Posted on 05/04/2014 6:21:54 PM PDT by expat_panama

Investment & Finance Thread (May 4 edition)

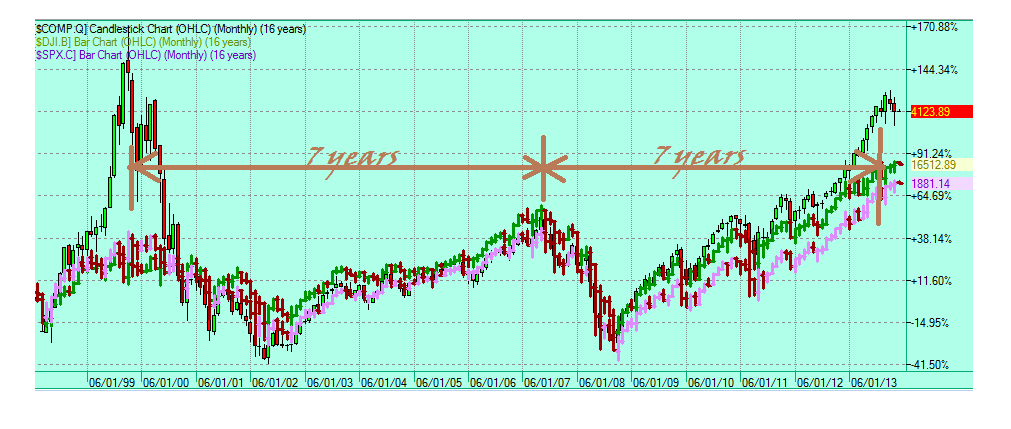

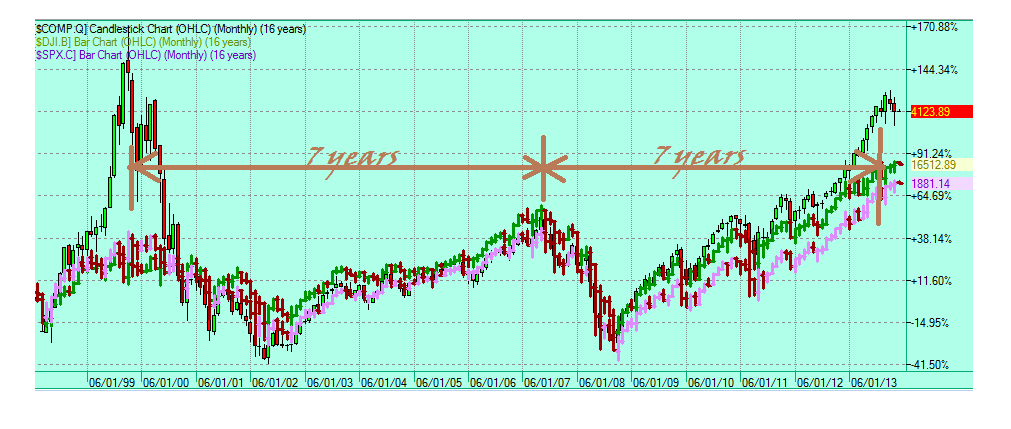

Something different we got while we begin this week is that we're also beginning a new month. Now, lot's of folks say May's are always a good time to sell (while I crunch that to see if it's true, everyone's welcome to check out "How to Use This Shockingly Simple Method to Immediately Improve Your Investment Returns"), what different this time is that if we look a the past couple hundred months--

--we're seeing that it's been as long since the '07 peak that was the same seven years after the dot-com peak. Coincidence?

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

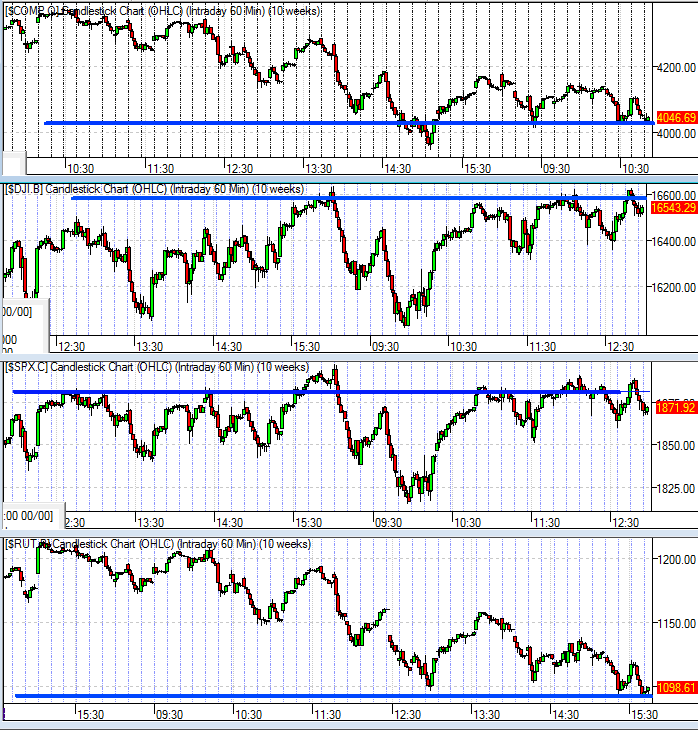

yeah. prices just going back & forth never into new territory.

Would you add me to the Investment & Finance ping list?

Thanks. ;-)

you bet!

A happy Friday to all! Looks like we're going into the weekend with futures a bit up in metals and a bit down in stocks, after yesterday's downside reverse. Morning reading:

Asia stocks mixed as Chinese inflation at 18-month-low Economic Times - 4 hours ago< HONG KONG: Asian stocks were mixed Friday after weak Chinese inflation data raised concerns about the risk of deflation in the world's second-largest economy but also opened the door to possible stimulus measures from Beijing.I'm worried about a crisis bigger than 2008: Dr. Doom The 2008 financial crisis could be just a precursor to a more severe economic fallout on the horizon, closely followed contrarian investor Marc Faber tells CNBC. CNBC

United States credit card system begins complete overhaul in the next 18 months The United States is lagging behind most of the world when it comes to credit card technology, but luckily it's about to catch up. In the next 18 months, the US is gearing up to transition debit and credit ...

Could take 5-8 years to shrink Fed portfolio: Yellen By Jonathan Spicer and Tim Ahmann NEW YORK/WASHINGTON (Reuters) - The U.S. Federal Reserve is in no rush to decide the appropriate size of its balance sheet, but if it ultimately shrinks it to a pre-crisis size, the process could take the better part of a decade, Fed Chair Janet Yellen said on… Reuters

House Republicans Propose Controversial Tax Vote House Democrats on Wednesday found themselves in the odd position of arguing against a tax credit that they generally support out of fear that its passage would endanger the success of other tax credit bills that they also favor. House Republicans brought a bill to the floor that would expand a tax… The Fiscal Times

Was on the golf course yesterday :-)

AAPL buying Beats for $3.2 billion? WTH did you guys let go on in the world yesterday???

This deal makes no sense whatsoever. Money to burn I guess.

--and I'll be flying off to TX this weekend --see how my posting goes out from my netbook in an airport waiting area...

$3 billion is 3 weeks of FCF...

A FReeper at an airport with a netbook? The TSA will have a field day.

uh oh...

That is an interesting chart. Haven't seen that before.

Depending how accurate it is, much can be inferred from the data. For example, looking at the "quits," one can infer that the macro effect of a relatively constant retirement rate would yield important information for the SSA (i.e. cash flow, cost of living adj, etc.).

Another example is how the "job openings," roughly correlates with GDP. Like I said, interesting graph.

5.56mm

" ...the data is (sic) noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million for the second consecutive month, and that quits are increasing..."

imho even if the grammar sucks the math looks good. Just the same we still need to keep in mind the cumulative totals that show up in the total employed/workforce/population numbers --numbers that don't come out as upbeat.

He is a super sharp music insider who has some innovative ideas and connections around music subscription services. AAPL's PR dept. may bob and weave and say they wanted a headphone line or that Dr. Dre is a new branding face.

I think Muve, Rhapsody, and Pandora know better though, and probably working feverishly for a defense.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.