Posted on 06/08/2014 11:38:26 AM PDT by expat_panama

Winding down the end of the first half of 2014 (dang, --already??) we can say we're looking (from here) at six months of getting no where, or we can also say we've built a solid base for long term growth.

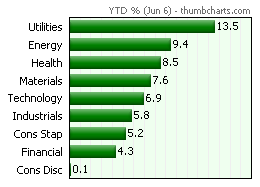

In terms of sectors (from here) this year's been generally showing these same slow but steady gains throughout:

Funny how we were just talking the other day about how nice a bit more boredom would be, although with negative interest rates, negative gdp, and mid-term elections five months ahead that may not be on...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

No way around it, there really are a lot of positive signs.

Amazing, yesterday's stock indexes ended flat --same prices same volume as before. This mornings futures are working on profit taking and that whatever day the official 'uptrend' continues, it's not looking like today. Then again, today we got Crude Inventories, Treasury Budg, and the Mortgage Index ahead of eight reports tomorrow, so hang on...

Reuters Global stocks slip from peaks, euro dips

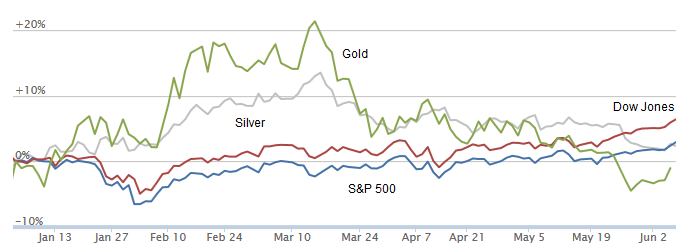

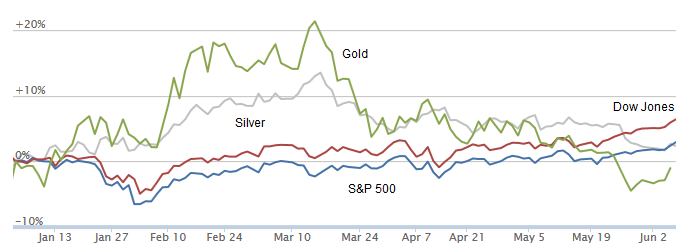

Is Gold Ready to Bounce? June 10, 2014 Chad Karnes. Gold and silver have been all over the map in 2014. Through February, they were both up over 10% and outperforming stocks. Since then, they have... Read More

U.K. Unemployment Falls; Payrolls Surge to Record High

Money managers are unhappy because 70% of them are lagging the S&P 500 and see the end of another quarter approaching. Economists are unhappy because they do not know what to believe: this month’s forecast of a strong economy or last month’s forecast of a weak economy. Technicians are unhappy because the market refuses to correct and gets more and more extended. Foreigners are unhappy because due to their underinvested status in the U.S., they have missed the biggest double-play (a big currency move plus a big stock market move) in decades. The public is unhappy because they just plain missed out on the party after being scared into cash after the crash. It almost seems ungrateful for so many to be unhappy about a market that has done so well ... Unhappy people would prefer the market to correct to allow them to buy and feel happy, which is just the reason for a further rise. Frustrating the majority is the market’s primary goal.

Also, UK unemployment dropped to a 5 year low. Damn Obama is cooking the book everywhere!

-——Frustrating the majority is the market’s primary goal.——

Which is why being a contrarian is the way to go

This quote is from 1989... Being contrarian at that point would have cost you a 350% return over the next ten years :-)

Frustrating the majority is the market’s primary goal.

If the majority is frustrated then it's because the majority wants to be frustrated. Sure, sometimes it seems like there's some kind of evil "they" that are out to get us, but in the adult world "the market" is us, and each and everyone of us who buys or sells things is setting market prices.

What still remains is the fact that we're acting as a group in a way that we're individually not understanding --hence the frustration and the disappointment. My take is maybe it's time we admit what we 'know' may not be true and a bit of learning is in order. That, and we can also have fun enjoying the circus...

Whoa, I'm having another deja vu attack again!!!

Futures are really heading south —crash time anyone?

The world bank lowered their estimates.

"The bank lowered its global economic growth forecast for 2014 to 2.8 percent from the 3.2 percent it estimated earlier. At the same time, the World Bank left its forecast for 2015 and 2016 broadly unchanged at 3.4 percent and 3.5 percent, respectively."

Yea I thought of it as just a little hiccup.

A beautiful new day today w/ this morning's futures flat/up after yesterday's flat/down in light trade. Reports today--

Initial Claims

Continuing Claims

Retail Sales

Retail Sales ex-auto

Export Prices ex-ag.

Import Prices ex-oil

Business Inventories

Natural Gas Inventories

--8:30 (or 10:30 for the last two)

Goldman Slashes Q1 GDP Estimate To -1.9%

huh.

0.1%, then -1.0%, now -1.9%, can’t wait to see how Q2 2014 comes out...

2Q will be >+2% easily. Bounce back.

There are so many contradictory signs (as usual) but that’s generally my gut feeling too. Watching for more signs through...

Other news:

British rate hike hint boosts sterling, Iraq unrest drives up oil LONDON(Reuters) - Sterling surged on Friday after the Bank of England hinted at an interest rate rise this year, while escalating violence in Iraq drove oil to a nine-month high and dampened equity markets. European shares .FTEU3 were still on course for the ninth week of back-to-back gains but opened in the red, with caution…

Wells Fargo: Take Advantage of Market Pullbacks Wells Fargo senior equity strategist Scott Wren explains how the World Bank's cut in its global growth projection impacts investors. WSJ Live

This chart shows the market to be 'a ticking time bomb' Are there too many bulls in the market? This chart shows there may be -- and it looks a lot like 1987 and 2007. Talking Numbers

...being a contrarian is the way to go...

Had to think on that.

Imho it depends on what we mean by "contrarian"; I understand it to mean going against general investor sentiment. Seems bullish sentiment peaks when it's time to sell ('2000 dot.com) and it's at its lowest during buying opportunities ('08 crash).

Right now bullish sentiment is low.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.