Skip to comments.

Investment & Finance Thread (Apr. 27 edition)

Daily investment & finance thread ^

| 04/27/2014

| Freeper Investors

Posted on 04/27/2014 4:06:29 PM PDT by expat_panama

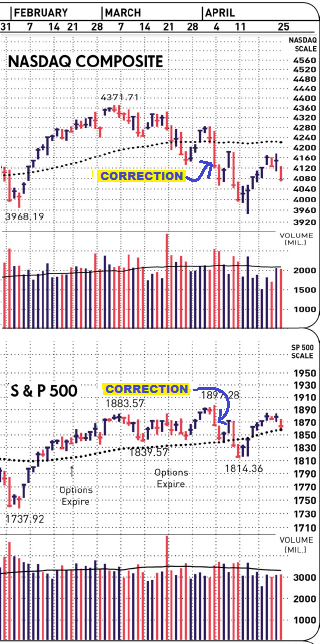

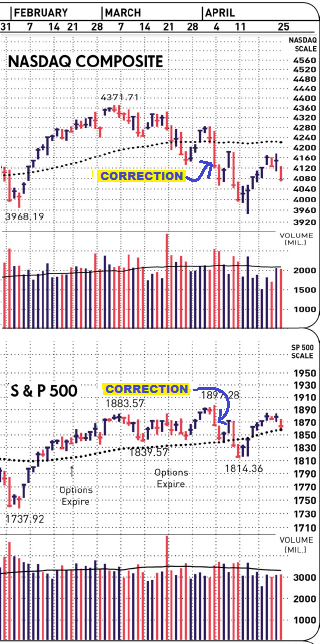

While we've all been asking 'which way' for the past few weeks all we've been getting is 'nowhere in particular'.

|

OK, so in the past 3 months we've seen everything leap up but then they all flop back to next to nothing just sitting there for a few weeks. Seems IBD called it right by saying the correction began 3 weeks ago with no 'uptrend' so far. Major indexes have given us new lows and descending highs --with volume on the bearish side. We got all kinds of pundits predicting all kinds of directions, but imho the "usually reliable" signs say we may as well get ready for more of the same. Unless we get a follow thru day tomorrow. 8P btw, IBD's clear on that follow-thru stuff saying it's no guarantee of things to come. It's just that (like they say) while not every FTD brings in a good uptrend, we know that every good up trend has had a FTD. |

|

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

Sunday afternoon pre-ping...

To: expat_panama

I’m pumped and ready for my punishment in the morning. Tomorrow when the Nasdaq gives my portfolio a low blow or judo chop, I’ll just grimace and say “Thank you sir can I have another”?

To: BipolarBob

Or— “Come back world, there’s part of my face you haven’t walked on yet!!!”

To: expat_panama

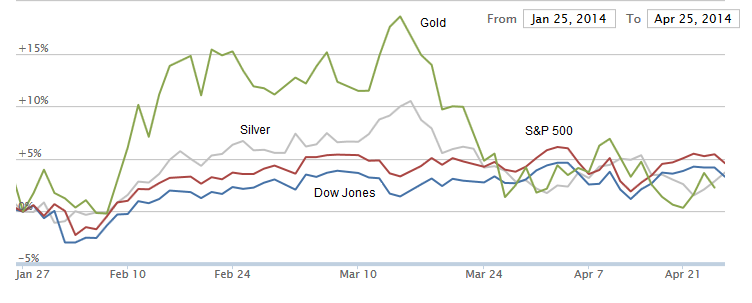

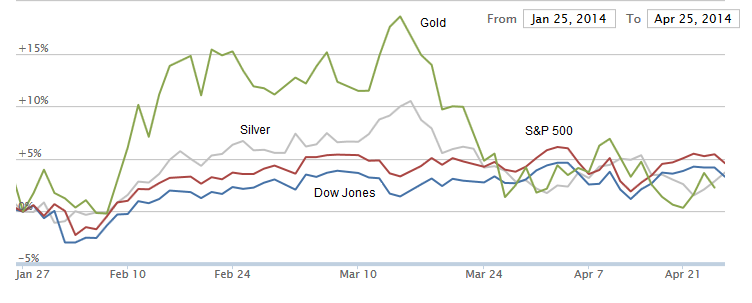

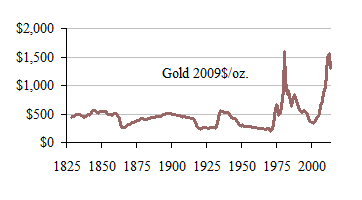

I told you the last time gold was going to fall and it did. I’m telling you again that it will fall, but most of you don’t listen.

5

posted on

04/27/2014 6:16:04 PM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: MeneMeneTekelUpharsin

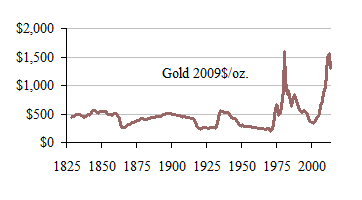

gold was going to fall and it didNo argument from me on that one, historically gold's price should be a fourth of what it is now--

--but it may take a few years though....

To: expat_panama

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: expat_panama

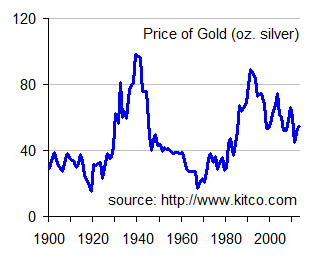

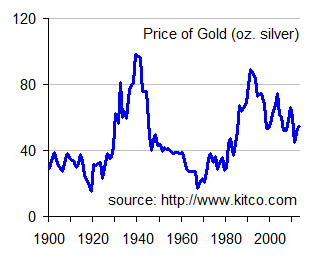

The ratio should be around 15.

That means silver needs to rise and gold to decline to close on the very long historic bench mark.

9

posted on

04/28/2014 4:47:16 AM PDT

by

bert

((K.E. N.P. N.C. +12 ..... History is a process, not an event)

To: expat_panama

Whoops...

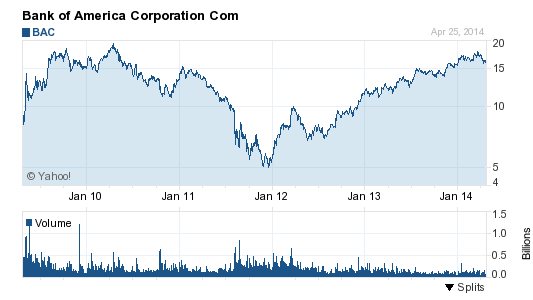

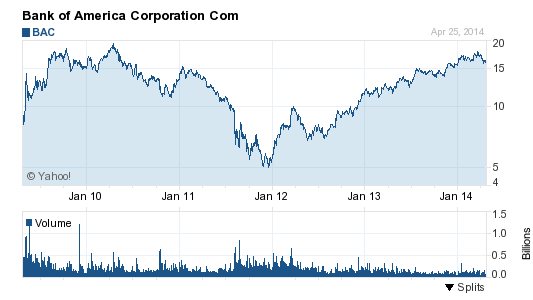

BANK OF AMERICA: We Screwed Up Calculating How Much Capital We Have

Kabul water park children slides

Reuters

Youths slide down a huge slide at a public water park in Kabul, October 4, 2013.

This morning Bank of America put out a statement revising its regulatory capital levels lower than the bank previously thought.

As a result, and at the request of the Federal Reserve, the bank will have to suspend its plans to boost dividends and repurchase stock. Naturally, this does not make shareholders happy.

The stock is down almost 3% in premarket trading on the news.

From the bank’s release:

On April 16, the company issued a press release announcing preliminary financial results for the quarter ended March 31, 2014. As part of such release, the company included estimated preliminary Basel 3 capital amounts and ratios as well as Basel 1 capital amounts and ratios for 2013. Subsequent to the press release, the company discovered an incorrect adjustment being applied in the determination of regulatory capital related to the application of the fair value option to certain legacy Merrill Lynch structured notes resulting in an overstatement of its regulatory capital amounts and ratios. The company correctly adjusted for the cumulative unrealized change on structured notes accounted for under the fair value option, but it incorrectly adjusted for cumulative realized losses on Merrill Lynch issued structured notes that had matured or were redeemed by the company subsequent to the date of the Merrill Lynch acquisition.

This month, Bank of America missed earnings estimates due to a one-time legal charge.

To: bert

...

the very long historic bench mark.A long time ago we used to have one-oz. $20 gold pieces and one-oz silver dollars, but that hardly ever matched open market commodity prices that were all over the place.

To: Wyatt's Torch

BANK OF AMERICA: We Screwed Up

They have been doing very well, but maybe these days BAC is one large cap that I might want to step back from...

To: Wyatt's Torch

800M? That is hard to believe. (i.e would be over 10% of the entire world’s population)

13

posted on

04/28/2014 9:45:21 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: expat_panama

Deal is , in the corporate world big banking and financials are the last ones I would trust. Too many examples through the years (even recent) of cooked books.

14

posted on

04/28/2014 9:47:28 AM PDT

by

catfish1957

(Face it!!!! The government in DC is full of treasonous bastards)

To: catfish1957

CHART OF THE DAY: Apple Has 600 Million Accounts, Blowing Away Every Other Company

Here's a great chart from BI Intelligence looking at one of Apple's most quietly powerful advantages.

It has ~600 million accounts on file, most of which are linked to credit cards, which is light years ahead of its competition according to BI Intelligence. Amazon, the biggest e-commerce company in the world only has 224 million accounts.

The 600 million accounts is really astounding when you consider that for people to get an account with Apple, they likely had to spend at minimum $200 for some sort of iPod, iPhone, or iPad.

Free, popular web services like Twitter don't have 600 million users. Yahoo, which is one of the most popular websites in the world has ~700 million monthly users. Apple isn't that far from Yahoo.

The bigger picture here, as far as Apple is concerned, is that the company has a healthy user base. Even if Apple totally botches execution of new products, it's going to be around for a long time with this many users. chart of the day credit card accounts

Business Insider: http://www.businessinsider.com/chart-of-the-day-apple-has-600-million-accounts-blowing-away-every-other-company-2013-11

To: expat_panama

GOOG below 200DMA

To: expat_panama

Pretty good morning read....

http://leavittbrothers.com/blog/index.php/2014/04/28/before-the-open-apr-28-3/

I like their chart work......fwiw-

I think Jason is living in Costa Rica...these days.

I trade pretty regularly...mostly energy / metals. I do send out a free e-mail now and again...

Anyone here would like to get it...let me know.

Always like to talk charts.

FRegards!!

17

posted on

04/28/2014 10:27:56 AM PDT

by

Osage Orange

(I have strong feelings about gun control. If there's a gun around, I want to be controlling it.)

To: expat_panama

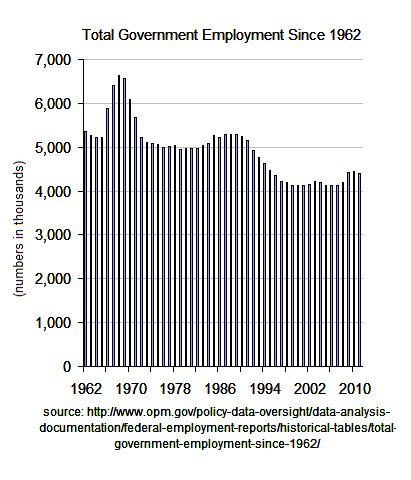

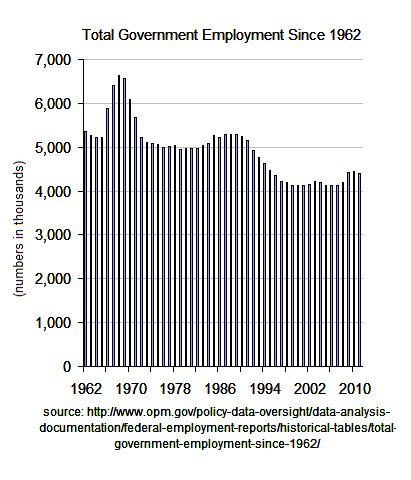

I'll need to pull this out again on NFP day. The facts are that government job LOSSES are the key driver behind the slow growth in NFP jobs. That will freak everyone here at FR out :-)

To: Wyatt's Torch

government job LOSSES are the key driver behind the slow growthEspecially in the Federal government. It's a real political topic, so we hear a lot of vague bizarre adjectives ("completely out of control", "literally exploding") w/o numbers that are open to all and speak for themselves:

Kind of like the way folks talk about global warming.

To: expat_panama

Wow. I didn’t realize it had dropped like that. Factoring in population growth adds to it also. That must be federal employees only.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-60, 61-80 ... 101-116 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson