Posted on 10/18/2022 7:23:20 AM PDT by Oldeconomybuyer

The cost of living in Cairo has soared so much that security guard Mustafa Gamal had to send his wife and year-old daughter to live with his parents in a village 70 miles south of the Egyptian capital to save money.

Gamal, 28, stayed behind, working two jobs, sharing an apartment with other young people and eliminating meat from his diet. “The prices of everything have been doubled,” he said. “There was no alternative.″

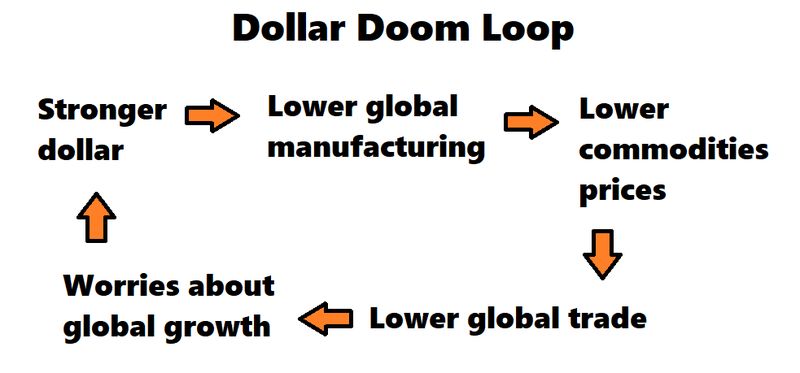

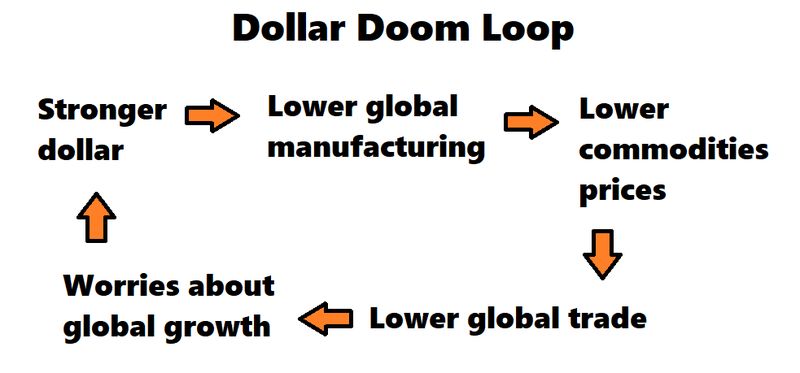

Around the world, people are sharing Gamal’s pain and frustration. An auto parts dealer in Nairobi, a seller of baby clothes in Istanbul and a wine importer in Manchester, England, have the same complaint: A surging U.S. dollar makes their local currencies weaker, contributing to skyrocketing prices for everyday goods and services. This is compounding financial distress at a time when families are already facing food and energy crunches tied to Russia’s invasion of Ukraine.

“A strong dollar makes a bad situation worse in the rest of the world,” says Eswar Prasad, a professor of trade policy at Cornell University. Many economists worry that the sharp rise of the dollar is increasing the likelihood of a global recession sometime next year.

The reasons for the dollar’s rise are no mystery. To combat soaring U.S. inflation, the Federal Reserve has raised its benchmark short-term interest rate five times this year and is signaling more hikes are likely. That has led to higher rates on a wide range of U.S. government and corporate bonds, luring investors and driving up the U.S. currency.

(Excerpt) Read more at apnews.com ...

The world is a dumpster fire, we are about to jump into said dumpster so this makes us “Strong” because we haven’t taken the full plunge, yet.

It’s okay because they have BRICs. /s

the dollar isn’t strong. it just sucks the least...

...... The reasons for the dollar’s rise are no mystery ....

——————————

Fails to mention reckless spending or failed energy policies and only points to higher interest rates.

Let’s Go Brandon. Let’s Go WEF. Let’s Go UN. Let’s Go Fed.

Let’s Go....

This is a manufactured intentional crisis. Pretty hard to deny it at this point but you know the leftist and RINO shills like the AP, MSM, CNN, MSDNC, etc. will.

The wealthy will get even more wealthy while middle and lower income suffer greatly.

Wanna bet the commies, uh, dems/uniparty/China come up with a great plan to fix everything sometime next year when reaches a zenith of financial suffering. A plan of socialism so heinous but assures the Jack and Jill Blow it would be better than what they are experiencing then so they go along with it. Can’t fix stupid and the elite dog turds know this.

Leftist governments across the globe are at fault for what ills the world. Remove the leftist and things can get better.

The lack of fiscal discipline in the US is possible now because of the status of the dollar. When we finish wrecking it the entire world is going to blame America for the economic catastrophe that will follow.

I bet many don’t realize this, but it could happen much sooner than we think.

We are going to be the wealthy family who decided to shoot off thousands of dollars worth of fireworks at a private party in July from the biggest house in town. The resulting wildfire burned down everything around us.

I wonder how they will like us after that? Do you think China, India, OPEC, and the EU are going to be interested in continuing to use the “dollar” after this or to allow the American banksters and politicians to control their economy with idiotic fiscal policy?

When the U.S. Federal Reserve is essentially creating money with extremely low interest rates they are spreading inflation only usually in the value of assets more than in the price of commodities, until the inflated circumstance start to mean excess money chasing too few goods - price inflation. That asset value appreciation, sourced from U.S. Federal Reserve actions was felt globally from 2009 to 2019, and was bolstered by similar low interest rates by other nations central banks.

Deflation of asset values from all that was going to happen sooner or later, but the lockdowns and supply disruptions of 2020-2021, together with the “stimulus” governments doled out, hastened the too much money chasing too few goods scenario - price inflation. Now asset value deflation is being seen, globally and not just in the U.S.

Then when the Federal Reserve increases interest rates to tamp down U.S. inflation, creating higher interest rates available on U.S. denominated debt, public and private, the dollar rises compared to other currencies (or other currency values lower compated to the dollar) and asset value deflation spreads globally.

Those intetest rates will, naturally stem inflation with the cost of that borne intially by the creation of a recession; and it will be global.

Biden’s domestic policies against U.S. domestic energy sources, and global energy disruptions stemming from Putin’s war and the response to that have only exacerbate an already developing situation created by the worlds central banks. That was already seen before Biden was elected and the shift in central banks positions from printing money to tamping inflation was already evident, even if the execution of it had not yet begun - everyone knew it was going to happen, the only question was when.

They really got four Asspress loons to compose this crap?

Not to worry. It is only their side of the boat that is sinking.

AGENDA 21

Have been pouring money into Canadian dollars the last 3-4 months. Good times (for now).

They really got four Asspress loons to compose this crap?Haha, you beat me to it! (And, yes, it takes at least four asspress loons -- I'd call them clowns -- to be thoroughly wrong. One can do it, but four ensures the clown show.)

The reasons for the dollar's rise are no mystery. To combat soaring U.S. inflation, the Federal Reserve has raised its benchmark short-term interest rate five times this year and is signaling more hikes are likely. That has led to higher rates on a wide range of U.S. government and corporate bonds, luring investors and driving up the U.S. currency.

Uh, no. Partisan Shills from the AP imply credit is due to the Fed and the Bidenflation regime. But Pow Wow Chow coauthor Fauxahontas sez:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.