Skip to comments.

Did You Know? Europe now has a natural gas oversupply (if you include ships waiting to unload)

Hotair ^

| 10/24/2022

| John Sexton

Posted on 10/24/2022 8:18:16 PM PDT by SeekAndFind

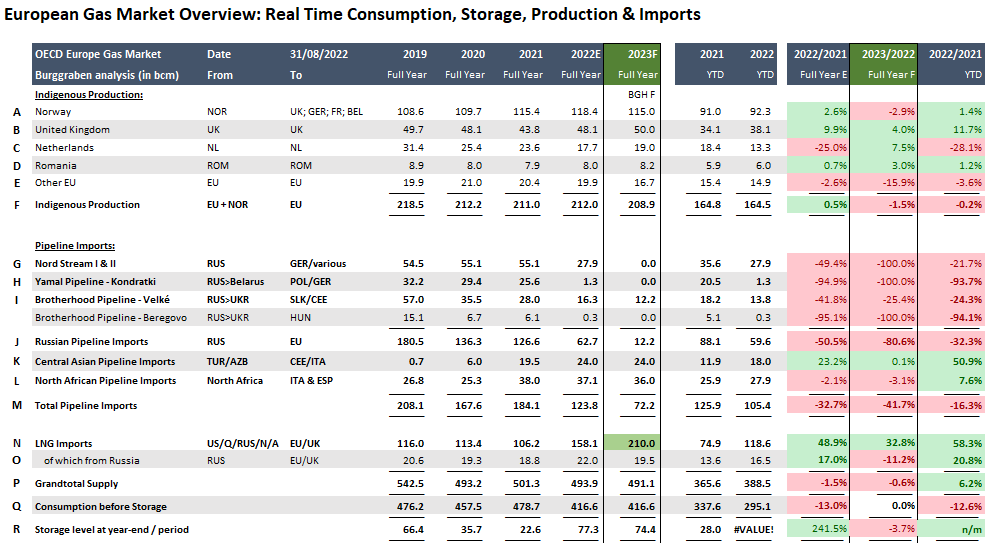

We all know how this has played out. This summer Russia started monkeying with the natural gas supply to Germany and the rest of Europe, claiming there was some technical problem that required maintenance. Then they cut the gas off completely and not long after that someone blew up the Nord Stream pipeline. The result of all this has been a huge spike in energy prices in Europe and concern that there might not be enough gas to heat homes this winter.

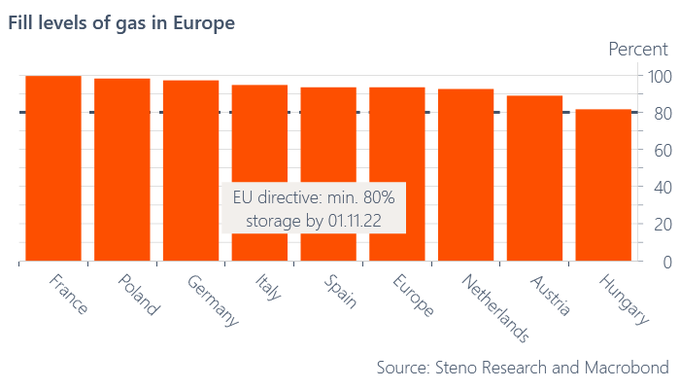

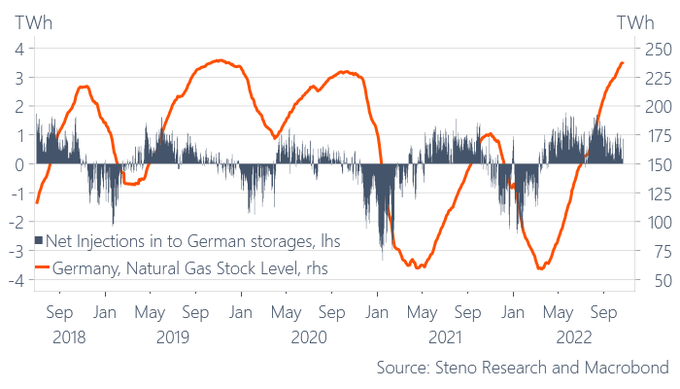

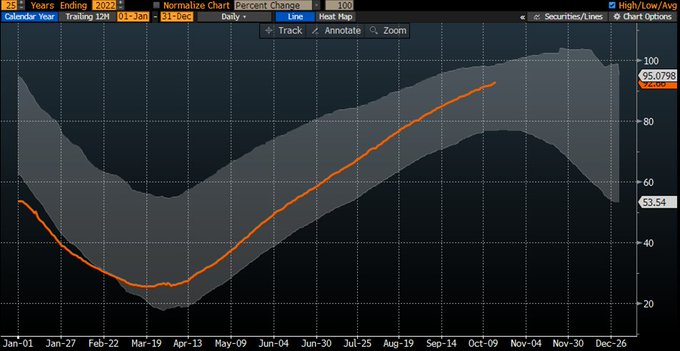

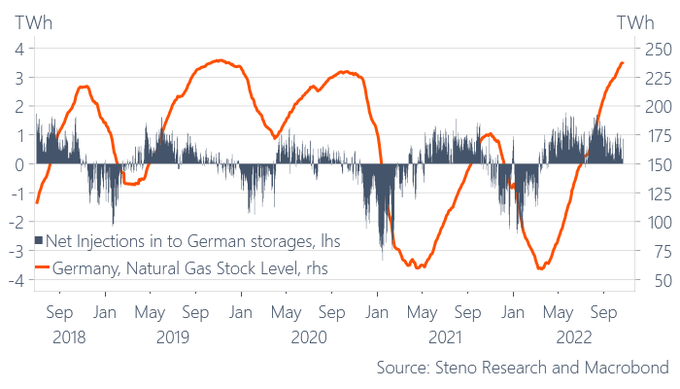

But here we are in late October and the situation is looking very different. For one thing, Europe has mostly filled the underground gas storage tanks for the winter. Collectively, the plan was to fill storage to 80% by November 1 but with a week left to go, European storage is 93.4% filled.

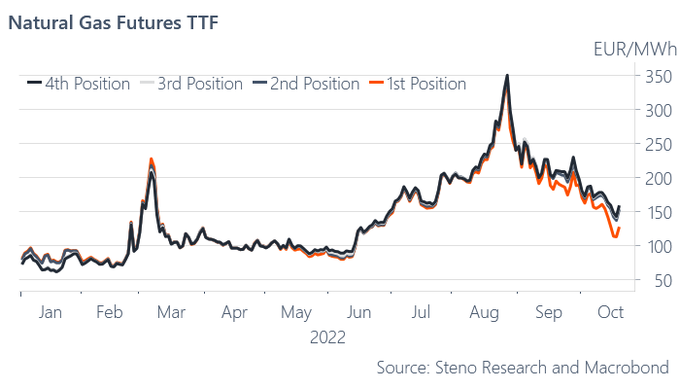

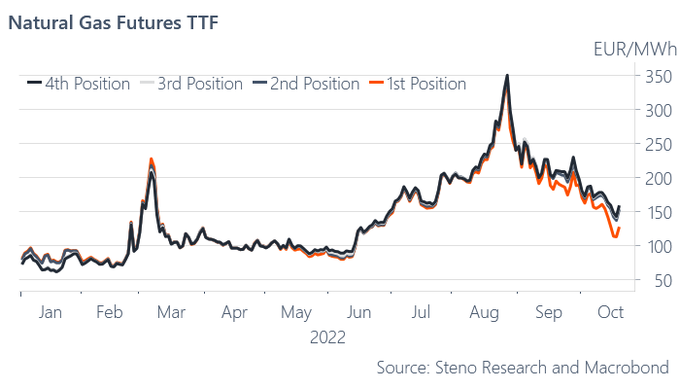

When Russia started playing with the gas supply, prices went way up but now the opposite is happening. Prices have dropped below $100 for the first time in months and there are lots of liquified natural gas tankers floating off the coasts of Europe waiting to unload.

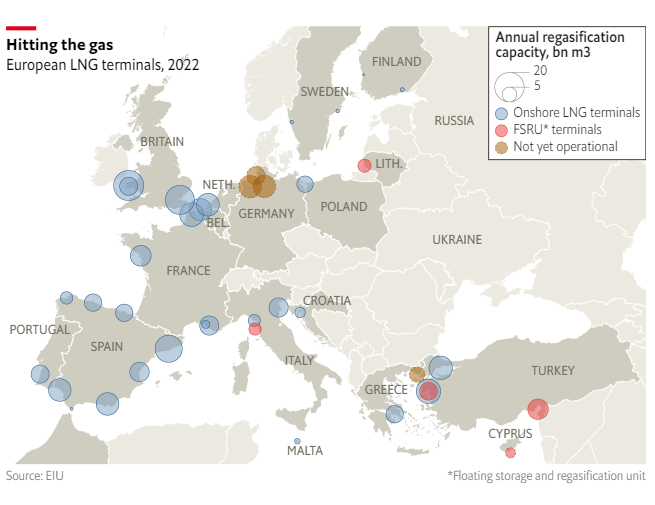

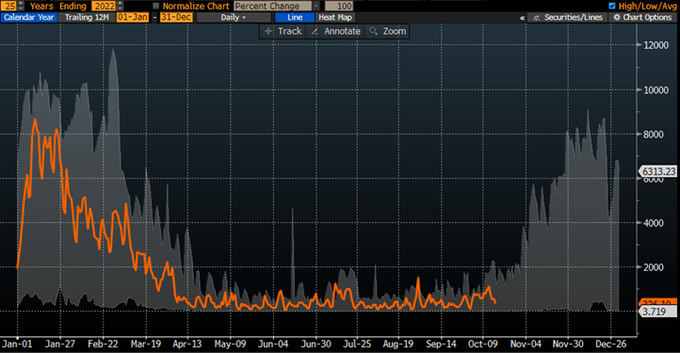

Sixty LNG tankers have been idling or slowly sailing around northwest Europe, the Mediterranean, and the Iberian Peninsula, according to MarineTraffic. One is anchored at the Suez Canal. Eight LNG vessels that came from the U.S. are underway to Spain’s Huelva port.

“The wave of LNG tankers has overwhelmed the ability of the European regasification facilities to unload the cargoes in a timely manner,” said Andrew Lipow, president of Lipow Oil Associates…

European gas prices had soared above 340 euros ($332.6) per megawatt hour in late August, but this week dipped below $100 for the first time since Russia cut supplies. Before the war, the price had been as low as 30 euros.

An investment analyst did a Twitter thread on this yesterday.

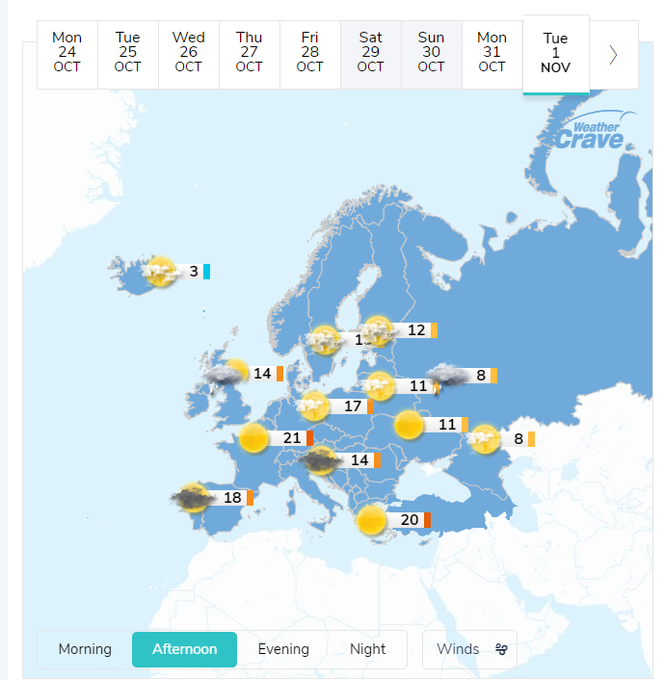

And there’s one more factor that is creating a short term over-supply. The temperature in Europe has been well-above average so far, meaning less gas is leaving those underground storage tanks than anticipated.

It has been an unseasonably warm October.

And the result of all of this is that prices should keep dropping.

But as good as this looks, the situation could turn very quickly. That’s because Europe’s gas storage needs continual resupply. So if the weather suddenly turns cold, the surplus could disappear in a matter of days or weeks. Unfortunately, there’s no telling what things will look like a month from now. Here’s the cautious view from a commodities analyst. Because natgas can only be consumed or stored. If storage is (95%) full & not consumed (mild weather), prices have to do the work to keep system balanced as comdties trade in present (d-s), unlike equities/bonds which discount future.

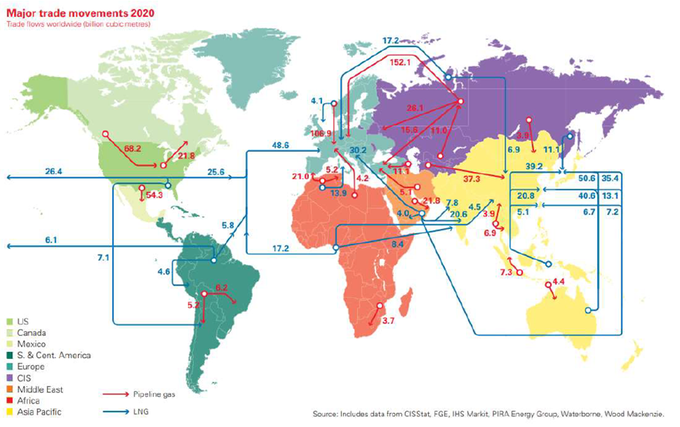

Here is a visual how to think about the global LNG market. In general: US, Qatar & Australia are the big 3 exporters while EU, China, Japan & South Korea are the big importers of the global LNG market.

Of course, Middle East (UAE; Oman) & Nigeria or Angola matter too.

In short, even if they get through this winter in good shape, they are still going to need even more gas next year and that won’t be easy or cheap to do.

TOPICS: Business/Economy; Foreign Affairs; Germany; News/Current Events; Russia; War on Terror

KEYWORDS: 0iqputintrolls; 0iqrussiantrolls; energyschadenfreude; europe; gaseousexcretions; germany; haha; hateamericafirst; hotgas; itisolaugh; itistolaugh; itsitolaugh; johnsexton; lng; naturalgas; nyuknyuknyuk; putinlovertrollsonfr; putinsbuttboys; putinsfrmistresses; putinswar; putinswarofchoice; putinworshippers; russia; russianstupidity; russiansuicide; sextonisaclown; supply; tdaw; ttdaw; vladtheimploder; waronterror; wemissallahpundit; zottherussiantrolls

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-62 next last

To: DesertRhino

That forecast is for the US, not Europe

Europe is still getting mild weather

To: canuck_conservative

LOL,, simpleton. Weather travels around the world, by hemisphere. Doesn’t bother me at all! Euro weenies are gonna freeze solid.

I’ll enjoy their lamentations.

22

posted on

10/24/2022 8:44:25 PM PDT

by

DesertRhino

(Dogs are called man's best friend. Moslems hate dogs. Add it up..)

To: SeekAndFind

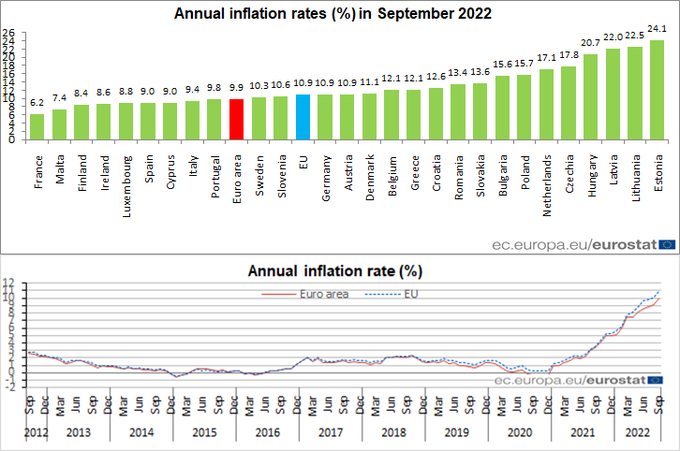

Inflation rates will be dropping when over all this goodness?

23

posted on

10/24/2022 8:44:26 PM PDT

by

cranked

To: DesertRhino

Hope I laid in enough wood.

24

posted on

10/24/2022 8:46:01 PM PDT

by

kiryandil

(China Joe and Paycheck Hunter - the Chink in America's defenses)

To: DesertRhino

Well they already got their gas storages full now

they’ll be fine this winter

any mild weather is just a bonus

To: lightman

That map is krap. Texas and Louisiana burn natural gas and some coal.

To: crusty old prospector

I was trying to find a map showing the primary source of home heating state by state...this was the best I could find.

27

posted on

10/24/2022 9:02:11 PM PDT

by

lightman

(I am a binary Trinitarian. Deal with it!)

To: crusty old prospector

OK...now that I went to Google instead of my primary DuckDuckGo:

28

posted on

10/24/2022 9:04:33 PM PDT

by

lightman

(I am a binary Trinitarian. Deal with it!)

To: SeekAndFind

how many days supply if storage is at 100%?

30 days?

29

posted on

10/24/2022 9:10:49 PM PDT

by

joshua c

(to disrupt the system, we must disrupt our lives, cut the cable tv)

To: SeekAndFind

Note the large number of Spanish Gas terminals. That is foresight.

30

posted on

10/24/2022 9:22:14 PM PDT

by

buwaya

(Strategic imperatives )

To: DesertRhino

“The EU, Brits and USA stole 650 billion in gold and cash on deposit in the west”

And people are wondering where the Ukrainian reparations from Russia will be coming from. Look there.

31

posted on

10/24/2022 9:24:18 PM PDT

by

buwaya

(Strategic imperatives )

To: DesertRhino

“The EU, Brits and USA stole 650 billion in gold and cash on deposit in the west”

And people are wondering where the Ukrainian reparations from Russia will be coming from. Look there.

32

posted on

10/24/2022 9:41:11 PM PDT

by

buwaya

(Strategic imperatives )

To: SeekAndFind

You may all have noticed that I’ve been predicting a global LNG glut for months.

This looks like the first payout on my bet.

33

posted on

10/24/2022 10:01:08 PM PDT

by

buwaya

(Strategic imperatives )

To: cranked

Eventually.

Inflation is worse than commodity shortages. Stuff like gas shortages can be fixed by the good old free market and a bit of engineering.

Inflation is, in the end, political.

34

posted on

10/24/2022 10:03:58 PM PDT

by

buwaya

(Strategic imperatives )

To: buwaya

‘Political’ inflation effects the average everyday Joe, and they will eventually make ‘political’ changes if that ‘political’ inflation gets bad enough.

The protest continue to grow.

35

posted on

10/24/2022 10:08:07 PM PDT

by

cranked

To: canuck_conservative

Absurd. Why would anyone want Europeans to suffer? They have been out in a terrible situation and managed to prepare well for now. But, they certainly need to stay on top of things.

I’m a bit blown away that you think freezers would want Europeans to be cold. Makes zero sense. That’s the behavior of liberals.

36

posted on

10/24/2022 10:42:30 PM PDT

by

HollyB

To: HollyB

Why would anyone want Europeans to suffer?

Because they had the nerve to oppose Russia

so according to the Russian shills, Europe must be brutally punished for that

To: cranked

European gov’t have put measures in place for max temperatures in buildings. I actually bought a heating pad (with 220/240 plug) for my son since the hotel rooms will be set max around 63 F. He’s over there 3/4 of the month every month. Yea, I know. I’m a mom. But I figure if he gets cold, he can plug it in.

38

posted on

10/24/2022 10:48:02 PM PDT

by

HollyB

To: canuck_conservative

I think zelensky is a corrupt and evil man. But, I certainly don’t want anyone to suffer because of him. Except zelensky. Too big for his britches. Cant stand him.

39

posted on

10/24/2022 10:50:30 PM PDT

by

HollyB

To: DesertRhino

“Somehow all the above is Russia “monkeying with the gas supply”. LoL”

No kidding. When they started out by blaming Russia for the supply problems, I knew where this was going.

Hell, they even refuse to connect the OBVIOUS dots as to who took out the pipelines. At the very least, they could ask China or India, it wasn’t very hard for them to figure it out.

40

posted on

10/24/2022 11:40:10 PM PDT

by

BobL

(By the way, low tonight in Estonia: 35 degrees)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-62 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson