Skip to comments.

Investment & Finance Thread (week July 6 - July 12 edition) [my title: The Economy Looks Great!]

Weekly investment & finance thread ^

| July 6, 2014

| Freeper Investors

Posted on 07/06/2014 10:24:34 AM PDT by expat_panama

|

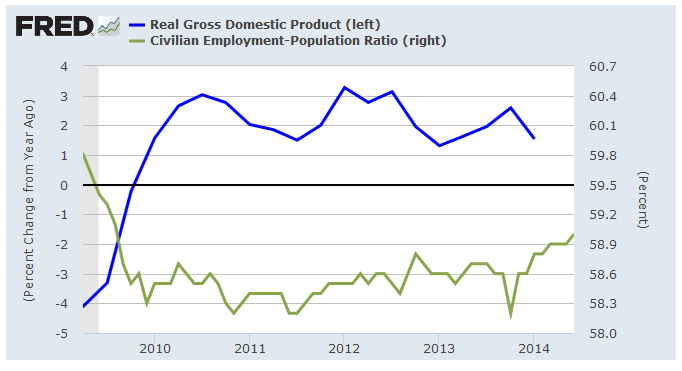

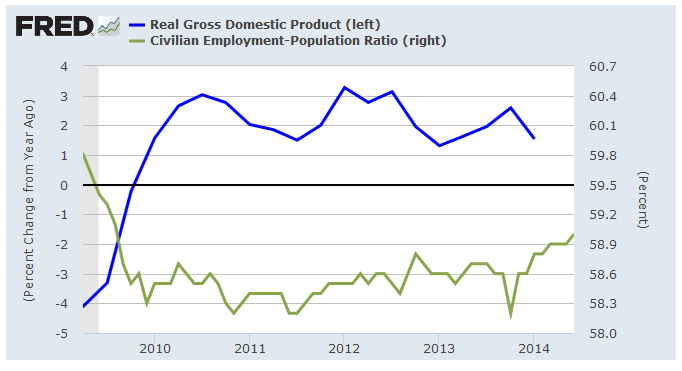

Huh. Huh. While coming into the second half of 2014 we just had the GDP and employment rpts, and what happened is we got what seemed to be contradictory -2.7% and +6.3 bombshells. On the other hand (Truman hated economists saying that) a look at the year over year GDP return along with the employment/population ratio puts the two together. [click to enlarge] The reason GDP growth looks solid is because that -2.7% was just one Qtr to the next, so last week's rpt tells us more about how good Q4 was than it does about how bad Q1 turned out. Something else is the fact that over this past 1/2 year employment/population is finally making a move --a move we've not seen since the "recovery" began in '09. |

|

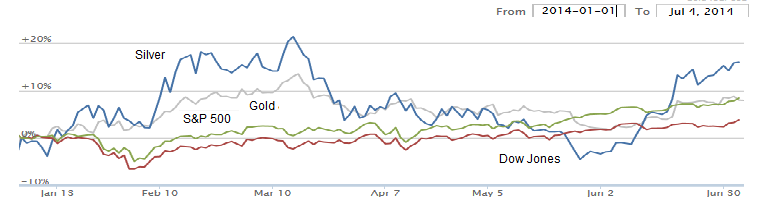

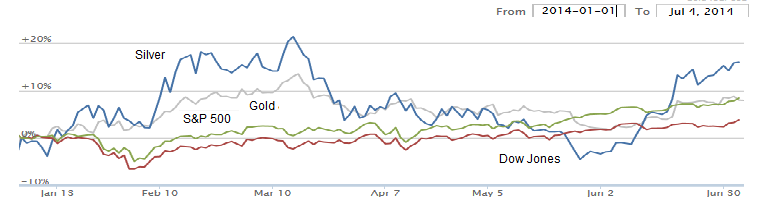

OK, so last week I said "IMHO we're in an economy where we can still make money but it's just going to take more effort", but judging how stocks'n'metals are now rising up from this year's base there's reason to think that it may not take as much effort after all... |

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

To: Chgogal

When you say “Feds” do you mean “Federal reserve” or “Federal Government” because my answer would be very different.

To: M Kehoe

Not yet...

To: All

To: Chgogal; Wyatt's Torch

It wasn't me that was saying that, but Steve Forbes on a question and answer session with a small group of people. I believe he had just written a book.

In answering a question, Mr. Forbes said that after the election the Feds are going to, quote, stick their claws into mutual funds, etc. He didn't elaborate. Nor did he show any approval or disapproval that I could tell. My impression (right or wrong) is that the gov’t meddling is a done deal. I don't know if it's called for by Dodd-Frank or not.

I came in very late to the session (Bloomberg TV) and only saw the last five minutes or so. But I thought what little I did hear was troubling, to say the least.

24

posted on

07/07/2014 8:02:58 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: Wyatt's Torch; Chgogal

I can answer that; I was quoting Steve Forbes. I’m reasonably sure he was referring to the Federal Government.

25

posted on

07/07/2014 8:06:46 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

So yesterday we had metals flat and stocks falling and today we're seeing metals solidly up with stocks continuing to fall. Reports today -JOLTS - Job Openings and Consumer Credit. Headlines direct from the Confirmation Bias Newsdesk:

- A Correction Is Coming - Barry Ritholtz, Bloomberg

- It May Be Time to Move Into Cash - Michael Pollock, Wall Street Journal

- Why DJIA May Slip Back to 15,000 - Douglas McIntyre, 24/7 Wall Street

- Ignore the Chatter, Markets Are Fairly Valued - Jeff Macke, Yahoo Finance

- Europe's stocks, bonds dip as bank fines mount, QE hopes dim Reuters - 10 hours ago LONDON (Reuters) - Europe's main stock indices and bond benchmarks dipped on Tuesday amid reports of new U.S. fines on banks and dimming prospects for an asset purchase programme from the European Central Bank.

- Gold, Silver: The Speculators Are Back There was a 20% increase in speculative gold positions in the futures and options markets during the week ending July 1, the latest Commodity Futures Trading Commission data shows. Commerzbank's commodity strategists write this morning that the trend is similar for silver: Net long positions in… Barrons.com

To: MichaelCorleone; Wyatt's Torch; Chgogal; Lurkina.n.Learnin

To: expat_panama

I tried. Now my head hurts.

28

posted on

07/08/2014 5:35:29 AM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: expat_panama

Great?! Not hardly. When I get the 1st Qtr 401k statement in a few days, I’ll be greatly paring my future stock allocations as well as moving a good portion of the accumulated stock money into bonds/cash/safer funds, etc.

The market won’t levitate on printed Fed money forever. And I don’t consider the June performance of losing 500K full-time jobs while gaining 1M part-time jobs anything but flat to bad.

Prices going up as wages and hours worked go down and the subsistence rolls swell is not a recipe for prosperity.

29

posted on

07/08/2014 6:29:42 AM PDT

by

citizen

(There is always free government cheese in the mouse trap.....https://twitter.com/kracker0)

To: citizen

30

posted on

07/08/2014 7:59:37 AM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: BipolarBob

To: expat_panama; citizen

"Let them lead you

up in the air"

Just trying to cheer up citizen.

32

posted on

07/08/2014 9:32:35 AM PDT

by

BipolarBob

(Obama - The Scandal a Week President.)

To: BipolarBob

33

posted on

07/08/2014 9:50:14 AM PDT

by

citizen

(There is always free government cheese in the mouse trap.....https://twitter.com/kracker0)

To: Lurkina.n.Learnin

“Truckers strike at Los Angeles, Long Beach ports”

Two jurisdictions, side by side, make up the biggest shipping port in the United States.

To: expat_panama; Wyatt's Torch

Can either of you confirm or refute the claim that our government plans on meddling in the investment fund business? Do you have an opinion on what the fallout might be if true?

Since the banking and investment industry is already heavily regulated, it's hard to see how more is better. If you would share your thoughts on this we would all benefit and appreciate it.

35

posted on

07/08/2014 8:28:23 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

--and a good morning to all! Futures are seeing a continuing climb in metals after yesterday's gain while stocks are seen flat after yesterday's drop (bargain hunting after profit taking?); IBD's headline said it all: Stocks Keep Sliding; Market Under Pressure. Reports today include MBA Mortgage Index, Crude Inventories, and FOMC Minutes. Some news feeds:

- Wall Street retreats Business Recorder - 6 hours ago US stocks dipped on Monday, retreating from last week's record levels as investors hesitated to make big bets before the start of earnings season.

- World stocks stumble as gains reassessed Boston Herald - 2 hours ago TOKYO - Asian stocks fell for a third day Wednesday and European markets traded tepidly as caution spread ahead of corporate earnings and after record highs on Wall Street.

- Shale boom confounds forecasts as U.S. set to pass Russia, Saudi Arabia Four years into the shale revolution, the U.S. is on track to pass Russia and Saudi Arabia as the world's largest producer of crude oil, most analysts agree.

- Government made $100B in improper payments

- 7 market myths that make investors poorer By better understanding the financial markets and our behavioral flaws, we can increase the odds of achieving our financial goals, writes Cullen Roche. MarketWatch

- Looking For Inflation In All The Wrong Places - Sigmund, Sigmund Holmes

- The Fed Increasingly Resembles Mexico's Bank - Desmond Lachman, RCM

- Yellen Winning Debate For More Regs - Darrell Delamaide, MarketWatch

- The Fed's 'Blunt Instrument' Engineers Instability - Caroline Baum, RCM

- U.S., Why Not Beat Up On Your Own Banks? - Leonid Bershidsky, Bloomberg

To: expat_panama

Good link >> • The Fed Increasingly Resembles Mexico’s Bank - Desmond Lachman, RCM << All should read.

Seems to me that the FED has become or, I guess, always was, an entity serving first it’s political and Wall Street masters and secondly following sound financial policy.

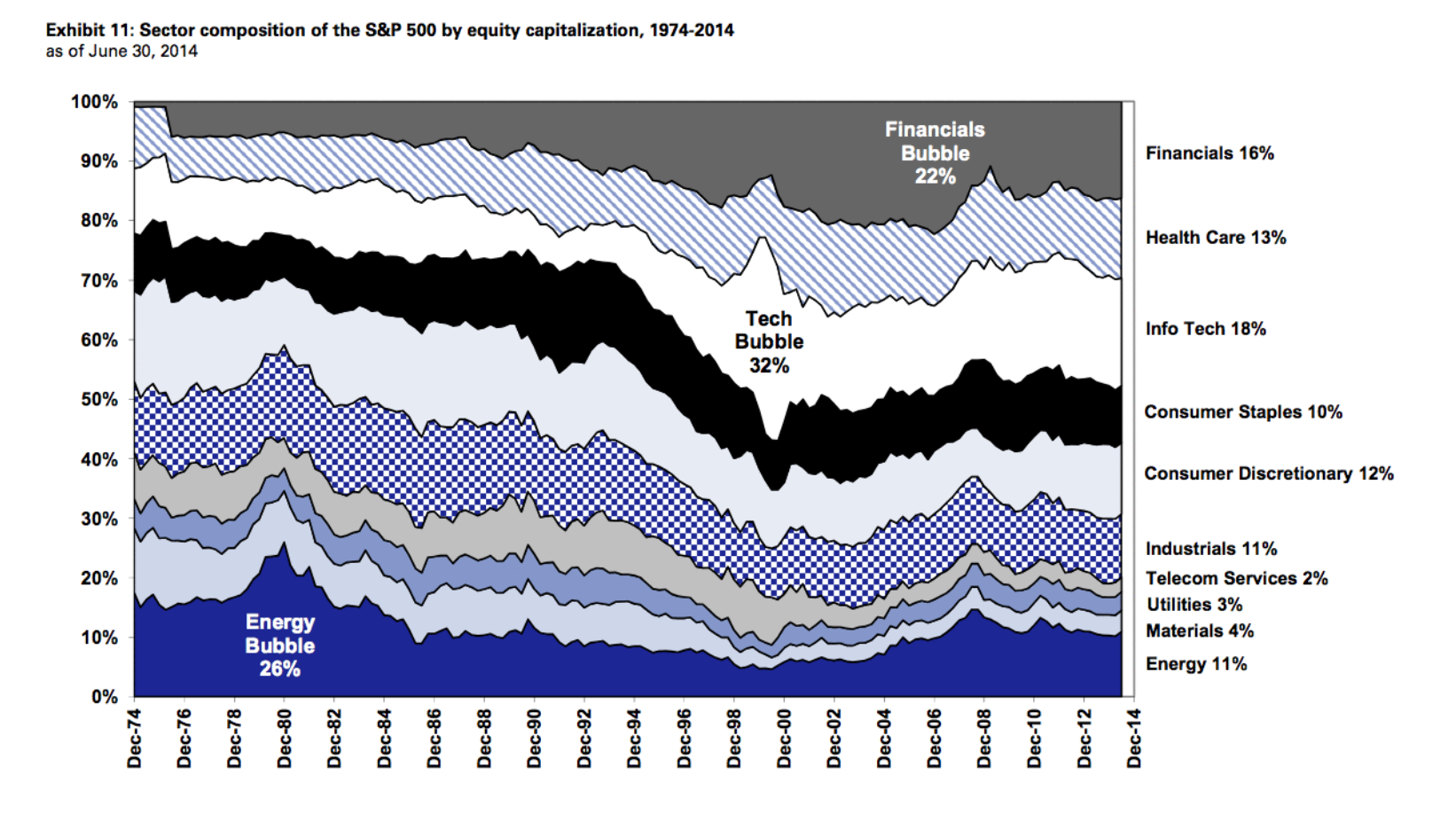

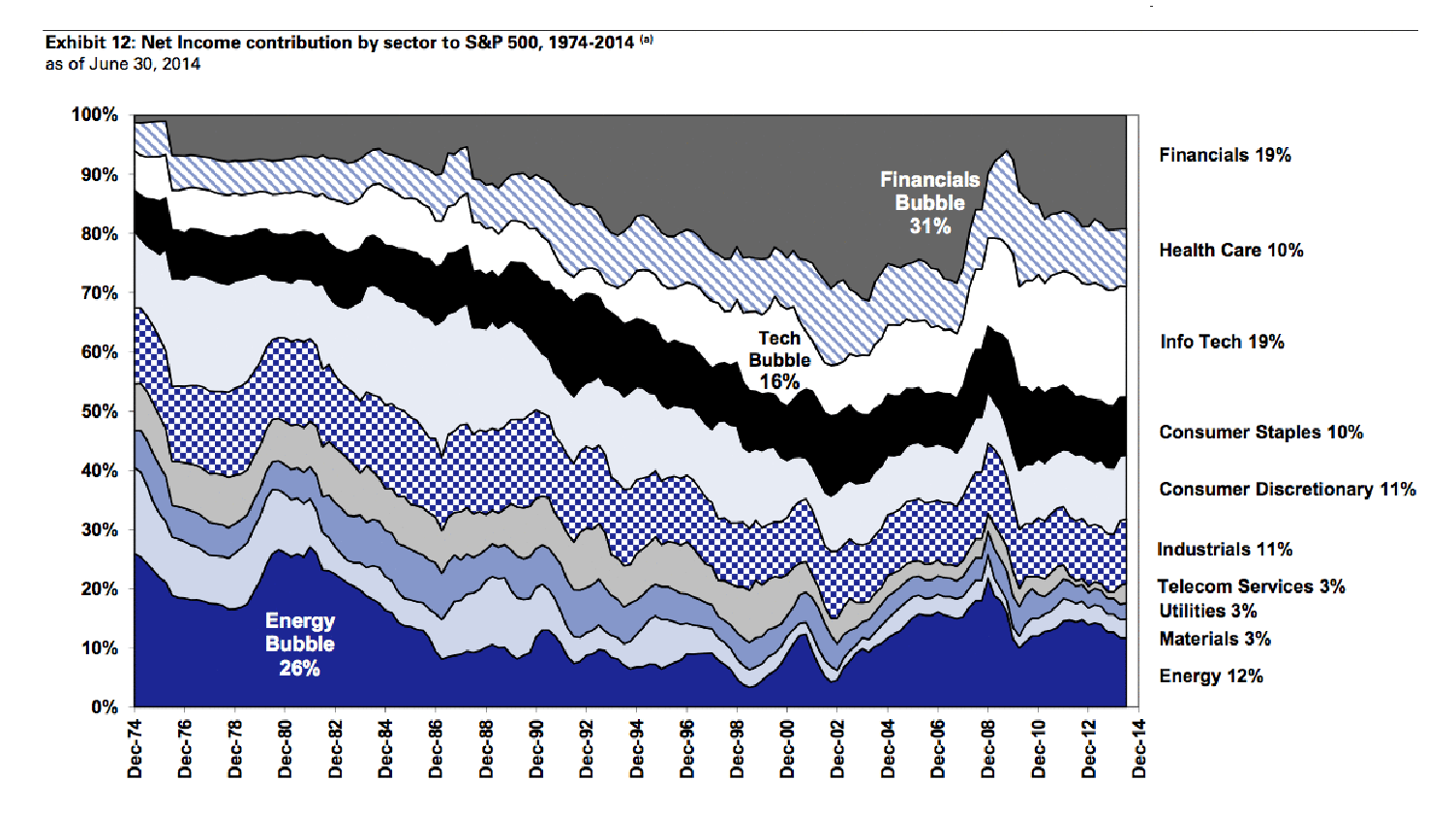

By inflating up one bubble or another the FED pleases the current political administration while assuring that the rich get richer via easy money and inflated asset value.

The rest of us suffer greatly while paying for it all as the bubble inflates and certainly when it bursts.

I’ll be largely abandoning stocks for safer havens soon.

37

posted on

07/09/2014 5:09:55 AM PDT

by

citizen

(There is always free government cheese in the mouse trap.....https://twitter.com/kracker0)

To: MichaelCorleone

When they propose confiscating wealth from 401k’s is when the shooting starts...

To: MichaelCorleone; Wyatt's Torch

...confirm or refute the claim that our government plans on meddling in the investment fund business? ... ...the banking and investment industry is already heavily regulated...The facts I'm working with are that the left struggles to plunder as much of the nation's wealth as possible, and that incomes and corp profits are already maxed out on the right side of the Laffer curve, so that leaves seizing private wealth. Other observable realities that we've seen already in Europe range from Cypress' 10% bite to Gorbachev's flat out confiscation of all private savings. In the U.S. we saw the Executive Branch rob GM stockholders outright while expanding restrictions on capital flight of private savings (Banks, Fidelity Start Saying Sayonara To U.S. Expatriates ... news.investors.com).

So. Other than that....

To: MichaelCorleone

I have heard for years that the Dems want to target 401k’s and potentially impose a 10-20% “one time tax” where they just take the money. Been hearing that since the mid-90’s. The natural course of government is to regulate more. I have no doubt that the Dems think they can sell confiscation to voters by demagoguing those with 401k’s as “rich” and “greedy”. And given the makeup of the electorate it’s an easy sell. And you will have rich Dems being okay with it because most of their wealth will be protected. The ones who will get killed are the middle class. As always.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-73 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson