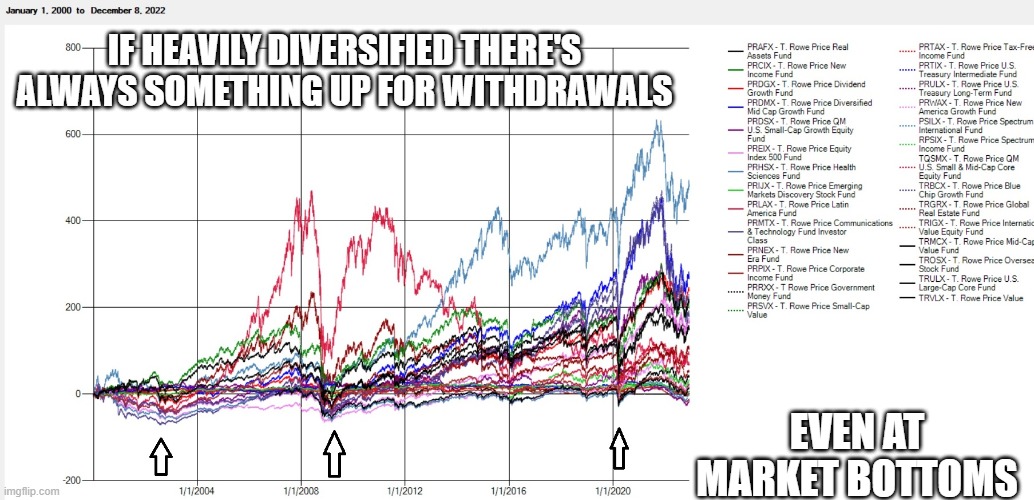

I like the dividends strategy. But before you think I'm out of my mind, take a gander at this graph I just generated and uploaded. This represents returns (including dividends) for many mutual funds spread out across many asset classes since the beginning of 2000. I did that to begin at the start of 2000 (right before the market tanked when the dot com bubble burst) to show how even if you retire at the worst possible time (right before a market crash), diversification covers you.

I put arrows at the time points of market bottoms for Fall 2002, March 2009, and March 2020 (forgive me Marty for the arrows not being drawn to scale LOL). Even at those times, something in the portfolio is up for you to live off of.

So let's look at the three market bottoms and pretend we were retired and looking for a place in our mutual funds to do our withdrawals from.

Fall 2002:

PRSVX (small-cap value) was up 21% from the start of 2000.

PRULX (long-term treasury) up 20%.

PRTIX (intermediate treasury) up 17%.

TRMCX (mid-cap value) up 13%.

PRTAX (municipal tax free bonds) up 9%

PRCIX (intermediate bonds) up 7%

So yeah, your overall balance is low, but there are many options to live off of (you're selling high by withdrawing from them).

March 2009:

PRLAX (Latin-American fund) up 113% since you retired in early 2000.

PRNEX (natural resources/energy) up 33%

PRULX up 29%

PRTIX up 23%

PRHSX (health sciences) up 20%

PRSVX up 14%

PRCIX up 5%

TRMCX up 2%

March 2020:

PRHSX up 341%

TRBCX (blue-chip) up 200%

PRMTX (communications and tech) up 191%

PRDMX (mid-cap growth) up 188%

PRDSX (small-cap growth) up 118% TRULX (large-cap core) up 115%

So if you can stomach your overall portfolio balance being low during market downturns, a very diversified portfolio can be 70% to 80% in equities and give you enough cushion to live on by always having some of your mutual funds be in the positive for you to withdraw from.

51

posted on

12/08/2022 7:55:42 AM PST

by

Tell It Right

(1st Thessalonians 5:21 -- Put everything to the test, hold fast to that which is true.)

To: zeestephen

“Labor Union” is a euphemism for organized crime. Money laundering (particularly for the demoncrat party) is their stock in trade.

To: zeestephen

MILLIONS of Americans have lost vast amounts of THEIR pensions thru 401 values dropping in stock market.

Dems will find a way to cut Soc Sec payments so they can continue to support Medicare & Medicaid payments to illegals & ‘low income’ for things ;ole food—rent—down payments on homes, etc.

Supporting TAXPAYER money going to the TEAMSTERS is outright theft/fraud.

I was a Teamsters union member in the late 60’s.

Hoffa was on trial for STEALING PENSION FUNDS THEN!!!!

Every Teamster member was assessed an extra $1 a month on their dues-—TO PAY FOR HOFFA’S legal team!!!

I was irate-—and still am over that.

NEVER FORGOT.

To: zeestephen

$36 BILLION

40,000 ‘workers’

My math says that is $900,000 PER WORKER

WTH???

JOE getting another 10% ?????//

To: unread

It is $900,000 each-——you are quick.

To: zeestephen

Well shoot...what the heck?

This just comes out of thin air?

SMDH.

56

posted on

12/08/2022 8:55:50 AM PST

by

EBH

(Ok Republicans, work like our Republic is the last one on earth.)

To: WMarshal

To: zeestephen

The Central States Pension Fund became severely underfunded while under the supervision of the Department of Labor and U.S. District Court, from 1982 through 2014. The CSPF assets were mismanaged by the government, who selected and vetted the Wall Street banks that squandered an estimated $20 billion through risky and reckless investments, which could have been prevented if The Employee Retirement Income Security Act of 1974 (ERISA) had been enforced by the labor department, as was their responsibility.

To: Magnum44

To: Bloody Sam Roberts

All 10.4 million Americans that could be impacted if the multiemployer pension system fails are all taxpayers. When big business, Wall Street, the auto industry, the airline and travel industry and the farmers continually get bailed out, these 10.4 million Americans/taxpayers pay for it.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-90 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson