Skip to comments.

Investment & Finance Thread 2014 New Year(Jan. 6 - Jan. 13 edition)

Freeper Investors ^

| Jan. 6, 2014

| Freeper Investors

Posted on 01/06/2014 2:28:44 AM PST by expat_panama

Investment & Finance Thread 2014 New Year(Jan. 6 - Jan. 13 edition)

Anyone want more stuff or less stuff posted here please let me know.

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me. The list of everyone's links is here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

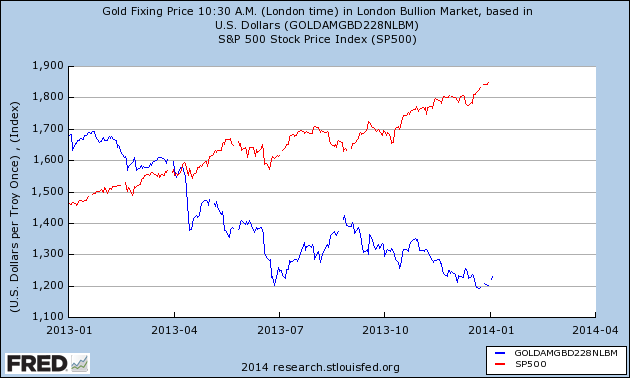

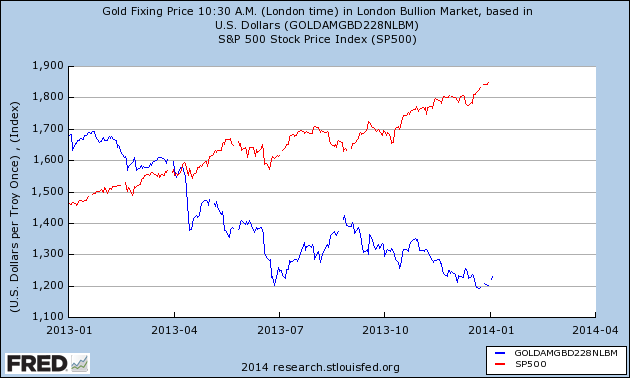

2013 was an amazing year-- stocks up 30%+ w/ metals tanking like 40%. Don't know about you but I spent most of it ready to bail out of stocks finding I never had a good reason. OK, so we made money but I'll be the first confess of being too cautious & missing out on some of the gains I should have gotten. New Year's Resolution #1: No more wimping. Sure, lots of folks are complaining about this past year's stock gains saying it can't last. The thing is that though we've been having a great run on stocks we can't expect it to last forever--- |

