Skip to comments.

The Fed's 'hidden agenda' behind money-printing [Weimar Republic: Germany, 1920s...]

CNBC ^

| 9/25/13

| Peter J. Tanous

Posted on 09/25/2013 11:50:30 AM PDT by SoFloFreeper

The markets were surprised when the Federal Reserve did not announce a tapering of the quantitative easing bond buying program at its September meeting. Indeed, its signal to the market that it was keeping interest rates low was welcome, but there may be a hidden agenda.

Since it began in late 2008, QE has spurred a vigorous debate about its merits, both positive and negative.

On the positive side, the easy money and low interest rates resulting from quantitative easing have been a shot in the arm to the economy, fueling the stock market and helping the housing recovery. On the negative side, The Fed accomplished QE by "printing money" to buy Treasurys, and through the massive power of its purchases drove interest rates to record lows.

But in the process, the Fed accumulated an unprecedented balance sheet of more than $3.6 trillion which needs to go somewhere, someday.

But we know all this.

I believe that one of the most important reasons the Fed is determined to keep interest rates low is one that is rarely talked about, and which comprises a dark economic foreboding that should frighten us all.

Let me start with a question: How would you feel if you knew that almost all of the money you pay in personal income tax went to pay just one bill, the interest on the debt? Chances are, you and millions of Americans would find that completely unacceptable and indeed they should.

But that is where we may be heading.

Thanks to the Fed, the interest rate paid on our national debt is at an historic low of 2.4 percent, according to the Congressional Budget Office.

(Excerpt) Read more at cnbc.com ...

TOPICS: Business/Economy; News/Current Events

KEYWORDS: bankrupt; devaluation; inflation

Danger, Will Robinson.

To: SoFloFreeper

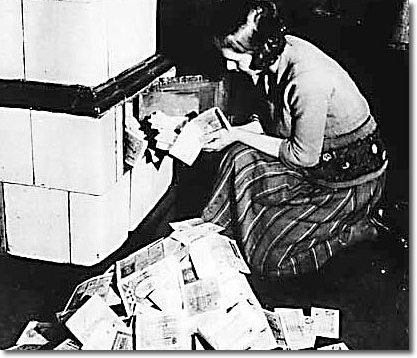

In the Weimar Republic, money was burned to heat homes...that is how worthless it had become.

Now the monies being created by Team Obama and his minions at the Fed are not being done with paper, but with 1s and 0s...just digital money, via computer.

The effect will be the same or worse.

We must stop this insanity.

To: SoFloFreeper

And here they are...

3

posted on

09/25/2013 11:58:11 AM PDT

by

DoughtyOne

(This post coming to you today from behind the Camelskin Curtain. Not the Iron or Bamboo Curtain...)

To: DoughtyOne

The new 100 dollar bills that is...

4

posted on

09/25/2013 11:59:09 AM PDT

by

DoughtyOne

(This post coming to you today from behind the Camelskin Curtain. Not the Iron or Bamboo Curtain...)

To: SoFloFreeper

McDonalds has a market capitalization of $97.84B. Wal-Mart has a market cap of $242.56B. Exxon has a market cap of $384.7B. These huge companies are dwarfed by the amount of money being created out of thin air by the Fed.

5

posted on

09/25/2013 11:59:15 AM PDT

by

CitizenUSA

(Why celebrate evil? Evil is easy. Good is the goal worth striving for.)

To: SoFloFreeper

LOL. That’s a good point. At least paper money can be burnt for energy or metal coins be melted for their metal value. When this all comes crashing down, we won’t even have that, and believe me, it’s going to crash. It’s only a matter of when.

6

posted on

09/25/2013 12:01:06 PM PDT

by

CitizenUSA

(Why celebrate evil? Evil is easy. Good is the goal worth striving for.)

To: SoFloFreeper

If creating all this money out of thin air isn’t a problem, why not print $300,000,000,000,000 and give every man, woman and child $1-million?

7

posted on

09/25/2013 12:09:13 PM PDT

by

wny

To: SoFloFreeper

During the Weimar Republic, one businessman, Hugo Stinnes, was known as “The Inflation King”.

He would borrow huge amounts, buy raw materials, hire labor and rent factories, and produce products. That took time during which his debt was inflated away to nearly nothing. After he got his products he would sell them for new, highly inflated currency and pay back his loans, whose value had gone to nearly nothing by the time he paid them back. Rinse and Repeat. He died of a gall bladder operation.

8

posted on

09/25/2013 12:09:16 PM PDT

by

donmeaker

(Youth is wasted on the young.)

To: SoFloFreeper

One tool a wheelbarrow to market to carry your money there, and carried your groceries home in your purse.

9

posted on

09/25/2013 12:10:24 PM PDT

by

donmeaker

(Youth is wasted on the young.)

To: SoFloFreeper

This bailout * money printing * benefits the too big to fail Crony foreign European & US banks and such.

10

posted on

09/25/2013 12:13:57 PM PDT

by

george76

(Ward Churchill : Fake Indian, Fake Scholarship, and Fake Art)

To: CitizenUSA

At a future date the United States Treasury and the Federal Reserve, together with the Banks of Canada and Mexico will announce a common currency called The American(s) Dollar which will replace the USD, Canadian Dollar and Mexican Peso. At this same news conference, all citizens will be enjoined to enjoy the open boarders in the new North American Free Trade Union. All the years of US Congressional and Senatorial failures to secure US Boarders were also revealed to be due to the behind the scenes knowledge that the NAFTA was actually being implemented without the citizens knowledge, albeit for their own collective good.

The American(s) Dollar is said to have alleviated much of the National Debts of the three signatory nations as they Devalued Nation Currency's with the exchange for the new Regional Currency. The North American Free Trade Union joins the EU as the second of what analysts say will be a trend ultimately resulting in five to sever total Trade Zones over the next thirty years. Analysts also predict that both Central and South American will join the NAFTU ultimately re-branding the Zone as the Americas or American Free Trade Union. Passage of this landmark bill now allows free travel by citizens of participant nations across nation and state boarders and a series of bilateral talks are underway to implement laws making treatment of all citizens equal with similar protections, which will result in a new legal code covering the North American.

11

posted on

09/25/2013 12:15:58 PM PDT

by

Jumper

To: SoFloFreeper

What’s to keep the FED from just writing-off the $3 Trilion-or-so it owns in Federal Gov’t debt?

Also, Conservatives need to be prepared for what comes AFTER the FED. The FED is the foundation of the progressive, socialist nanny state. When it dies (or kills itself) we have to be prepared for what kind of system should come next.

the good thing is though - no more money printing means the US Government can no longer fund its many social-engineering progressive schemes. The sooner the FED is shut-down, the better.

12

posted on

09/25/2013 12:32:56 PM PDT

by

PGR88

To: SoFloFreeper

John Maynard Keynes, - “By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

To: SoFloFreeper

The income tax is not used for Social Security and Medicare as they have their own taxes.

The income tax is not used to build/repair federal highways and bridges as tolls and gas taxes pay for this.

The income tax is not used to pay for schools as local property taxes and state levies are used to pay for this.

And so on.

What are income taxes used for?

Welfare

Defense

Courts

Agencies

AND INTEREST ON THE DEBT.

The interest on the debt will not explode if rates rise because the Fed will give the free money from thin air to the federal government with a 2% administrative fee to its member bank bond traders. In other words, the Fed will continue to prop up the federal government at sweetheart rates; no one else will be able to get these special rates. It’s no longer an open market when it comes to government financing.

The Fed’s other requirement is to prop up the Stock market to pacify retirees and working stiffs because retirement plans are now entangled via 401ks with the stock markets and ‘index funds’. Working stiffs that are near retirement and retirees form a huge voting bloc and it is certain there would be a revolt if the Stock markets took a massive hit.

All of this flies in the face of fundamentals, it doesn’t seem right, it doesn’t feel right; but it is what it is.

What can cause the scheme to fail?

QE Tapering,

Loss of the US dollar as world’s reserve currency,

Oil Supply Disruption (War)

Food inflation continuation

But I think it will be a slow insidious realization of the numbers, as they accumulate more and more debt, as they do now and as basics and essentials continue to inflate. Like the proverbial fog in the pot of water with the heat burner turned on to boil, life in the USA will become more amd more

uncomfortable, stifling and miserable.

14

posted on

09/25/2013 1:04:32 PM PDT

by

Hostage

(Be Breitbart!)

To: SoFloFreeper

On the positive side, the easy money and low interest rates resulting from quantitative easing have been a shot in the arm to the economy, fueling the stock market and helping the housing recovery. Not even that. By interfering with the free market, neither the economy nor housing marked ever recovered with the economy actually descending into a real depression. The only segment to thrive is the stock market, which has divorced itself from reality.

But this is not by accident. While our currency is being devalued courtesy of the Federal Reserve (a group of unaccountable banks) and our national debt goes crazy courtesy of federal government (a group of unaccountable traitors) the stock market allows groups of savvy speculators to profit.

Here's how it works. The world is undergoing an economic collapse. This happens periodically and is always the result of government malfeasance and banks' manipulation. Basically, governments try to get something for nothing by devaluing their currencies and incurring debt beyond their ability to pay. Banks encourage these, for them, opportunities to accumulate and concentrate real wealth, i.e. real estate (especially producing real estate such as farms/ranches), precious metals (in custody), commodities (not futures), etc. One of the great mechanisms to transfer this wealth is through stock markets.

So the stock market is supported to enable transfer of wealth from the wealth creators to banking entities and some of their enablers in government. Once the transfer is as complete as possible, the stock markets are allowed to crash.

Accompanying stock market crashes is hyperinflation and collapse of financial systems, Wiemar Republic. What then follows is a realignment of order, normally through war.

Remember, at this point in the process real wealth has been transferred and secured as completely as possible to the usual suspects via market methods, especially the stock market. But both a point of diminishing returns and a tripping point are reached. Further acquisition is only possible by realignment, meaning war.

We are approaching collapse and war. Congress refuses to pass a budget. Our money is nothing more than fiat currency with no real value. Our real debt is beyond redemption. And our major if not principle creditor, Red China, is planning on war with us for world leadership in 2025.

Can this be avoided? Yes. Will it be avoided? Likely not.

Our Founding Fathers designed the Republic through the Constitution to preclude this. However, the Progressives, Democrats, and Richard Nixon have pretty well defeated all safeguards against it.

The Progressives dismantled numerous protections of the Constitution. The Democrats with their "something for nothing" mentality have always pursued and exercised power outside the law. And Richard Nixon put the final nail in the coffin when he removed us from the gold standard.

Yes. There are many more details. But the important thing to remember is that this mess is a recurrence of a well-known process. It is a process caused by government and abetted by banks. America would have avoided it had we just kept our government under control.

But we didn't.

The "Great Experiment" is over.

15

posted on

09/25/2013 1:04:53 PM PDT

by

DakotaGator

(Weep for the lost Republic! And keep your powder dry!!)

To: Hostage

16

posted on

09/25/2013 1:19:33 PM PDT

by

Pagey

(HELL is The 2nd Term of a POTUS who uses the terms “social justice” and “fair distribution".)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson