P>

P>

Posted on 05/28/2021 12:56:39 PM PDT by blam

US Mint Delays Silver Shipments Due To “Global Silver Shortage” Interest in silver is soaring (both for industrial use and financial investment), echoing 2013’s crisis, as a recent report from the Silver Institute, silver demand for printed and flexible electronics is forecast to increase 54% over the next 10 years. Demand for silver in this rapidly developing sector is forecast to come in at 48 million ounces this year. By 2030, the demand is expected to surge to 615 million ounces.

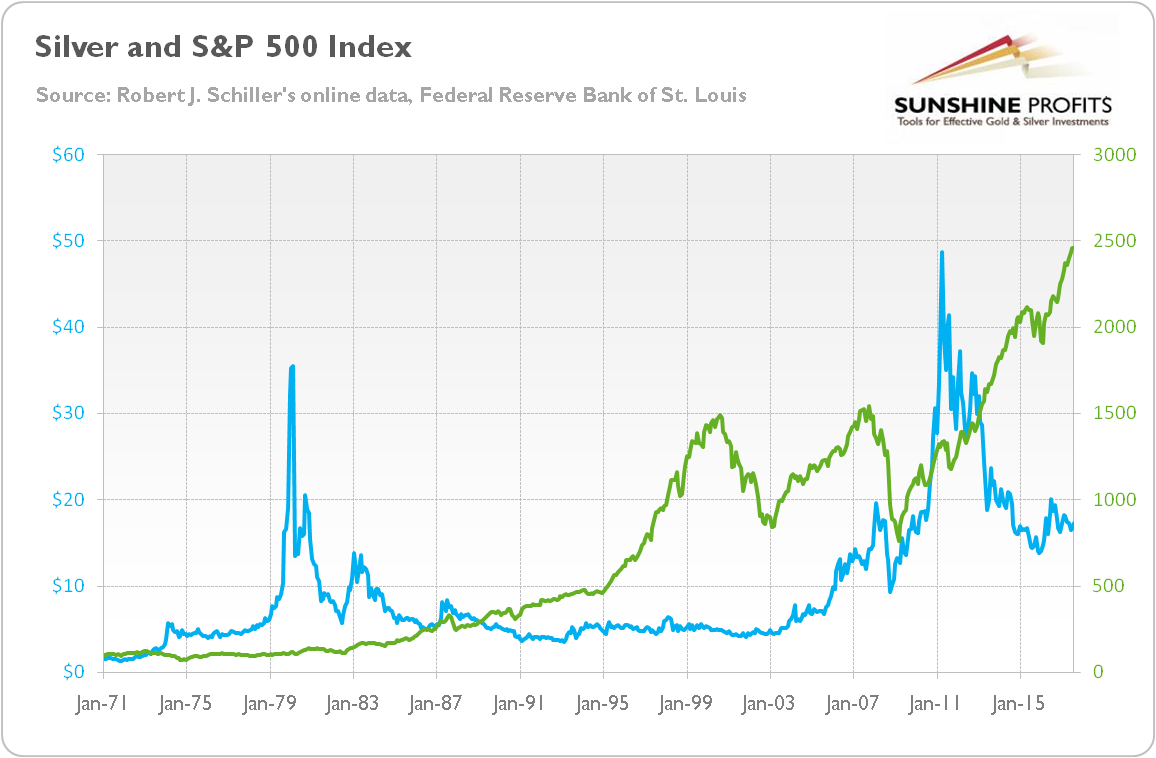

And silver prices are back near recent highs as monetizing debt

And according to the New York Times, the U.S. Mint even upped its coin production in mid-2020 after shortages of coins have been reported in the U.S. as a result of the coronavirus pandemic, but demand over the past few months from coin hodlers appears to have overwhelmed the US Mint.

As they just warned that they are halting sales due to a global silver shortage leaving them unable to meet orders…

The full statement from the US Mint (via Facebook):

The United States Mint is committed to providing the best possible online experience to its customers.

The global silver shortage has driven demand for many of our bullion and numismatic products to record heights. This level of demand is felt most acutely by the Mint during the initial product release of numismatic items. Most recently in the pre-order window for 2021 Morgan Dollar with Carson City privy mark (21XC) and New Orleans privy mark (21XD), the extraordinary volume of web traffic caused significant numbers of Mint customers to experience website anomalies that resulted in their inability to complete transactions.

In the interest of properly rectifying the situation, the Mint is postponing the pre-order windows for the remaining 2021 Morgan and Peace silver dollars that were originally scheduled for June 1 (Morgan Dollars struck at Denver (21XG) and San Francisco (21XF)) and June 7 (Morgan Dollar struck at Philadelphia (21XE) and the Peace Dollar (21XH)).

While inconvenient to many, this deliberate delay will give the Mint the time necessary to obtain web traffic management tools to enhance the user experience. As the demand for silver remains greater than the supply, the reality is such that not everyone will be able to purchase a coin. However, we are confident that during the postponement, we will be able to greatly improve on our ability to deliver the utmost positive U.S. Mint experience that our customers deserve. We will announce revised pre-order launch dates as soon as possible.

For now, according to generic data from Bloomberg, the physical premium over paper prices has somewhat normalized…

But a quick check of actual prices in the real world shows silver bullion trading at a huge premium…

(snip)

P>

P>

It’s all those silver eaters................

If you want to buy silver, you pay the physical premium. If you want to sell, you get the paper price. Even the miners have to play this game with wall street.

Bull shit. There is no silver shortage. This is written for morons that used to believe in peak oil. People need to recognize this crap for what it is. It is to convince people to buy silver coins. That is a rip off. If you want to buy silver, that’s fine, but premium paid for coins is not worth it.

Until the day they don't. Then, Stackers (and Supply/demand) rule.

COMEX and NESARA are incompatible. We either have one, or we have the other.

Silver Shortages Suggest We Are Only Months Away From $50 Silver

Feb. 10, 2021 2:20 PM ET

https://seekingalpha.com/article/4404967-silver-shortages-suggest-are-only-months-away-from-higher-silver

The real price of silver is like $1500 an once but wells fargo and other banks artificially hold the price down. /s

I thought it was $1,800 per ounce.

I have 2 silver mines.

There is no silver shortage.

More commie propaganda BS.

The gold dots on this map of southern Arizona are abandoned gold mines. Most of the rest are abandoned silver mines. The Tombstone mines produced 32 million troy ounces (1,000 metric tons) of silver, more than any other mining district in Arizona.

what do you think the correct market price is?

I am 60. I think this is the 3rd time in my life that there has been an attempt to corner the silver market.

I wish them luck. But I will sit this one out. Although I enjoy the increases in the gold market. (I think I was THE buyer at the top in 2008. We only need a double from here. Lol.)

If the price of silver was really poised to skyrocket then no one would be willing to sell it. I’ve seen this movie before. Shysters all over the radio hawking gold or silver with wild claims of impending price spikes. Spikes that never materialize. Thousands of suckers pay well over spot price and are left holding the bag.

No one is cornering the silver market.

The Lone Ranger digs the bullets out of everyone he shoots

Watching this.

They should stop wasting silver on that commemorative crap and stick to Eagles.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.