Skip to comments.

After 8 Years Of Radical Moves, The Fed’s Still In A Box

Investors Business Daily ^

| 5/20/2016

| TERRY JONES

Posted on 05/24/2016 4:54:13 AM PDT by expat_panama

When the economy stumbles, can the Fed still catch its fall?

A growing number of economists, market analysts and investors worry that the answer is no. The Federal Reserve’s radical approach to monetary policy since the financial crisis, they believe, has confounded its ability to do anything about a potential downturn — or an unexpected shock to the economy.

Worse, others argue that by staying with a zero interest rate for so long, the Fed has put itself into a box...

...the dilemma.

The post-financial crisis economic recovery still looks shaky. The Atlanta Fed’s widely followed GDPNow number, a timely estimate of the current economy, anticipates 2.5% growth in the second quarter, down from a 2.8% estimate a week ago. That follows the first quarter’s tepid 0.5%...

...Taylor’s rule seeks to optimize policy by stipulating how much the Fed should raise or lower its benchmark interest rate in response to changes in output, inflation and other economic variables.

Until the early 2000s, many of the world’s central banks used a Taylor Rule...

...we need a rule — a target — for monetary policy. Historically, a clear target has led to a sounder economy, says Allan Meltzer, a professor at Carnegie Mellon University and Hoover fellow who advised both President Reagan and Margaret Thatcher on economic policy.

Meltzer argues that there have been two “golden ages” for Fed policy: 1923 to 1928, when the Fed was on a gold standard, and 1986 to 2002, when Greeenspan in effect followed a Taylor Rule approach. We need to return to a system based on rules, says Meltzer.

“The current Fed responds to noisy current data,” Meltzer asserts. “A rule would give markets and the public better information about future policy actions. The current procedure increases uncertainty.”

(Excerpt) Read more at investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; fed; investing

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

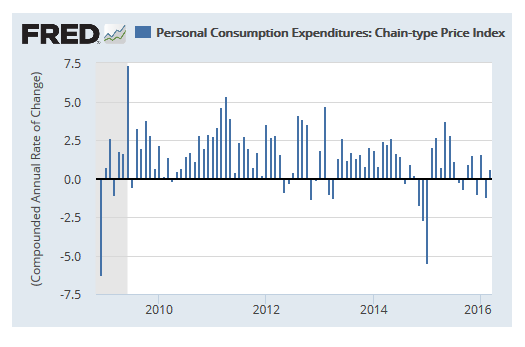

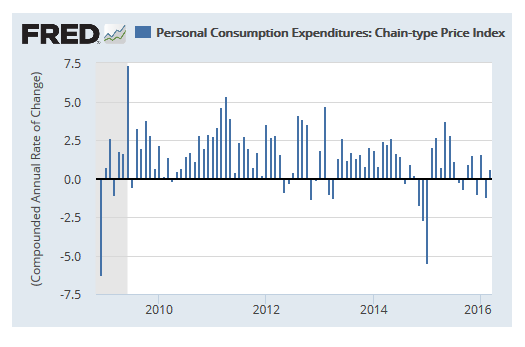

imho the entire premise of this essay is wrong, that somehow it's the government's job to run the economy --and this is the nonsense that's got Yellen in a box. The Fed was created to --and is able to-- act on behalf of Congress' constitutional mandate to regulate the value of the dollar. The fed's inflation measure is the price index for the PCE--

Personal consumption expenditures (PCE) is the primary measure of consumer spending on goods and services in the U.S. economy. It accounts for about two-thirds of domestic final spending, and thus it is the primary engine that drives future economic growth.

--and that index is dangerously low:

Yellen's got lots of tools to keep up prices, but it's no longer just a monetary concern but instead it's now becoming a political problem. Politics has no place in monetary policy (mho).

To: expat_panama

One of the worst federal decisions was the largest tax increase in history (Obamacare) right after the worst economic downturn since the depression.

2

posted on

05/24/2016 4:57:39 AM PDT

by

The_Media_never_lie

(Apparently, most people are fine with what Obama is doing, while he ignores our problems.)

To: expat_panama

The Fed gave billions of dollars to the entities that caused the problem, then told the US taxpayers it was our debt. Can’t imagine why that longterm only made things worse. (eyes rolling)

3

posted on

05/24/2016 5:06:09 AM PDT

by

grania

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; aposiopetic; ..

Happy Tuesday fellow investors! Gold'n'silver keep stabilizing (more or less) and after yesterday's modest stock losses in falling trade we're now looking, well, somewhere. Either with up futures or down a bit.

New Home Sales comes out today, note that IBD's econ news led w/ Existing-Home Sales Steadily Advance To 5.45 Million Annual Rate.

More news:

Trump's Wall St Rapport Not As Great As He Claims - Susanne Craig, NYT

Will Trump and '0' Rescue Americans From the U.S.? - John Tamny, RCM

Bernie Sanders Still Has No Idea How Banks Work - Debra Saunders, TAS

ACA Reform:What's Next - Henry Aaron/Kevin Lucia/Justin Giovannelli,RCM

Technology's Rendering Obamacare Irrelevant - Alfredo Ortiz, OC Register

CA's Bullet Train to Nowhere Is Delayed...Again - John Merline, Investor's

Connecticut and Taxes: 25 Years, $13 Billion Lost - Rex Sinquefield, Forbes

Save Puerto Rico, Set It Free - Veronique deRugy & Tad DeHaven, USA Today

The Adjective 'Developing Country' No Longer Exists - Matthew Lynn, DT

What, you didn't know that "Developing Country" was an adjective?

To: The_Media_never_lie

...worst federal decisions was the largest tax increase in history (Obamacare) ...Dang! That's where we really need to be focusing. It's national fiscal policy (tax'n'spending) what's been so screwed up, monetary policy (inflation) is fine, although maybe that's why I like to keep going back to it....

To: grania

The Fed gave billions of dollars to the entities that caused the problem...If you're talking 'TARP', that money got paid back. The_Media_never_lie and me blame cr@p like Obamacare.

To: expat_panama

my thought was should the Fed even try to catch the fall?

falls are required to sort the wheat from the chaff

7

posted on

05/24/2016 5:15:46 AM PDT

by

bert

((K.E.; N.P.; GOPc;+12, 73, ....Opabinia can teach us a lot)

To: expat_panama

It’s good that the money got paid back. It doesn’t change what happened. The big banks got bigger and the federal debt and budgeting restraint got worse. Now, we’re possibly on our way to another credit bubble. The middle class has been decimated. Paying back the TARP money doesn’t seem to have stopped the damage that “too big too fail” contributed to.

8

posted on

05/24/2016 5:22:26 AM PDT

by

grania

To: bert

the Fed even try to catch the fall?That was my take. Reminding me of that clown/fireman act in Dumbo.

To: expat_panama

"The post-financial crisis economic recovery still looks shaky." The article's author will never be able to draw a rational conclusion when his basic assumption is a lie.

There is no recovery. All of it - every single bit - is pure propaganda.

To: grania

...the federal debt and budgeting restraint got worse. Now, we’re possibly on our way to another credit bubble. The middle class... ...TARP money doesn’t seem to have stopped the damage...--but that's what we're saying. TARP had nothing to do w/ federal debt and the middle class, it was just for fighting deflation and it worked. If we want to do something now about budget debt and the middle class we need to repeal Obamacare. The fed had nothing to do w/ Obamacare.

To: expat_panama

She is a central planner. That’s not about economics; its all about political power and control.

To: bert

falls are required to sort the wheat from the chaff

***********

Bingo!!! We have a winner.

To: TruthInThoughtWordAndDeed

...no recovery. All of it - every single bit - is pure...Either that or it's like the official line that we got full employment and we never had it so good. All good or all bad --great for comic books but for those of us who don't live next door to Captain Marvel it's a thing where we're stuck w/ the fact that we're seeing the great American people pushing forward and creating wealth while a mob of crazy left-wingers mess things up.

The result is a mix. Not one you and I are satisfied with but not "pure" by a long shot.

To: expat_panama

One of the Pauls said that if we did not have the FED we would each be 17% richer. They are making money hand over fist or they would do something. I think their plan is well on the way and I think the goal is to take over the USA.

15

posted on

05/24/2016 5:48:32 AM PDT

by

mountainlion

(Live well for those that did not make it back.)

To: Starboard; bert

...sort the wheat from the chaff *********** Bingo!!! ...Of course the result's usually that a bunch of people scream "help I've been reaped" but the economy's like that.

To: expat_panama

This might be of interest.....

MAY 10, 2016 @ 06:00 AM 81,563 VIEWS The Little Black Book of Billionaire Secrets

The Panama Papers? Here’s The Real Panama Story

Steve Forbes , FORBES STAFF

“With all thy getting, get understanding.”

This story appears in the May 31, 2016 issue of Forbes. Subscribe

SAY “PANAMA” these days and the word “papers” quickly comes to mind. Too bad. I recently visited this small Central American country and saw firsthand what is largely unknown: Panama is a huge economic success story, enjoying an average annual growth rate that’s about the best in the world in the 21st century. Things have “slowed” recently: Growth last year was a tad below 6% but is expected to be a bit above 6% this year. Unlike the numbers coming out of China these days, which are ostensibly slightly higher, Panama’s are the real deal. Its growth is still light-years ahead of that in most of the world’s countries.

Contrary to global headlines, Panama is no sleazy money-laundering backwater. Quite the opposite. Panama City is becoming the financial center of Latin America, with scores of global and Latin-American financial institutions having a sizable presence there. The country has made considerable progress in transparency. The multigovernment Financial Action Task Force on money laundering removed Panama from its gray list this year. In 2012 it was taken off the OECD’s blacklist of tax havens. Panama is implementing other reforms, such as doing away with anonymous shareholder certificates, and expects to be in compliance with OECD transparency standards by 2018.

Investors think Panama’s prospects are bright. The government recently floated a $1.2 billion bond issue, which was quickly oversubscribed. Government debt to GDP is only 40%; in the U.S. it’s over 100%.

In terms of moving freight, Panama has made itself the economic crossroads of the Americas. It has handled control of the canal well since it took over in 1999. The number of containers moving through this historic byway in 1993 was 267,000. Today there are well over 6 million, and with the opening of a third set of locks in June, which will enable the canal to handle today’s megaships, that number should surge to well over 12 million. The massive infrastructure attendant upon this growth in traffic has obviously been a boon to the country. The government wisely didn’t treat the canal as a short-term political piggy bank the way most countries have done with, say, their state-owned oil companies. Considerable sums have been reinvested in the canal. The resultant growing volume of trade has meant that government revenues from the canal have also grown nicely.

Almost a decade ago Panama enacted what is called Law 41, which offered considerable incentives to any major company making Panama its regional headquarters for Latin America. More than 100 multinationals, such as Procter & Gamble, have done so. Among the enticements is that their employees pay no Panamanian income taxes. As with the canal, the creation of these headquarters has generated supporting infrastructure, including schools.

Panama’s expanding airport has also became a crucial regional hub; 68% of the passengers landing there are passing through to other destinations.

With the exception of New York and Chicago, Panama City has more skyscrapers these days than any other city in the Western Hemisphere, and 16 of Latin America’s 25 tallest buildings are in Panama City. This is amazing when you consider such megametropolises as São Paulo, Mexico City and Buenos Aires.

Panama has been attentive to building the necessary infrastructure to support all of this expansion. Construction of a major monorail is under way, and a new convention center to handle such “business tourism” as conferences and exhibitions is near completion.

Another source of growth with enormous potential is medical tourism. Johns Hopkins, for example, has a large facility there. With health care less available in the virtually bankrupt systems of many Western countries, especially in Europe, demand for what Panama offers–excellent care at affordable cost–is almost limitless.

FORBES recently ran a major story about an extraordinary new “city,” Panama Pacifico, that’s rising on 4,450 acres of a former U.S. Air Force base. Billions of dollars’ worth of structures have already been built for numerous companies and thousands of residents. In 2007 a syndicate made up of a Colombian billionaire and a London-based real estate development company won the right to develop the site over a company made up of powerful local families. The triumphant developers are raking in big bucks, but the government doesn’t mind because it recognizes that the developers’ success is a boon to the Panamanian economy.

Business executives told me that one of Panama’s key advantages is its currency, the U.S. dollar, which the country has used since it broke away from Colombia and the canal was constructed over a century ago. Chronically unstable local currencies have been the bane of Latin America. The recent 35% currency devaluation in neighboring Colombia has sent shudders through Panama, reminding its businesspeople of the dollar’s advantages. For all the greenback’s woes, it’s a Rock of Gibraltar compared with the moneys of the rest of the region.

Panama is open to having foreigners move there, as long as they’re willing to work. Panama City has become more and more cosmopolitan, with numerous nationalities living side by side.

Foreign direct investment is also welcome. Though obtaining permits can sometimes require patience–Panama has its share of environmentalists–entrepreneurs believe the process to be well worth the effort and less cumbersome than in much of the U.S. Capital is seen as a friend, not something to be feared or strangled.

The tax system is also benign. The general VAT is only 7%, and there’s no inheritance tax. But the government should go the distance and enact a Hong Kong-like flat-tax system. It must also slow down the growth in government spending that’s taken place over the past four years.

17

posted on

05/24/2016 6:32:14 AM PDT

by

bert

((K.E.; N.P.; GOPc;+12, 73, ....Opabinia can teach us a lot)

To: bert

Exactly, that was a great article! When it first came out I’d been thinking of posting it and I showed it to the wife —we can vouch for it.

To: bert

Panama is open to having foreigners move there, as long as they’re willing to work. Panama City has become more and more cosmopolitan, with numerous nationalities living side by side.

Why should they be required to work? It is not that way in America. Open the doors to refugees and illegals. Apparently Mexico has not gotten the word things are great down south.

19

posted on

05/24/2016 7:15:18 AM PDT

by

taterjay

To: expat_panama

Bientot.....

Navigation: use the links below to view more comments.

first 1-20, 21-24 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson