Posted on 03/20/2009 10:11:56 AM PDT by givemELL

"The fed is planning moves that would more than double its balance-sheet assets by September to $4.5 trillion from $1.9 trillion. Whether expressing approval or concern over the fed’s move, most commentators fail to understand the real magnitude of the projected expansion of the US monetary base because they don’t take into account the amount of dollars circulating abroad......................The fed’s planned balance sheet expansion results in a 15-fold increase in the base money supply.

262 Billion = US monetary base as of September 2008 (minus dollars held abroad) 3,818 Billion = projected US monetary base in September 2009 (minus dollars held abroad)

3,818 Billion / 262 Billion = 15-Fold Increase in US monetary base

This is a staggering devaluation of the US currency! That means for every dollar that existed in America in September 2008, the fed is going to created fourteen more of them! Below is a rough sketch of what this Increase in US monetary base would look like:

>GRAPH<

This 15-Fold Increase will be impossible to reverse

Next September, when the fed realizes it has gone too far and tries to reverse its balance sheet expansion, it will be unable to do so. The realities which will hinder the fed’s control of the money supply are:"

(Excerpt) Read more at marketskeptics.com ...

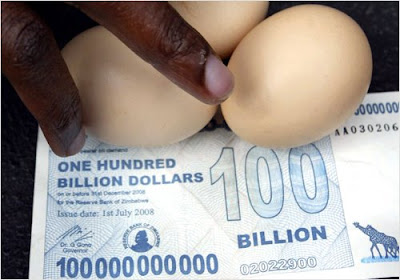

Maybe I’m going too far here, but I can’t help thinking of Weimar, Zimbabwe, the Ukraine and Ayers’ “final solution”.

Your dollar will now be worth one penny. A loaf of bread will cost $500.

It’s post-WW1 Germany, folks.

...gulp....

Interesting analysis. How good have his articles and predictions been in the past?

Glenn Beck has been urging people to buy what they need ASAP before their money becomes worthless. Food storage set aside for an "emergency" may well be an essential element of survival.

"Photoguy said...

Eric,

"Excellent, lucid, thought-provoking post. I agree on the "ego" post regarding Denninger; if he's going all cash, he'll be in the food lines of 2012."

"There is no doubt, NO DOUBT, in my mind that within the next three years, Au & possibly Ag will be confiscated. Other than canned goods, hard liquor, and other obvious storable items of value, what else could be transition our wealth into that could be easily stored and that would preserve our wealth during a period of hyperinflation? Other than Au & Ag? Diamonds are too hard to accurately grade, so I wouldn't want them. Land & CRE is taxed each year, so I don't want that. What?"

"There has to be something, other than Au & Ag. Perhaps I'm overthinking this, but I see what's coming and I'm doing my best to prepare."

How does one decide whether home ownership will be a good idea? On the one hand, the monthly cost (mortgage) is fixed (assuming a fixed rate mortgage). On the other, the cost of repairs and maintenance is bound to skyrocket.

You will want to keep your food hoarding habits to yourself too.

Reference bump ... why are we in this hand basket and where are we going? :-(

Yup. Firearms details should likewise be kept quiet. You don't want to paint a target on yourself. I've been tempted to purchase a gasoline powered generator for emergency purposes at the house. I've resisted because a running generator makes noise and attracts attention. At a time when others have no electricity, the noise tells everyone else that you do have electricity. You probably have food too.

Having some backup water is critical. My city provides water from the aquifer below the city. It is pumped with electric pumps. There are a few storage tanks, but they won't last long in a prolonged power outage. Gas stations don't work without electricity either. A prolonged outage would find folks on bicycles to fetch water from the river. It's at least 5 miles to the nearest surface water in my area. That's a damn long way on foot or peddling a bicycle.

Speaking as both a homeowner and a landlord... if you have decent credit and a down payment, a mortgage of 5-6% should look pretty good considering the inflation and subsequent rise in interest rates that's expected to hit us over the next few years.

As a renter, you're paying your landlord's mortgage(s), property taxes, insurance, and maintenance costs anyway. If I had extra money laying around, I'd buy more rental property.

The underlying news is that the Fed is going to increase the amount of treasury securities it holds from 1.9 trillion to 4.5 trillion.

The article subtracts the currency currently circulating abroad from the new amount of treasuries held by the Fed to get a figure for the new "US domestic monetary base" of 3818 billion.

It then defines the old monetary base as the currency circulating in the US = 250 billion.

But shouldn't the old monetary base be computed the same as the new? In other words it should be 1.9 trillion - 583 billion = 1.317 trillion.

This would mean the the US monetary base is increasing by a factor of about 3 rather than 15.

Also the article assumes that all the new money created will circulate in the US. Taking this into account would mean that the US monetary base is increasing by a factor of less than 3.

Welcome to the Big Zimbabwe.

the other factor nobody ever comments about, is that an overseas dollar is about 50% more valuable than a domestic dollar...because it escapes the current confiscatory taxation we’re drowning under....

As I pointed out yesterday, the flag is up... Hard decisions to make here. Will be at the gulch next week, seems we will be on a buying spree when we get there...

It would lead to lack of food only because you would not have enough cash to keep up with inflation.

The real problem is how to keep something that is trade-able for your needs.

Water and electricity would only be unavailable if you could not pay for it. You will be in big trouble before you reach that stage.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.