Skip to comments.

Insight: Equities carry too much risk ('faith-based' rally gone too far?)

FT ^

| 09/23/09

| David Rosenberg

Posted on 09/25/2009 5:54:49 AM PDT by TigerLikesRooster

Insight: Equities carry too much risk

By David Rosenberg

Published: September 23 2009 17:00

The banker J.P. Morgan was fond of saying: “I never buy at lows, I never sell at the highs, I play the middle 60 per cent.” Well, from our lens, we are well past that middle 60 per cent point of this bear market rally.

At the lows in the equity market in March, the S&P 500 was de facto pricing in a 2.5 per cent decline in real gross domestic product and $50 of operating earnings for the year. Guess what? Far from being grossly undervalued (although some stocks were – especially financials, priced for bankruptcy), the market at those lows was fairly priced on a price-to-book and price-to-earnings basis.

Usually at bear market troughs, the S&P 500 goes to silly cheap levels. It did not this time round and, six months and 60 per cent later, there is yet again, in 2007 style, tremendous risk in this market. Never before has the stock market surged this far, this fast, between the time of the low and the time the recession (supposedly) ended. What is “normal” is that the rally ahead of the recovery is 20 per cent. This market is now trading as if we were in the second half of a recovery phase, yet it has not even been fully ascertained the downturn is over.

Remember, Mr Dow and Mrs Jones are not always rational beings. At the stock market highs of October 2007, equity valuation was embedding a 5.0-5.5 per cent GDP growth profile. What did we end up with? Try flat, on average, over the subsequent four quarters. Fast-forward to today and the S&P 500 is priced for 4 per cent real economic growth in the coming year.

(Excerpt) Read more at ft.com ...

TOPICS: Business/Economy; Extended News; News/Current Events

KEYWORDS: bearrally; qe; stock; stockmarket; stocks

To: TigerLikesRooster; PAR35; AndyJackson; Thane_Banquo; nicksaunt; MadLibDisease; happygrl; ...

2

posted on

09/25/2009 5:55:41 AM PDT

by

TigerLikesRooster

(LUV DIC -- L,U,V-shaped recession, Depression, Inflation, Collapse)

To: TigerLikesRooster

I have several stocks where I am receiving a 10-12% dividend on my original investment, and they are well able to keep paying.

Why should I sell?

To: proxy_user

To: Pearls Before Swine

No green shoots for you. Soup czar nazi.

To: proxy_user

Any chance you would like to share which companies? (No problem if you don’t.)

To: equalitybeforethelaw

I was offering unsolicited advice. I stayed at a Holiday Inn once, so to speak.

To: TigerLikesRooster

This wasn’t a faith-based rally. It was a ‘free credit for Investment Banks rally’

Time to get out.

Disclaimer: I am positioned for a crash.

To: Loyal Buckeye

...here’s three stocks that I own that pay a decent dividend...BMY(5.6%) DUK(6.1%) T(6.0%)

To: agere_contra

Yesterday I stopped out of my Bank of America holdings. I bought at just under $4 a share in March. My stop executed at $17.25.

Purely a gamble on my part. No special insight but I managed to erase all of my losses in this cycle. I am now up %38 over last year.

Now I need to find something to do with my dollars before BHO makes them worthless...

10

posted on

09/25/2009 6:48:09 AM PDT

by

Syntyr

(If its too loud your too old...)

To: Pearls Before Swine; Loyal Buckeye

I bought oils when oil was selling for $18 a barrel, about 10 years ago. That and cigarette companies, you can never lose. My only regret is that I didn’t buy more.

Sure, the stock price has peaks and valleys, but the long-term cash flow seems to be ever upward.

To: TigerLikesRooster

Thanks for a good article. I have been out of the market since 12/06. I really thought we were going down further and missed this rally but am not overly sad about it, as I still saved myself form a 25% loss by doing what all my friends urged, dollar cost averaging through it all.

This market has me very confused and I hate to touch it, but I can’t help but feel we are going to retest the lows. I am no good technically and always get stuck on just the fundamentals. From the fundamentals, I would say future business profits don’t look good, so corresponding earnings and share prices should not be good either.

I am sticking to my guns that the S&P will go back under 700 before it sees 1500 again.

To: proxy_user

To: proxy_user

Oil and tobacco—might as well hold ‘em as fold ‘em. Only problem is nationalization, either by courts or by tax, which cuts down profitability.

That said, oil did get ahead of itself in 2008. I was able to pick up some additional tobacco at good prices (Universal Corp and British Tobacco) this spring.

To: proxy_user

Those high dividend stocks and cash are the only play I have as well.

15

posted on

09/25/2009 10:43:55 AM PDT

by

reed13

(The only thing necessary for the triumph of evil is for good men to do nothing.")

To: reed13

My in also a tobacco: MO sitting at 7%

16

posted on

09/25/2009 10:45:49 AM PDT

by

reed13

(The only thing necessary for the triumph of evil is for good men to do nothing.")

To: TigerLikesRooster; M. Espinola; stephenjohnbanker; FromLori; GOPJ; Liz; All

17

posted on

09/25/2009 1:12:13 PM PDT

by

ex-Texan

(Ecclesiastes 5:10 - 20)

To: TigerLikesRooster

And another thing that I failed mention above . . .

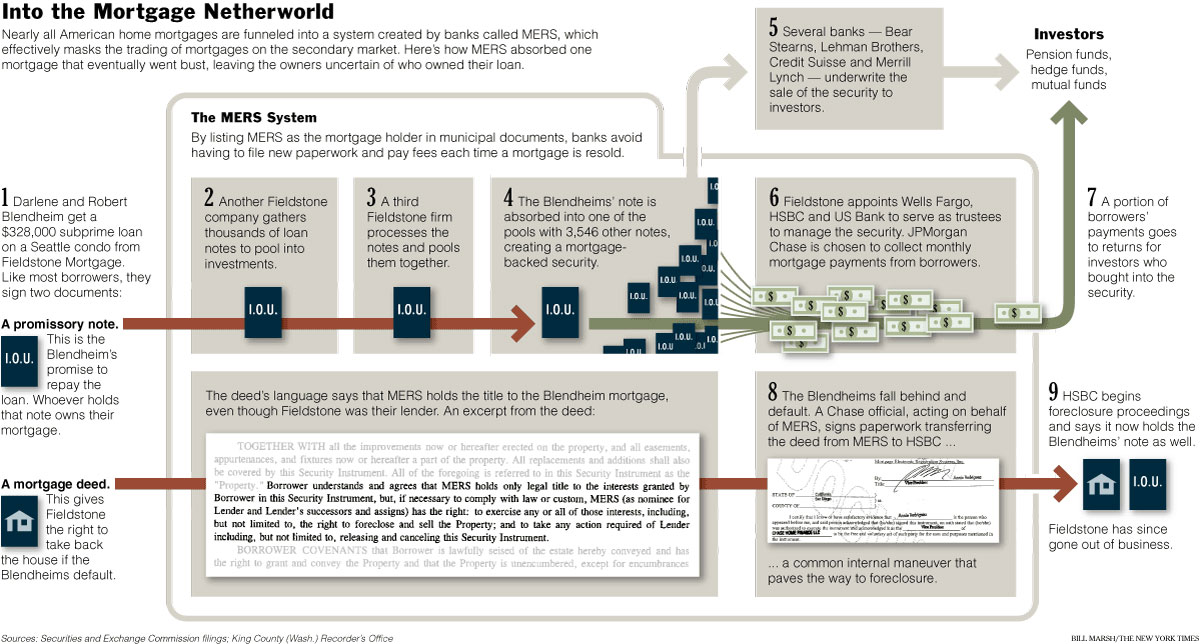

These Mortgage Backed Securities were sold by all the Big Wall Street Banks. All of them were in on the fraud. Why am I using that term? Because the sale of MBS was a massive fraud on those that bought these FAKE securities. These 'securities' were sliced and diced and shredded and mixed and blended into A+ rated paper.

When you get right down to it the reason WS employed statistical experts and math experts was to confuse the rating agencies. Exotic algolrhythms are not subjects most business majors embrace except as the doctoral level.

And hiding in these massive piles of securities were thousands or hundreds of thousands of FORGED MORTGAGES . . . And nobody wants to talk about that subject. Not in D.C. Not the alleged regulators. Not Obama's Two Bit 'Czars.' And certainly not the Fed.

Fake securities being sold to foreign governments and foreign investors and pension funds and to individual investors -- has a lot to do with the stability or instability of our stock markets. And world stock markets.

I'm biting my tongue. 'Nuff said be me here on FR.

18

posted on

09/25/2009 1:33:56 PM PDT

by

ex-Texan

(Ecclesiastes 5:10 - 20)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson