To: Sprite518

Therefore, $17.71 is 23% of $77. So the product total would be 77 + 17.71 = $94.71 and not 100. LOL! You still don't get it. Here is the explaination from the FairTax web site:

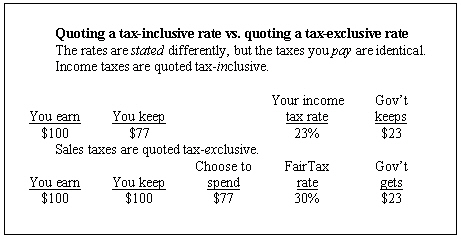

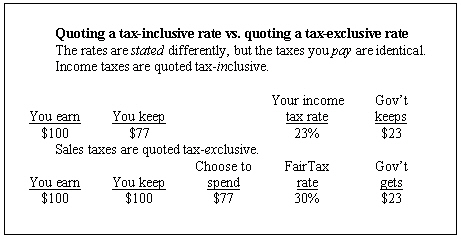

I know the FairTax rate is 23 percent when compared to current income taxes. What will the rate of the sales tax be at the retail counter? 30 percent. This issue is often confusing, so we explain more here.

When income tax rates are quoted, economists call that a tax-inclusive quote: “I paid 23 percent last year.” If that were the case, for $100 one earned, $23 went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s a 23-percent tax-inclusive rate.

We choose to compare the FairTax to income taxes, quoting the rate the same way, because the FairTax replaces such taxes. That rate is 23 percent.

Sales taxes, on the other hand, are generally quoted tax-exclusive: “I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.” This rate, when programmed into a point-of-purchase terminal, is 30 percent.

Note that no matter which way it is quoted, the amount of tax is the same. Under an income tax rate of 23 percent, you have to earn $130 to spend $100.

Spend that same $100 under a sales tax, you pay that same $30, and the rate is quoted as 30 percent.

Perhaps the biggest difference between the two is under the income tax, controlling the amount of tax you pay is a complex nightmare. Under the FairTax, you may simply choose not to spend, or to spend less.

Figure 4: 23 percent tax-iunclusive vs. 30 percent tax-exclusive

To: Always Right; Sprite518

You're wasting your time -- he's not going to catch on.

To: Always Right

You are right about one thing. Whomever typed this up has their numbers all fouled up. He or she is trying to say the tax is revenue neutral that is it. In other words the federal government is going to collect the same amount of tax revenue at the 23% rate.

Don't get all caught up in the numbers because their math is wrong. Anyone that understands percentages would know this. Plus you can do it on a calculator.

Nevertheless, my whole point is that the only person, company, etc that has to be concerned with the taxes is the Buyer and not the Seller. This is because taxes only come from consumption. Not like todays Progressive tax system or a flat tax where no matter what you do you will still be taxed.

Did you know that conservative estimates of revenue that is being held off shore because of our current tax code is at least 10 Trillion dollars? Can you imagine if we bring that money home what it would do for our economy. Imagine all the new jobs it would add.

Oh and how about this with the illegal immigration. Right now I would guess that most illegal immigrants do not pay into tax system, but they use our welfare system, social security, and public schools. Under the fair tax(NRST) the illegal immigrants would have to pay the same consumption tax that everyone else pays when we make purchases.

Oh and going back just for a moment. Imagine all the headquarters that would relocate from all of the world here since they would not have to pay taxes. Just think about it. There is a book coming out written by my congress man and Neal Boortz. It is already at number three in the Barnes and Nobel Web site, and the book has not even gone into print yet. Basically there are many preorders. Here is a link. I suggest you buy it and read it. http://www.barnesandnoble.com/bestsellers/top100_cds2.asp?PID=5575&userid=fW0eXWcBf8&cds2Pid=5576

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson