2014 Recap --Looking Back; Investment & Finance Thread - Dec. 14

Posted on 12/21/2014 8:49:52 AM PST by expat_panama

2014 Recap --Looking Back; Investment & Finance Thread - Dec. 14

Merry Christmas!

We get to open some goodies a few days early here, first with the list of this past year's thread links (left) for a nostalgic walk down Memory Lane while we go over this past market strategies.

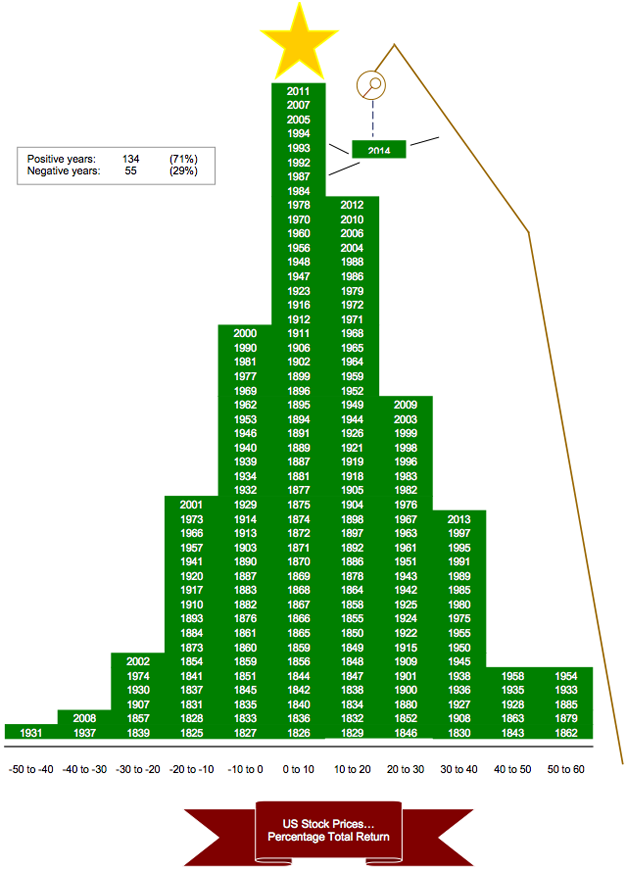

Then we can number-plot check out how general markets fared.

Stocks: Looking over the past year (as of Dec. 19) we're seeing the S&P 500 up 12.0% and the NASDAQ up 14.1% --above average! OK we've done better but I personally can live w/ this.

However, maybe this is just me but something unusual this past year is that it's been unusually hard to gage. Too many times it's seemed we were definately going one way and POW, we'd do the opposite.

No problem. What's good is we see what's happening, that the signs are dodgy, so we move forward knowing we got things not being what they seem.

Good enough.

Metals had a rough year but not as badly as many feared. Sure, silver lost 20% but gold's actually about where it was a year ago. IMHO Barchart's got a great longer term overview for precious metals at Gold And Silver - Nothing Is Ever As It Seems And No Respite For PMs.

IMHO Barchart's got a great longer term overview for precious metals at Gold And Silver - Nothing Is Ever As It Seems And No Respite For PMs.

* * * * * * * * *

All of this begs the biggest, most often asked, and most useless market trend question: WHY? OK, here are the top headlines for 2014 and the stories we can blame:

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

|

Markets | Yesterday'x Action | Futures (2-1/2 hrs. before the bell) | ||

| metals | Inching back down w/ gold $1,177 & silver $15.66 | -0.06% | |||

| stocks | ...(from here) "...continues advance... ...S&P 500 rose 0.4% to a new closing high. It's just about a point away from its Dec. 5 all-time high..." Volume plunged --but that's compared to Fridays soaring 'options expire vol. & this weeks holidays. | +0.10% |

HUGE pre-holiday document dump:

Durable Orders

Durable Goods -ex transportation

GDP - Third Estimate

GDP Deflator - Third Estimate

FHFA Housing Price Index

Michigan Sentiment - Final

Personal Income

Personal Spending

PCE Prices - Core

New Home Sales

--and the news is hoppin' too:

- Asian stocks rise on 'Santa rally' after Wall St record

- European Stocks To Follow Wall Street Higher

- Gold is heading toward a critical point: Charts As gold finishes out a rocky year, its chart is heading toward critical development point, and the yellow metal may fall below $1,000 an ounce. CNBC

- Did the U.S. Kick North Korea Off the Internet? Dec. 22 –- Bloomberg’s Jordan Roberston discusses North Korea’s loss of access to internet networks. Bloomberg Video

- E-books 'damage sleep and health' If you curl up under the duvet with an e-book for a bedtime read then you are damaging your sleep and maybe your health, US doctors have warned. BBC News

- Exclusive: Arab OPEC sources see oil back above $70 by end-2015 Reuters - 3 hours ago ABU DHABI (Reuters) - Arab OPEC producers expect global oil prices to rebound to between $70 and $80 a barrel by the end of next year as a global economic recovery revives demand, OPEC delegates said this week in the first indication of where the ...

- U.S. Economy Pulling Away From Rest of the World As more Americans find jobs, they're willing to spend, priming the economy. Lower fuel and food prices are helping, too.

- Natural Gas Glut Isn't Deterring Southwestern Energy New York Times - 6:40am WONDERVIEW, Ark. - Across the giant Fayetteville shale gas field here, country roads that were clogged by truck traffic just a few years ago are empty again.

http://www.wsj.com/articles/chinas-dark-shadow-looms-over-oils-future-1419312039

China’s Dark Shadow Looms Over Oil’s Future

By Abheek Bhattacharya

Dec. 23, 2014 12:20 a.m. ET

At the heart of global oil demand in China, there remains darkness.

Oil’s collapse in 2014 has been a tale of gushing supply, but it is worth remembering that investors started the year feeling jittery about slowing demand. That centered around China, the world’s largest contributor to oil demand growth in recent years. The problem for investors next year isn’t only that Chinese demand still looks slow. It is also inscrutable.

Most observers can’t agree on how much oil China actually burns. A few days before 2014 ends, the International Energy Agency says China will consume 2.5% more barrels this year than in 2013. Wood Mackenzie reckons 3.4%. IHS Energy Insight thinks 2% and Barclays 1.1%.

Why the differences? Analysts infer demand by combing through refinery output, trade and inventory of products such as gasoline. This being China, questions surround most data, especially inventories, with guesswork often needed. Analysts are also sometimes watching different moving parts. IEA doesn’t adjust for inventory. Barclays, IHS and Wood Mackenzie do.

Beijing is already stimulating the economy, like with last month’s interest-rate cut. Plus, low fuel prices should themselves stimulate consumption. Though these figures deserve a grain of salt, Barclays, one of the least optimistic forecasters, estimates demand will grow faster at 1.9% in 2015. Wood Mackenzie says 3.3%.

But even the most optimistic forecasts aren’t high enough for what oil bulls have come to expect of China. When the economy boomed between 2009 and 2013, oil demand averaged 6.5% growth every year by Barclays’ measure. With China now burning one of every nine barrels of oil in the world, it is gotten too big to keep growing so fast.

snip

You know I’m a silver and gold bug; 14 years and still holding. I have quadrupled my investment in PMs.

Not a bad return at all...but you really DID need to get in on the bottom floor. And while I’ve always been in Commodities, it took Dad a long time to convince me to go in that direction. So glad I did! :)

(I’m well diversified; PMs, stocks, bonds, land, ammo and dry socks!)

--because just a few years ago China was a net oil exporter. imho, oil's return to historic levels will make China more prosperous and that will further encourage China to behave itself. They know they sure don't want to end up like Russia.

--as we all should be, with each of us allocating to match our needs. There are a lot of folks smarter than me doing quite well thank you in PM's though I still often have a hard time following the reasoning. Success stories like yours simply remind me to keep a lid on my sarcasm and maintain an open eye on PM trades. That and it's also good to know I'm not the only one into dry socks...

LOL! Thanks. I don’t even respond to the peeps here that sneer at gold & silver. It’s not my ONLY investment; it’s my hedge.

And, it ain’t braggin’ if’n you can do it! :)

GDP was WOW

The nattering nabobs of negativism on this thread.

U.S. Economy Grew 5% in Third Quarter, Its Fastest Rate in More Than a Decade

http://www.freerepublic.com/perl/post?id=3239569%2C26

tx!

|

Markets | Yesterday'x Action | Futures (2 hrs. before the bell) | ||

| metals | Steady; gold @ $1,177 & silver $15.79 | -0.24% | |||

| stocks | ..IBD announces that we're now in an uptrend. Uh-huh. "...S&P 500 and Dow Jones industrial average extended their winning streaks to five sessions, but the Nasdaq couldn't keep up, weighed down by a burst of institutional selling in the biotech space. The Dow hit a milestone..." | +0.09% |

NYSE will only be open today for 4-1/2 hours, closed tomorrow, and I imagine that on Friday the only people trading will be me and some day-trader in Saskatchewan who just move there from India. In the meantime:

MBA Mortgage Index

Initial Claims

Continuing Claims

Crude Inventories

Natural Gas Inventories

Oh, wait... Wrong thread

You have a merry Christmas. I’ll probably be here next week with you and that fellar from Saskatchewan.

http://www.wsj.com/articles/oil-prices-slide-on-signs-of-growing-supply-glut-1419432130

Oil Prices Slide on Surge in Supplies

U.S. Crude Supplies Unexpectedly Rise, Adding to Glut of Oil

By Timothy Puko

Updated Dec. 24, 2014 2:43 p.m. ET

snip

January diesel hit its lowest settlement price since July 6, 2010. It lost 6.71 cents, or 3.4%, to close at $1.9236 a gallon. Distillate stocks, which include heating oil and diesel fuel, added 2.3 million barrels—more than double expectations—to 123.8 million barrels.

For some analysts the buildup of products shows that low prices aren’t triggering enough consumer demand to end the glut anytime soon.

“If the U.S. gasoline market can’t pull us higher … then it reinforces the idea that we are still in a petroleum bear market,” said Tim Evans, analyst at Citi Futures Perspective in New York.

But there are some who found hope in the numbers that consumers are starting to buy more.

Refiners moved an additional 572,000 barrels of products like gasoline and jet fuel last week, according to the EIA. That number is more akin to the summer driving season than the start of winter, said Carl Larry, director of oil and gas for Frost & Sullivan.

“That’s a crazy number,” Larry said. “You’re really seeing these low prices drive the consumer (to) increase the demand

Great —the 3 of us! We can take turns selling each other Dow stocks at twice market value and then look at the weekend headlines: “Dow Tops 36,000!!!!”

http://www.wsj.com/articles/russian-finance-minister-upbeat-on-ruble-1419511839

Ruble Crisis Is Over, Russian Finance Minister Says

Currency Firms to Three-Week High in Thin Trade

By Andrey Ostroukh

Dec. 25, 2014 7:50 a.m. ET

MOSCOW—Russia’s finance minister declared the currency crisis over as the ruble firmed to a three-week high on Thursday.

After losing around 50% of its value against the dollar and hitting record lows last week, the ruble has been strengthening for the past five trading days as prices for oil, Russia’s key export, stabilized and month-end tax payments came due.

“We think that now this period has come to an end, the period of instability. We think that the ruble is still undervalued at the current price of oil,” said Finance Minister Anton Siluanov, according to Russian news agencies.

The ruble gained nearly 2% to 52.3 versus the U.S. dollar in thin trade Thursday, heading away from its weakest-ever level of 80.1 last week, as exporters converted their dollar holdings to rubles to meet local tax payments due by the end of the month.

snip

Shoppers’ Late Rush Gives Hope to Retailers

Early Estimates Show Best Holiday Sales Growth in Three Years

By Suzanne Kapner And Sara Germano

Updated Dec. 25, 2014 3:26 p.m. ET

American shoppers were on track to deliver a welcome Christmas gift to retailers: the best holiday sales growth in three years.

Sales gained momentum throughout December, according to the International Council of Shopping Centers, as the countdown to Dec. 25 brought out more shoppers needing presents to put under the tree.

“Sales got very strong leading up to Christmas,” said Gerald Storch, a former CEO of Toys “R” Us Inc., who next month will take the helm of the company that owns Saks Fifth Avenue and Lord & Taylor.

A series of encouraging economic indicators has raised optimism about the U.S. economy that may have helped boost confidence during the critical holiday shopping season.

Among them: The economy expanded at its fastest pace in 11 years in the third quarter, and job growth is the strongest since 1999. The Thomson Reuters/University of Michigan’s measure of consumer confidence rose in December to its highest level since January 2007.

Meanwhile, gas prices have fallen to their lowest levels in five years, which is saving U.S. consumers more than $450 million a day, according to auto club AAA.

“You can’t minimize the importance of falling gas prices and the increase in personal income,” said Jack Kleinhenz, the chief economist for the National Retail Federation, an industry trade group. The NRF is expecting a 4.1% increase in sales during November and December, the strongest rate since 2011, when sales rose 4.8%.

snip

Personal spending for Nov. rose +0.06% compared to +0.02% for Oct. Incomes are up too. Of course there's a lot more to the story but...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.