Posted on 07/23/2014 8:08:12 AM PDT by Kaslin

The U.S. Court of Appeals for the D.C. Circuit invalidated a major provision of Obamacare, ruling 2-1 that participants in health exchanges run by the federal government in 34 states are not eligible for tax subsidies.

No doubt, cheers went out from the anti-Obamacare crowd.

However, just a few hours later, the Richmond Appeals Court ruled 3-0 the opposite way, citing pizza in its explanation.

Conflicting Rulings

The New York Times reports Courts Issue Conflicting Rulings on Health Care Law.

Two federal appeals court panels issued conflicting rulings Tuesday on whether the government could subsidize health insurance premiums for people in three dozen states that use the federal insurance exchange. The decisions are the latest in a series of legal challenges to central components of President Obama’s health care law.

The United States Court of Appeals for the Fourth Circuit, in Richmond, upheld the subsidies, saying that a rule issued by the Internal Revenue Service was “a permissible exercise of the agency’s discretion.”

The ruling came within hours of a 2-to-1 ruling by a panel of the United States Court of Appeals for the District of Columbia Circuit, which said that the government could not subsidize insurance for people in states that use the federal exchange.

That decision could potentially cut off financial assistance for more than 4.5 million people who were found eligible for subsidized insurance in the federal exchange, or marketplace.

Under the Affordable Care Act, the appeals court here said, subsidies are available only to people who obtained insurance through exchanges established by states.

The law “does not authorize the Internal Revenue Service to provide tax credits for insurance purchased on federal exchanges,” said the ruling, by a three-judge panel in Washington. The law, it said, “plainly makes subsidies available only on exchanges established by states.”

Under this ruling, many people could see their share of premiums increase sharply, making insurance unaffordable for them.

The case is one of many legal challenges to the Affordable Care Act in the last few years. The Supreme Court upheld the law in 2012, but said the expansion of Medicaid was an option for states, not a requirement, and about half the states have declined to expand eligibility.

How Much Would Premiums Rise?

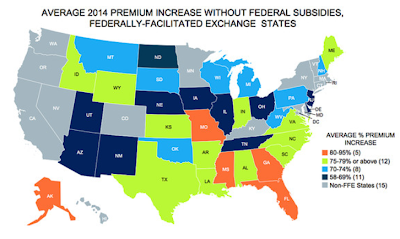

Marketwatch reports Average Premium Hike is 76% in States Without Federal Subsidies.

A Study from Avalere Health shows that the average health-care premium increase for those who actually lose their subsidies would be 76%. The hike in premiums would be highest in Mississippi, where it would be roughly 94%, as well as Missouri, Georgia, Florida and Alaska.

The map shows just how much the increases are likely to be, and the decision could exempt many of the roughly 4.7 million people who received subsidies and enrolled via federal exchanges. Those who enrolled in states with their own exchanges are not subject to the ruling.

Thirty-six states currently use the federal exchange, but two of those — Idaho and New Mexico — are setting up their own marketplace. That means 16 states plus the District of Columbia will be operating their own exchanges in future years.

Health-Care Premium Rise

Pizza Party

Yahoo!Finance reports A Federal Judge Used Pizza To Explain Why A Key Provision Of Obamacare Is Legal.

Just hours after the Affordable Care Act was dealt a serious blow from a federal appeals court, a different appeals court gave the law a victory — thanks in part to an analogy based on pizza.

Senior Fourth Circuit Judge Andre Davis explained the debate in terms of a pizza order:

If I ask for pizza from Pizza Hut for lunch but clarify that I would be fine with a pizza from Domino’s, and I then specify that I want ham and pepperoni on my pizza from Pizza Hut, my friend who returns from Domino’s with a ham and pepperoni pizza has still complied with a literal construction of my lunch order.

That is this case: Congress specified that Exchanges should be established and run by the states, but the contingency provision permits federal officials to act in place of the state when it fails to establish an Exchange. The premium tax credit calculation subprovision later specifies certain conditions regarding state-run Exchanges, but that does not mean that a literal reading of that provision somehow precludes its applicability to substitute federally-run Exchanges or erases the contingency provision out of the statute.

Question of Intent

The issue is one of intent. Right, wrong, or indifferent, it's highly the Supreme Court will rule on the intent of Congress, not actual wording of ACA, nor whether the alleged intention makes much or any sense.

I suspect Obama will get a reprieve, but it is by no means certain. The outcome may depend on how other courts rule before the Supreme Court accepts the case.

Well, the judge isn’t exactly working with a full set of transisters, is he?

What’s the frequency, judge?

When will Obama Admin declare Obamacare is really Single Payer ,so shut up, D’oh

Short summary: It’s whatever.

When it gets to the USSC we have to remember that Roberts has been bought, at least on this issue.

This is not the case with the ACA law. While a pizza from Pizza Hut that has ham and pepperoni can be substituted with a pizza from Dominoes, the ACA states that the ham and pepperoni can be used only if it comes from Pizza Hut and not Dominoes. ...................

How can we judge their intent when no one actually read the law before they voted. They even bragged that they hadn't read it.

It is like in a criminal case where you have to prove intent or there was no crime.

In this case there was no way to know what the legislators were intending since they were voting on a law that they had not read. Therefore no one knows what was intended.

There is absolutely no doubt about the intent of the clause for excluding subsidies from Federal programs.

The Federal exchanges were barred from providing subsidies to prevent the program costs from exceeding what were already staggeringly expensive levels - a Trillion dollars as scored by CBO.

This is a part of the record - a ban on Federal Exchange subsidies were a deliberate, fully considered Cost Control measure intentionally drafted into the bill to make the costs close.

You are missing the point. It is beneficial to the liberal cause, so none of that matters. All that matters is what the "intent" was. Now, if it were reversed, and it benefited the Conservative cause, then the courts, the Dems, the GOP-e, and the media would all be insisting that the letter of the law be followed exactly.

I wonder if this judge will be praised by the liberals for his wisdom, for talking about pizza.

The liberals were outraged when Justice Scalia asked if the government can force us to buy and eat broccoli. Which is why I bring up the pizza analogy. Which food analogies are considered okay with liberals, and which ones are absurd. What are the liberal criteria here?

You are spot on.

The liberals want to have it both ways, and they may get it.

When the liberal view of an issue calls for review of legislative intent or some other inexact criteria, then the liberals will talk about that as being how the decision should be made.

If the liberal view of an issue calls for the letter of the law to be followed exactly, then liberals tell us that this is how a case and a law should be interpreted.

Great, now I can pay my taxes to my cousin instead of the IRS because I still complied with a literal construction of paying taxes!

Where do they find these Judges? At the bottom of a box of Cracker Jacks?

Just another libtard indulging in what libtards do - hair-splitting exercises.

It doesn’t matter if it doesn’t comport with the letter of the law, the spirit of the law, or traditional precedent - I want what I want and I’ll torture language, the law, and anything else in my way until I get what I want.

(Cue 6 year old child on his back stomping his feet)

The road to ‘hell’ is paved with good ‘intent’ions.................

Why didn’t the judge declare that the Federal government is a state since it has a State Department?

That’s the wrong argument to make. If that is the argument, then the judges will feel that they have every right to correct what amounts to nothing more than an error in the text. The correct argument is that it WAS their intent to exclude federal exchanges from the subsidies.

Appeal: 14-1158 Doc: 83 Filed: 07/22/2014 Pg: 42 of 46 43

So does common sense: If I ask for pizza from Pizza Hut for lunch but clarify that I would be fine with a pizza from Domino’s, and I then specify that I want ham and pepperoni on my pizza from Pizza Hut, my friend who returns from Domino’s with a ham and pepperoni pizza has still complied with a literal construction of my lunch order.

And this has what exactly to do with the text of the law?

Was there a Pizza Hut bammycare application or a Domino's bammycare application ?

Maybe it was just a check-box somewhere... .

Immaterial since no one FORCED you to have pizza for lunch, you judicial dipstick!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.