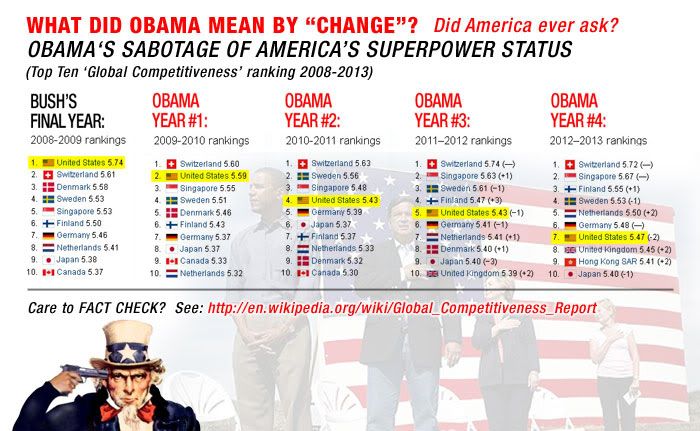

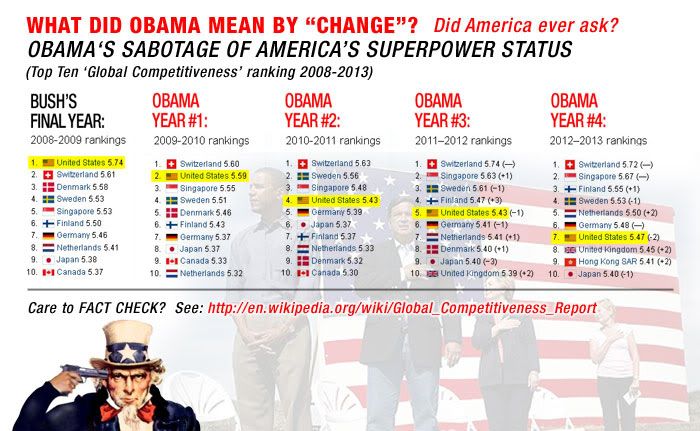

HOW LOW CAN WE GO, YEAH!!! BRING IT DOWN, OBAMA!!!! THIS IS 'CHANGE'!!!! AMERICA IS NO LONGER A SUPERPOWER, YEAH!!!!!! /s

Posted on 09/14/2012 12:32:42 PM PDT by tcrlaf

From Egan Jones:

Synopsis: UNITED STATES (GOVT OF) EJR Sen Rating(Curr/Prj) AA-/ N/A Rating Analysis - 9/14/12 EJR CP Rating: A1+ Debt: $15.2B EJR's 1 yr. Default Probability: 1.2%

Up, up, and away - the FED's QE3 will stoke the stock market and commodity prices, but in our opinion will hurt the US economy and, by extension, credit quality. Issuing additional currency and depressing interest rates via the purchasing of MBS does little to raise the real GDP of the US, but does reduce the value of the dollar (because of the increase in money supply), and in turn increase the cost of commodities (see the recent rise in the prices of energy, gold, and other commodities). The increased cost of commodities will pressure profitability of businesses, and increase the costs of consumers thereby reducing consumer purchasing power. Hence, in our opinion QE3 will be detrimental to credit quality for the US.

Some market observers contend that a country issuing debt in its own currency can never default since it can simply print additional currency. However, per Reinhart & Rogoff's " This Time Is Different: Eight Centuries of Financial Folly " , p.111, 70 out of 320 defaults since 1800 have been on domestic (i.e., local currency) public debt. Note, US funding costs are likely to slowly rise as the global economy recovers or the FED scales back its Treas. purchases (75% recently).

From 2006 to present, the US's debt to GDP rose from 66% to 104% and will probably rise to 110% a year from today under current circumstances; the annual budget deficit is 8%. In comparison, Spain has a debt to GDP of 68.5% and an annual budget deficit of 8.5%. We are therefore downgrading the US country rating from "AA" to "AA-".

HOW LOW CAN WE GO, YEAH!!! BRING IT DOWN, OBAMA!!!! THIS IS 'CHANGE'!!!! AMERICA IS NO LONGER A SUPERPOWER, YEAH!!!!!! /s

I need a tshirt that says,

“My country went 16 trillion dollars into debt and all I got was this lousy credit rating”

INTENTIONALLY leaving America in a mess that NO PRESIDENT CAN FIX.

No report of this at cnn.com. I wonder if they plan to cover this breaking story? (Sarcasm)

The faux Intrade bump must be a manipulation — maybe QE3 related.

President Downgrade proves himself ever more worthy of the title.

I don’t doubt that.

Egan Jones defines the Fed’s quantitative easing as ‘’issuing additional currency and depressing interest rates via the purchasing of MBS...’’ Yet today the interest rate on 10-Year Treasuries rose by 6.5%.

No wonder Ben Bernanke held back from imposing QE3 for so many months. He must have surmised that there would be at least one bond-rating agency that would be honest with its clients in evaluating the U.S.’s credit-worthiness.

The fact is, the U.S. bond market is a giant, hugely overpriced tulip bulb that’s about to be bulldozed into oblivion.

This is huge, isn’t it?

Huge enough to not be covered up by the foreign-policy events.

If the mainstream media ignores it, Romney/Ryan better keep harping on it. Ryan explains economic data better than anyone.

Bump

-

No -

That homo General has already ordered a gay firing squad to terminate the problemo with extreme prejudice.......

- Obama-Rigging is on the case!

-

So this is what he was doing when the phone rang at 3:00 AM.

The screwing continues....

OMG-bama

The left is saying the downgrade is Bush’s fault.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.