Posted on 05/12/2008 4:34:46 PM PDT by freerepublic_or_die

Note:I took literary license to post this as "What Does $120 Oil Mean for the Global Economy? from What Would $120 Oil Mean for the Global Economy?

The pdf is a short report written by Robert F. Wescott and published in April 2006 by Securing America’s Future Energy. It was written when oil was ~$60 a barrel and addressed a scenario where the price of oil surged to $120 due to coordinated terrorist attacks on global oil transport infrastructure. Well, here we are, two years on at $120 oil (without the attacks) so it’s worth revisiting the analysis in light of the conclusion:

The main conclusion of this note is that $120 oil would have profound negative effects on the world economy and global financial markets. ... Such oil prices would almost certainly precipitate a global recession.

The scenario is not identical to the present situation, Wescott’s terrorism induced $120 involves a rapid spike upwards however the analysis is based on the $120 price being sustained for a year. This long term high price is similar to today’s situation.

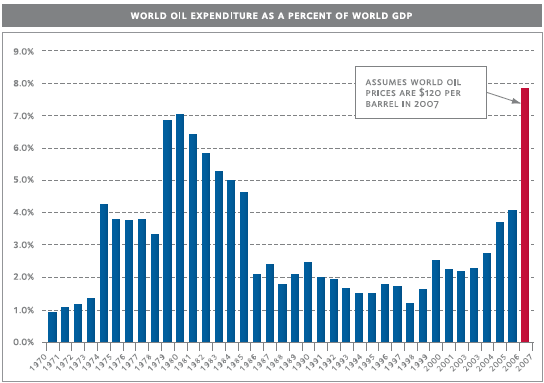

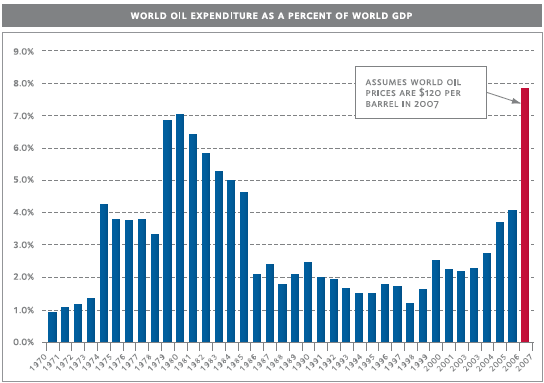

The most interesting chart from the report shows world oil expenditure as a percentage of world GDP

Wescott points out that historically this metric has been in the range of 1-3% and recessions have occurred when the expenditure exceeded 4%. $120 represents approximately 8% of world GDP, higher than at any time in modern history. Two studies are cited: The International Monetary Fund (IMF) suggesting a $5 increase cuts world GDP by 0.3% so it follows that the $60 to $120 doubling would reduce world GDP by 3.6% and the US Federal Reserve estimates that a $20 increase reduces GDP by 0.75%, which would result in a loss of 2.3% from increase $120.

(Excerpt) Read more at theoildrum.com ...

The author is correct in that we cannot sustain the price of oil climbing $10.00 a month for all that long. There is a breaking point somewhere and it would be optimal for oil to settle at somewhere between $75 and $85.

I shouldn’t HAVE to say it again, but to reduce oil prices:

1) Decriminalize Atlantic coast drilling,

2) Decriminalize Pacific coast drilling,

3) Decriminalize ANWR drilling,

4) Decriminaize Florida Gulfcoast drilling,

5) Wait 10 years, and

6) Raise the value of the dollar in world currency markets.

It means that terrorists are raking in record profits...

What are you smoking? Name one candidate or current politician who would even THINK about making such statements?

And I don’t think $25/barrel is a good price - our own oil industry would be discouraged from drilling. $40 per barrel would likely be enough to be able to make a profit. That would be less than 1/3 of the current price.

Current price locally for regular unleaded - $3.59. That should then be somewhere less than $1.20 per gallon (except for those pesky gas taxes).

Yeah - manufacturing everywhere except the US where we have let nearly every major industry go overseas (or south of the border). It isn't just our stupid-low interest rates causing a plunge in the value of the US $, it is our lack of manufacturing. We import so much... folks just thought we were importing a lot 20 years ago.

Anyone remember FORMER Wal-Mart slogan under Sam Walton? We buy American, so you can".

Now, their unspoken slogan is - we buy as much from China as we can, so you can get cheap stuff... even if you are pissing your job and standard of living away... Oh - and have you applied for our Wal-Mart Credit Card? Pay 24% interest for your Chinese junk...

I wonder what the pump price has to be until all the environazis and the Fools on the Hill are told to get the he!! out of the way and LET US DRILL FOR OUR OWN OIL. Drill ANWAR, off our coasts, justg suck it dry, and build the refineries to handle the stuff. When are we going to tell all those involved with this situation ENOUGH IS ENOUGH!

The end result very well may be a faltering world economy that will cause a decrease in consumption and lower prices. However, there is a good chance that the faltering world economy will be more painful than the current and future price of oil.

You think a 10% drop in the $ causes a 100% increase in oil? Ok, then why is oil up almost 40% on gold in the last year?

I was not aware that we were paying $2.39 in gas taxes.

What is your source for that tidbit?

did his report in 2006 take into account dollar devaluation as part of the price move in oil? If he assumed a stable dollar from 2006, his chart would tend to overstate the % of world gdp spent on oil due to the currency devaluation in the US.

Where did YOU get that we are paying $2.39 in gas taxes?

If you read my post, you would see I was making a point about the price of oil - were it to be $40 per barrel, that would be 1/3 the current price. 1/3 of the current price of gasoline would be $1.20 (at least based on the price at the pump here).

But, as gas taxes total up to around 40 cents, and that is not reduced as the price of gas goes up or down, the price of gasoline would not be 1/3 the current price because of those taxes.

So I ask - what the heck were YOU thinking?

Iran’s OPEC terrorist thugs should have been sent to Shi’ite ‘paradise’ after we bagged Saddam. Now Tehran’s oil-rich, jihad exporting tyrants are even more dangerous, in part, thanks to Putin’s ongoing advanced weapon’s shipments, coupled with Russkie nuclear fuel, complete with Moscow’s advisor’s stationed in Iran, ironing out any ‘nuclear technicalities’.

Excellent point!

I now see the rest of your post and understand what you meant.

However, $40.00 a barrel is still too low of a price to sustain the domestic industry.

Sticker Shock-$3 a gallon gas? Click the picture:

And I still stand by my vest-pocket summary:

I've been saying for years the way to revive and restore the economy ( and it would have headed off these oil price problems as well ) was to-

1- drill for gas & oil like crazy- onshore, offshore, and in Alaska

2- go nuclear for power

3- convert stationary plants to clean coal technology

4- slash taxes and regulations like crazy

Not to mention... start building ‘coal-to-oil’ facilities and ramp up the use of the Canadian tar sands.

You may have a point on the $40 per barrel price point.

What is the actual production cost of a barrel of domestic oil right now? I have heard the figure before but cannot for the life of me remember it.

The dollar has been involved, but less so as time goes on. The True Cause is elsewhere.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.