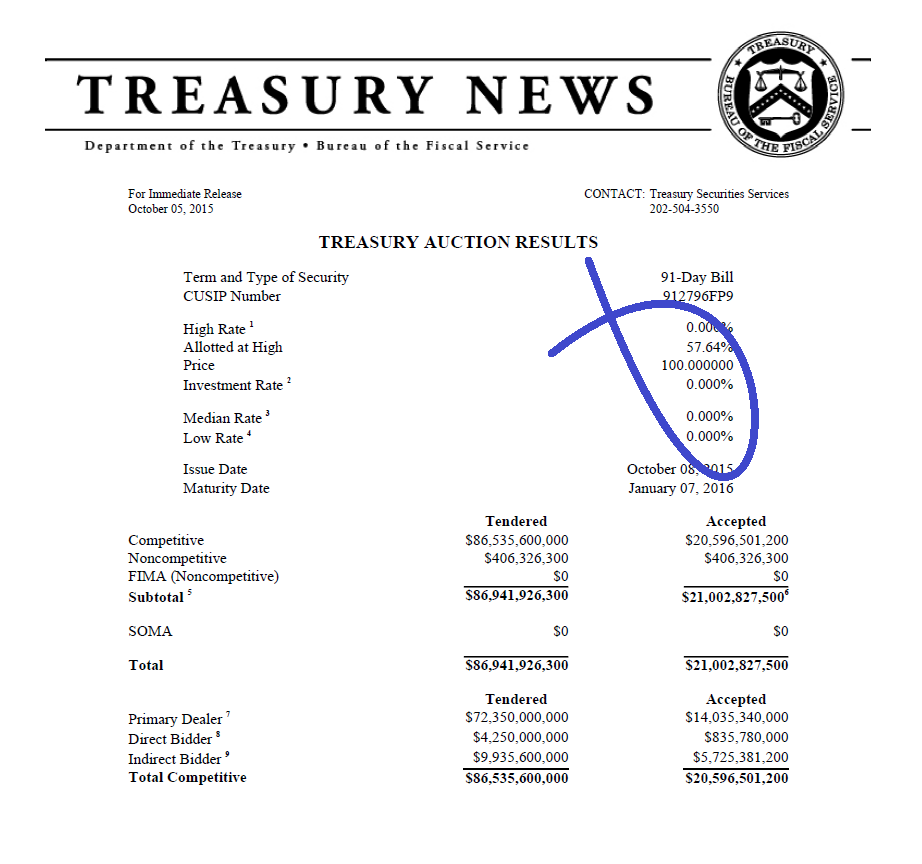

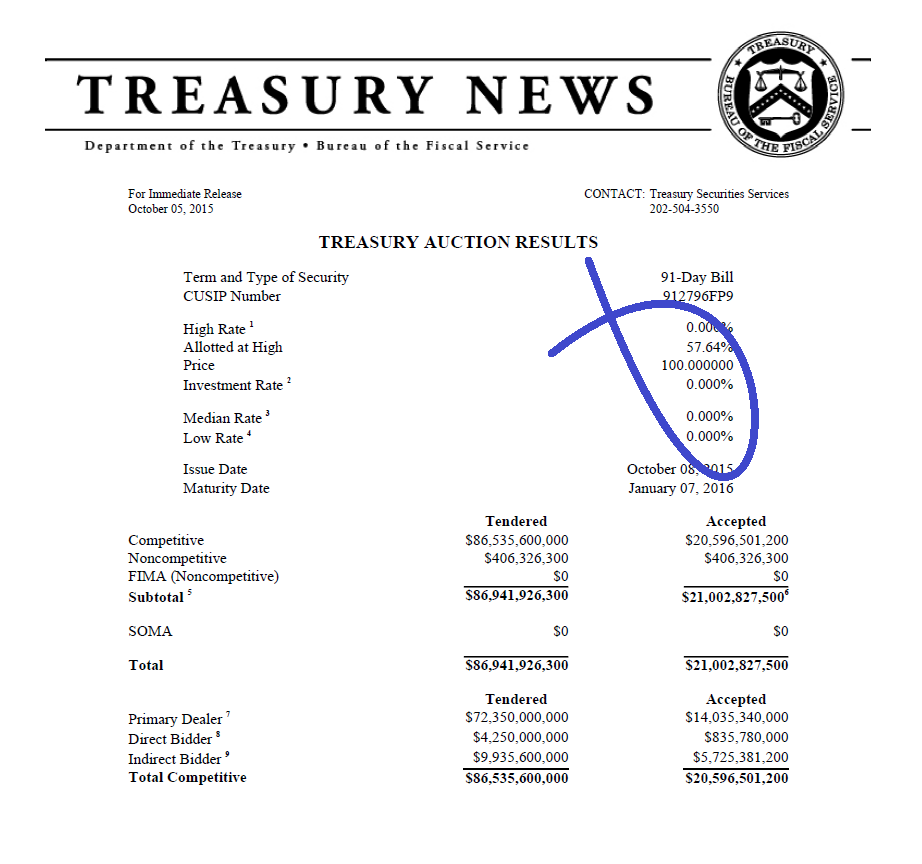

A while back that was my concern too but right now we got folks loaning the U.S. treasury money for no interest!

The fact is that this zero interest is not Yellen's idea, this is private traders who are buying T-bills with their own money.

Posted on 12/03/2015 4:16:20 AM PST by expat_panama

Monetary Policy: Fed Chair Janet Yellen thinks the economy is so strong that the central bank can start raising rates this month. So why are Democrats alarmed? Because they know that the "Obama recovery" is hollow.

It's true there have been marginal improvements in key economic indicators since 2008, as would be expected following the worst downturn since the Great Depression.

But the "recovery" that was touted so loudly by Democrats until last year has also been the worst ever†2% average growth. Now they're worried about the prospects of even a tiny hike in interest rates by the Fed.

[snip]

,,,a Politico headline bluntly asked, "Could An 'Accident' By Janet Yellen Derail Clinton?"

Yellen doesn't seem to think so.

[snip]

Contrary to what the Democrats say, the recovery was never that good to begin with. And contrary to Yellen, it's not that strong now. When the nation's top central banker touts a 5% jobless rate, she does so knowing virtually no economist treats that number as real anymore. Most agree the "real" unemployment rate is 10% or so.

Worse still...

[snip]

...for the future, things may not be so rosy.

-- Banking giant Citigroup says there's a 65% chance of a recession next year.

-- The Institute of Supply Management's manufacturing index has fallen to its worst level since 2009.

-- The Atlanta Federal Reserve's GDPNow index for the fourth quarter dropped to 1.4% this week, well below market forecasts of 2% to 3% GDP growth.

-- Brazil, Russia, India, China " the BRICs...

[snip]

Given so much doubt, now is not the best time for the Fed to start "normalizing" interest rates. And, no, we don't worry about "derailing" Clinton's presidential campaign. Voters will do that. We do worry about derailing what remains of the post-Obama economy.

(Excerpt) Read more at news.investors.com ...

A rate hike makes any further debt growth incurred by selling US treasuries start to go vertical in terms of domestic taxes needed to service the new debt. Any old debt bonds expiring and traded in for higher interest paying treasuries will explode our public debts beyond sustainability in terms of taxpayers being able to service that debt!

Because it HAS been a 7 year recession?

Check this site out: http://www.financialsense.com/contributors/michael-shedlock/trends-in-interest-rates-on-national

Here is the money quote:

“Currency Crisis Coming

“If you get the idea a crisis of some sort is coming, fueled by out-of-control deficit spending as well as the Fed’s ridiculous “Operation Twist Policy,” then you get the right idea.

“The Fed ought to be selling long-term bonds at these rates, locking in financing at attractive rates, not buying those bonds hoping to drive yields still lower.

“Of course, that latter statement assumes there should be a Fed or deficit spending in the first place, neither of which I believe.”

I agree with the first part, and I think Trump has as good a chance with it as anyone else available. When the castles in the air start to collapse, it's going to be ugly.

I don't think they really want to, but they have painted themselves into a corner at this point. This Friday's non-farm payroll figures will be key. Any sign of weakness may give the Fed some pause and enough of a plausible excuse not to raise rates at the December 16th meeting.

Coming off of last month's 'blockbuster' numbers of +270k (mostly due to holiday hiring), I would expect a slight downward revision. If there is no downward revision and a payroll number in the 225-250k range, they may have to bite the bullet and raise 25bps. If they do raise this time around, it will be a token gesture and we probably won't see another hike for more than a year.

If there is a downward revision from last month's payroll numbers and weaker than expected payroll number this time around, the Fed will be able to punt yet again.

Please note that I take all of the government data with a heaping tablespoon of salt so to speak.

>>We’ve been in a recession since 2007.

Only for people who work for a paycheck or own a small business. To politicians in today’s America, those people don’t matter.

Winner. Debt servicing costs will mushroom. And inflation will rise causing increased entitlement program costs. The stock market will plummet. The Fed holds 4 trillion of our 18.8 trillion national debt. The Fed is riding on the back of a tiger and has a hard time getting off.

Your comment is the early leader for the financial BPOD Award!! (BEST POST OF THE DAY)

They can’t sell em at the current low rates because no one wants the worthless trash littering up their studies/accounts.

(venting complete)

And they want the economy to trash after the election so Ocraphead can blame others.

I suspect that’s true.

How is this supposed to end? How is this a good thing?

Couldn’t the amount of debt will get to a “point of no returnâ€. Maybe not. Maybe we’ll become like a lawn with no fertilizer.

Something rotten is going on and I think Trump is the best guy to straighten things out.

YES,A huge amount. Sub-prime car loans,student loans and Major corporations borrowing massive amounts of cheap money to buy back stocks, That is what is pushing up the stock market.

It going to end very badly for everyone especially for anyone in the stock market. This is a world wide problem not just here.

The amount of debt World wide is PAST the point of return.

Donald Trump may be the ONLY one capable of fixing this.

Isn't the Fed's balance sheet on top of the authorized national debt?

Congress did not allocate money for the QEs or any other Fed program, correct? Or do I have that all balled up...

.25 per cent is not going to crash anything.

A while back that was my concern too but right now we got folks loaning the U.S. treasury money for no interest!

The fact is that this zero interest is not Yellen's idea, this is private traders who are buying T-bills with their own money.

Very interesting link. Thanks!

“While the world was leveraging itself to the hilt, governments and big banks were manipulating virtually every major market for, respectively, political gain and trading profits.”

And therein lies the rub!

Belief in a savior is no more endearing on the right than it was on the left in 2008.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.