Posted on 05/26/2013 1:09:04 PM PDT by blam

U.S. Economy Drowning In A Liquidity Trap?

Economics / US Economy

May 26, 2013 - 06:33 PM GMT

By: Frank Shostak

Bruce Bartlett recently lamented in The New York Times that given the current state of economic affairs we need more Keynesian medicine to fix the US economy. According to Bartlett, the core insight of Keynesian economics is that there are very special economic circumstances in which the general rules of economics don’t apply and are in fact counterproductive. This happens when interest rates and inflation rates are so low that monetary policy becomes impotent; an increase in the money supply has no boosting effect because it does not lead to additional spending by consumers or businesses. Keynes called this situation a “liquidity trap.” Keynes wrote,

There is the possibility ... that, after the rate of interest has fallen to a certain level, liquidity-preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control over the rate of interest.[1]

Bartlett holds that:

Under such circumstances government spending can be highly stimulative, because it causes money that is sitting idle in bank reserves or savings accounts to circulate and become mobilized through consumption or investment. Thus monetary policy becomes effective once again.

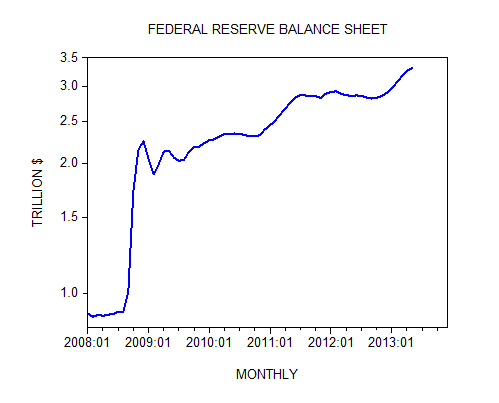

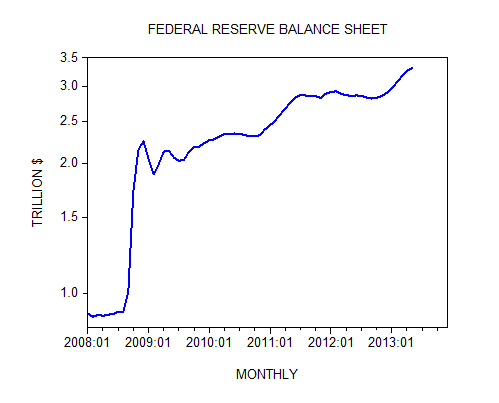

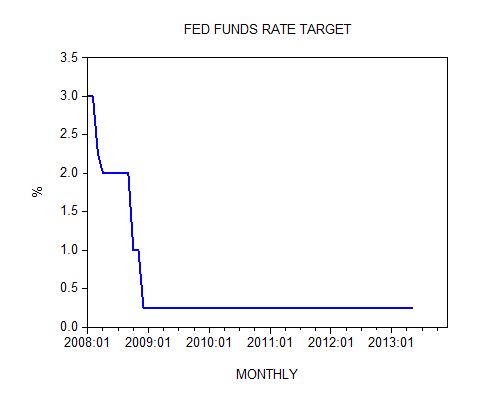

Bartlett regards this as an extremely important insight that policy makers have yet to grasp. According to our columnist, despite massive monetary pumping by the Fed since 2008, it has produced very little boosting effect on the economy. The Fed’s balance sheet jumped from $0.897 trillion in January 2008 to $3.3 trillion in early May 2013. The Federal Funds Rate target stood at 0.25 percent in early May against 3 percent in January 2008.

According to Bartlett,

In normal times, one would expect such an increase in the money supply to be highly inflationary and sharply raise market interest rates. That this has not happened is proof that we have been in a liquidity trap for several years. We needed a lot more government spending than we got to get the economy out of its doldrums.

Note also that Nobel Laureate in economics Paul Krugman holds similar views. For them what is needed is a re-activation of the monetary flow that somehow got stockpiled in the banking system. Observe that in the Keynesian framework the ever-expanding monetary flow is the key to economic prosperity. What drives economic growth is monetary expenditure.

