Skip to comments.

Top 11 Secrets of a National Retail Sales Tax

Various

| 6-10-05

| Always Right

Posted on 06/10/2005 11:13:37 AM PDT by Always Right

1. The 23% sales tax rate turns 37%. A retailer who sells an item for $100 must charge his customer an additional $30 for federal sales tax. Most people familiar with state sales tax call this a 30% tax, since the tax is 30% of the seller's price. The Sales Tax folks call this a 23% tax, since $30 is 23% of the final price ($130 including tax), which they call the 'tax-inclusive' rate. Neither way is technically incorrect, it is just important to understand what is really being discussed. Remember this 30% tax-exclusive rate is only the federal portion of the tax, state sales tax will also be added in. With the elimination of federal reporting, states will have to replace their personal and corporate income receipts, with a sales tax. States collected nearly $500 Billion in 2003 through income tax and sales tax. With Personal Consumption at $7.76 Trillion in 2003, that is 6.4% in tax inclusive terms, which will add another 6.8% to the tax-exclusive rate. So if you buy $100 worth of goods, you will end of paying nearly $137 once State and Federal Sales tax.

2. Even 37% is not enough. One amazing fact when sales tax calculates their rate is that they assume 100% compliance. Everyone will cheerfully report every sale. There will be no under the table or black market sales. Also, no one will try to buy goods overseas to avoid this tax. This is pure fantasy. No one could believe any tax system will have perfect compliance and zero avoidance. The current income tax system has about a 15% tax-evasion rate. Conservatively, we could assume that the sales tax will have a similar tax evasion rate of 15% and a tax avoidance (like spending overseas) rate of 5%. With these more realistic assumptions, the tax rate would have to be bumped up to 44% to be revenue neutral. And these are very conservative assumption. Brookings Institute economist William Gale (National Retail Sales Tax, September, 2004) calculated that about a 60 percent sales tax would be required to be revenue neutral.

3. Fraudulent Calculations. Besides using ridiculous assumptions like 100% compliance, the sales tax economists create money out of thin air. Their paid for economists routinely double-count savings of their plan. The biggest one is being the $1.3 Trillion that individuals pay in taxes. Under the 30% Sales Tax bill, that money would end up in the pocket of individuals, and the proponents correctly tell you that take home pay will go up. But then the Sales Tax proponents go on to tell you that prices will go 25-33% to offset their 30% sales tax. Well if individuals are pocketing 67% of the taxes that are eliminated, how are businesses going to reduce prices very much? The sales tax eliminates about $650 Billion in taxes to businesses. Considering Americans consumers spend $8 Trillion on goods and services, that only allows for businesses to lower their costs by 8%. Once the 30% sales tax is added, the final end cost to the consumer will be 20% higher if the calculation were done honestly. Even allowing for a reasonable amount of savings in compliance costs to businesses under the sales tax system, prices would still shoot up 18-19%.

4. Millions must file. The Sales Tax supporters would have you believe that only retailers need to file under the Sales Tax. That simply is not true. In order to offer the 'low' 30% rate, the Sales Tax must tax services too. 'In 1993, 12,778,000 taxpayers filed individual returns with business income or losses, and another 1,919,000 filed farm returns. In addition, in 1992 the IRS received returns for 17,292,286 non-farm sole proprietorship businesses, 1,484,752 partnerships, and 3,868,004 corporations-all of which probably produced goods or services on which the sales tax would be levied. Thus the supposed simplicity of the sales tax turns out to be a mirage.' (Brookings Institution Policy Brief #31-March 1998) Thus over 35 million filers will still be subjected to reporting and audits, most of these are individuals. This doesn't even consider the 100 million of people who will still have their wages reported to the SSA. Also, all households must register every year with the 'sales tax administering authority' in order to receive your monthly tax rebate. Furthermore, individuals that buy things without sales tax, like overseas purchases, must submit monthly forms and payments to the government. Hardly the zero tax filings for individuals as the sales tax supporters claim.

5. Tax Evasion will skyrocket. 20 countries have tried a national sales tax, and 20 have switched to a value-added tax. These countries have gone on record and have flat out stated a retail tax of more then 12% is unworkable. People will avoid it, especially with the internet which makes it very easy for the common citizen to purchase goods from foreign sources. The fact that businesses to business sales are not taxed, makes it very tempting to buy personal stuff under a business name. It will take a mighty powerful and intrusive taxing authority to audit all business expensive to make sure. The sales tax rates we are talking about have never been successfully implemented in the history of the world, but it hasn't been for a lack of trying. "Many people would masquerade as businesses" to avoid the tax, says Robert Hall, an economist at the Hoover Institution. Gale reckons that evasion would be far higher than today 's estimated 15%.

6. Big Government gets Bigger. In the 20 countries where the national sales tax has been implemented, and in each case replaced by necessity by a Value-Added Tax, the amount of federal taxes quickly grew from about 20% of GDP, as currently in the US, to 40% and above of their GDP. Not a promising precedent.

7. Underground Economy still not taxed. The NRST advocates falsely claim that the underground economy now will be taxed. Nothing could be further then the truth. Sure, when the money re-enters the legal economy the money is taxed, but that is true today. But will the drug dealers and prostitutes remit sales tax for their goods and services under the NRST? Absolutely not, this portion of the economy is still invisible to the tax collector and therefore not taxed. According to Bruce Bartlett, 'thus whatever revenue is gained when drug dealers spend their ill-gotten gains will be lost because no tax was collected on their drug sales.' (Bruce R. Bartlett, senior fellow, National Center for Policy, Analysis, November 5, 1997).

8. Lower and Middle Income pay more. Steven Sheffrin of UC Davis in a 1996 CPS brief says that a revue-neutral consumption tax even with a generous personal exemption shifts the tax burden to the lower to middle income households. A 1992 Congressional Budget Office study of consumption based tax concluded the consumption tax would decrease the tax on the wealthiest 20% by five percent, while hitting all other groups with a higher tax burden. The poorest quintile being hit the hardest with a 20% increase in tax and the 20-40% income quintile being hit with 9.3% increase in their effective tax rate. This is because the poorest spend a much higher percentage of their income each year and in many cases are even forced to borrow to keep up with their expenses. These numbers are much worst today as the federal tax liability for the bottom 20% has been greatly reduced through expansion of the earned income tax credit.

9. Elderly assets are unfairly burdened. While people currently working will get to keep more of their paycheck, people on fixed incomes will stay the same. Elderly, who have already worked and saved under the income tax system, will now be faced with paying additional high consumption taxes. This group of especially hard hit people, will not have the opportunity to earn tax-free wages, so all their already taxed wealth will be taxed again when they spend it. Come January 1, 2007, if someone's rent was $1000, they will owe an additional $300 in federal tax alone, and many without any additional source of income.

10. Government Taxes Itself. One amazing thing is under the Sale Tax is that government somehow raises money by taxing itself. Whereas this is an interesting way to reduce government, it is typical of the smoke and mirrors the fraudulent analysis of the so-called fair taxers use. Under the plan, the government is considered the consumer and most of it's purchases and employee salaries are taxable. So if the state of Alabama pays its clerk $30,000 in salary, it would be liable to pay the federal sales tax of $9000. The same applies to the federal government, but it pays itself. An interesting way to raise revenue, but it more fraud on their part. If government could truely tax itself, why not just put 100% sales tax on government and then no one else would have to pay taxes.

11. Auto and Housing Industry Hit Hard. As the luxury taxes have proven in the past, adding a large sales tax on item deters people from buying. In 1991, after the Democrats snuckered Bush Sr. into signing the Luxury Tax, Yacht retailers reported a 77 percent drop in sales that year, while boat builders estimated layoffs at 25,000. And that was only for a 10% tax! With new homes and autos having to compete against existing homes and used cars, paying the additional 30% sales tax will be hard to swallow for most consumers.

TOPICS: Business/Economy; Government; News/Current Events; Your Opinion/Questions

KEYWORDS: fairtax; incometax; irs; nrst; salestax; taxes; taxreform

Navigation: use the links below to view more comments.

first previous 1-20 ... 941-960, 961-980, 981-1,000 ... 1,241-1,246 next last

To: expatpat

The revenue neutral rate will be something when the bill is marked up, but my point is that the number presently in the bill is 23% and nothing but.

Nor was I quarreling with 30 vs 29.9. I pointed out that the correct calculation to go from 23% in the bill to a t-e value is 29.87% (and nothing but).

961

posted on

06/12/2005 5:32:00 PM PDT

by

pigdog

To: Always Right

I also collect my income tax from customer, so where's the difference? The biggest difference is under the sales tax I pay on gross income, and under the income tax I pay on net income. The fact is I still send a check to the government and the customer is where the money came from in BOTH cases. Wouldn't it just be easier, and intellectually honest, to admit that you are wrong than to post something stupid like this after 5 years of debating the FairTax proposal and having it explained to you countless times? As someone else has already pointed out, you include the costs, but leave off the benefits of the FT.

962

posted on

06/12/2005 5:33:10 PM PDT

by

Badray

To: expatpat

Lets just put away the numbers for a moment. Basically you guys are saying that Sellers factor in the taxes. Well nothing could be further from the truth. You see Sellers will not be taxed. Only the buyers on a volunteer basis. Not like the way the current progressive tax, and or the flat tax.

To: Always Right

The biggest fallacy of a national sales tax is the notion that other taxes will be eliminated when this is done.

To: Diplomat

Another one who hasn't read the bill. My, my!!

965

posted on

06/12/2005 5:36:30 PM PDT

by

pigdog

To: pigdog

LOL! Thanks :-) They seem to believe that the Seller pays taxes, and has to factor that part in to whatever he or she is selling. Nothing could be further from the truth. That is the beauty of it. The only thing that is taxed is the buyer, and that is by choice. Its not like the current progressive tax or even by a flat tax. They try to confuse everyone with the numbers. Plus they assume all prices for products would remain the same, and not go down.

To: ancient_geezer

To: jammer

Thank you.

Your post demonstrates just how fraudulent some of the anti FairTax people are. Unlike you, they never admit to any good aspects of the plan (there has to be some, doesn't there?), they never acknowledge a sound argument. They just try to rip it to shreds.

Having doubts is fine. Having questions is normal and good. But some intellectual honest, like yours, is appreciated. So again, thank you.

968

posted on

06/12/2005 5:41:03 PM PDT

by

Badray

To: Sprite518

Yup, you're right of course ... and they also throw out that wages will go down but that's just to scare wage earners and those of us who have to work for a lining.

Nothing like a few lies sprinkled in among some half truths to try to fool the unwary/uninformed.

969

posted on

06/12/2005 5:43:16 PM PDT

by

pigdog

To: expatpat

Ok let me keep it simple for you. 77 times .23 = 17.71

Therefore, $17.71 is 23% of $77. So the product total would be 77 + 17.71 = $94.71 and not 100. LOL!

First off this guy is assuming prices would not go down. Guess what they would, and you know why? Because the buyer is the ONLY person that pays the tax on a VOLUNTEER basis. Its not like the current progressive tax or Flat tax. If the fair tax was ever passed, then you would see states change their tax codes too in order to stay competitive.

To: Mad Dawgg

It's somewhere around the middle. The thread is too long and I'm too tired of repeating myself to look for it for you, but it's there. Use the search tool.

To: expatpat

Put the numbers down for a moment. Why would the Seller care about the price of a product if he did not pay taxes. Just think about that because that is what you flat taxers are saying.

To: Sprite518

Don't post your quibbling to me. I was quoting pigdog's post 749, so please argue with him, instead.

To: pigdog; Always Right

29.87% as calculated from a stated 23% because, you see, some sales tax rates are quoted to two decimal places - your idiocy not withstanding.

Who's idiocy Lapdog?

AFT's FAQ #47

I know the FairTax rate is 23 percent when compared to current income taxes. What will the rate of the sales tax be at the retail counter?

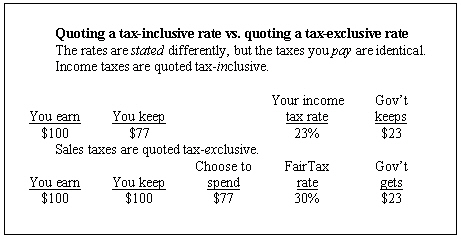

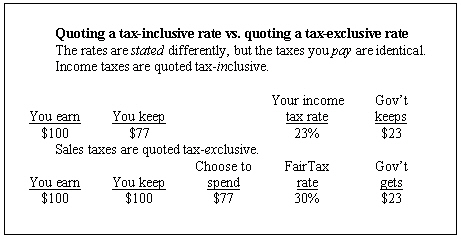

30 percent. This issue is often confusing, so we explain more here. When income tax rates are quoted, economists call that a tax-inclusive quote: “I paid 23 percent last year.” If that were the case, for $100 one earned, $23 went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s a 23-percent tax-inclusive rate.

We choose to compare the FairTax to income taxes, quoting the rate the same way, because the FairTax replaces such taxes. That rate is 23 percent.

Sales taxes, on the other hand, are generally quoted tax-exclusive: “I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.” This rate, when programmed into a point-of-purchase terminal, is 30 percent.

Note that no matter which way it is quoted, the amount of tax is the same. Under an income tax rate of 23 percent, you have to earn $130 to spend $100.

Spend that same $100 under a sales tax, you pay that same $30, and the rate is quoted as 30 percent.

Perhaps the biggest difference between the two is under the income tax, controlling the amount of tax you pay is a complex nightmare. Under the FairTax, you may simply choose not to spend, or to spend less.

974

posted on

06/12/2005 5:51:42 PM PDT

by

lewislynn

( Is calling for energy independence a "protectionist" act?)

To: Diplomat

The biggest fallacy of a national sales tax is the notion that other taxes will be eliminated when this is done. Well, the sale taxers got all over my case when I assumed that states would eliminate their income tax and roll it into the sales tax. I guess they believe that states will go the other way and predominately use the income tax. But then we are still reporting income and having our income audited.

To: Sprite518

What I had posed to him, of course, was that if you paid $100 for a thing, then the tax was $23 and the thing itself was $77.

That's not what he posed to you. Do you suppose that was just a slip of his tongue?

976

posted on

06/12/2005 5:54:38 PM PDT

by

pigdog

To: lewislynn

Besides the 23% rate still assumes a 100% compliance rate. They just take the total taxes replaced add in their tax credit and divide that by total consumption. To hang their hat on the 23% rate is just plain silly and dishonest.

To: pigdog

I don't understand why they think this is so hard to understand? Its very simple. I laugh every time they say you have the base price of $77 then you add the taxes and fed and state which comes to $100. Therefore, there is your 30% sales tax. I laugh so hard every time I read that. First, they assume States are going to leave their current tax system in place and not change in order to keep business and jobs in the state. Second, they do not understand percentages.

To: Sprite518

Why would the Seller care about the price of a product if he did not pay [the] taxes. The seller worries about it because of price resistance or "sticker shock" and thus lower sales -- the buyer cares what he is paying out of his pocket, not what the base price was. The FT fans claim that lower prices are advantageous, which conversely means that there is a disadvantage to having a higher gross price, if you agree with them.

To: Sprite518

Therefore, $17.71 is 23% of $77. So the product total would be 77 + 17.71 = $94.71 and not 100. LOL! You still don't get it. Here is the explaination from the FairTax web site:

I know the FairTax rate is 23 percent when compared to current income taxes. What will the rate of the sales tax be at the retail counter? 30 percent. This issue is often confusing, so we explain more here.

When income tax rates are quoted, economists call that a tax-inclusive quote: “I paid 23 percent last year.” If that were the case, for $100 one earned, $23 went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s a 23-percent tax-inclusive rate.

We choose to compare the FairTax to income taxes, quoting the rate the same way, because the FairTax replaces such taxes. That rate is 23 percent.

Sales taxes, on the other hand, are generally quoted tax-exclusive: “I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.” This rate, when programmed into a point-of-purchase terminal, is 30 percent.

Note that no matter which way it is quoted, the amount of tax is the same. Under an income tax rate of 23 percent, you have to earn $130 to spend $100.

Spend that same $100 under a sales tax, you pay that same $30, and the rate is quoted as 30 percent.

Perhaps the biggest difference between the two is under the income tax, controlling the amount of tax you pay is a complex nightmare. Under the FairTax, you may simply choose not to spend, or to spend less.

Figure 4: 23 percent tax-iunclusive vs. 30 percent tax-exclusive

Navigation: use the links below to view more comments.

first previous 1-20 ... 941-960, 961-980, 981-1,000 ... 1,241-1,246 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson