Skip to comments.

Investment & Finance Thread Freepathon Special

Weekly investment & finance thread ^

| Oct. 11, 2014

| Freeper Investors

Posted on 10/11/2014 8:49:26 PM PDT by expat_panama

Money. Investing. Freerepublic. Here are the top 10 reasons that us FR investors want to participate in the current FReepathon:

10. Gold, silver, stock indexes, and bond values are all cr@pping out these days anyway...

9. The FReerepublic is a proven and solid force for (among other things) sound national fiscal policy; we need that force stronger now more than ever.

8 We benefit from these threads personally. Equity as a legal doctrine thus requires our compensatory donations.

7. Economic realism: there's no free lunch.

6. Market realism: you get what you pay for.

5. Donations are necessary for continued maintenance/loss reduction of desired FR services.

4. Donations are a guaranteed adjunct to an individual investor's game plan. These threads will either pay for themselves through info leading to profits or reduced setbacks (in which case a monthly donation is reasonable overhead) or if by chance what you pick up here is dumb then having donated enables you to request a cheerful refund. [Note: "request" ≠ "receive"]

3. Hey, this place is fun!

2. This thread's been going on a year now. Those of us that found this thread useful for money making will be able to consider donations when they itemize in Schedule B next April.

--and here's my favorite:

1. On the internet, when you're getting something you're not paying for, then you're not a customer. You're a product.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-114 next last

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

Mid-weekend ping.

To: expat_panama

How very thoughtful!!! Thank you so much, dearest expat_panama!

©

3

posted on

10/11/2014 8:57:45 PM PDT

by

onyx

(Please Support Free Republic - Donate Monthly! If you want on Sarah Palin's Ping List, Let Me know!)

To: expat_panama

Add me, please and thank you. Freeangel

4

posted on

10/12/2014 4:01:45 AM PDT

by

freeangel

( (free speech is only good until someone else doesn't like it)

To: All

An alert freeper pinged about reason # 2 ("

consider donations when they itemize in Schedule B") and how the freerepublic home page says "

Donations to Free Republic are NOT tax deductible." What I got is the Freerepublic is not incorporated under section 501(c)3 so donations are not

charitable.

So the same applies for money given to Investors Business Daily, yet for years now I've entered my IBD subscription cost (which pays for the IBD chat investment forum) into my tax program. This should now be perfectly clear to anyone who does not understand it because it's confusing. Tax law is so convoluted that one tax court can say that a particular way of filing federal taxes is just fine, and some other court can call for stiff penalties for the same action --so we're talking probabilities.

fwiw, if I were to bet money (preferably someone else's money) I'd say that anyone here listing the FR expense wouldn't see any difference in the final tax bill anyway.

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

To: expat_panama

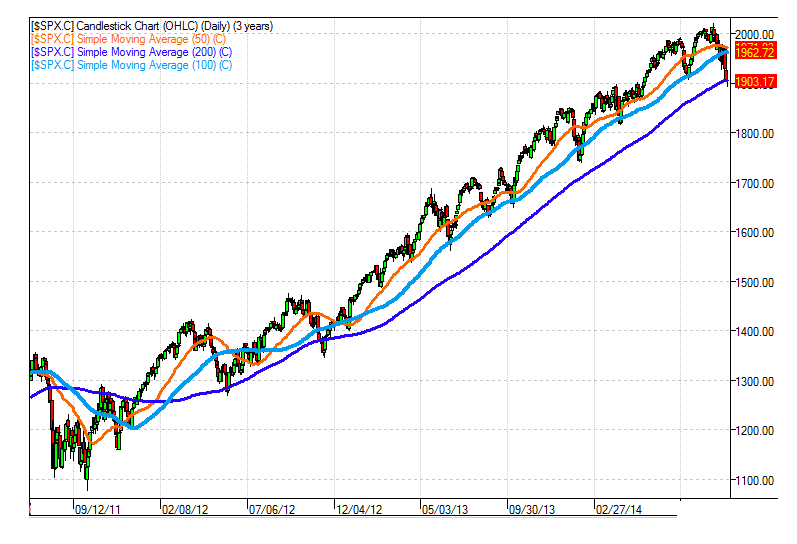

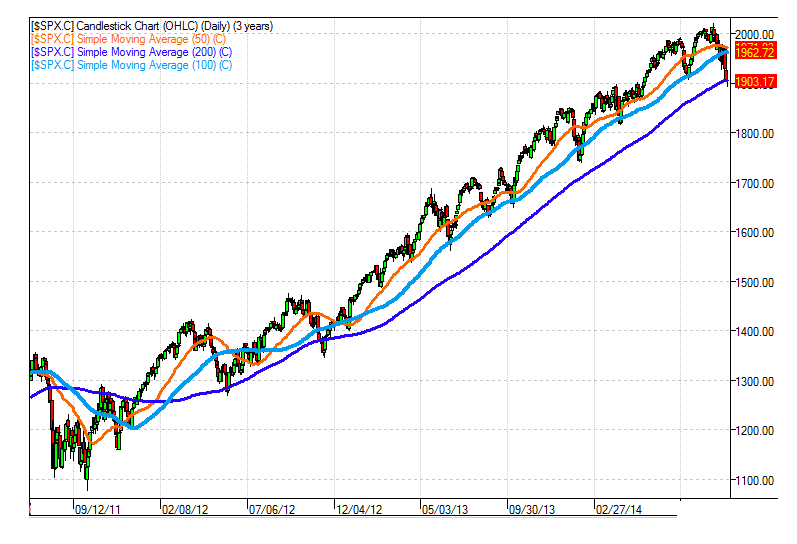

So, have we hit resistance against the 200-day moving average thing-y? And are we headed back up now? Or is it doom and gloom, big crash to come?

