Posted on 06/08/2014 11:38:26 AM PDT by expat_panama

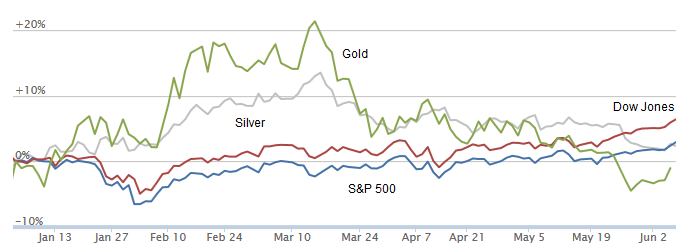

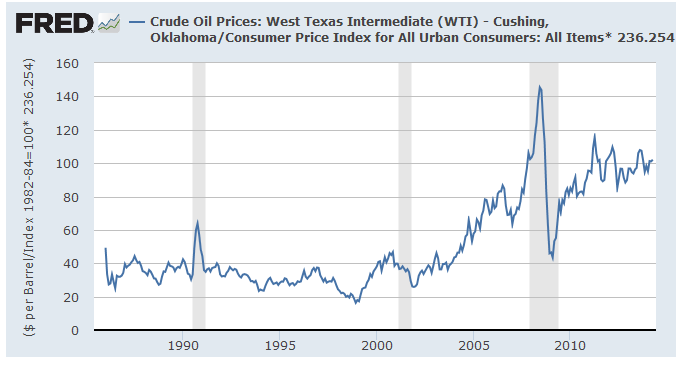

Winding down the end of the first half of 2014 (dang, --already??) we can say we're looking (from here) at six months of getting no where, or we can also say we've built a solid base for long term growth.

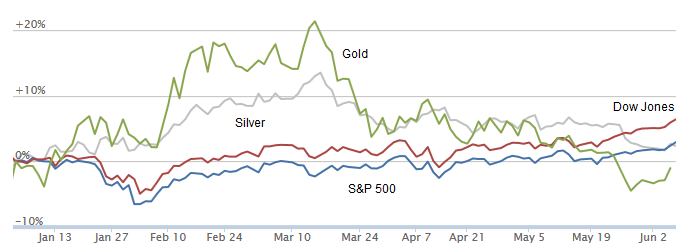

In terms of sectors (from here) this year's been generally showing these same slow but steady gains throughout:

Funny how we were just talking the other day about how nice a bit more boredom would be, although with negative interest rates, negative gdp, and mid-term elections five months ahead that may not be on...

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

S&P 1950

Ah, thanks --so McBrides's association of Presidents w/ public sector jobs is misleading and bogus because we can't say GHW Bush increased hiring by Yolo County California. Let's compare the quoted McBride numbers with the Fed's BLS numbers in your post and the OPM numbers in my post:

| Billy McBride | BLS | OPM | |

| Carter | 1,304,000 | 110,000 | -63,000 |

| Reagan | 1,414,000 | 197,000 | 350,000 |

| G.H.W. Bush | 1,127,000 | -66,000 | -358,000 |

| Clinton | 1,934,000 | -339,000 | -802,000 |

| G.W. Bush | 1,744,000 | 33,000 | 77,000 |

| Obama | -710,000 | -81,000 | 106,000 |

My thinking is that the BLS numbers are only civilian payroll --that would explain why they differ from OPM numbers..

lol! While that is technically true, it's a bit like saying "staying alive" is the phrase people use to justify breathing.

Given that all the major exchanges sell access to their matching engine to HFT firms for huge sums of money it’s a bit of a co-dependent breathing relationship :-)

DJIA & S&P staking out new highs 8D

There’s a thread about the price of awl being too high.

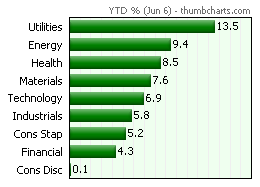

A radio report just said oil is surging, up today more than $1, above $104/bbl. That looks like WTI price/bbl.

Maybe later today we'll have a thread about water being too wet. It's true that priced in 2014$ we had oil at $40/barrel for decades and then from '04 to '07 it renotched @ $100/barrell, but that's not news.

Weird. The title of the thread is “There’s No Justification for Crude Oil Prices in the Stratosphere”.

Say what?

Bob Brinker keeps recommending the DJIA total stock index. I think it's from Vanguard which Scottrade last I looked said not available. It's costs $3,000 min (he told a lady last night) to get in. I heard Vanguard commissions aren't too bad.

Still rather stick with Scottrade but have gotten cold feet and no time to do the home work, been doing other things.

That's not a problem, with Scottrade you can own shares in Vanguard (and other) funds. There's some kind of nominal fee but like I own my VFINX in my Scottrade IRA account. Call them up and they'll 'splain which keys to mash.

There's another thought though, it's that instead of buying shares in a DJIA fund w/ a $3k min, you can also just buy shares in an exchange traded fund. I got wise to that idea when I was helping my daughter set up her IRA so she saved some money by paying just the ETF commission and no fund fees. At their website they got an ETF screener that should be able to pop up some ETF that emulates the Dow. Something else is that the min. balance becomes just the cost of a share.

Ah, missed that part. Never mind then...

I couldn’t figure out why XBI jumped so much this morning but I guess IDIX was the reason

Like That Idenix Deal ? Owners of These ETFs Do

http://blogs.barrons.com/focusonfunds/2014/06/09/like-that-idenix-deal-owners-of-these-etfs-do/?mod=yahoobarrons&ru=yahoo

Found it!

If you want to invest in the Dow w/ scottrade just buy shares in DIA —it’s an etf that goes for about $170/share and it tracks the Dow exactly (http://finance.yahoo.com/q/bc?s=DIA&t=5y&l=on&z=l&q=l&c=^DJI)

Fidelity has some great ETF funds that mirror the biggies with lower entry princess.

For many years I had an account w/ Fidelity and was quite satisfied; then about ten years ago I got mad at them and moved. Can’t remember just what it was that ticked me off but there are so many other great brokerages that it doesn’t matter much.

Seems yesterday's mild gains in mixed volume have led us to morning futures traders moving from stock indexes to metals. Reports this week begin with Wholesale Inventories and Job Openings; some headlines:

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.