Posted on 07/31/2011 9:03:02 PM PDT by blam

An Historically Weak Recovery: Outright Economic Contraction Imminent

by: Erik McCurdy

July 31, 2011

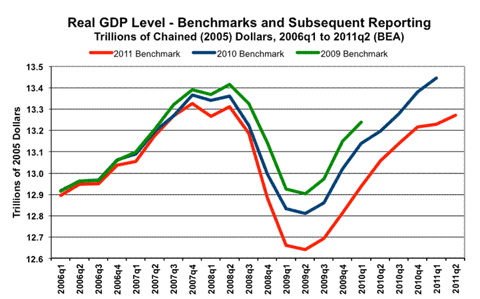

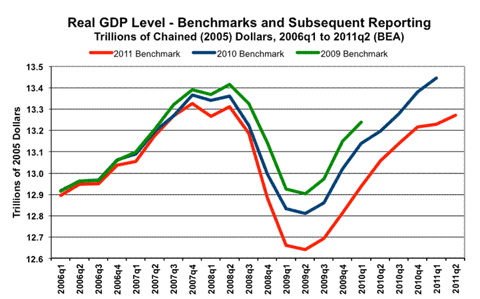

The Bureau of Economic Analysis (BEA) released its advanced estimate of second quarter growth, forecasting a real annualized growth rate of 1.3%, well below consensus expectations for 1.9%. More significantly, major downside revisions to data for the past few years indicate that the last recession was much worse than originally reported. The following graph (click to enlarge images) from Shadow Government Statistics displays real GDP data for the past five years.

The three data sets represent the 2009, 2010 and 2011 benchmarks. As expected, the earlier data were much more optimistic than the latest figures. We have noted many times during the past few years that the BEA is under tremendous political pressure to produce the most optimistic view possible during periods of poor economic performance.

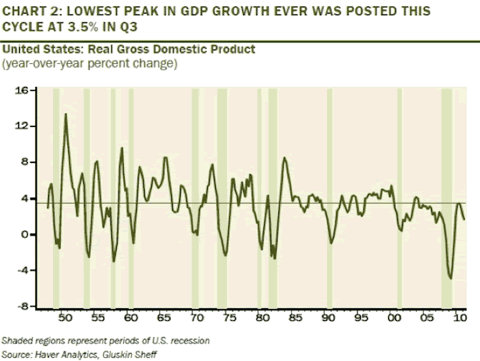

Notice how significant the downside revisions were in both 2010 and 2011. The 2009 trough was more than 2% lower than originally forecast and a rebound that was predicted to have moved up to new highs has yet to return to pre-recession levels. In terms of growth rates, the recent high at 3.5% in the third quarter of 2010 was the lowest peak recorded since the Great Depression as shown on the following graph from John Mauldin's latest weekly commentary.

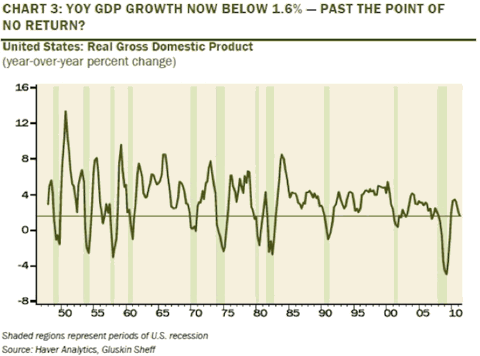

Additionally, a decline of year-over-year (YOY) GDP growth below the 2.0% level has been followed by a recession every time during the last 60 years. The YOY growth rate now stands at 1.6%, indicating that a return to outright economic contraction during the next few quarters is becoming more likely.

Since the economic rebound began in early 2009, our analysis has suggested that the cyclical recovery would be weak by historical standards...

(snip)

(Excerpt) Read more at seekingalpha.com ...

bump.

ping

Few economists want to stand up and say that the fiscal policies enacted in the last 2 years are driving investors overseas.

This is unexpected . . . .

Just keep storing up food.

What recovery? Where is this recovery happening? Buehler? Buehler?

--------------------------

BOHIC-A!

I agree...LOL decisis!

| We said; cut, cut, cut. But it looks like we got; spend, spend, spend. A hamburger today for payment later. So Obama's economy continues on a downward track. Once you go over a cliff you cannot stop half way down, and the DeathCare bill that he and Nancy put in place might finish it off. BOHIC-A! What the Tea Party wants is what most Americans want - fiscal sanity. I don't think it is possible for this country to have a more sorry bunch of losers running the show. An arrogant Marxist was spending Trillions of bucks without comprehending. The piss-stream media concurred Without saying a negative word For the Republic they thought was ending. The Gross Domestic Product, Second Quarter 2011 (Advance Estimate) is reported by the Bureau of Economic Analysis at 1.3% (as of 8:30 A.M. EDT, Friday, July 29, 2011). If they tell us we had 1.3% growth, it really means we had no growth or negative growth. 2011 Q1 GDP was revised down from 1.9% to 0.4%. So in the first quarter, real GDP increased 0.4 percent. We're economically frozen as a nation with this jackwagon president in office. We have an economy that lags behind Canada and Mexico! Egan-Jones, the only really independent and credible ratings agency, downgraded the U.S. from AAA to AA+. S&P, Moodys and Fitch -- are the best ratings money can buy. They all receive money from the companies they give ratings on. They failed to lower ratings on any financial institution during the financial meltdown until the day most of them filed for bankruptcy. Downgrades = no more juicy fees. They don't downgrade the gov't because the managers and owners are all Northeast Ivy League Liberals and help bankroll fools like Schumer, Durban, Kerry, and Frank. Read Charlie Gasparino's book 'The Sellout' that names the names and the firms involved in aiding and abetting the downfall of the Republic. |

2007! This means that GDP has been overstated by about 2-2.5 points for four years. GDP has been overstated since the magenta circles connected by the green vertical line on the chart. (The bottom chart is the corrected one)

That is astronomical.

It was Krugman who said all along that we needed a bigger stimulus....wasn't it?

Most people haven't figured out that deficit spending currently represents around 10% of our current GDP making the real GDP horrendous. Since it is borrowed money, that yearly 10% comes from our future GDP piled on year after year, as in spending our future away to oblivion.

And our ruling class demands we keep doing so...

lulz, there was/is no recovery and we never came out of the first initial recession... =.=

Totally off topic here.. but recently I have noticed many people typing ‘an’ before any word that starts with an ‘h’...

Has there been a rule change for ‘a’ and ‘an’? (an honest question..)

From what I remember, you use ‘a’ when the word uses the sound of the H... you use ‘an’ when the H is silent and sounds like a vowel.. (maybe I forgot the rules myself :/ )

Sorry about the OT... don’t mean to hi-jack the thread)

I don't know anymore, lol.

lol, I am glad I am not the only one that is confused... maybe we need a ping list to get people’s opinions... but I don’t want to p!ss anyone off :/

Also, it appears you were thinking along the same lines when you corrected yourself.. then ‘re’corrected... what is going on with the language?! :p

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.