(snip)

Of course, the “liquidity trap” is fixed with higher taxes.. keeps the velocity of money going. /s

More government spending? Idiots!! ObamaCare alone is going to tank us.

"Fear the Boom and Bust" a Hayek vs. Keynes Rap Anthem

In the 1930,s Keynes could say "in the long run we're all dead." Well guess what? The long run is here now.

We have experienced 6% inflation for the last 5 years running, these moneychanger fraudsters are the problem, and they have been since the beginning of Recorded History. Our entire monetary system is based on fraud and deceit. The biggest problem we have is the FED itself. But with scumbag fraudsters like this pumping their “Print more money” schemes, along with their accomplices in the media and the Government, we are SCREWED. Maybe one of these moneychanger assholes would like to explain what the inflation rate would be if we calculated the same way we did in the 70’s. Can you say 8%?? The price of ENERGY has more than doubled, the price of food also. The food that hasn’t doubled has decreased portions, a half gallon of Ice Cream is now 48 ounces.

We don’t need more government spending. At least not with this President.

What we need is to reindustrialize and provide jobs for the 23% unemployed (Shadowstats.com). To do that, we need to restore the import tariffs back to where they were 40 years ago. And maybe even go higher until industry has a chance to recover.

We could lower the income taxes by the same amount as the tariffs so that it’s revenue neutral. The income tax decrease would further boost the economy and offset any higher product prices on foreign imports.

Government revenues would increase and gov’t outlays would decrease as people went back to work, which would fix our budget deficits.

I think it’s called”Too Many Dollars Chasing Too Few Goods”?This leads to”De-Flation”which,(in turn),leads to”INFLATION”!!As far as economics goes,did ANYBODY in The White House study ANYTHING except for the old Soviet Union’s”Five_Year Plan”?????????????????????????

The only way to get money in the hands of the people is to lower taxes. The leftist Keynesians will never do that.

You are such a quaint 18th century person. /sarc

“To do that, we need to restore the import tariffs back to where they were 40 years ago. And maybe even go higher until industry has a chance to recover.”

We need to put them back at the levels of the late 1800s, which is to say, enough to run the government off of. Then abolish the income tax altogether.

The “liquidity trap” is all the American dollars going to China.

We are buying imports.

This helps nobody. Except for Chinese.

If we want a free market, we better protect it from the likes of China. We are trading with markets that are not free. That do not purchase U.S. goods in return, but instead use the dollars they raise to purchase our manufacturing know how.

And while I want the EPA brought under control and due process before they can levy fines, I don't want pollution deregulated. I want rivers and lakes we can swim in and air that's fit to breath.

And I'd love to see some deregulation, but I'm not hearing anybody say specifically what they would deregulate except to mention whole agencies that wouldn't fly with me and wouldn't fly with most Americans. I don't think anybody really has a plan to deregulate.

If we want a free market, we better protect it from the likes of China. We are trading with markets that are not free. That do not purchase U.S. goods in return, but instead use the dollars they raise to purchase our manufacturing know how.

And while I want the EPA brought under control and due process before they can levy fines, I don't want pollution deregulated. I want rivers and lakes we can swim in and air that's fit to breath.

And I'd love to see some deregulation, but I'm not hearing anybody say specifically what they would deregulate except to mention whole agencies that wouldn't fly with me and wouldn't fly with most Americans. I don't think anybody really has a plan to deregulate.

”Too Many Dollars Chasing Too Few Goods”?This leads to”De-Flation”

No, too many dollars chasing too few goods never leads to deflation. It would lead directly to inflation, like we experienced in the ‘70s.

What lead to deflation in the ‘30s was the collapse of the money supply, specifically the credit component of the money supply as banks failed. If we are experiencing deflation now it will be due to a vast amount of mortgage loans going bad inside the banking system.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.