Posted on 08/17/2014 1:35:32 PM PDT by expat_panama

Alternate Title: UPTREND SPECIAL EDITION!

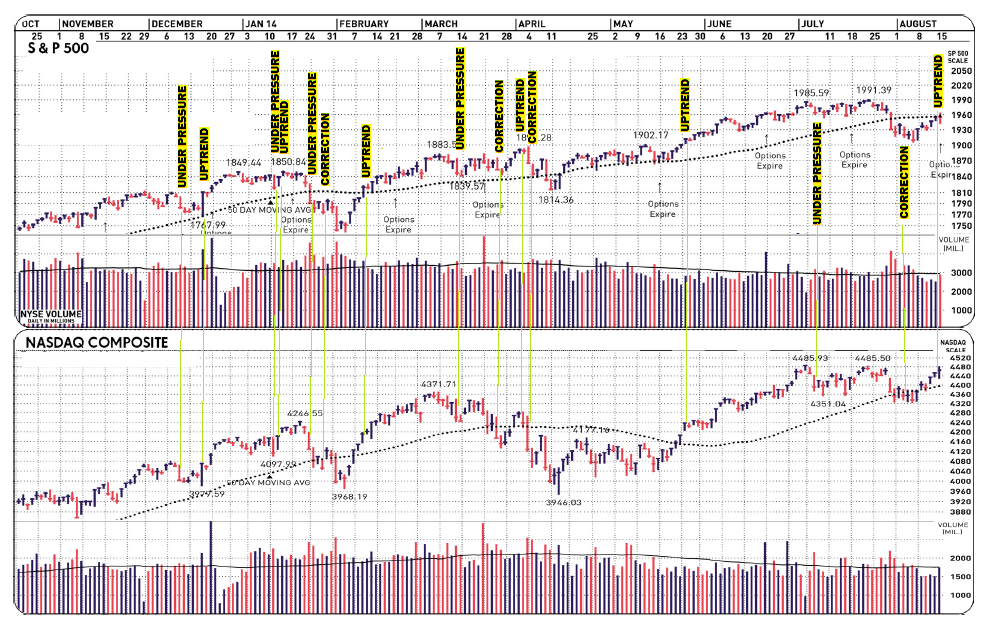

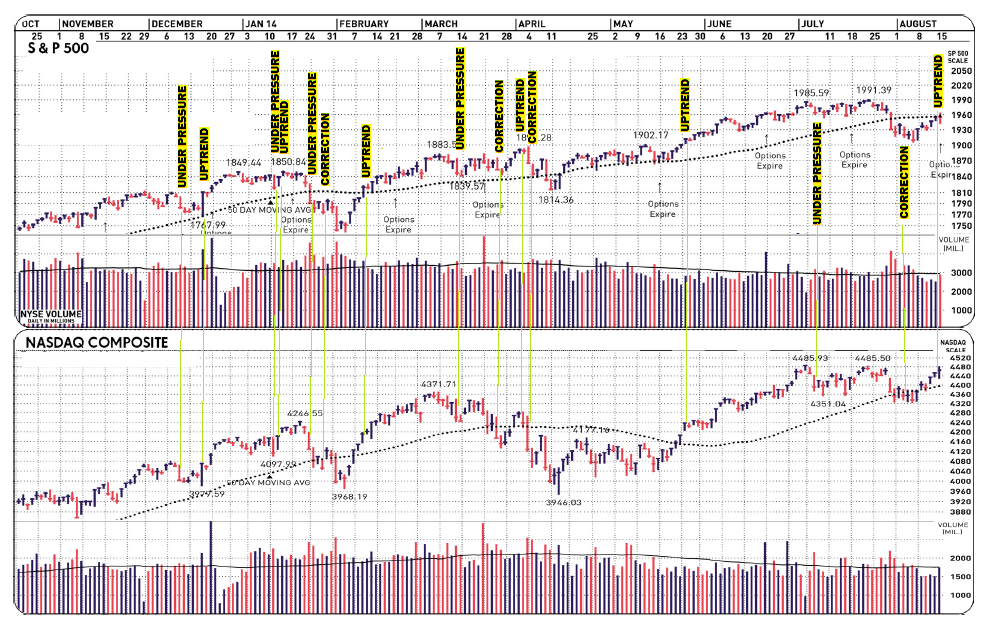

That's right, last Thursday IBD announced that NASDAQ had its "follow-through-day" so investors in the driver's seat just saw the light turn green. That said, we also know that nobody walks across a one-way street without looking both ways, and even though the signs say 'buy' here's what they've been saying so far this year--

--and this is the problem we got driving down the road while only being able to look out the back window.

Remember these market designations are not arbitrary, they're signals proven with decades of research. That said, we're still looking at a market where price trends have not yet proven themselves. We've gotten so many false signals this year that a person would've done better by buying on the 'corrections' and selling when uptrends begain.

Of course, if we're concluding that past patterns don't mean anything for seeing the future, then to be honest we'd also have to admit that simply being contrary promises nothing.

OK, so imho 'honesty' is highly over-rated.

Maybe our bottom line here is that it's IBD's job to show what usually has happened before when stuff looking like today's headlines popped up --and truth betold they do it superbly. When it comes to guarding our family's wealth and keeping the kids fed, well that's our job. It means we can still learn from folks like NEWSMAX/FINANCE, IBD, WSJ, but we also need to kick those guys around on this thread too...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy. |

FYI>>

Also, I feel compelled to ALERT this group to a new, MAJOR FLASHING RED ALERT sell signal.

As of this morning, SCMT is “fully invested”.

Certain DOOM is sure to befall the market.... soon.

As of this morning, SCMT is “fully invested”.

Who is SCMT?

why... ME! Of course.

LOL. That should have dawned on me.

I’ve not gotten my reliable signal yet - my brother. He’s exactly wrong, every time.

Bought gold at the 1982 top.

Bought stocks during dotcom boom.

Called me and told me to sell in March of 2003, and again in March 2009, at the very bottom each time.

FReepmail me with his latest recos, please.

I got a few of those correct, thanks to Bob Brinker, at MarketTimer.

But,in 2008? I blew it. Was OUT of the market in May/June... so proud of myself. I moved back in, fully... in August. Just saying that now scares me.....

Just today, I do this.. tell the world, and immediately our Sec of Def starts warning about terrorist attacks on the homeland... Great.

I now LIVE on a wall of worry.

and this from Texas Is A Real Model For Economic Opportunity:

Early profit taking? Sudden capital asset transition? This morning's futures put metals strong and stock indexes off. Looking closer at the indexes what's really there is that it's the S&P that's off but the Dow and NASDAQ are still positive.

Ah. A Good Morning and Happy Open Line Friday everyone --the plot thickens!! No major reports scheduled for today after what's been a week of pretty good news. Speaking of news:

Good stuff. Saw a big article on wages yesterday i need to find and post.

DJ00 -5 this morning. They know we know... ;-)

DB preview:

hmmm, wondering why the two have never been seen at the same place and same time...

We always hear about how legisation back in the '70's required the fed to worry about employment as well as prices, but everyone seems to have forgotten that back then the fed was also required to eliminate the trade deficit too. My thinking is that a T-D fuss is just too goofy for all concerned so everyone opted to just ignore the subject til it was forgot and went off the radar.

| THURSDAY, AUGUST 21, 2014 | FRIDAY, AUGUST 22, 2014 | SATURDAY, AUGUST 23, 2014 | |||

| 6 p.m. | Opening Reception and Dinner | Chair: | Peter Blair Henry | Chair: | Christina D. Romer |

| Dean, Stern School of Business, | Professor, | ||||

| Host: | Esther George | New York University | University of California, Berkeley | ||

| President and Chief Executive Officer, | |||||

| Federal Reserve Bank of Kansas City | 8 a.m. | Opening Remarks | 8 a.m. | Scars From the Crisis | |

| Janet L.Yellen | |||||

| Chair, | Author: | Till Marco von Wachter | |||

| Board of Governors of the Federal Reserve System | Associate Professor, | ||||

| University of California, Los Angeles | |||||

| 8:30 a.m. | Churn and the Functioning of Labor Markets | ||||

| Discussant: | Antonella Trigari | ||||

| Authors: | Steven J. Davis | Associate Professor, | |||

| Professor, | Bocconi University | ||||

| University of Chicago | |||||

| 8:35 a.m. | General Discussion | ||||

| John Haltiwanger | |||||

| Professor, | 9 a.m. | Wage Dynamics | |||

| University of Maryland | |||||

| Author: | Giuseppe Bertola | ||||

| Discussant: | Richard Rogerson | Professor, | |||

| Professor, | EDHEC School of Business | ||||

| Princeton University | |||||

| 9:45 a.m. | Discussant | ||||

| 9:05 a.m. | General Discussion | ||||

| Discussant: | Mark Bils | ||||

| 9:30 a.m. | Job Polarization | Professor, | |||

| University of Rochester | |||||

| Author: | David Autor | ||||

| Professor, | 10 a.m. | General Discussion | |||

| Massachusetts Institute of Technology | |||||

| 10:25 a.m. | Overview Panel: Labor Markets and Monetary Policy | ||||

| 10:15 a.m. | Discussant | ||||

| Panelists: | Ben Broadbent | ||||

| Discussant: | Lisa M. Lynch | Deputy Governor for Monetary Policy, | |||

| Professor, | Bank of England | ||||

| Brandeis University | |||||

| Haruhiko Kuroda | |||||

| 10:30 a.m. | General Discussion | Governor, | |||

| Bank of Japan | |||||

| 10:55 a.m. | Panel on Demographics | ||||

| Alexandre Antonio Tombini | |||||

| Panelists: | Karen Eggleston | Governor, | |||

| Professor, | Central Bank of Brazil | ||||

| Stanford University | |||||

| 11:25 a.m. | General Discussion | ||||

| David Lam | |||||

| Professor, | 2 p.m. | Adjournment | |||

| University of Michigan | |||||

| Ronald D. Lee | |||||

| Professor, | |||||

| University of California, Berkeley | |||||

| 11:55 a.m. | General Discussion | ||||

| 12:30 p.m. | Luncheon Address | ||||

| Speaker: | Mario Draghi | ||||

| President, | |||||

| European Central Bank | |||||

| 2 p.m. | Adjournment | ||||

Yes, clearly... they know we’re ON to them!

I think, they’re just testing. You know, to see if the market can stand on it’s own.

Hopefully, they will resume buying... soon.

Nice charts.... I actually still hear people trying to argue that ObamaCare is NOT a job killer.

Yea... right.

Actually, it’s really nothing new that with enough money, prestigious respected highly qualified experts can be paid to say the stupidest things for global warming, min.wage, obamacare, etc. What’s interesting to me is how so many other good, intelligent people accept and defend the dribble for free!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.