Skip to comments.

5 Things Most People Don’t Understand About the National Debt

Money ^

| April 22, 2016

| Taylor Tepper

Posted on 04/23/2016 9:18:03 AM PDT by expat_panama

Since this is an election year, you’re hearing a lot about the size of the national debt — and the financial imperative to expunge it before it gets passed on to our kids and grandkids.

Donald Trump ... ...suggested earlier that it would be possible to pay off the entire national debt in about eight years...

...the only way to advance the debate is to get past the myths...

#1) The federal government’s books are not like a family’s finances

...put yourself in the position of the government. Say you earn the typical American family income, and you spend and borrow as the government does... ...The Federal government does not have a literal ticking clock to race against.

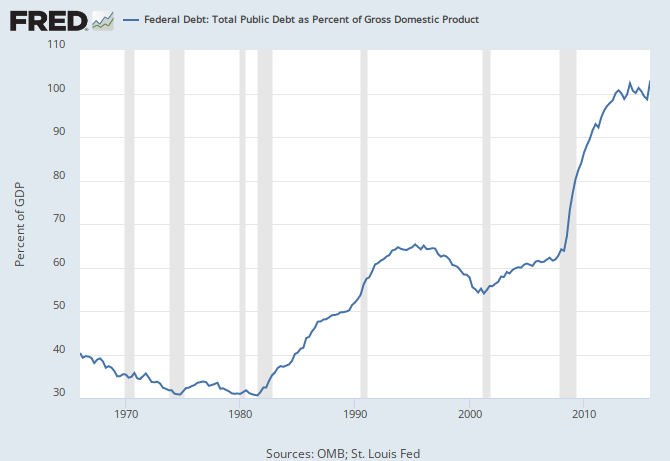

#2) Even if government finances were like a family’s checkbook, things aren’t at a boiling point — yet.

At the very least, you probably want your elected representatives in Washington to spend within their means...

...What matters to families isn’t their total debt; it’s their ability to service those obligations.

Typically, families seeking a mortgage...

#3) American households aren’t just victims of the national debt — we’re benefiting from it too.

By most accounts, the U.S. debt stands at nearly $19 trillion. But in his Time article, Grant points out that some of this money is owed by the Treasury to other parts of the federal government...

#4) There are some unintended consequences to lowering the debt.

...the balance sheets of corporations and individuals have improved significantly... ...it’s preferable to have rising government debt and private-sector surpluses than the other way around... ...With fewer Treasury bonds floating around, it would be harder for investors ...

#5) Even if the debt isn’t at crisis levels, it is an important issue.

...“excess inflation” and a bond market in turmoil aren’t exactly minor concerns...

(Excerpt) Read more at time.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: cruzerluzer; cruzerluzers; debt; economy; investing; luzer; luzers; money; nationaldebt; taylortepper

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-68 next last

This piece (my guess) was written in no small part becuase of Trump's answers in a Post intervew a few weeks ago:

Transcript: Donald Trump interview with Bob Woodward and Robert Costa where he said

DT: ...We’ve got to get rid of the $19 trillion in debt.

BW: How long would that take?

DT: I think I could do it fairly quickly, because of the fact the numbers . . . .

BW: What’s fairly quickly?

DT: Well, I would say over a period of eight years.

At first I wanted to avoid saying Trump was spouting like an idiot but then I caught the fact he didn't say he would do it, or even that he should do it, but only that he could do it. I could too, just double everyone's taxes. No luck, later this came up:

BW: Would you ever be open to tax increases as part of that, to solve the problem?

DT: I don’t think I’ll need to. The power is trade. Our deals are so bad.

BW: That would be $2 trillion a year.

DT: No, but I’m renegotiating all of our deals, Bob.

--which makes no sense at all because private trad e is private money, not government money.

e is private money, not government money.

NP, w/ those of his followers that don't know the difference between the federal and the trade deficit.

However the big gap in the Post article (imho) is their lack of money/math savvy, that if we say every American owes $19,196,769,313,019.68 (from here) ÷ 318.9 million (from here) = $60,196.83, then we can also equally divide the total $128T in federal land, structures, bonds, oil rights, yada yada.

Then again, why bother. Total private wealth in the U.S. is over $86T so why worry about owing $60k if you got $272K in the bank?

To: expat_panama

All I know about the national debt is it is about 3 light years ahead of us.

2

posted on

04/23/2016 9:20:14 AM PDT

by

disndat

To: disndat

3

posted on

04/23/2016 9:22:03 AM PDT

by

disndat

To: expat_panama

America living from paycheck to paycheck (i.e., Treasury Department tax receipts, debt selling in T bills, et al) and ever increasing entitlement commitments coupled with minimal debt service are NOTHING to worry about. If it is, that’s a problem for our grandchildren, right?

4

posted on

04/23/2016 9:22:46 AM PDT

by

Gaffer

To: disndat

So if Trump can’t get the economy moving faster than the speed of light...warp 2 or better... we won’t ever catch up.

5

posted on

04/23/2016 9:23:16 AM PDT

by

disndat

To: expat_panama

I recall candidate Obama calling Bush irresponsible and unpatriotic because he increased the debt.

6

posted on

04/23/2016 9:32:44 AM PDT

by

Michael.SF.

(That was the gift the president gave us, the gift of happiness, of being together,' Cindy Sheehan")

To: disndat

...the national debt is it is about 3 light years ahead of us... ...And accelerating.That's great --all we have to do is wait until it leaves our universe altogether!

To: expat_panama

After eight years of DJT just oozing his sheer awesome Trumpishness all over the national debt, the debt will just give up and poof! out of existence.

And if that doesn't work, we'll build a wall around the debt so it never bothers us again. And we'll make the debt pay to build the wall!

8

posted on

04/23/2016 9:37:03 AM PDT

by

Eric Pode of Croydon

("I play to people's fantasies." - Donald J. Trump)

To: expat_panama

1- It is mathematically impossible to clear the debt without reneging on most of it.

2- The majority of people in the US are so ignorant that they couldn’t tell you the difference between the debt and the deficit.

3- If you take cash advances on your MasterCard to make the minimum payments on your Visa card, most people would say you are in deep guano. When the government borrows money to pay the interest on existing debt, we are told it’s good for the economy, nothing to worry about.

9

posted on

04/23/2016 9:40:32 AM PDT

by

ChildOfThe60s

(If you can remember the 60s, you weren't really there....)

To: disndat

So, it is expanding faster than the known galaxy. About right I guess.

10

posted on

04/23/2016 9:45:26 AM PDT

by

mc5cents

(Pray for America)

To: expat_panama

For being the smartest businessman to ever live he’s a total moron when it comes to basic economics.

To: Michael.SF.

I recall candidate Obama calling Bush irresponsible and unpatriotic because he increased the debt. Which is further proof that Obama is unpatriotic and irresponsible, he knows it, and he just flat out doesn't care.

12

posted on

04/23/2016 9:51:25 AM PDT

by

FreeAtlanta

(Restore Liberty!)

To: expat_panama

Federal debt service cost is 20% of revenue, and rising. Double interest rates, and that goes to 40%. The greater three debt, the greater those payments. The greater that percentage, the greater the debt and the faster that percentage grows. That’s payments which MUST be made on time. When it hits 100% you’re completely bankrupt.

10% is ok.

25% is time to seriously start paying it down.

50% is serious austerity budget time (which you should have been OB anyway).

75% is oh $#!^.

100% is financial collapse. You can’t even meet interest payments; borrowing to pay interest doesn’t work.

13

posted on

04/23/2016 9:53:28 AM PDT

by

ctdonath2

("Get the he11 out of my way!" - John Galt)

To: expat_panama

Revenue vs obligations is a very meaningful argument.

How much would the obligations go up just from interest rates approaching historical norms?

What happens if interest rates continue to be artificially low?

What happens to the stock market once there are significant investment alternatives?

What does THAT do to the economy?

14

posted on

04/23/2016 9:54:26 AM PDT

by

lepton

("It is useless to attempt to reason a man out of a thing he was never reasoned into"--Jonathan Swift)

To: expat_panama

“#1) The federal government’s books are not like a family’s finances “

I’m so sick of patronizing articles like this.

The fedgov’s books are a corrupt sham.

Our children won’t have the prosperity we had, and our grandchildren will be impoverished.

And it’s the fedgov’s fault.

15

posted on

04/23/2016 9:55:08 AM PDT

by

JPJones

( You can't help the working class by paying the non-working class.)

To: expat_panama

16

posted on

04/23/2016 9:56:37 AM PDT

by

smokingfrog

( sleep with one eye open (<o> ---)

To: disndat

From reason #4

“Think about it this way: If the government spends $1 billion more than it receives in taxes, that money doesn’t just disappear — it flows into the hands of workers or companies or institutions”

Wonder how many FReepers are at the top tier of this great money give away?

17

posted on

04/23/2016 9:57:49 AM PDT

by

jcon40

To: expat_panama

We owe $19 trillion but that doesn't include the over $100 trillion in unfunded liabilities, i.e., the entitlement programs. And what happens when interest rates return to normal levels and our debt servicing costs soar consuming even more of the federal budget. The entitlement programs, other mandatories like Medicaid, food stamps, etc, and debt servicing costs consume more than two thirds of the budget now. Those costs will go up as the population of those over 65 doubles over the next 15 years.

18

posted on

04/23/2016 10:01:30 AM PDT

by

kabar

To: expat_panama

The govt debt should be called what it actually is:

Deferred Taxes

19

posted on

04/23/2016 10:03:14 AM PDT

by

joshua c

(Please dont feed the liberals)

To: ChildOfThe60s

Nope. It is absolutely possible to clear the debt without reneging. Just inflate the currency by a factor of 19 times current value and print our way out of it. We’re kind of doing that already in slow motion.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-68 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

This piece (my guess) was written in no small part becuase of Trump's answers in a Post intervew a few weeks ago: Transcript: Donald Trump interview with Bob Woodward and Robert Costa where he said

This piece (my guess) was written in no small part becuase of Trump's answers in a Post intervew a few weeks ago: Transcript: Donald Trump interview with Bob Woodward and Robert Costa where he said e is private money, not government money.

e is private money, not government money.