Skip to comments.

Burning down the house; How Democrats sparked the Great Recession (book recounts Fannie Mae debacle)

NY POST ^

| 7/3/11

| GEORGE WILL

Posted on 07/03/2011 6:09:37 AM PDT by Liz

“Reckless Endangerment” a scalding new book ....... is another cautionary tale about government’s terrifying self-confidence.........."a story of what happens when Washington decides, in its infinite wisdom, that every living, breathing citizen should own a home.” The 1977 Community Reinvestment Act pressured banks to relax lending standards......... In 1994, Bill Clinton proposed increasing homeownership through a “partnership” between government and the private sector, principally orchestrated by Fannie Mae. Fannie Mae’s political machine dispensed campaign contributions, gave jobs to friends and relatives of legislators, hired armies of lobbyists (even paying lobbyists not to lobby against it), paid academics who wrote papers validating the homeownership mania, and spread “charitable” contributions to housing advocates across the congressional map. By 2003, the government was involved in financing almost half — $3.4 trillion — of the home-loan market..........by summer 2005, almost 40% of new subprime loans were for amounts larger than the value of the properties. “Reckless Endangerment” is a study of contemporary Washington, where showing “compassion” with other people’s money pays off in the currency of political power, and currency.

(Excerpt) Read more at nypost.com ...

TOPICS: Crime/Corruption; Extended News; Government

KEYWORDS: debt; deficit; fannie; fanniemae; feddie; freddie; freddiemac; gretchenmorgenson; liz; mortgagecrisis; recklessendangerment

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-109 next last

To: slowhandluke

“Bush was not a conservative. “

Nonsense. Compared to who?

Some on the right play the blame Bush meme just like the Kenyan lizard. It sickens me.

81

posted on

07/03/2011 6:37:49 PM PDT

by

y6162

To: Liz

LOL! Oh, that is too true to be good, eh? LOLOL!

82

posted on

07/03/2011 8:39:38 PM PDT

by

redhead

(Don't bother to impeach the miserable SOB, ARREST him!)

To: raybbr

Bush pushed for years for Congressional ways to "increase home ownership" so the numbers for the GDP would look good. He also pushed for Fannie Mae and Freddie Mac reform.

And, by the way, there is absolutely nothing wrong with a goal of "increasing home ownership". There's no reason to challenge Bush's motivation in this regard.

Doing it the way the Dems did it, though, is criminal.

83

posted on

07/03/2011 10:09:55 PM PDT

by

okie01

(THE MAINSTREAM MEDIA: Ignorance On Parade)

To: okie01

And, by the way, there is absolutely nothing wrong with a goal of "increasing home ownership". There's no reason to challenge Bush's motivation in this regard. Doing it the way the Dems did it, though, is criminal.What would you call demanding that Congress use taxpayer money to 'give' to home buyers for down payments so that the poor could buy a home?

Bush's policies mirrored the dems early in his admin. Simply look at who he appointed as Sec's of Hud: Mel Martinez and Alphonso Jackson both Bush family cronies. Bush had Fannie and Freddie INCREASE the purchase of marginal loans in 2004 to make the economy look better - that was long after they tried to "fix" F and F.

84

posted on

07/04/2011 4:34:53 AM PDT

by

raybbr

(People who still support Obama are either a Marxist or a moron.)

To: raybbr

Ray -- you misunderstand my point.

"Increasing home ownership" is a totally admirable objective for a U.S. President. Any U.S. President.

The tactics used to do so can range from admirable (improving the economy) to criminal (as Frank & Dodd demonstrate).

Just because you and Ol' Dan don't like Bush is not a reason to take him to task for wanting to increase home ownership.

Falling in with the Democrats to do it, though, is objectionable.

Make distinctions, man. Make distinctions.

85

posted on

07/04/2011 6:41:16 PM PDT

by

okie01

(THE MAINSTREAM MEDIA: Ignorance On Parade)

To: okie01

Just because you and Ol' Dan don't like Bush is not a reason to take him to task for wanting to increase home ownership. Falling in with the Democrats to do it, though, is objectionable. Which is exactly what Bush did. I'm surprised you didn't get that from my posts or the info on Ol' Dan's page.

Make distinctions, man. Make distinctions.

I would were there any to make...

86

posted on

07/04/2011 7:00:53 PM PDT

by

raybbr

(People who still support Obama are either a Marxist or a moron.)

To: y6162

I’m not wrong. Democrats are 100% responsible for the size and scope of sub prime collapse. Read Reckless Endangerment.100%?

For the record, what was the purpose of the US/Mexico Partnership for Prosperity Agreement signed by the Bush Administration on September 6, 2001?

What was the purpose of the New Alliance Task Force?

The American Dream Down Payment Act?

Please explain exactly which group of people these were supposed to benefit? Wall Street Bankers and Mexican illegal aliens or American citizens?

87

posted on

07/04/2011 7:56:18 PM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Ol' Dan Tucker

Don’t forget the Community Redevelopment and Reinvestment Act which made ‘redlining’ a civil-rights issue. Since that piece of legislation, the banks have been forced to make more and more sub-prime loans. When Bush left office the amount was 53%.

Obviously the thing to do with unavoidable risk is to minimize repercussions and so the credit-swap dervivative was born. It just snowballed from there, and liar loans weren’t far behind. Is it any suprise this resulted in a real-estate bubble? Everybody was falling all overthemselves to get into larger and more expensive homes.

Its when the economy hiccuped that things began to unravel. The sub-prime loans unsuprisingly began to default first, which ultimately led to virtual meltdown of the global financial system.

88

posted on

07/04/2011 8:08:12 PM PDT

by

raygun

(http://bastiat.org/en/the_law DOT html)

To: okie01

"Increasing home ownership" is a totally admirable objective for a U.S. President. Any U.S. President. Yes, but exactly which group of people was Bush trying to help? Mexican illegal aliens or American citizens?

Exactly what was the purpose of the US/Mexico Partnership for Prosperity Agreement?

New Alliance Task Force?

American Dream Down Payment Act?

Why did the Bush Justice Dept. and Treasury Dept. give their blessings to the change in banking regulation to allow banks to accept the Matricula Consular card as ID?

Why did the Bush Administration change the rules to allow banks that served the 'minority' market through international remittances to claim CRA credit?

Why did Bush champion amnesty for Mexican illegal aliens?

Why did the Bush administration claim that national security was a priority and form the TSA and DHS while supposedly fighting a "War on Terrorism", then leave the southern borders wide open by ordering border and interior immigration enforcement to the lowest levels in years?

Why didn't the Bush administration complete the southern border fence despite the signing the appropriations into law?

Just because you and Ol' Dan don't like Bush is not a reason to take him to task for wanting to increase home ownership.

Again, exactly which group was Bush working to help through the above actions? American citizens or his Wall Street Banker buddies and Mexican illegal aliens?

Make distinctions, man. Make distinctions.

Yes, please make distinctions to show how all of Bush's above actions during his first term was done to help American citizens.

89

posted on

07/04/2011 8:08:27 PM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Liz

The 1977 Community Reinvestment Act pressured banks to relax lending standards......... In 1994, Bill Clinton proposed increasing homeownership through a “partnership” between government and the private sector, principally orchestrated by Fannie Mae. Fannie Mae’s political machine dispensed campaign contributions, gave jobs to friends and relatives of legislators,And, no mention of what Bush did for the CRA as part of his US/Mexico Partnership for Prosperity Agreement (signed, September 6, 2001) and New Alliance Task Force?

"In June 2004, in an effort to encourage more banks to enter the remittance market and improve access to the U.S. banking system among recent Latin American immigrants, (read: Mexican illegal aliens) bank regulatory agencies clarified that financial institutions offering low cost international remittance services would receive credit under the Community Reinvestment Act (CRA).18 Regulated financial institutions are required under the CRA to serve the convenience and credit needs of their entire communities, including low- and moderate-income areas. Most remittance senders to Latin America are low- to moderate-income immigrant wage earners who operate outside the formal banking system."

90

posted on

07/04/2011 8:14:09 PM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Ol' Dan Tucker

“100%? “

Democrats are 110% responsible for the sub prime collapse.

The trillions in bad loans to minorities were based on Democrat collaboration with Fannie Mae, not W’s puny housing initiatives.

Blaming W for the sub prime mess shows a ridiculous lack of judgment. Not to mention, right wingers who collaborate with the Kenyan lizard king’s blame Bush meme make me sick.

91

posted on

07/05/2011 9:17:34 AM PDT

by

y6162

To: y6162

The trillions in bad loans to minorities were based on Democrat collaboration with Fannie Mae, not W’s puny housing initiatives.Blaming W for the sub prime mess shows a ridiculous lack of judgment. Not to mention, right wingers who collaborate with the Kenyan lizard king’s blame Bush meme make me sick.

Absolving Bush for his involvement in the sub-prime mess shows willful ignorance.

Had you bothered to do even a modicum of research, you'd know that Bush's housing initiatives were anything but puny. In fact, it was Bush, himself, who in 2002 called for Fannie and Freddie to increase their commitments to the housing market and it was he, who praised Franklin Raines for the job he did running Fannie.

|

Park Place South is, in microcosm, the story of a well-intentioned policy gone awry. Advocating homeownership is hardly novel; the Clinton administration did it, too. For Mr. Bush, it was part of his vision of an “ownership society,” in which Americans would rely less on the government for health care, retirement and shelter. It was also good politics, a way to court black and Hispanic voters. But for much of Mr. Bush’s tenure, government statistics show, incomes for most families remained relatively stagnant while housing prices skyrocketed. That put homeownership increasingly out of reach for first-time buyers like Mr. West. So Mr. Bush had to, in his words, “use the mighty muscle of the federal government” to meet his goal. He proposed affordable housing tax incentives. He insisted that Fannie Mae and Freddie Mac meet ambitious new goals for low-income lending. Concerned that down payments were a barrier, Mr. Bush persuaded Congress to spend up to $200 million a year to help first-time buyers with down payments and closing costs. And he pushed to allow first-time buyers to qualify for federally insured mortgages with no money down. Republican Congressional leaders and some housing advocates balked, arguing that homeowners with no stake in their investments would be more prone to walk away, as Mr. West did. Many economic experts, including some in the White House, now share that view. The president also leaned on mortgage brokers and lenders to devise their own innovations. “Corporate America,” he said, “has a responsibility to work to make America a compassionate place.” And corporate America, eyeing a lucrative market, delivered in ways Mr. Bush might not have expected, with a proliferation of too-good-to-be-true teaser rates and interest-only loans that were sold to investors in a loosely regulated environment. “This administration made decisions that allowed the free market to operate as a barroom brawl instead of a prize fight,” said L. William Seidman, who advised Republican presidents and led the savings and loan bailout in the 1990s. “To make the market work well, you have to have a lot of rules.” But Mr. Bush populated the financial system’s alphabet soup of oversight agencies with people who, like him, wanted fewer rules, not more. The president’s first chairman of the Securities and Exchange Commission promised a “kinder, gentler” agency. The second was pushed out amid industry complaints that he was too aggressive. Under its current leader, the agency failed to police the catastrophic decisions that toppled the investment bank Bear Stearns and contributed to the current crisis, according to a recent inspector general’s report. As for Mr. Bush’s banking regulators, they once brandished a chain saw over a 9,000-page pile of regulations as they promised to ease burdens on the industry. When states tried to use consumer protection laws to crack down on predatory lending, the comptroller of the currency blocked the effort, asserting that states had no authority over national banks. The administration won that fight at the Supreme Court. But Roy Cooper, North Carolina’s attorney general, said, “They took 50 sheriffs off the beat at a time when lending was becoming the Wild West.” The president did push rules aimed at forcing lenders to more clearly explain loan terms. But the White House shelved them in 2004, after industry-friendly members of Congress threatened to block confirmation of his new housing secretary. "In the 2004 election cycle, mortgage bankers and brokers poured nearly $847,000 into Mr. Bush’s re-election campaign, more than triple their contributions in 2000, according to the nonpartisan Center for Responsive Politics. The administration did not finalize the new rules until last month." Among the Republican Party’s top 10 donors in 2004 was Roland Arnall. He founded Ameriquest, then the nation’s largest lender in the subprime market, which focuses on less creditworthy borrowers. In July 2005, the company agreed to set aside $325 million to settle allegations in 30 states that it had preyed on borrowers with hidden fees and ballooning payments. It was an early signal that deceptive lending practices, which would later set off a wave of foreclosures, were widespread.

Andrew H. Card Jr., Mr. Bush’s former chief of staff, said White House aides discussed Ameriquest’s troubles, though not what they might portend for the economy. Mr. Bush had just nominated Mr. Arnall as his ambassador to the Netherlands, and the White House was primarily concerned with making sure he would be confirmed. “Maybe I was asleep at the switch,” Mr. Card said in an interview. Brian Montgomery, the Federal Housing Administration commissioner, understood the significance. His agency insures home loans, traditionally for the same low-income minority borrowers Mr. Bush wanted to help. When he arrived in June 2005, he was shocked to find those customers had been lured away by the “fool’s gold” of subprime loans. The Ameriquest settlement, he said, reinforced his concern that the industry was exploiting borrowers. In December 2005, Mr. Montgomery drafted a memo and brought it to the White House. “I don’t think this is what the president had in mind here,” he recalled telling Ryan Streeter, then the president’s chief housing policy analyst. It was an opportunity to address the risky subprime lending practices head on. But that was never seriously discussed. More senior aides, like Karl Rove, Mr. Bush’s chief political strategist, were wary of overly regulating an industry that, Mr. Rove said in an interview, provided “a valuable service to people who could not otherwise get credit.” While he had some concerns about the industry’s practices, he said, “it did provide an opportunity for people, a lot of whom are still in their houses today.” The White House pursued a narrower plan offered by Mr. Montgomery that would have allowed the F.H.A. to loosen standards so it could lure back subprime borrowers by insuring similar, but safer, loans. It passed the House but died in the Senate, where Republican senators feared that the agency would merely be mimicking the private sector’s risky practices — a view Mr. Rove said he shared. ‘We Told You So’ Armando Falcon Jr. was preparing to take on a couple of giants. A soft-spoken Texan, Mr. Falcon ran the Office of Federal Housing Enterprise Oversight, a tiny government agency that oversaw Fannie Mae and Freddie Mac, two pillars of the American housing industry. In February 2003, he was finishing a blockbuster report that warned the pillars could crumble. Created by Congress, Fannie and Freddie — called G.S.E.’s, for government-sponsored entities — bought trillions of dollars’ worth of mortgages to hold or sell to investors as guaranteed securities. The companies were also Washington powerhouses, stuffing lawmakers’ campaign coffers and hiring bare-knuckled lobbyists. Mr. Falcon’s report outlined a worst-case situation in which Fannie and Freddie could default on debt, setting off “contagious illiquidity in the market” — in other words, a financial meltdown. He also raised red flags about the companies’ soaring use of derivatives, the complex financial instruments that economic experts now blame for spreading the housing collapse. Today, the White House cites that report — and its subsequent effort to better regulate Fannie and Freddie — as evidence that it foresaw the crisis and tried to avert it. Bush officials recently wrote up a talking points memo headlined “G.S.E.’s — We Told You So.” But the back story is more complicated. To begin with, on the day Mr. Falcon issued his report, the White House tried to fire him. (See: White House Philosophy Stoked Mortgage Bonfire) |

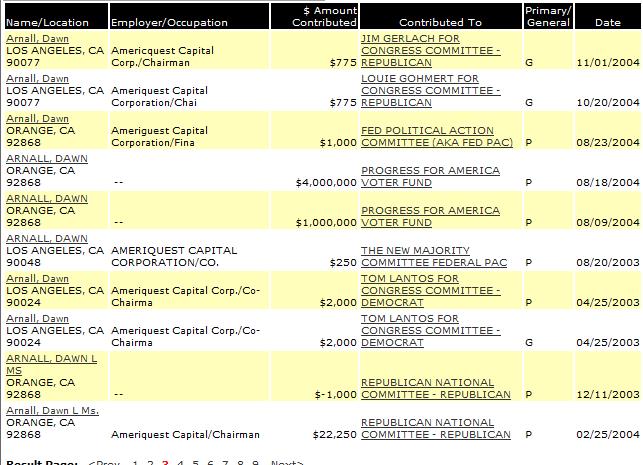

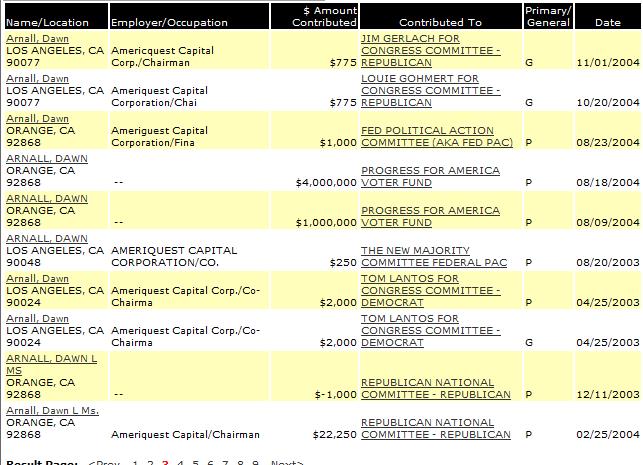

Who is the Progress for America Fund that received $5 million in campaign contributions from the sub-prime lender, Arnall?

From: Progress for America Voter Fund:

Progress for America (PFA) (a 501c4) and its affiliate Progress for America Voter Fund (PFA-VF) (a 527 committee) are national tax-exempt organizations. The PFA was, from the beginning, "closely associated" with the Bush administration, the Republican National Committee and "their consultants." [1]

PFA was established in 2001 to support George W. Bush's "agenda for America." The PFA Voter Fund, which was set up in 2004, raised $38 million in support of Bush's 2004 election bid.

Progress for America, a "friends of the party" organization "operated by Tony Feather, the former political director of Bush-Cheney 2000 and a close friend of White House political adviser Karl Rove, is described by some Republicans as a new group dedicated to corralling outlawed party soft money," Steve Weismann, Associate Director for Policy at The Campaign Finance Institute wrote January 28, 2003.

In addition, Bush received the following campaign contributions for the 2004 election cycle:

Goldman-Sachs: $4,000,000

Merryl-Lynch: $1,500,000

Morgan-Stanley: $1,500,000

UBS-AG: $1,400,000

Lehman Bros.: $1,000,000

Grand Total: $12,900,000

But, you assert that, despite receiving almost $18 million in contributions for the 2004 election, Bush was not in the pockets of the Wall Street bankers who were at the center of the sub-prime mess.

92

posted on

07/05/2011 1:49:07 PM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Ol' Dan Tucker

“18 million”

Peanuts. And W’s contribution to the sub prime bubble was miniscule compared to the Democrat’s who started pressuring banks to lower loan standards a decade earlier.

Self loathing right wingers like you make me sick. Why don’t you just become a Democrat and get it over.

93

posted on

07/05/2011 4:33:03 PM PDT

by

y6162

To: y6162

Peanuts. And W’s contribution to the sub prime bubble was miniscule compared to the Democrat’s who started pressuring banks to lower loan standards a decade earlier.That's where you're mistaken. The politicians weren't pressuring the banks.

The banks wanted to lower the standards so they could tap into the illegal alien market. We're talking about a market that was worth trillions of dollars to them.

It was the Bush administration who changed the banking laws to allow this.

Perhaps you could answer some questions?

Exactly what was the purpose of the US/Mexico Partnership for Prosperity Agreement?

New Alliance Task Force?

American Dream Down Payment Act?

Why did the Bush Justice Dept. and Treasury Dept. give their blessings to the change in banking regulation to allow banks to accept the Matricula Consular card as ID?

Why did the Bush Administration change the rules to allow banks that served the 'minority' market through international remittances to claim CRA credit?

Why did Bush champion amnesty for Mexican illegal aliens?

Why did the Bush administration claim that national security was a priority and form the TSA and DHS while supposedly fighting a "War on Terrorism", then leave the southern borders wide open by ordering border and interior immigration enforcement to the lowest levels in years?

Why didn't the Bush administration complete the southern border fence despite the signing the appropriations into law?

Self loathing right wingers like you make me sick. Why don’t you just become a Democrat and get it over.

I am registered non-partisan because unlike you, I don't need a political party to tell me how to think.

94

posted on

07/05/2011 6:18:22 PM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Ol' Dan Tucker

Reckless Endangerment. Read it.

95

posted on

07/06/2011 4:05:44 AM PDT

by

y6162

To: y6162

Reckless Endangerment. Read it.You're late to the party, pal.

Never forget that Bush comes from a long line of Wall Street bankers and it is with them that his true loyalty lies.

That book is pure propaganda by the Bush administration and his Wall Street banker buddies designed to preserve his legacy and hide his involvement in the housing crash. He's been doing this since he left office.

I'll bet there's no mention in the book of the US/Mexico Partnership for Prosperity Agreement or the New Alliance Task Force, is there?

Do you honestly think that these were omitted by accident or oversight?

... Wall Street was supplying money to companies making increasingly poisonous loans to people with no ability to repay them. And the firms knew precisely what they were doing.

--Reckless Endangerment

Who were the people being talked about here? Mexican illegal aliens. And the size of the market Wall Street was going after was worth trillions of dollars to them.

The US/Mexico Partnership for Prosperity Agreement or the New Alliance Task Force which were the vehicles Bush's Wall Street banker buddies used to pump up sub-prime lending, and yes, they knew exactly what they were doing.

That's why one of Bush's first official acts upon taking office was to meet with El Presidente Vicente Fox.

On February 16, 2001, just 3 weeks after his inauguration, President George W. Bush met with Mexican President Vicente Fox to discuss the terms of the US/Mexico Partnership for Prosperity Agreement.

The P4P agreement was signed on September 6, 2001, just six months later.

Bush came into office with the economy humming along and by late 2007, the housing crash had begun.

The wheels were supposed to come off on Oh!Brother's watch leaving him and the democraps with egg on their faces. Bush's Wall Street banker buddies got greedy and the real estate bubble grew faster than was intended and burst before Bush left office and there was no one to blame, but him, his policies and his Wall Street banker buddies.

So, they've been foisting propaganda pieces, like Reckless Endangerment to divert attention from Bush's policies and actions during his first term that caused the housing bust.

96

posted on

07/06/2011 8:41:01 AM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Ol' Dan Tucker

“That book is pure propaganda by the Bush administration and his Wall Street banker buddies”

This proves that you are bat shit crazy. NYT reporters don’t write propaganda for W.

Hoping for a Lyndon LaRouche revival?

Our business is concluded.

97

posted on

07/06/2011 9:23:45 AM PDT

by

y6162

To: y6162

This proves that you are bat shit crazy. NYT reporters don’t write propaganda for W.Ask yourself this question. Why would a NYT reporter write a book that attacks Democrats and ignores Bush and his policies?

Does the book make any mention of Bush's US/Mexico Partnership for Prosperity Agreement or the New Alliance Task Force?

Do you honestly believe this was omitted by accident or oversight?

98

posted on

07/06/2011 1:32:30 PM PDT

by

Ol' Dan Tucker

(People should not be afraid of the government. Governement should be afraid of the people)

To: Ol' Dan Tucker

“Ask yourself this question. Why would a NYT reporter write a book that attacks Democrats and ignores Bush and his policies? “

Occam’s Razor. Because W’s housing policies did not cause the sub prime bubble. duh?

Weighing culpability, W would be a few grams of sand in one hand and the Democrats’ a pound of crap in the other.

99

posted on

07/06/2011 1:43:19 PM PDT

by

y6162

To: Mr. Peabody

Have you read Paulson’s book? I just finished it and will get this one next. Fascinating stuff. the speed in which things unraveled is amazing. It’s a miracle it wasn’t a hell of a lot worse.

100

posted on

07/06/2011 2:02:16 PM PDT

by

Wyatt's Torch

(I can explain it to you. I can't understand it for you.)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-109 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson