My thinking was that if the current stock correction's now six weeks old, how old would that be if I could prove I was a cocker spaniel?

fwiw, we're still inside both these trendlines and these too.

Posted on 05/18/2014 5:35:14 PM PDT by expat_panama

My thinking was that if the current stock correction's now six weeks old, how old would that be if I could prove I was a cocker spaniel?

fwiw, we're still inside both these trendlines and these too. |

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

--I mean, how long could this correction possibly last anyway?

Didn’t Buffet say something along the lines of being lethargic bordering on slothful as regards trading. John Templeton remarked that if you don’t use borrowed money you’ll never have anything to worry about. Viewing this once again was valuable: http://www.youtube.com/watch?v=XFn1G2goDQw

That was a fun trip down memory lane! Dad & I always watched WSW together...WAY back in the day when you needed a newspaper and a telephone to do your commodities trading, LOL!

Not much economic data on tap this week...

Plosser speaks tomorrow

Yellen giving commencement speech at NYU on Wednesday

FOMC minutes for 4/29 meeting on Wednesday

PMI Manufacturing Flash and Initial Claims on Thursday

Existing home sales Thursday, New home sales on Friday

NYSE MARKET ACCESS CENTER: MORNING REPORT

Ahead of the Bell: Dow futures are trading down 32 points and S&P futures are trading down 4 handles. U.S. stock futures are trading below fair value ahead of the opening as investors assess a slate of deal developments, including the rejection of Pfizer’s bid to buy drug maker AstraZeneca PLC, while waiting for two Federal Reserve officials to talk about monetary policy. The corporate calendar is light with Campbell Soup (CPB) and Valspar (VAL) reporting before the opening bell, while Urban Outfitters (URBN) reports after the market close. In other news, The Kremlin is reporting that Russia is ordering troops deployed near Ukraine to return to their home bases.

• No releases scheduled on today’s economic calendar. Dallas Fed President Richard Fisher and San Francisco Fed President John Williams speak in Dallas at 12:10 ET. Market participants also await the FOMC minutes release on 21-May.

• On Friday, stocks rose with the Russell 2000 Index erasing a loss as data showing growth in housing starts overshadowed a drop in consumer confidence. The Dow and S&P still finished lower for the week ended May 16th.

• With the bulk of Q2 earnings season behind us, analysts are forecasting S&P 500 companies (in aggregate) will report 6.87% earnings growth for the second half of 2014 and 14.73% earnings growth for 2015.

• The dollar is down against a basket of major currencies. Gold is trading at $1,302. Crude oil is currently trading at $102 a barrel.

• On CNBC this morning, Ben Lichtenstein, president of TradersAudio.com, said that a “major divergence” is developing in the U.S. market as the Russell and Nasdaq are “unwilling” to participate in the rally.

Friday’s Close

DJIA up 44.50 pts / +0.27% / 16,491.31

S&P up 7.01 pts / +0.37% / 1,877.86

Nasdaq up 21.30 pts / +0.76% / 4,090.59

Monday’s Futures

Dow Futures down 32.00 pts / -0.19%

S&P Futures down 4.00 pts / -0.23%

Nasdaq Futures down 6.50 pts / -0.18%

Overseas Markets

FTSE -1.95%

CAC 40 -0.15%

NIKKEI 225 -0.64%

HANG SENG -0.04%

Overseas: Global stock markets are mixed today. In Asia, equity markets finished broadly lower. Negative sentiment surrounding China was cited as a regional headwind amidst continued slowdown in the housing sector and further crackdown on shadow lending. Following a mixed open, European equity markets have generally drifted lower, with just Greece +2.0%, Ireland +1.5% and Austria +0.04% currently trading higher. Amidst light macro updates, focus was on earnings announcements and M&A developments.

Economic Reports: None.

Top Headlines

• AstraZeneca PLC tumbled in London earlier today after the company rejected a sweetened and final offer from pharma giant Pfizer. AstraZeneca said PFE’s offer falls shorts of AZN’s value as an independent science-led company.

• AT&T Inc. announced late on Sunday it will buy DirecTV in a stock-and-cash deal worth $67.1 billion (including the DTV’s debt). Under the $95. a shares deal, approved by both companies, DTV shareholders will receive $28.50 per share in cash, and about $66.50 per share in AT&T stock (depending on price of AT&T stock upon closing of the transaction).

• Google Inc.’s YouTube unit has struck a deal to buy Twitch, a privately held video-streaming service for gamers, for more than $1 billion in cash.

Commodities/Currency

Gold: up $8.80 to $1,302.2

Oil: up $0.69 to $102.27

EUR/USD 1.3716 +0.0024

USD/JPY 101.17 -0.32

GBP/USD 1.6825 +0.0012

Volatility Index (VIX): As of the close of business Friday, May 16, 2014 the VIX is down 0.73 at 12.44

Companies Reporting Quarterly Earnings

• Campbell Soup reports Q3 EPS $0.62 vs est $0.59.

• Valspar reports Q2 EPS $1.07 ex-items vs est $1.04.

Today’s Opening and Closing Bells

Executives and guests of Merk Investments LLC will visit the New York Stock Exchange (NYSE) to highlight the launch of its deliverable gold ETF, Merk Gold Trust ETF (NYSEARCA: OUNZ). Axel Merk, Manager of the Merk Funds and President of Merk Investments LLC will ring the Opening Bell.

The Council for Economic Education Highlights the 14th Annual National Economic Challenge will ring the Closing Bell.

GOOOD MORING ALL! We're starting with futures saying gold up & stocks down --more or less. The Yahoo calendar says nothing much in econ reports til Wed, though I'll never know why we got Durables coming on what, Saturday? News:

Isn't that up? I mean, I thought it closed Fri. @ 11.39...

--and doing research at the public library. Whoa, that was over a quarter of a century ago, tx fer the ping!

That is why the markets are so oversold, and why there is so much cash sitting on the sidelines. Never in my life would I dream I would do a dance for a 5% return.

You guys may want to shoot me, but I'd like to see about a 10-20% correction in equities, so we can bring some sanity and normalcy back into the equation.

I bought DTV the other day in the mid 80s when T said they were going to buy it out in the high 90s. I’ll unload today if it pops. Regulators could derail this buyout so it’s just a quick time trade.

FactSet is showing the open at 13.25 - the futures (VX00) is up 0.11 to 13.36

I’m fine with a 10-20% drop in equities...if I know it’s coming :-)

You will. It's estimating the WHEN that's tricky. Several months ago, I read a bio on Hetty Green, the richest woman on Wall Street. One of her maxims was to keep a stash of ready cash, so as to take advantage of a distress sale when the opportunity arose.

Interesting, we’re all in agreement with this. Personally, I’d just love to see a bit more clarity here.

I don’t think the market it over-bought. Given earnings there is room to expand from here. But if there is a correction there is room to make money on the downside and then again on the upside :-)

abb keep a stash of ready cash

Wyatt's Torch don’t think the market it over-bought.

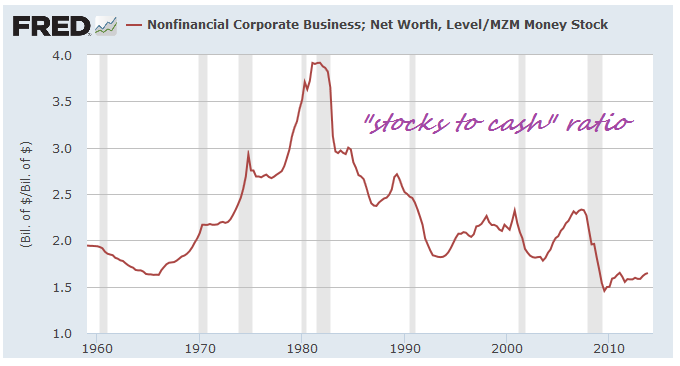

My take is that everyone's right here at the same time. I was just comparing total cash to total stock assets and --

--back in the early 80's folks had almost four times as much wealth tied up in stocks as they had ready in cash, and that's been falling ever since. Sometimes the drop supports a lovely bull market, but other times it just seems to reflect a new economic structure...

I go by the same philosophy. I bought more equities in the 1st half of '09 than in any other time of my entire 35 yrs. of investing. Was I nervous?, yep!!!!! But the consolidation had begun, and it was worth it.

Hi gang --running late on vacation sched but after yesterday's 'dead-cat-bounce' (rebound in lite trade) we're looking at more of the same. Thinking of creating a 'more of the same' macro...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.