To: Abigail Adams

Yeah, I was asking myself the same question. So far so good though--

--we haven't hit the 200DMA since 2012 when we bounced off it twice. We're hitting it now though, and if it's like July 2011 the next few days should tell whether we're going to slam right through it for a month or two.

To: expat_panama

That chart makes the stock market look pretty good, overall!

To: Abigail Adams

To: Abigail Adams; expat_panama

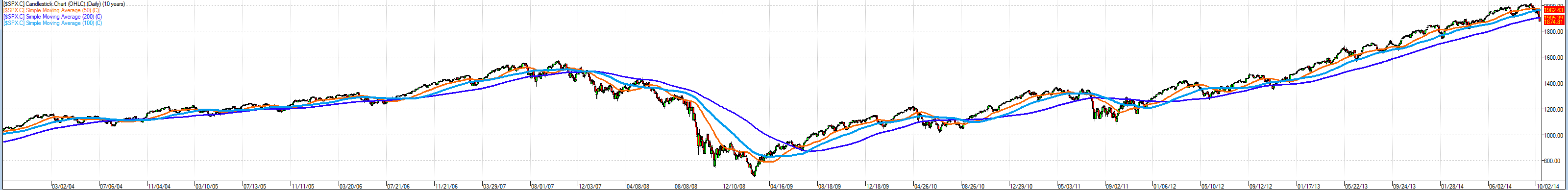

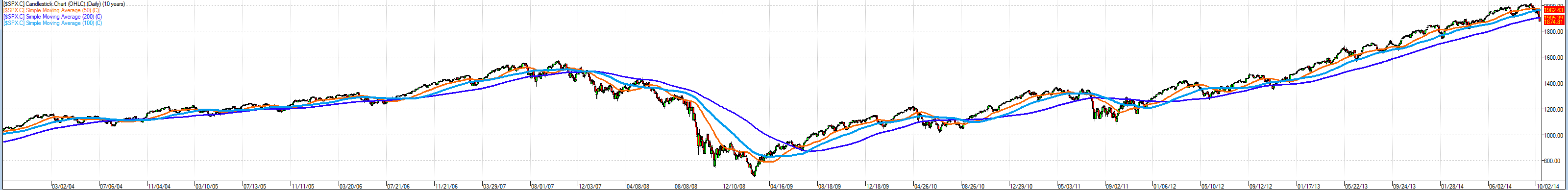

Hey you guys, include the years prior to 2011. Oh I'd say that itsy bitsy little dip that bottomed out in March/April 2009 would look pretty dramatic. ; )

That being said - BUMP TO THE TOP for post #8! We may be coming to bargain basement time in the next few days/weeks/months but fasten your seat belts. We in for a bumpy ride. (Betty Davis movie)

11

posted on

10/13/2014 1:24:30 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

Darn it where do the word “are” go?

We are in for a bumpy ride. (Betty Davis movie)

12

posted on

10/13/2014 1:27:49 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: Chgogal

include the years prior to 2011.Excellent idea! Here's every day for the past ten years [click to enlarge]--

--(got to just LOVE scottrade's platform). Noticing how the 200 day ma is actually a darn good tech indicator, thinking that I might even want to unload my 'buy'n'hold' package...

To: expat_panama

14

posted on

10/13/2014 3:50:32 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

15

posted on

10/13/2014 9:38:12 PM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: expat_panama

Count me in, expat - I’m interested.

I’ll get this every week?

CA....

16

posted on

10/13/2014 11:01:12 PM PDT

by

Chances Are

(Seems I've found that silly grin again....)

To: expat_panama

17

posted on

10/14/2014 12:31:36 AM PDT

by

2ndDivisionVet

(The question isn't who is going to let me; it's who is going to stop me.)

To: A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ...

| Tuesday, October 14, 2014 |

| |

Markets |

|

yesterday |

|

today |

|

|

|

|

|

|

|

| |

metals |

|

gold $1232.23, silver $17.59 |

|

Futures @ 2 hrs. before opening.+0.73% |

| |

stocks |

|

Stocks tried for a comeback, but big selling in the last hour sealed a third straight loss Monday. The S&P 500 tumbled 1.6%, breaking its 200-day moving average, |

|

Futuress +0.49% |

To: Chances Are; All

They had it a daily ping before I got here but I was too lazy to make an new post every day so I just ping. It would be interesting to know if everyone now wants a daily, weekly, or either to choose from list. Let me know what you’d like.

To: 2ndDivisionVet

neat! A while back I was reading how TX has most of it’s foreign trade w/ Mexico and Calif. trades most w/ Asia —and it seems to reflect in attitudes.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-114 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson