Posted on 04/23/2011 5:11:22 PM PDT by blam

Silver Black Swan If Rampant Speculation Is Not Reigned In

Commodities / Gold and Silver 2011

Apr 23, 2011 - 11:49 AM

By: Dian L Chu

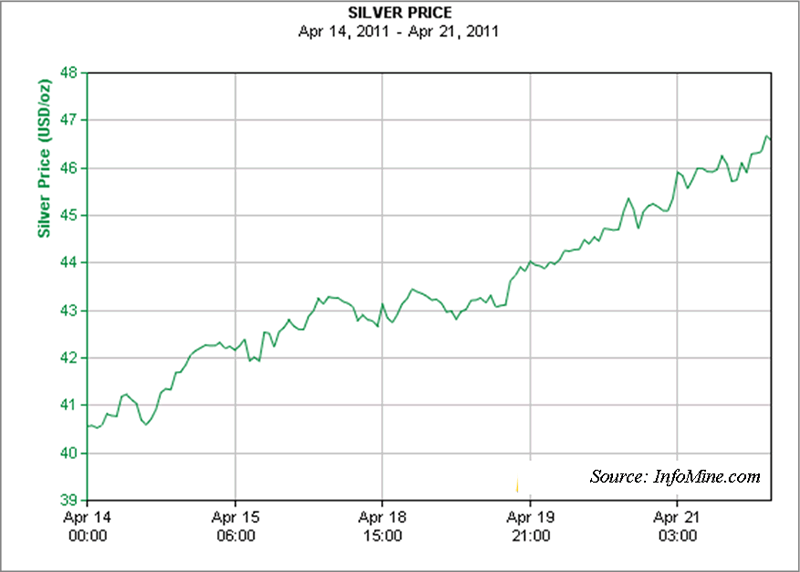

If you think the crude oil market has gone totally out of control in the past month or so, observe the Silver. The Silver market has basically gone parabolic the week of April 17, going from $41.75 on April 15th to $46.69 on April 21st--a 12% move in 5 trading days, topping off the move with a 5% move on Thursday (See Chart).

As Silver is a thinly traded market, one thing the CME could do is to raise margin requirements for Silver speculators; otherwise risk is setting up the silver market for an record-setting crash, which could impact many other markets in the process of correcting, especially other commodities like Gold and Crude Oil.

A Silver Contagion

We are not talking about a 5% correction setting up at these levels for silver, we are talking in terms of a 20% down day that poses a contagion effect to markets in general.

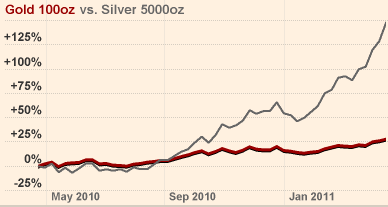

The reason the contagion risk in the Silver market is that while Gold is going up half a percent to one percent, Silver is logging in 3.5% days routinely (See Chart below). Well, what goes up, must come down... eventually. So, when this market breaks, it is going to break hard to the order of 10% easily.

That kind of market selling will not occur in a vacuum, especially since commodities have been trending up as a group, i.e., the same hedge funds and banks are trading all the risk-on commodities as well, like Gold, Copper, Crude Oil, Wheat, etc.

In other words, if Silver gets a 10% down day, which it almost will for sure, and if it isn`t cooled off considerably with proper margin requirements instituted by the CME, then, the rest of the commodities will be forced to overshoot to the downside as well.

ETF Trading & Portfolio Rebalancing

There are a couple of reasons for this. With the advent of commodity funds, silver is part of the basket of commodities in the funds. Also, because traders will not want to fight the tape, shorts will come in and take advantage of the selloff in Silver to push other commodities down through ETF trading vehicles.

Moreover, the same banks and hedge funds trading silver are also involved in the major commodity groups as well, and they will be liquidating other positions to keep their portfolios balanced with regard to risk. So expect a lot of portfolio rebalancing to take place if the Silver market drops 10% in a day across many hedge funds.

Price & Margin Out of Balance

The CME routinely sets margins based upon contract prices. So, if Silver goes up $10 more in price, then the ratio of margin to price goes down. In order to realign margins with the higher price, CME would raise the margins.

The reason this becomes a problem is that if price gets too far out of balance with margin requirements, the risk goes up, because traders will not be properly sized with regard to risk for a potential correction, and many trading accounts could be devastated due to overleverage.

Black Silver Swan

In addition, if Silver speculators are all heavily leaning towards one direction as the action of recent silver price movement suggests, then, there is an increased risk of a major market dislocation, thus creating a ‘black silver swan' day. That’s exactly the kind of event that exchanges try to prevent from occurring, as it is extremely unhealthy for markets, and bad for business.

It is obvious to anyone observing the Silver market that it is overheated to the Nth power. The longer CME ignores the problem, the worse the consequences will be down the line. When all the other risk-on commodity trades are putting in 1% days, and Silver is putting in 5% days, then you know the longer this goes on, the higher probability that this trade and market could end very badly.

Flash Crash 2.0?

As the very real possibility of a 20% two-day correction is moving towards becoming a very real probability, it could bring down a lot of other markets in the process. Remember, we had the flash crash around this time last year? Well, if the Silver market isn`t cooled off, it could potentially be one of the catalysts for another broad flash crash this year.

Raise Margin Requirements by 30%

The easiest way for the CME to lessen the probability of an epic crash in the Silver market, and the subsequent public and regulatory inquisitions, would be to raise margin requirements by at least 30%, as the starting point.

Actually, the CME could be a little late based upon the manner in which silver speculation has gone bizzerk, especially over the last trading week--the market has simply become parabolic. The CME could have raised margin requirements once Silver broke $40 an ounce, and without a doubt they should have raised margin requirements on the 14th of April, before this latest 12% weekly move.

The longer the CME fails to address the problems in the Silver market to rein in excessive speculation, the more risk there is of an extreme market crash. Just as I said before--"The white metal appears overbought and could be heading towards a bubble stage," and without QE2, that bubble would have formed and burst by now.

Silver A Screaming Short

With gold/silver ration setting new 28-year low record almost everyday in April, it looks like the necessary elements are already set in motion for another horrid crash and burn contagion scenario--but this time originating from Silver--due to the interconnected nature and electronic evolution of modern day markets. Any intervention effort by that time would most likely be futile in the face of a multi-market algo contagion.

“Unless you think that gold is too high (which given the historical ratios, is an impossible case to make if you’re also saying silver is going to go higher).”

I don’t understand this line of thinking, it doesn’t make any sense. If silver rose 20% and gold dropped 20%, the spread would be a ratio of (1:21.5, gold vs. silver), far from historical norms. Silver can go up by 30% (of its current value, to $61) and gold can drop 30% (of ITS currents value, $1050), (a ratio of about 1:17) and we still wouldn’t be at the historical ratio of gold to silver (about 1:15). While people can think gold is too high, they can also think silver will go higher, according to historical ratios, and be entirely probable and plausibile, not IMpossible. In fact according to historical ratios, either gold is far too high, or silver far too low, or it could even be argued that both values can adjust. However, according to buying power, gold seems to still be about right (A good suit), but silver is a bit low (A family meal at a restaurant) (*Note there are other rules of thumb used by people). The buying power of silver is still not caught up to what is once was, but it’s slowly moving up (at a slightly faster rate than the other commodities/general goods). Me, I think both gold and silver will rise, but silver at a much faster rate. JMHO.

“The Japanese Earthquake would be a black swan. The markets just seemed to shrug that off.”

Never underestimate the power of a Central Bank to print/lend/fabricate fiat money into an economy until the whole thing collapses.

The silver bulls are all over the internet and despise JP Morgan which is a notorious short on silver for years. They are gunning for JP Morgan and Blythe Masters and think they can bankrupt JP Morgan. By demanding silver for delivery at the Comex

http://tfmetalsreport.blogspot.com/

It's difficult to take someone seriously who can't tell the difference between "reigned" and "reined."

Do you have a better opinion of Ultra Silver? Their “silver” must be all futures and derivatives?

http://www.proshares.com/funds/agq.html

Here is the author with the incorrect usage

http://about.me/dian.l.chu

Or maybe she did a hasty spell check and it slipped past her.

Buy Silver — Crash JP Morgan

http://www.youtube.com/watch?v=bTalT9iI-k4&feature=related

more fun-—>>>

http://www.youtube.com/watch?v=WhcFI-vzNXk

http://www.coinflation.com/silver_coin_values.html

The caveat is that precious metals could experience their own bubble - but any such bubble will be temporary.

If you *really* want to know what's going in with the stock market research the term "DOW in gold dollars" (aka "DIG$").

Silver is just closing in on its traditional historical price ratio of 15 to 1 with gold (15 oz silver=1oz Gold). I believe there will be hiccoughs along the way, but that it is headed somewhere near there.

If peoples income moves with inflation, everyone moves up in tax brackets as well.

Sudenly, everyone is "rich" and fair game for punishing taxes!

I think a 20% down move is wishful thinking on the parts of the silver bears.

“The “value” of an ounce of silver won’t change much, however the “price” will change dramatically with the fall of the dollar.”

Exactly correct...

Gold and silver ‘is not’ ‘will not’ and ‘will never be’ in a “bubble” because they are the true money of the world...

The US already has said they will back a global monetary reserve currency that is NOT the US dollar.

This is also a way to destroy the middle class and much of the smaller rich and small business people. Hyperinflation will kill off a lot.

A SPECULATOR!!! A SPECULATOR!!! BURN HIM!!!! BURN HIM!!!!

It'll kill off me. I'm sitting on cash, as circumstances would have it.

I'm like that dog in the commercial, "Trouble. Trouble. Trouble." I forget what the solution was for him. Give his money to some one else, I think. But why would they want it?

Hahaha. Nice! Wait, didn’t I lower the average market price...? Or, did I create an artificial scarcity..? Me so confused!

Yeah...but are we sure GLD and SLV really take hard metal as delivery?

“why fill vaults with silver instead of gold”

Will you be going to the grocery store with a Krugerrand or

Maple Leaf worth $12,000. to buy bread and ask for change each time? I doubt it. Silver is the money of the masses, and will be the medium of exchange on the street for the entire world.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.