Posted on 06/05/2022 8:24:03 AM PDT by Erik Latranyi

Russian oil and gas sales could hit $285 billion this year, outstripping last year's takings by 20%. Europe is a major buyer of Russian energy products, accounting for about 50% of its crude oil exports and 75% of its natural gas exports in 2021. Germany was the biggest buyer of Russian energy in the first two months of the war.

Russia's invasion of Ukraine is entering its 100th day on Friday, with no clear end to the war in sight.

Despite intensifying sanctions, Russia could still rake in $800 million a day from oil and gas revenues this year amid soaring energy prices, according to Bloomberg Economics.

Russia's coffers have been bolstered by a rally in oil prices, which have risen about 50% this year and are at 13-year highs. The gains could bring Russia's oil and gas sales to a total of $285 billion this year, Bloomberg forecasts. That's 20% higher than the country's $235.6 billion takings from oil and gas in 2021.

(Excerpt) Read more at msn.com ...

Thanks Brandon.

So much for destroying the Russian economy. It backfired. The Ruble is as strong as ever.

But people still post “Ukraine winning” threads here. So it must be true that Ukraine isn’t being sacrificed for the Biden Crime Family.

Hello, hello, is anyone in the Districit of Commnists listening? Oil is fungible. If we don’t sell it, somebody else will.

That’s what happens when low IQ criminals run our country!

Biden is also making OPEC Very Rich

GDP tells the big picture story and it is not pretty.

"Russia is facing the deepest economic contraction in nearly three decades as pressure from sanctions imposed by the U.S. and its allies mounts, according to an internal forecast by the Finance Ministry."

"Gross domestic product is likely to shrink as much as 12% this year, deeper than the 8% decline expected by the Economy Ministry, according to people familiar with the estimates who spoke on condition of anonymity to discuss internal deliberations. The government hasn’t released a public forecast since the invasion of Ukraine. "

"A 12% contraction would put the economic pain on par with the turmoil seen in the early 1990s, when Russia’s Soviet-era economy lurched toward capitalism with a contraction not seen since wartime. "

Oil was $41 a barrel on Election Day, 2020.

None of this would have happened if the election had not been stolen from President Donald J. Trump.

And so, as with the CDC/FDA/Pfizer standing against those opposing them with citations from mainstream and alternative press framing the "news" in opposing way, this Yahoo/Fiance/MSN is the definitive tale?

My wife and I have adopted a "wait for a year to go by" to make such judgments. After all, Biden's first week in office isn't as is this week in office, is it?

Oh yes Ukraine must be winning. Look at all the Russian land occupied by Ukraine military. And look at all the apartment buildings bombed out in Russia by Ukrainian shelling. /S/S

“ Western citizens are paying for Putin’s war and for Ukraine’s war at the same time”

Exactly 100% wrong! Putin did not cause this! It’s the obsessed and crazy west who imposed sanctions that backfired. It’s called shooting yourself in the foot (or pocketbook)!

There are big losses from loss of sales and enormous retooling costs across the board for Russian manufacturers and retail. All of that hits GDP.

😨😨😨

EU? Ukrainians can that Biden first.

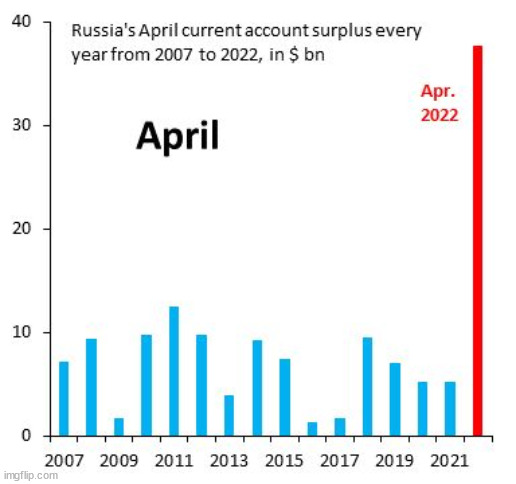

So, what does a current account surplus have to do with overall GDP? Answer, next to nothing.

The US GDP grew from 10 trillion to 22 trillion over 20 years, and all that time it had a current account DEFICIT in the hundreds of billions of dollars?

Stay in your lane.

If the average temperature increases over the last three months continue all year, it will be the hottest year ever!

But we know that Winter will come, and the rate of change will itself change over the year.

Just as we can forecast temperature declines next Winter, we can also forecast declines in Russian oil exports to Europe through the end of the year, after that policy was formally adopted by the authorities there.

All we are seeing is a relatively short term surge in prices, offset the total revenue effect of declining volume, in the short term. Russian oil export Volume is set to continue its strong decline all year.

Prices may continue up to $150 or $180 before peaking. But after prices peak, it is “Katie, Bar the door!” For Russian net revenues. OPEC agreed to start ramping up production this week, so the corrective supply force on price is already engaging. US rig count is increasing.

From the European press I read, the same may be said for Europe in this time. Additionally, there are loss of sales and, if Taiwan falls to the Communist Chinese at some time or is simply affected politically or embargoed, retooling to make chips will become an absolute necessity for all of us in the West. It is already, but the politics here lags because the current administration is throttling energy to promote "green."

The point of my comment was not to negate that there are losses in various economic arenas, but that the wars -- plural -- have not as yet come to their ends. Ergo we await further outcomes as they come, Nothing is static.

Russia is the most resource rich nation on the planet.

And it’s not Woke, so it won’t go broke, unlike US/EU.

You ought to know by now that economic predictions aren’t worth the paper they are written on. And predictions by “anonymous” people who are “familiar with the estimates” have even less value.

But, since you seem interested in the “predictions” here is Reuters latest:

Russia’s post-Feb. 24 economic data paints mixed picture

Retail sales, which mirror consumer demand, the main economic driver in Russia, slumped 9.7% year-on-year in April after a 2.2% rise in March, while economists polled by Reuters had on average predicted a 6.8% decline, data from Rosstat statistics service showed.

The drop in retail sales, however, was expected after a massive buying spree after Feb. 24 as households stocked up on a wide range of goods on expectations rouble depreciation and western sanctions would drive prices higher.

But weekly consumer inflation was at 0.0% in the last week after modest deflation in the preceding seven days, reflecting sluggish consumer demand and opening the door for more interest rate cuts by the central bank to make lending cheaper to support the economy.

This came in line with the latest Reuters poll of analysts from late May that marked an improvement in economic expectations after the central bank last cut its key rate by 300 basis points to 11% (RUCBIR=ECI) at an off-schedule meeting in May ahead of the June 10 planned rate-setting meeting.

Industrial output shrank by 1.6% in April, data showed on Wednesday, after 3% growth in March, in line with expectations that unprecedented western sanctions will damage the Russian economy.

But the unemployment rate unexpectedly declined to a record low of 4.0% in April from 4.1% in March.

Data showed with a month lag that real wages, which are adjusted to inflation, rose in March by 3.6% contrary to expectations in the Reuters poll for a 4.5% decline.

The Reuters poll showed in late May that Russia’s economy will contract less than expected this year and inflation will be lower than previously thought even though what Moscow calls a “special military” operation in Ukraine entered its fourth month.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.