Posted on 04/30/2020 3:31:23 AM PDT by SkyPilot

When Kentucky senior Senator and Majority Leader Mitch McConnell said this week that he would be in favor of allowing states to use the bankruptcy route to deal with their underfunded public pensions amid the pandemic emergency, state workers and retirees—already struggling with the economic and health crisis—were rightfully alarmed. “Using the bankruptcy route” is code for slashing pension benefits promised to state workers. Under current law, only cities and other local governments can file for bankruptcy and only with permission of the state.

McConnell supposedly represents Kentuckians and Kentucky already had the worst-funded state pension system in the nation—only 16% funded—before the COVID-19 market meltdown. Chris Tobe, a former trustee of the Kentucky pension and SEC whistleblower, suspects when the pension reports fiscal-year-end performance July 1st, its funding level may fall into single-digits. (Full disclosure: I served as Independent Counsel to Mr. Tobe in connection with his SEC whistleblower complaint.)

Presumably Kentucky would be the first state to use McConnell’s bankruptcy plan to eliminate state worker retirement security. Kentucky has over half a million (514,000) current and future pensioners who are unlikely to support his reelection. A staggering percentage (94%) of the state’s 114,000 retirees still reside in Kentucky and pump over $1.9 billion a year into all 120 counties. Cutting pension benefits will undoubtedly depress the local economy.

To be clear, McConnell is not opposed to all federal bailouts of pensions. A few months ago, he joined a bipartisan group of senators in introducing a bill to secure the pensions for nearly 90,000 retired coal miners as a recent wave of coal company bankruptcies threatened the solvency of the federal pension fund.

(Excerpt) Read more at forbes.com ...

I am not a state pensioner - but I pay state taxes, and like most of you I am watching the economic disaster of the COVID situation cause utter destruction. Most states have grossly mismanaged their bloated pension systems, and COVID has caused their ships to hit the proverbial iceberg.

Despite the massive turn around in investment opportunities since the 2008 economic collapse, state pensions have only become more insolvent. They couldn't exploit that incredible growth - and I predict that many states pensions systems are about to collapse.

See this article from Reason:

I know many of the responses here will be "Good - F em!" Believe me, I am no fan of funding the six figure, gold plated state pensions in my state. I post this because the pension collapse is going to affect quite a bit: the economy, and politics, very soon.

I spoke to a friend who runs and accounting firm, and who knows many politicians at both the state and national level. He told me that some states are going to keep hoping for a bailout, and other states are trying to use the COVID crisis as an excuse to cover up for their years of pension mismanagement and over promises. He also said the instinct in many states will be raise taxes (sales, property), but even many insane Democrats know that with the economic collapse, this will only make their states bleed out taxpayers and revenue. You can't get blood from a stone.

We live in incredible times.

Can’t get blood from a stone, but can sure grind it to dust.

Exit tax by each state would stifle migration.

If someone promises you something 40 years in the future and it doesn’t happen, they did not necessarily lie to you. No one has a crystal ball to see that far ahead.

True. I believe the exit taxes are unconstitutional, but then, the courts are not usually friends of the Constitution. There may be other schemes that Democrats are dreaming up to prevent people from moving out of some states. Time will tell.

Some here won’t have the attention span to read your whole post. It’s incredible that I did :-) and is very accurate.

but it hurts the narrative that big bed New York will be destroyed. New York State pension fund is actually very well-funded right now.

And as the article States Kentucky has about 19% of what has been promised to Future retirees.

in the end folks will be shocked or which states need the help the most.

And I wonder if they will sing the same tune then

Especially when those promises are not based on reality. The company I work for has a fully funded pension, at least they tell us it is, that is based on reality. It’s not a six figure retirement like we see in the public pensions.

In NYS, a cousin was a police officer earning $40,000 a year. At age 50, he worked so much overtime his final year, he retired with a state pension of $89,000. State pensions are graft for the unions.

Correct. But the courts don't see it that way. In Illinois, a judge simply ruled that the state had to not only pay every penny of pensions earned by retirees, but it also had to pay every future pension of workers.

Illinois Supreme Court rules landmark pension law unconstitutional

I have a relative who is a retired police officer. His pension is a very healthy six figures.

In many high tax states, the retired teachers and administrators qualify for their pensions......and then run screaming for the hills to another state so that they don't have to pay the high property and other taxes of the state that is funding their generous pensions.

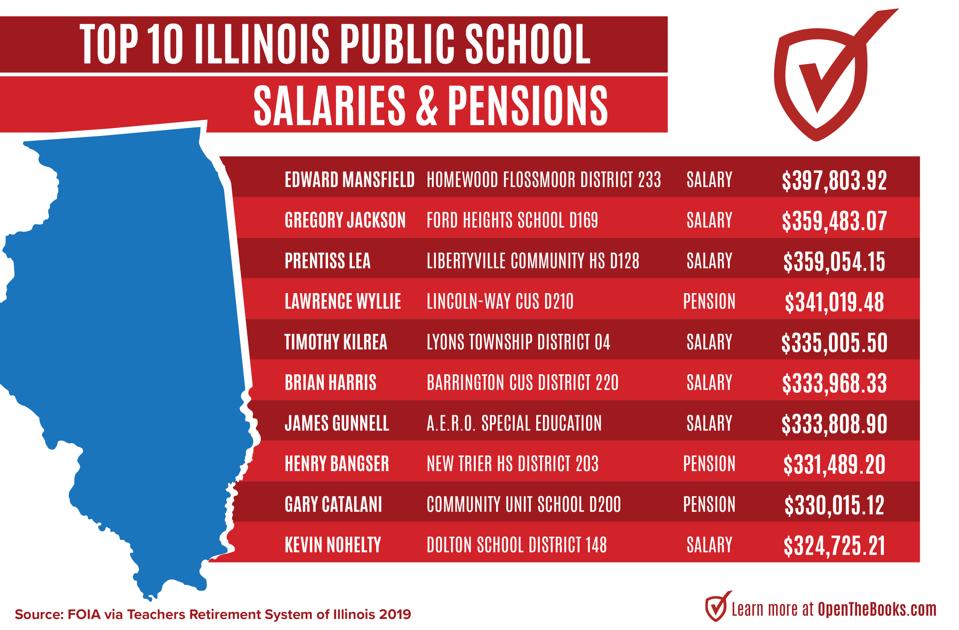

Should be a Federal Law that requires states to budget for each year to a locked down individual account similiar to the 401K provisions. Some of these contracts are ridiculous. I saw some Rep Congressman on TV saying in his hometown, where average home prices are about 75K, the Supt of Education got 400K and 300K a year in pension. Isn’t it funny how states want their rights and then come for National taxpayers to bail them out.

A lot of retirement systems fall into the same category.

Some say Social Security is a Ponzi scheme. In many ways, they're not wrong.

The Stock Market? Most stocks in the stock market meet the SEC’s definition of a Ponzi scheme.

He wasn't exaggerating either.

Take just Illinois for example.

Why Illinois Is In Trouble – 109,881 Public Employees With $100,000+ Paychecks Cost Taxpayers $14B

My brother is an actuary who works with pension plans. He tells me that those rooted in reality are few and far between.

I am from Illinois. I know two retired high school principals that get over $150K per year, and a superintendent who gets over $200K. At least two of them “spiked” their salary during their last year of employment to add about $15K to their retirement. The Illinois retirement system is obscene. No other state should have to help fix it.

Sounds as a good a time as any to work to get the vastly out control public pension systems overhauled and back in control and away from pandering liberal politicians. I say no to any federal bailouts to states with out of control public pension systems. Enough is enough already.

I live in one of the districts on the chart. Real estate taxes to support these gonefs are outrageous. Nice to know the fruit of one’s labor finances luxurious lifestyles of these unscrupulous bastards who in turn are in charge of childrens’ education.

About 34 days ago, before any “official” lockdown, There was already a lot of small businesses closing. This was before I believed we had crossed the line and killed the economy. But I said to my friends, “States live off tax income - and much of that is sales and income tax. If people stop earning and spending, the states are going to see their income collapse. And unlike the fedgov, they can’t print money.

In KY, Bevin lost because he was trying to save the state’s economy by making some tough choices regarding state pensions (ours were, I believe, second worst only behind Illinois). The teachers hated him so much (even the conservative ones) that they successfully got our states previous, corrupt governor’s son elected, beating Bevin by 5,000 votes out of 1.5 million. And here we are.

Looks like he’ll be a one termer too. It was comical how some of our female friends - even republican ones - were posting pictures of themselves and their husband on facebook, with Beshear’s face over their husband’s. It was creepy.

He was popular even though the only thing he actually did was approve four new abortion clinics in a state where the sole clinic was on its last legs. This is a strong pro-life state. Once the polish fades, this guy is going to be in deep water in popularity, I suspect.

Perhaps - but when the promise is constantly renewed over them 40 years, whether by actual renewal or by not removing the promise from the “rules book”, it takes on a different tone - especially with a State, which doesn’t just go away like many businesses...many businesses will, “retool/rebrand” to change enough so they no longer have to honor their 20 year or even lifetime warranties...States can’t do that.

Public sector pensions should be outlawed and replaced with a fully funded 401-K type plan.

The current system is insane.

Back in 1970 in high school, some of my friends asked, “whaat if I buy these savings bonds but when they mature the government won’t honor them.” I told them that if we lived in such a world, that would be the least of your problems.

I still feel that way about the fedgov. But this state stuff is different. States can’t print money and there are all sorts of things they can do to harm citizens, depending on how much they control their citizens’ lives.

If your life savings is in Social Security and Precious Metals hidden in your mattress, there is not much they can do to you other than create massive price inflation, don’t raise SS in response, and confiscate your pm’s at a set price. They did the latter almost a century ago, so they’ll have a hard time doing it again, but I fully expect the price inflation. They can’t just hand out money like it’s free breath mints and not expect prices to rise in response.

But when the state controls your savings, watch out. You may be set for a very bumpy future.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.