Posted on 02/15/2011 9:54:49 AM PST by FromLori

Former Treasury Secretary Robert Rubin's warnings about the economy and debt situation are getting louder and louder. Speaking at CME Group’s Global Financial Leadership Conference in Naples, Fla, he warned that Federal deficits are on an unsustainable trajectory, and large state and local budget gaps must be closed. He also said:

I think the prospects for the United States economy for both the short term and the long term are the most complex and uncertain of my adult lifetime.That obviously creates an extremely difficult decision-making environment for investors, for business people, for policymakers and for our people...

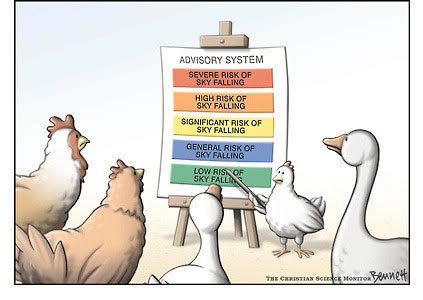

Substantial new deficits could also lead to sudden and unexpected disruptions in market psychology and, following from that, disruptions in the bond market.... He also added that a weaker dollar could lead to dangerous competitive devaluations and that those devaluations could lead to financial chaos, or restrictive trade measures elsewhere in the world. Commodity prices are already increasing as a result and could undermined the development of additional demand, he said, but the most serious problem is that the new program of quantitative easing has heightened existing concern that we might, at some point, monetize our debt to try to inflate our way out of our fiscal problems.

Rubin noted the box the U.S is in given that the politics of deficit reduction are enormously difficult, because the American people do not want tax increases or spending reductions that would affect them.

Rubin is a POS who paid lavishly for running Citigroup into the ground. Hussein bailed em out to the tune of $380 BILLION in part because Prince Al Waleed is a major shareholder - like he is in Fox News.

What’s the problem, are we running out of ink?

“I think the prospects for the United States economy for both the short term and the long term are the most complex and uncertain of my adult lifetime.That obviously creates an extremely difficult decision-making environment for investors, for business people, for policymakers and for our people...”.

He’s scared.

lol picture worth a thousand words like I said our debt is already being monetized even Fed’s Fisher talked about it but no one does anything about it.

And that's why holding the debt ceiling steady is the way to go. It becomes mathematical. The politicians have to cut this much money. Put everything on the table, hand out axes, and start the process.

So long as the debt ceiling is allowed to rise, the politicians will see a patient with gangrene in his leg, and they will recommend a pedicure.

We are so screwed!

Rubin has a lot to do with cooking up the current financial crisis with his socialist pal, Clintoon. He is the one who worked out the deal of bank deregulation in exchange droping “racist” loan qualification standards.

He knows he screwed the pooch and I am sure he could really care less what happens to the US given he is a ‘citizen of the world.’

Rubin is one of the primary CREATORS of this mess, and he got paid handsomely for it....

Sorry bastards, all.

Didn’t work so well when Weimar did it, did it?

A globalist, predicting the past.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.