Posted on 04/14/2019 11:46:37 AM PDT by Moonman62

If the Fed had done its job properly, which it has not, the Stock Market would have been up 5000 to 10,000 additional points, and GDP would have been well over 4% instead of 3%...with almost no inflation. Quantitative tightening was a killer, should have done the exact opposite!

The Fed did go to far. They flattened the yield curve.

Trump is great on economics. The Fed is wrong.

So you are saying there was no economic growth since 2016? CPI (inflation) is up significantly since 2016...I though you liked President Trumps’ economic plan?!?

http://explistats.com/economic-activities/consumer-price-index/?tab=cc&0=5yrs&1=cpiu&2=1687

http://www.shadowstats.com/alternate_data/inflation-charts

The question really was at the time (a) did the yield curve invert because of Fed action, or (b) because of what was seen then as a slowing in the global economy. As what does past history indcate, that (1) an inversion of the yeild curve is a cause of a recession, or (2) is it an approximate 1-year advance warning of factors building towards a recession. The warning in item (2) is exactly what the last yield curve inversion represented.

Many companies pay little to nothing in dividends, acting on the idea that a rising share price provides plenty of substitue gains on an investment, if someone wants and needs to take them, even if no dividend is paid. Not paying dividends means a company is either (a) not doing well or (b) is doing well but reinvesting earnings. Most Facebook shareholders seem to think it is the latter. Dividends or no divdends are not an exclusive barometer of how well a company is doing.

Facebook and other current tech leaders are not unusual in the history of technology companies when it comes to paying dividends. Microsoft was listed for 18 years before it started paying dividends.

https://www.dividend.com/investor-resources/sp-500-companies-that-dont-pay-dividends/

This is no defense of Facebook as to what are its user policies or its censorship and manipulation of what its users see.

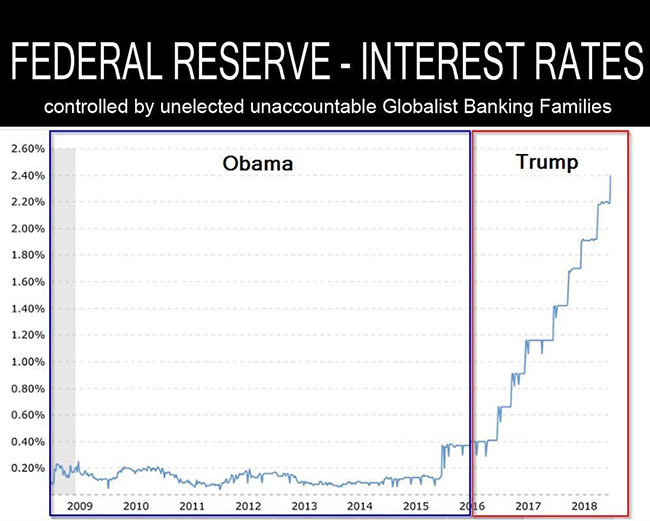

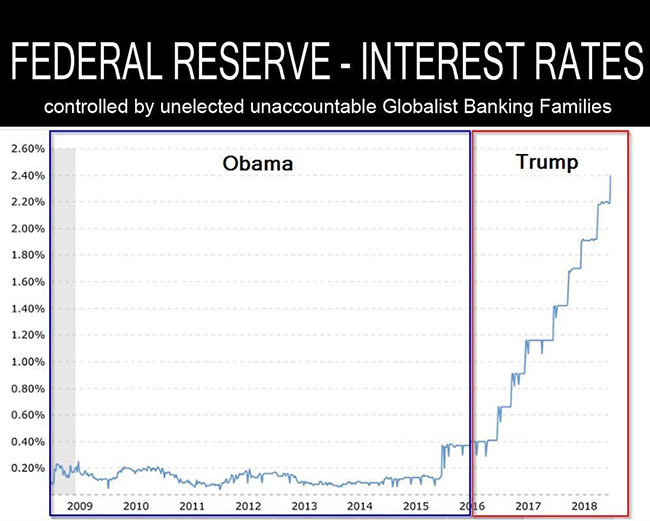

The chart is a direct indicator of President Trumps’s economic policy success. If the Fed stops raising rates then it indicates that the economy is flattening/faltering. Fed interest rate policy was in the best interest of the people not Obama (”dual mandate”) and the rate increases started under Obama.

Agreed.

Keep in mind that President Clinton had the budget and the debt under control when he left office. Credit Clinton and Gingrich with having a responsible attitude toward sustaining the nation's financial health.

The Federal Reserve likes to punish Trump, policies that make the economy grow, and the people that make the economy grow.

There are some people on the FOMC that agree with Trump, but they are in the minority. Perhaps that will change when he gets the two vacancies filled. In the meantime I think he’s at least convinced them not raise rates any more.

At this point, that’s looking like the cost-effective way.

Easy peasey to answer that.

Economic stimulus. They were trying hard to cover up Obama's failures on the economy. He never saw a tax he didn't like or a regulation he did not want to make more onerous.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.