Skip to comments.

Apple, the tax-dodger? We certainly hope so. You should too.

ORANGE COUNTY REGISTER ^

| 4-30-12

| Mark Landsbaum

Posted on 04/30/2012 1:46:10 PM PDT by freedombiz

The New York Times reported Apple “paid cash taxes of $3.3 billion around the world on its reported profits of $34.2 billion last year, a tax rate of 9.8%.”

Further more, Apple’s federal tax bill likely would have been $2.4 billion higher last year without these moves, says the Times.

The fact remains Apple paid less tax than it would have otherwise had it not moved operations to low- or no-tax jurisdictions.

Good for Apple. Wouldn’t it be wonderful if we all had the same flexibility?

(Excerpt) Read more at orangepunch.ocregister.com ...

TOPICS: Business/Economy; Government

KEYWORDS: apple; april15; incometaxes; taxes; taxevasion

If government wants to compete for Apple's business and jobs it can cut its taxes and regulations.

To: freedombiz

I believe Apple took all legal deductions and used them to their advantage——just like obama, buffet and romney.

2

posted on

04/30/2012 1:48:56 PM PDT

by

freeangel

( (free speech is only good until someone else doesn't like it)

To: freedombiz

Anytime you deny the government your hard earned money, I’d call it Genius Bar.

3

posted on

04/30/2012 2:01:11 PM PDT

by

unixfox

(Abolish Slavery, Repeal The 16th Amendment!)

To: freeangel

"

I believe Apple took all legal deductions LOOPHOLES and used them to their advantage——just like obama, buffet and romney."Hired Chinese instead of Americans. That's legal too.

4

posted on

04/30/2012 2:13:50 PM PDT

by

ex-snook

("above all things, truth beareth away the victory")

To: freedombiz

Apple did nothing wrong. They are smart.

It's just that in general Apple core supporters preach everyone must pay their fair share, Obama mmmm mmmm mmm.

5

posted on

04/30/2012 2:20:44 PM PDT

by

WilliamofCarmichael

(If modern America's Man on Horseback is out there, Get on the damn horse already!)

To: freedombiz

Apple’s federal tax bill likely would have been $2.4 billion higher last year without these moves, says the Times. I'm confused. I thought Apple moved some operations to Nevada to avoid California taxes. If Apple had had to pay the California taxes then presumably its profit would have been lower than it was. And I thought Federal Corporation taxes were based on profits earned by the corporation. So wouldn't Apple have paid LESS federal tax if it had kept those operations inside California?

ML/NJ

6

posted on

04/30/2012 2:40:06 PM PDT

by

ml/nj

To: freedombiz

Just following the President’s lead.

Pray for America

7

posted on

04/30/2012 3:23:14 PM PDT

by

bray

(Power to We the People)

To: freeangel

Tax avoidance is NOT illegal or immoral. Tax evasion IS.

When FDR raised taxes the expected increase did not materialize. The US Treasury dragged any entity it could into court. Judge Learned Hand gave my favorite quote:

“Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one’s taxes. Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.”

8

posted on

04/30/2012 3:23:58 PM PDT

by

griswold3

(Big Government does not tolerate rivals.)

To: freedombiz

"Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes."- Judge Learned Hand, Helvering v. Gregory, 69 F.2d 809, 810-11 (2d Cir. 1934).

9

posted on

04/30/2012 5:14:02 PM PDT

by

Scoutmaster

(You knew the job was dangerous when you took it)

To: griswold3

Sorry about that. I really should read until the end of the thread, but I like your taste in quotes.

10

posted on

04/30/2012 5:15:48 PM PDT

by

Scoutmaster

(You knew the job was dangerous when you took it)

To: Scoutmaster

So the NYT doesn’t minimize its taxes within the law? Right. Pot meet kettle.

11

posted on

05/01/2012 4:27:15 AM PDT

by

hal ogen

(First Amendment or Reeducation Camp?)

To: ml/nj

Taxes are paid on revenues, not profits

To: freedombiz

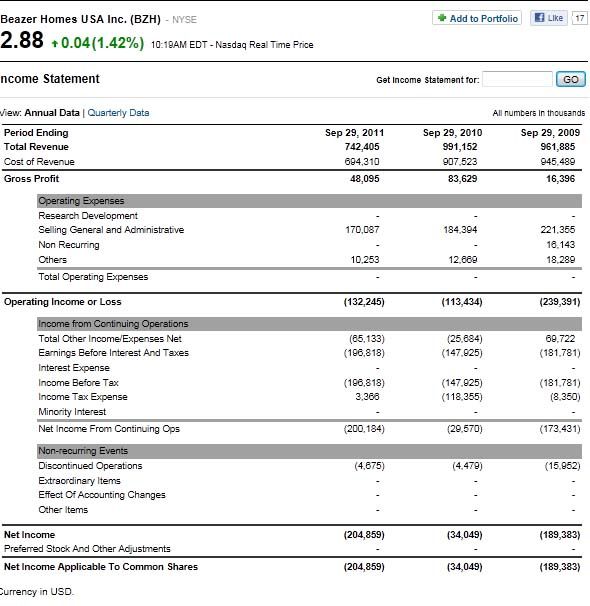

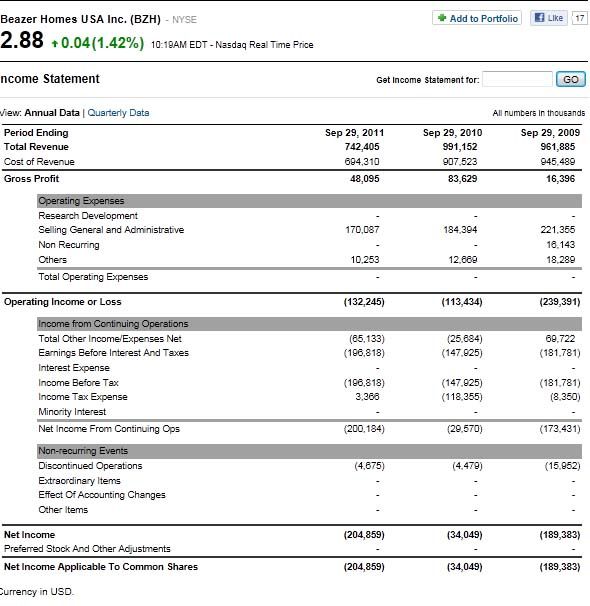

Taxes are paid on revenues, not profits You are simply wrong. Check out this income statement for a NYSE company that has been losing money.

They obviously have revenues but the parentheses around the Income Tax Expense numbers indicate that for those periods they have a tax credit.

ML/NJ

13

posted on

05/10/2012 7:28:10 AM PDT

by

ml/nj

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson