Posted on 05/13/2013 5:08:26 AM PDT by blam

U.S. Economy Staring Into The Abyss! Only Gold Is Worth Buying

Stock-Markets / Financial Markets 2013

May 12, 2013 - 07:38 PM GMT

By: Robert M Williams

"Behind every great fortune there is a crime." - Honore de Balzac (1799-1850)

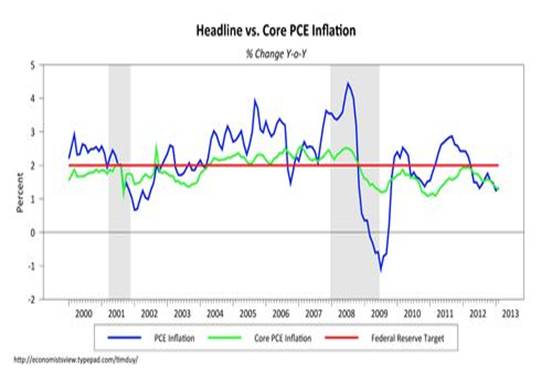

A number of important figures are now talking about the possibility of increasing the US Federal Reserve’s quantitative easing given the “decline in inflation.” In March we heard comments from Fed Presidents Eric Rosengren and Narayana Kocherlakota calling for QE well into 2014 while Chicago Fed President Richard Evens thought the Fed needed to do more. Then in April the St. Louis Fed President James Bullard came out on a number of occasions saying inflationary pressures may be growing too weakly and if they soften further, the central bank may have to boost its asset buying to bring price pressures back up to more desirable levels. They all share one thing in common, they are worried about a decline in the rate of inflation as seen in this chart:

With the Fed's preferred inflation target trending down, these gentlemen think it seems a little silly to start talking about ending the asset purchase program when in fact you might need to increase it.

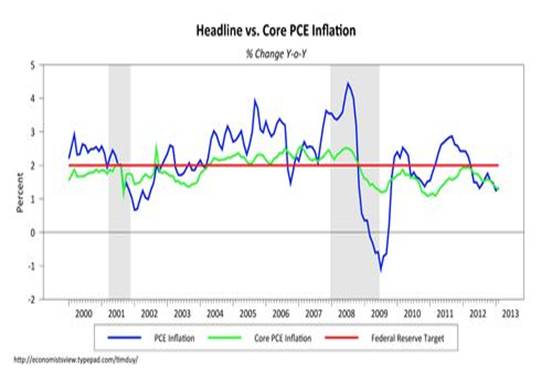

What’s all the noise about? Quite simply the Fed missed the boat and the much-heralded expert on the causes of the Great Depression, Ben Bernanke, will be responsible for the deflationary spiral that is now gripping the nation. That’s right! The man famous for saying that he has helicopters and a printing press, and knows how to use them, has let the wolf in the door. The fact that everybody is still on inflation watch even though inflation left the building a long time ago, is an effort to ‘sing the bull to sleep.’ The media constantly drags out experts to tell us that current central bank policy will lead to higher inflation, or even hyperinflation. We had inflation, but we don’t have it anymore! Now we have deflation and everybody is in denial. Typically the experts will point to the expansion of the monetary base and, relying on past performance, assume that high inflation is a logical consequence:

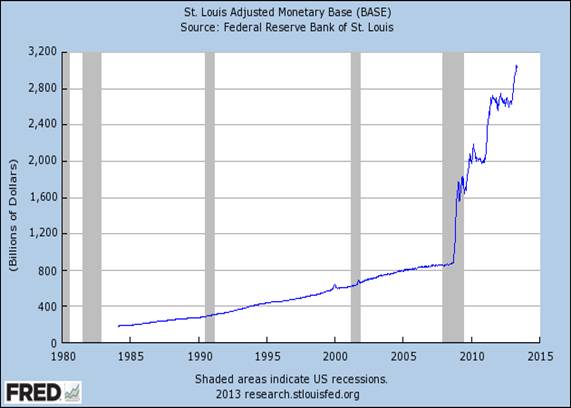

Without a doubt there was a brutal expansion in the monetary base beginning in 2008, but that’s less than the whole story. The problem I see is that the money never made it out of the banks that received it. You can see that

in the following chart showing the growth in the monetary bases of the EU, UK and US. They’ve all expanded to various degrees, but there is little or no growth in bank credit:

Most people understand that the economy will never grow if people don’t have access to credit, and this is especially true for small and medium sized businesses. The small and medium sized businesses are the mainstay of the US economy producing most of the growth and jobs we need to advance.

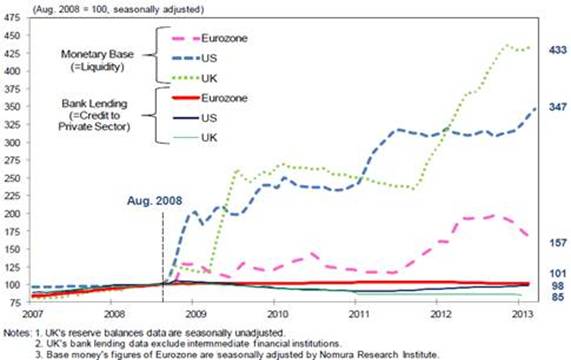

What happens to all of this money? The domestic banks deposit these funds back into their respective central banks to earn risk free interest. What do the central banks do with the money? They finance their respective government’s debt. Think of this as owning your own candy store and you are constantly eating your profits! The fact that the politicians have access to a printing press has convinced then that they can spend whatever they want with no consideration as to whether or not the debt will ever be productive. That’s how you end up with a chart that looks like this:

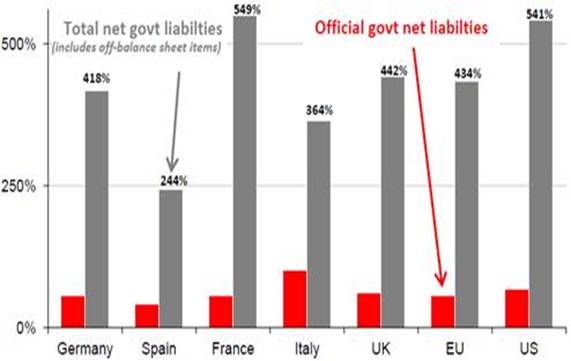

Source: Societe Generale Cross Asset Research

If you look at total government liabilities as a percentage of GDP, you’ll see that the western world is completely out of control. Surprisingly the biggest offenders are not the ones you hear about in the media (Spain and Italy); instead it’s the US and France with Germany not all that far behind.

That brings us to the real problem. Debt is everywhere, more than US $1.3 quadrillion in a world worth approximately US $80 trillion. To make matters worse debt has taken on a life of its own and we’re now to the point that no amount of printing can allow the Fed to catch up to the growing debt. That’s the problem in a nutshell, debt can now outrun the printing press and that’s why you’ll see deflationary pressures grow.

(snip)

(More charts and a conclusion at the site of this article)

"If we do not cut spending, the Republicans say, our debts will spiral out of control and the country will implode.

"The good news, for those who don't relish the thought of the country imploding, is that this fear-mongering appears to be seriously overblown "

Don’t forget the nitrocellulose.

I used to be a free market conservative, but now I understand that government spending is really quite reasonable (except for the military, and who needs such a huge arsenal in a peaceful world as ours?), taxes are too darned low, and interest rates will stay near zero for the foreseeable future, so we should be able to pay off our debts rather easily, assuming stable growth. That's swell. I've just bought some put orders for pink unicorns. You know, the ones who crap Skittles.

Usually the writer goes to great pains to make a show of basing points on hard numbers --but only when it doesn't matter because he's just rambling. On this debt thing (the nub of the entire rant) he suddenly flips into fantasy mode making up numbers knowing the true believers never care about checking.

Seriously, in the real world we got the US --with maybe a fourth of the world's wealth-- at $79T assets minus $13T debt and that = $66T net worth. Money is important and we can't just make up our numbers and think we can get away with it..

How about Najix, the ice cream crapping taco?

I’ll take a dozen cases. LOL.

Uh...if gold were money your pile of greenish Federal Reserve Notes would be worth a lot less since last October, but the price of goods in gold would not have changed much at all.

Right now there is a brawl going on between deflation and inflation, and yes, they can happen at the same time. This can be seen in grocery stores right now with some products suddenly jumping in price by an entire dollar “a unit” amounting to a 20% or more inflation, and others getting ridiculous discounts.

More than anything else this shows dangerous price fluctuations, happening at the enormous scale of commodities. This indicates that smaller markets could get nailed with far greater inflation or deflation, quickly.

Gold's not money so we can go anywhere with "what-if's". What we do know for sure is that most gold sellers are willing now to trade an oz. of gold for the same pile of food, oil, clothing, and housing that last Oct. would have been worth less than 7/8 of an oz.

Sell it for fiat paper when needed. What if Au went to 10 or 20,000 per ounce!?

Junk silver might be better for direct buying and selling.

There's a category error in your formula.

You have government debt minus national wealth.

As if the government was the same as the nation.

Sorry about my curiousity, but how does one clean a corn cob? Swish it in water, and let it dry? Scrape it with a pocketknife? Now's the time to ask, before I need to use one.

What is left after you eat corn off the cobb?

Keep wet, use once, drop it. They come cheap. Biodegradable and all that.

Probably, but I have some 22LR (5000 rds) I paid about 4 cents a round for that I know I could sell for 10 times that now. That’s great value appreciation in my book, and I could sell it all in about 10 minutes outside WalMart.

...in the real world we got the US --with maybe a fourth of the world's wealth-- at $79T assets minus $13T debt and that = $66T net worth....

...You have government debt minus national wealth...

Let's get together on what we we're talking about.

The article looks like it's working with private net worth so that means we go to the link and get $13T private liabilities total from table B.100 page 113 (p. 120 of the pdf). No gov't debt involved. If you think the writer meant gov't debt you can say why but that's still not the point. The writer made up a $1.3Q number out of thin air and somehow that's supposed to mean everyone should buy gold.

Bogus.

Thanks for the info. That’s a lot of corn. Guess I’ll start growing some. My mom had told me long ago that during WWII in her country, they used a cloth rag and washed it out. No TP. No washing machines either, Scrub boards were the norm for baby cloth diapers so it was no big deal for them.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.