|

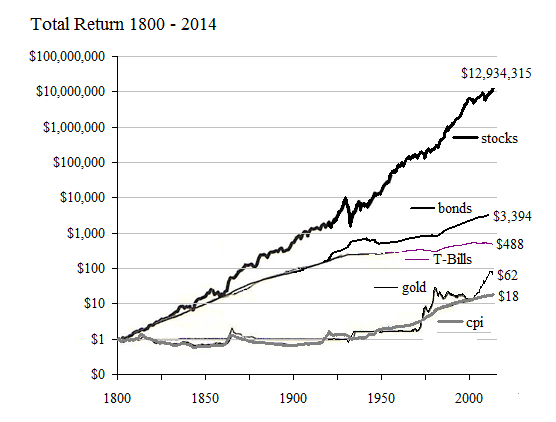

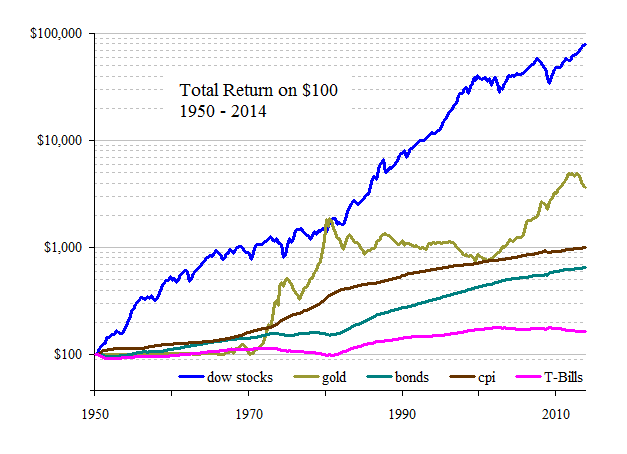

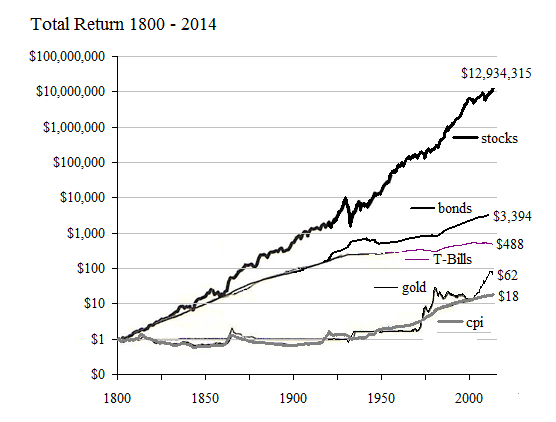

--because the fact that it's been going on for hundreds of years means that stocks are sure to revert to where they were in 1799 any second now. Actually, no. Stock returns are a function of the value of American commerce. America grows. We need to get used to it. The long term pattern is total return on stocks since 1800 has been 8%/year-- that comes out to doubling our money in just over a dozen years. On average. |

|

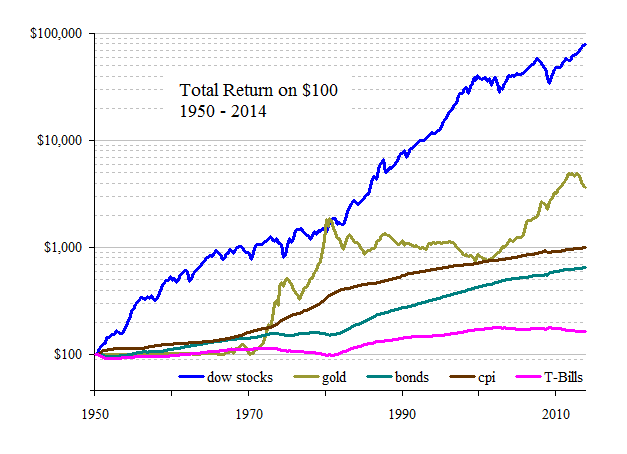

Looking more closely at the past few decades what I'm seeing is the fact that we're apparently leaving the stock perch we've been on for the past decade and a half, and we're seem to be emerging into what a lot of people call a 'secular bull market'. OK, I'm still ready to dump if what I got drops 9%, but I'll put more effort into really checking before I post my sell order... |

TOPICS: Business/Economy; Culture/Society; Government

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-52 next last

To: Tennessee Conservative

I have owned since about 1977 and its a core holding for me. One of my son’s now 25 years old got shares when P & G bought Gillette. His nice little shares have been growing since he was 2 and now is worth a small fortune. I advised him to hold on all his life if he could.

21

posted on

01/06/2014 12:27:31 PM PST

by

ncfool

(Obama's aMeriKa 2012 The land of entitlement for the 51% crowd.)

To: ncfool

That’s about where mine are now. I was working for Gillette when P&G bought it and have received shares of stock each year in the profit sharing account. They have steadily grown and that’s why I keep it all in stock but it seems like it isn’t growing very fast. I think I’m impatient and more nervous than I was while I was working and getting shares on a yearly basis. I got my last shares in July or August. Personally, I think if a person wants to invest in stock for the long term, you can’t beat P&G for stability even if it does grow slowly. If you want to make a fast buck and sell, it’s probably not the stock you want. Most P&G employees hang on to it for the dividends. I reinvest all of mine.

To: ncfool

How do you read IBD...Never leave home without it. I got the online subscription and that gives me all the website access. I overlook and miss a lot of what they got 'cause there's so much there.

Should have bought it..

It may not be healthy to say that, what I've been getting is that I'm supposed to say "whoa neat --let's check out what the signals were so I can spot the next one!". We never make any money on what we should'a could'a would'a, only on what we do. That FONR looks pretty good though; they IBD folks would say it's just had a 'breakthrough day' by punching through the previous high on Nov. 25. atm it seems to be losing steam --new highs @ lower volume-- so if it dips below 23.50 again I may buy into it...

hmmm

To: expat_panama

Embarassing as it might be that my 80 year old Mother beleives in the IBD fourmula. She spotted this on Saturaday and asked me what I thought. I agree with Would have, should have and could have. She gets the Sat copy of the IBD and I take the Online version since it was an add on to her subscription.

I better start studying IBD.

24

posted on

01/06/2014 6:10:50 PM PST

by

ncfool

(Obama's aMeriKa 2012 The land of entitlement for the 51% crowd.)

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

--and a very good morning to all! We got stuck w/ an institutional sell off on both the NASDAQ & the S&P500 yesterday, but today we're starting (as of 5:42AM) with all market's futures are upbeat, especially stock indexes; maybe we're finally getting our--

january effectWeb definitions

The January effect is a seasonal anomaly in the financial market where securities' prices increase in the month of January more than in any other month. This creates an opportunity for investors to buy stock for lower prices before January and sell them after their value increases. ...

http://en.wikipedia.org/wiki/January_effect

Other news:

Yellen wins confirmation as Fed chief

To: ncfool

...start studying IBD.IBD not only supplies answers to a lot of questions but they also warn about the importance of evaluating our own progress. After two years of disappointments my own experience told me that the 'cup'n'handle' buy points didn't work for me as well as they seemed to work for them.

Then again, it may have been something else; please let me know what you're finding.

To: expat_panama

I don't understand the cup 'n handles, head 'n shoulders and other patterns yet. I think the Bollinger bands are good indicators for buy points. I haven't exactly used them yet as the major indicator.

I watch and watch and do what my instincts tell me. I've missed so many opportunities to make money since I've been sitting it out but I'm just not seeing anything I want.

Either the stocks I have a feel for are stuck around a pivotal point for weeks now or I feel they are over-priced.

I'll tell you what I was doing. I wasn't ready to buy in 1000 lots, max was 300 for me. You should really start at opening and watch all day; they all seem to take off up or down. I look at the general past trend, then pull up a 1 day 1 minute chart, keep refreshing it. That combined with the MACD and started watching volume, I was getting fairly good at hitting the highs and lows for the day. Also the RSI. That isn't foolproof, but when a stock goes into oversold at the bottom, sometimes a couple bounces, that's a good point to buy in. But some stocks aren't that volatile. Some stay on a narrower channel.

My biggest problem is when a trade starts to go bad, I have a sale ready to get out as soon as I buy but it hard to resist the temptation to hang on. One day it went bad on me, 300 sh I sold at about 80 loss. So I see where to buy back in, stayed in, maybe that one was a swing and made about 180 on it. Net gain not so good. But those amounts are still considerable cash for me.

I guess I just got cold feet. I am risk averse right now.

27

posted on

01/07/2014 9:22:59 AM PST

by

Aliska

To: Aliska

Have any of you tried buying and selling ETF funds? I have been looking at them as it would be nicer to buy a bunch of stocks at one time. The ETF accomplishes that goal.

Black rock have lots to chose from.

I was looking at the IYT fund iShares Transportation ETF

and the

ITA Fund iShares U.S. Aerospace & Defense ETF

28

posted on

01/07/2014 11:11:17 AM PST

by

ncfool

(Obama's aMeriKa 2012 The land of entitlement for the 51% crowd.)

To: ncfool

Scottrade has lots of ETF's. I read a little about them but have forgotten. I don't think one should start trading anything they don't fully understand.

Some ETF's are inverse and can cause losses. Also, there was something else about they are limited about upper value, can't remember.

I'm also studying options. Also you can play indexes.

For now I have to stick with what I understand.

29

posted on

01/07/2014 2:23:45 PM PST

by

Aliska

To: Aliska

don't understand the cup 'n handles IBD uses them so much I'd been thinking that they invented them, but it seems lots of people like 'em. Here's the basic pattern (from here) and when I looked I even found a youtube chat here. Several times a week IBD has several dozen stock graphs and they point out what the buy points are --for a while I was writing down the 30 or 40 buypoints they were announcing and used those for my "buy" list.

IBD uses them so much I'd been thinking that they invented them, but it seems lots of people like 'em. Here's the basic pattern (from here) and when I looked I even found a youtube chat here. Several times a week IBD has several dozen stock graphs and they point out what the buy points are --for a while I was writing down the 30 or 40 buypoints they were announcing and used those for my "buy" list.

So using cup'n'handles is easy (or head'n'shoulders or whatever). The hard part is making money off 'em. After about a year or more of sooo many IBD cup'n'handles I wasn't making as much money as I was before, so a few months ago I decided to ignore those patterns and all I'm doing is I buy stocks with good valuation numbers that's got good steady price growth. Seems to be working better & it's a lot easier.

Everyone has their own risk tolerance and their own investment goals so there's not right or wrong here. The only rule is to understand what we're doing and then be happy with what we did.

To: expat_panama

I’m emailing you a couple things. Given to me on a closed forum so don’t want to upload to my flickr and embed.

31

posted on

01/07/2014 6:37:51 PM PST

by

Aliska

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

We got a percent increase in stock indexes yesterday w/ higher volume --showing some feeling there. This morning's stock futures are off a bit, profit taking maybe. News is mixed too:

S&P 500 leads stock rally as year-opening slide ends Columbus Dispatch - 7 hours ago State Auto has a new tool to help policyholders assess their risk as a potential victim of identity theft and recommend what steps they can take to be... Other Business Features. S&P 500 leads stock rally as year-opening slide ends · Cold boosts power demand; ...

Unemployment in Europe Remains Stubbornly High New York Times - 2 hours ago PARIS - Europe's labor market remained stagnant in November, official data showed Wednesday, suggesting the region's economy will continue treading water in the new year.

To: Aliska

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

Morning heads-up: Futures a bit up in general w/ stock indexes a bit off in particular. Not much news is good news 'cause if this were a stock bubble then what we'd be seeing is frantic intense interest. We're not. [going back to bed]

Bloomberg - 6:58am

Reynolds Center - an hour ago

International Business Times UK - 2 hours ago

To: expat_panama

I’m curious, what percentage of your (people on this thread) income are you (or did you) putting away for retirement savings? 10%, 15%, 20%, 25%, etc.?

I think we need to boost ours and I was wondering what a good goal might be. (I know, it all depends, LOL!)

To: Abigail Adams

(I know, it all depends, LOL!)lol right! Seriously what decides it all is the choice of how you want to live. Like do you want to live w/ the same style after retirement as before (after you figure your reduced costs & your reduced income) or is it ok to accept a cut in lifestyle. If you decide you want no change, then you figure what cut from your present income will give you the savings you need to generate the retirement you want to live on. Return on investments at 8% is believable, and while I've been doing better than 8% I'm honestly not sure how much of that's dumb luck.

At any rate, if you know how to do simple math on a excel or some other spreadsheet (many are free) then you make a column for years, another for income and the 3rd column for the balance and it tells you what you need to save. Let me know what you find, it's one of my favorite pastimes.

To: Abigail Adams

To: expat_panama

Thank you very much! I’ll check it out.

To: expat_panama

40

posted on

01/16/2014 1:38:42 PM PST

by

Lurkina.n.Learnin

(This is not just stupid, we're talking Democrat stupid here.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-52 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

IBD uses them so much I'd been thinking that they invented them, but it seems lots of people like 'em. Here's the basic pattern (from

IBD uses them so much I'd been thinking that they invented them, but it seems lots of people like 'em. Here's the basic pattern (from