If they pass this bill, it's bye bye GOP majority in the House of Representatives.

Posted on 11/10/2017 12:56:39 PM PST by Oldeconomybuyer

Senate Majority Leader Mitch McConnell (R-Ky.) is walking back his claim that no middle class Americans will see a tax increase under the Senate GOP plan.

"I misspoke on that. You can't guarantee that absolutely no one sees a tax increase," McConnell told The New York Times on Friday.

McConnell added that "what we are doing is targeting levels of income and looking at the average in those levels and the average will be tax relief for the average taxpayer in each of those segments."

(Excerpt) Read more at thehill.com ...

These same people think that the government sends a bigger gift (refund) to rich people than to them and are not happy about it.

Some Republican congress critters and pundits are still saying "give people back more of their money" instead of "let people keep more of their own money." Words mean something. The title EITC is another misnomer. It is a welfare payment, not a refund.

People also call their EBT payments their "paycheck." It should be titled: Thank you very much Taxpayers card.

That's the most succinct description I've seen of this tax plan. Well stated.

Just more Turtle rear output.

Just put the guy on a post.

Where is the common sense, comprehensive spending reduction?

Next week it'll be "You can't guarantee that absolutely most people won't see a tax increase..."

Socialism, communism or liberalism it’s all the same for all troubles. Lower the bar to the lowest common denominator. Third world status for all. Well all but the ruling class.

Lol!! Spot on!!

I wish that could be tweeted to McConJob, since his DC voicemail box is full :-)

Why are the Repubics destroying themselves? They have a senate majority to pass this bill. Now the Turtle says some middle class will see a tax increase????? Throw the bums out!!!!!

Large families will pay more taxes...I did some figuring when it first was announced they were upping the standard deduction, but doing away with dependent deductions.

Now maybe they’ve worked this out, and changed it up, but this original statement meant anyone with more than 3 kids would pay more taxes.

Now approx $12000 for a family deduction, plus $4K for every person/dependent, so a family of free gets $32000 deduction.

New proposal, the $24,000 standard deduction, but no personal deductions. Hopefully they’ll realize this.

I know the child credit increases $600 per kid, and there’s a big difference between a credit and a deduction and my mind can’t wrap itself around that

right now :)

But it’s not just kids that are added to your income tax as dependents. We took care of my MIL in our home and since we were supporting her, she was a dependent as well.

I hope it’s all been resolved, and who knows what the bill will look like when the two bills are “merged” but to tout savings for middle class and then noticed the

dependent problem, I was really disappointed. Now we’re empty nesters, but I knew many in our younger years and the families had 5 or 6 kids. I don’t know if there are a log of larger families these days, but they’d be hit hard.

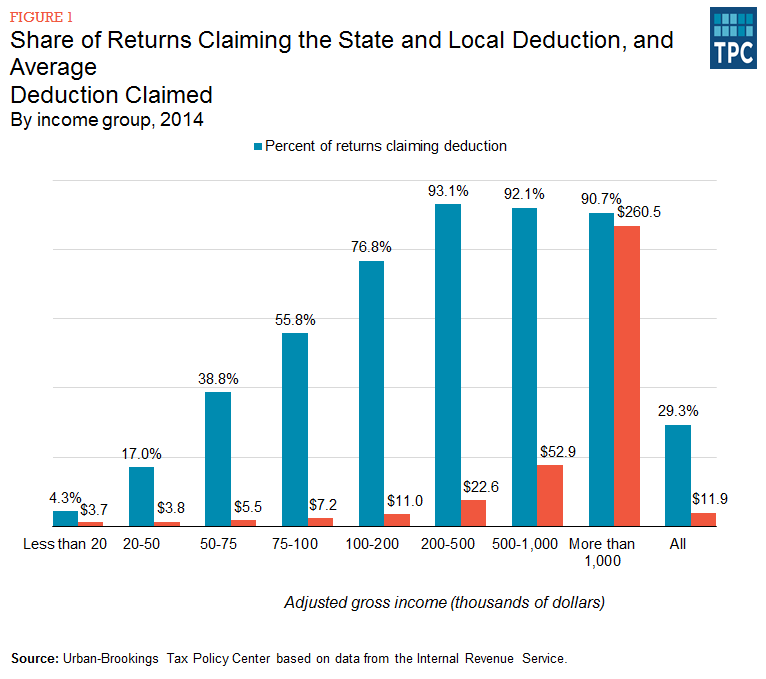

Anyone presently in the 25% bracket in a state with high income tax rates who pays more than $10,000.00/year in property taxes will have a Federal Income Tax INCREASE.

Static rate + fewer deductions = higher taxes.

The GOP may as well kiss the rustbelt goodbye—forever.

Ping.

We need common sense, comprehensive spending control.

I am upper middle class (barely). I live in California and will definitely get a tax increase. The value of my home will be going down too.

If they pass this bill, it's bye bye GOP majority in the House of Representatives.

But think of all the jobs it will create for h1b visa holders. Heck there will be so many jobs companies refuse to give Americans, they’ll have to pass comprehensive immigration reform to meet the demand.

They can be primaried and replced with a MAGA candidate.

Ping.

Exactly!

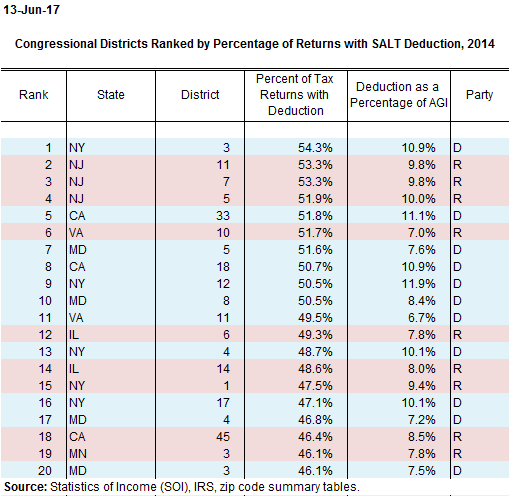

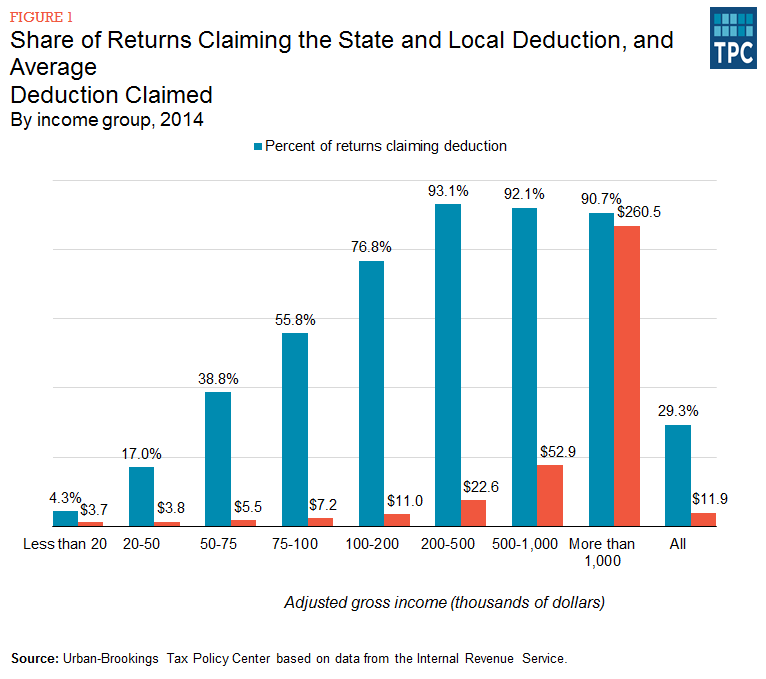

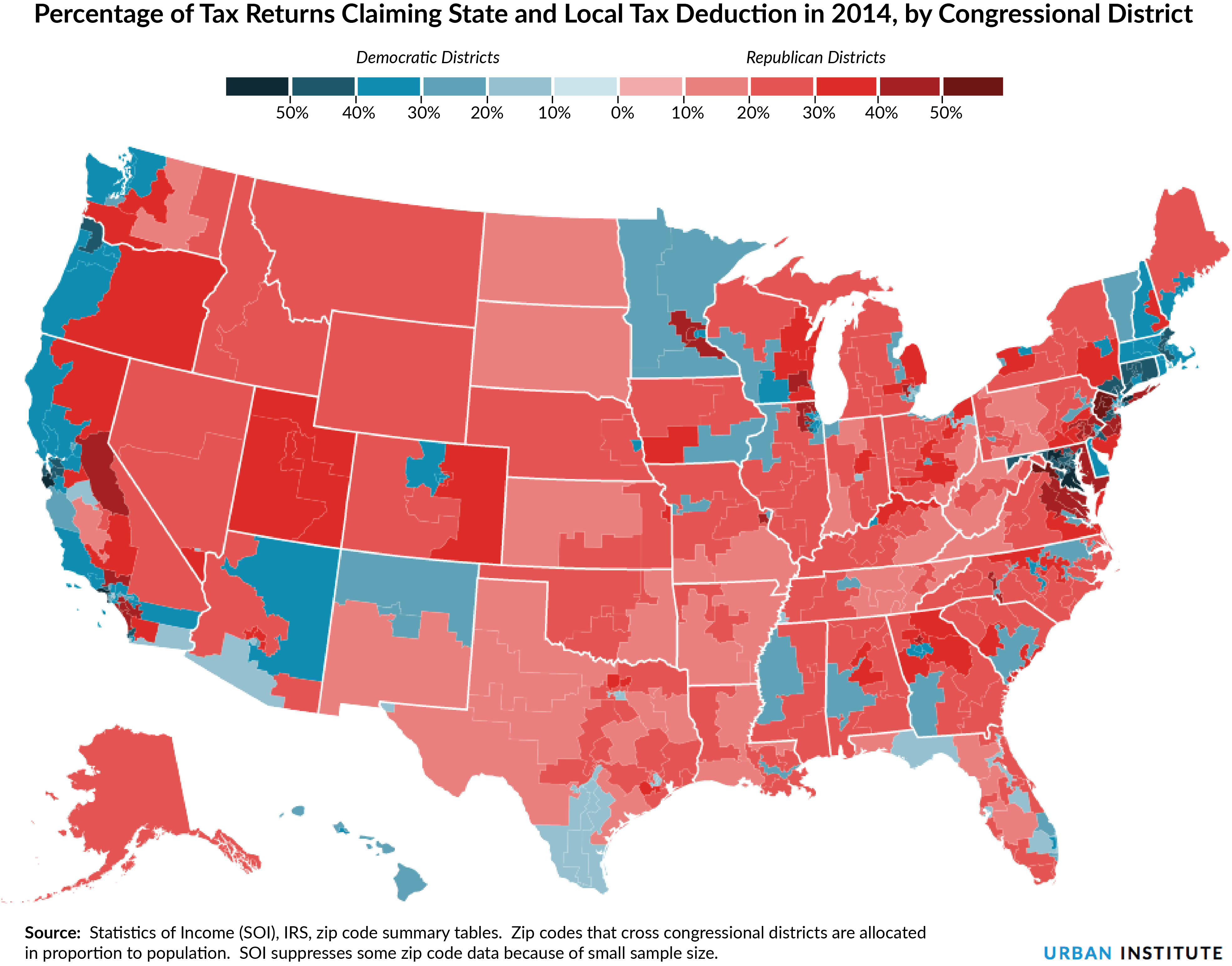

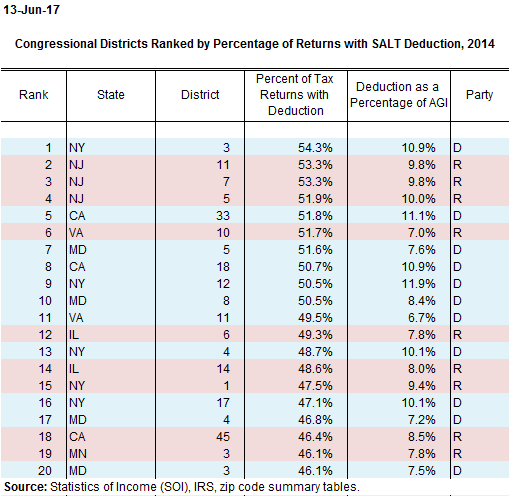

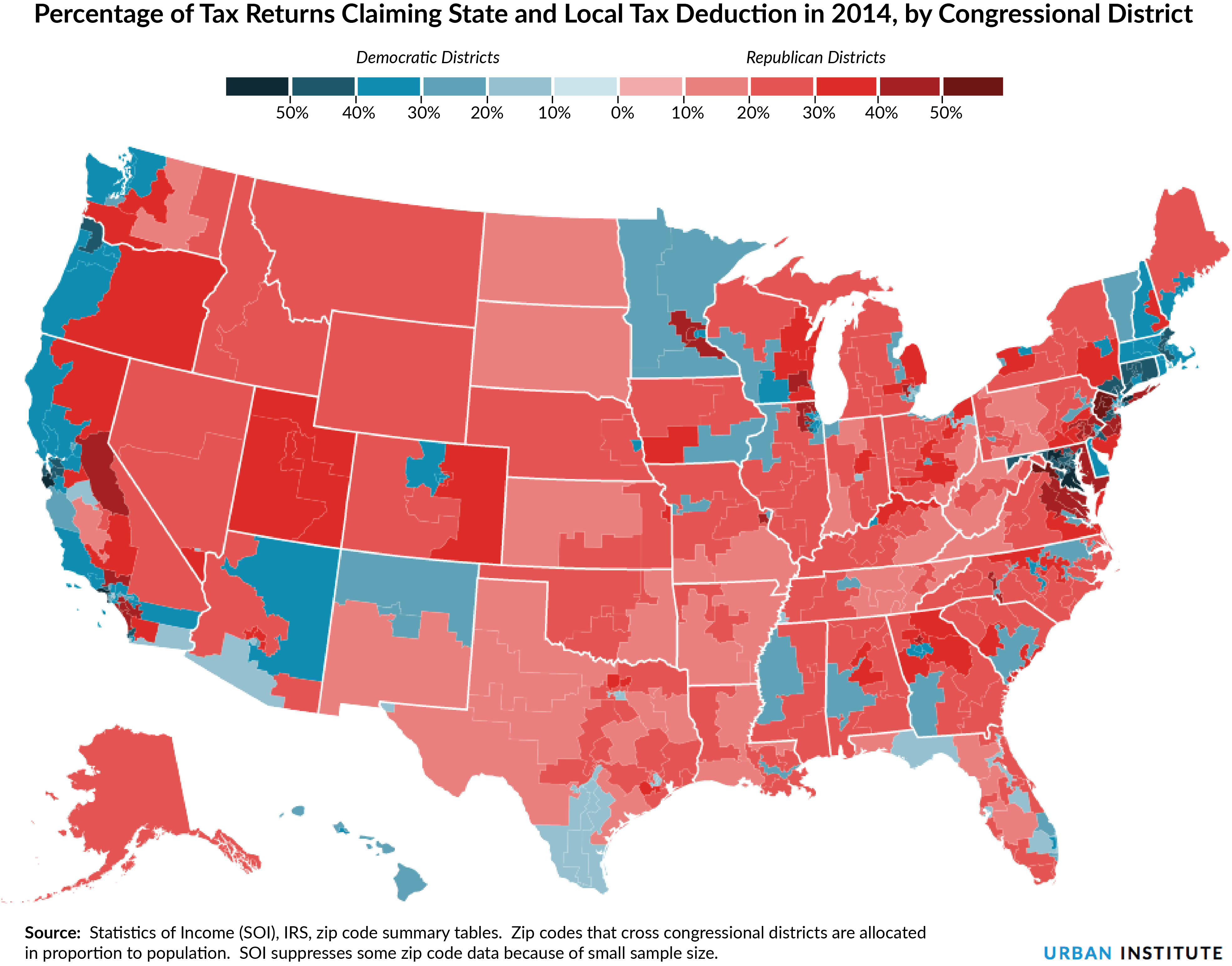

I look at the data, combined with what we know about net donor states and wonder how anyone can believe support for these Republican plans is anything but class warfare.

Every Congressional district in America has some taxpayers who make use of the SALT deductions, and while some will drop off with the increased standard deduction, very, very few will drop off if their income is over $100k.

Yet I’ve seen several dozen right here on Free Republic who still want to “stick it to those blue states”. And every state in the union, every single congressional district, red or blue, are taking these deductions because they have middle class income, a mortgage and therefore; significant state and local taxes.

When the income tax was first passed in 1913, taxing those monies which were used to pay other taxes was considered a moral issue. Something even the Progressives of the era would not propose.

Now we have a bunch of Social Justice Warriors on Free Republic, many who have probably never itemized a return in their adult lives, demanding these tax plans go forward.

They should now understand, if they are paying attention and not ignoring the data, that it would be their last hurrah at the political level.

There would never be another Republican majority in either House of Congress.

And Trump would be lucky to survive until the 2020 election.

Still, somebody is going to post after this one saying I’m just trying to protect the commies in California.

Similar to the House bill, the Senate bill allows for the immediate deduction of capital expenses, business spending on new equipment, but this would expire after 5 years... the standard deduction would rise to $12,000 for individuals and $24,000 for married couples...

Caroline Glick... considers our very own D.C. lobbyists and reveals information that is on the record yet, as James Lewis pointed out to me, is almost never mentioned in the media: Saudi government spending on lobbyists in Washington far outstrips that of any other nation... "Since 2015, the Kingdom has expanded the number of foreign agents on retainer to 145, up from 25 registered agents during the previous two-year period." ...Saudi lobbyists shielded the kingdom from serious criticism... even as it was revealed that Princess Haifa, wife of Prince Bandar, the Saudi ambassador to Washington at the time the September 11 attacks occurred, had financially supported two of the hijackers in the months that preceded the attacks... Read the whole thing, and then realize that the tap is being cut off for the lobbying and much, much else financed by rogue royals...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.