Posted on 01/16/2010 6:54:20 AM PST by blam

Consumer Prices: Now Up 2.7% Year-Over-Year

by: Tim Iacono

January 15, 2010

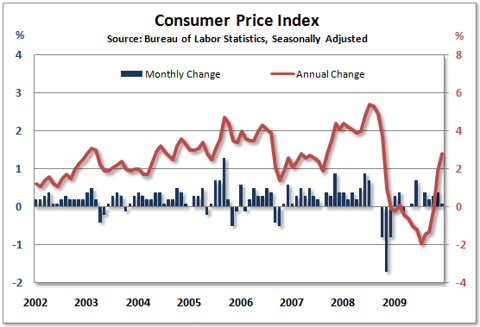

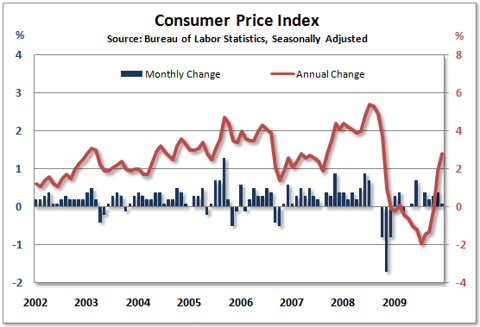

The Labor Department reported a 0.1% rise in consumer prices from November to December and, largely due to much lower energy prices in early 2009, annual inflation is rising, now up to 2.7 percent, with a menacing trajectory.

Of course, many will dismiss the higher year-over-year inflation rates as transitory, however, they will be with us for at least the first half of the year as long as current energy prices remain relatively high.

While the price of gasoline hit bottom in December of 2008 at $1.65 a gallon, the price at the pump didn't rise much above $2 a gallon until May, meaning that, current prices (a national average of $2.75 a gallon as of last week) still represent very large annual increases, though not quite as large as the 50+ percent increase last month.

Moreover, natural gas prices are now rising and will soon be compared to sharply lower prices in early-2009. In the December report, household heating costs actually declined from year-ago levels but, based on wholesale prices, that will soon turn into large year-over-year gains. Of course, these price increases must go through utility companies to reach consumers, so it's not the same thing as the corner gas station raising their prices, but it will be an important factor nonetheless.

[snip]

“I guess they are a bit hot for the economic times were in, but I wouldn’t call them major. Housing is completely flat, and would likely be negative for the year if they used home prices instead of rent.”

How many homes do you buy each year??? People pay rent every month.

Not so, I’ve noticed an increase in mid-range women’s clothing. Two years ago, I could get a decent pair of slacks or a skirt for $30. Nothing special, but OK for work with a jacket. The $30 stuff now is like the $15 stuff was a few years ago. Really cheap looking and crap.

“Good” pants/skirts ran in the 60-70 dollar range. They are now pushing $100. I hate risking the wait for a sale (my size runs out alot), but have done so when I replace my good work clothes.

Well, three necessities of Milk bread and toilet paper are up 38% since 9/2008. Some food items are up even more. My generic drug for hypertension went up 66.6%. I am amazed that the CPI is so low.

Yes interesting that all of a sudden they release figures showing an increase in the CPI...AFTER telling SS/military Retirees NO COLA FOR YOU.

didn’t we just hear this week that they are planning 3 years without Colas.

We need a spy in the Dum Camp, so that we REALLY know WTH they are up to.

See my post #17. Believe your own eyes.

"Everything is about to get more expensive. From gasoline to anti-freeze, life jackets to golf balls, and eye glasses to fertilizer. There are very few things in the modern world that aren't made from oil, made by machines dependant on oil, or shipped by vehicles powered by oil."

I remember the same one's were telling us, when it was in its very early stages, that we weren't seeing a collapse in the real estate market.

At the time I was doing IT/systems admin for a local Realtor/MLS outfit. I seeing 400-500 being listed per day, whereas shortly before then only 10-20 max were being listed. At first I thought there was something wrong with the software, servers or database. It was truly shocking, as being in real estate literally since my childhood, I had never seen anything remotely like it.

Then I'd log onto FR and "those guys" you refer to would be telling us how their daughter-in-laws (or whatever friend/relative) were Realtors and were having their best year ever. Those of us trying to give witness to what was really happening were a bunch of Chicken Little, doom-&-gloom, Ron Paul freakoids.

This was extremely frustrating being that I was looking the objective data right in front of my face.

I’d agree with that. Not major inflation yet.

That’s the real question. I pay for food and energy much more frequently than I buy a new house or change apartments so inflation in those areas affect me more than housing costs.

I am convinced there was lots of manipulation(more that usual even) of the markets starting in Sept. 2008.

About a hour ago.

I rent. I would agree with the BLS stats. Not much rent inflation where I live. If mine goes up, I'll start looking for another place to rent or buy.

I am a blue jeans sort of guy. So if Kohl's doesn't have them on sale and with the 30% special discount, I don't buy.

Hey AAABest,

Some of us took heed of the warnings we saw on FR, you and Texan et al.

ATM I’m working in IT support for a CRE brokerage, holy mother of gawd the stuff I’m seeing is unbelievable. A single county in NJ has lost market value in CRE in the last 6 months greater than the yearly GDP of small countries such as Haiti.

LoopNet is a graveyard, a digital representation of a modern abandonment of a civilization. SunkenCiv and Blam post articles to the GGG list about how ancient societies apparently abandoned their cities under mysterious circumstances. I’m seeing that right now on Costar.

In my area - a particularly hard hit area in SW Florida - people are picking up 4 bedroom homes for $50,000 that would cost 4 times that amount just to build the structure without the land. They went for 6 or 7 times that just a few years ago.

Some are buying these then renting them out. The only problem with that is there is nearly no such animal as a renter with good credit and solid employment anymore. Also, the turnover is very high as renters are moving in and out like gypsies because of their personal financial issues and because there is so much very low-priced rental inventory to choose from. When they move out they often leaving the unit trashed.

I've been thinking of buying something as an investment, but I'm not sure if I want to put up with the BS.

Yep they were talking their book the whole way down. Which gives me an excuse to post this picture again -- this is from September 2006, long after it was clear that the bubble days were over:

Su Casa....

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.