Posted on 11/23/2021 6:04:15 PM PST by blam

The real trouble will start when this year’s energy crisis morphs into next year’s food inflation problem.

We’ve all become armchair inflation experts. And why not? It’s almost impossible for anyone to keep getting it as systematically incorrect as professional economists have done this year.

It’s time for the conversation to move beyond the current obsession with eye-catching headline numbers. That we’re in a global inflation regime of a kind not seen for decades, is beyond doubt.

Interest in supply chains is at a 17-year high, according to Google Trends, but it has become a red herring when it comes to forecasting the persistence of inflation.

Supply-side constraints are usually a key initial catalyst in any price spiral. And it’s intuitive that the vast majority of supply-side issues are “transitory” in nature as supply eventually responds to higher prices. So, while it’s good to know when supply-side pressures will ease, that knowledge isn’t sufficient to conclude when the broader inflation threat will pass.

What we need to establish is whether demand will take over in leading the inflation charge. And, for that purpose, inflation expectations are critical. As measured by breakeven rates, U.S. 5-year expectations have breached 3% for the first time in at least 19 years. The U.K. equivalent is well above 4% for the first time in records going back more than 25 years.

Expectations of higher inflation have the double impact of encouraging people to front-load spending, further pushing up prices, as well as the more important effect of laborers demanding higher wages, thereby both directly increasing costs and the future pool of capital allocated to demand.

This latter point is crucial to dwell on: CPI gets boosted as equality increases and labor takes a larger share of profits from capital. This is because lower-income individuals have a higher marginal propensity to consume, whereas wealthier people just add to investments. An extra $1 billion to Warren Buffett won’t change his spending habits, whereas an extra $100 to a low-income single parent likely gets recycled into the real economy within days.

Inflation becomes a material economic problem when it significantly affects the person on the street, squeezing their disposable income and compelling central bank reactions.

And the various themes of 2021 are coalescing into a perfect storm for one of the few unavoidable items in every CPI basket: food. Climate disruption has been a primary catalyst, but the price impacts have been exaggerated by supply-chain issues and labor shortages driving up wages. Now, the energy crisis is exacerbating the problem directly through costs.

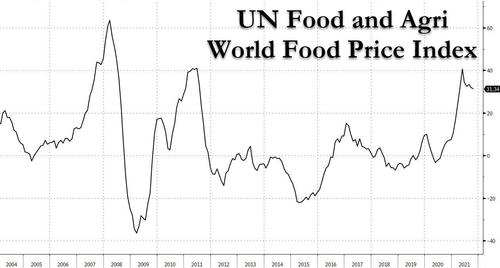

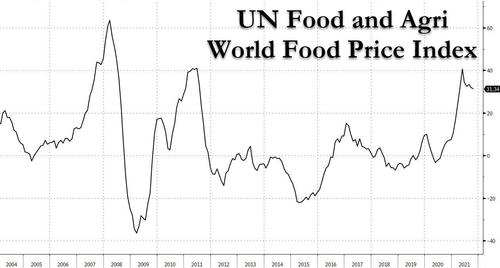

But it’s the issue of fertilizer becoming too expensive and industrial greenhouses getting turned off that is sowing the seeds (inappropriate pun intended) of the 2022 crisis. The UN Food and Agriculture Organisation’s food price index is up more than 30% over the past year as of the end of October, and not slowing down this month.

Coffee, a daily staple for many of us, provides one great example where there’s been such damage to crops that it’ll take several years to see the damage repaired. Arabica coffee beans, the main type, have doubled in price over the past year.

Wheat is surging globally with negative supply stories mounting by the day. Milling-wheat reached another record in Paris and the International Grains Council warned last week that inventories across major exporters could fall to a nine-year low. That’s something to bear in mind as tensions mount on the Russia/Ukraine border — two of the world’s largest wheat producers.

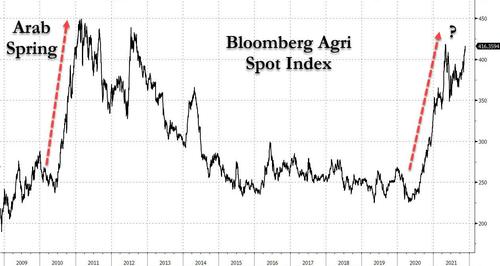

The Bloomberg Commodity Agriculture Subindex is up more than 80% from last year’s lows. The last such extreme surge, in 2010-11, was partially blamed as a catalyst for the Arab Spring, a series of social uprisings across much of the Arab world.

That is an index measured in dollars, and back then the greenback was weakening steadily. This year, the dollar is on a tear, meaning the true effect of these commodity price rises is even greater on consumers through much of the rest of the world.

A squeezed consumer is bad for stability in both politics and markets, and a negative for stocks. And few things motivate laborers to demand higher wages more than being unable to afford putting dinner on the table for their families.

It is this food crisis that will sustain the inflation problem well into 2022 and wreak havoc on a humanitarian level as well as for markets.

Something to ponder as we celebrate the food-focused holiday of Thanksgiving

I bought a whole beef from a local farmer last month. He kept the price the same as he charged last year. I asked him how he could afford to do that. He sells 50 or so a year and told me his expenses for this year were up $35 a head, primarily from increases in fuel. He raises all feed for them and made no capital expenses last year though.

Maybe President Retard can beg OPEC to send food too? 🤪

I suspect you mean “president Brandon” here...

Well he could tap the gummint to cheese reserves...

Time to break out the tiller and plant some seeds.

economists incorrect all this year....

Like they say weather forecasters and economics ones can be wrong all the time and still looked up to and paid big.

In other lines of work you get your rear end kicked out of the place.

It is still the supply chains, because it is the supply chains that supply the food.

I wonder if this took into account the possibility that the Administration makes good on their threat to keep the unvaxed from crossing State lines.

Good idea to tap the cheese reserves for guberment people as it tends to plug you up if you eat too much. God knows a lot of them need to be plugged up.

It’s not one or the other, and the underlying causes are the same.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.