Skip to comments.

Top 11 Secrets of a National Retail Sales Tax

Various

| 6-10-05

| Always Right

Posted on 06/10/2005 11:13:37 AM PDT by Always Right

1. The 23% sales tax rate turns 37%. A retailer who sells an item for $100 must charge his customer an additional $30 for federal sales tax. Most people familiar with state sales tax call this a 30% tax, since the tax is 30% of the seller's price. The Sales Tax folks call this a 23% tax, since $30 is 23% of the final price ($130 including tax), which they call the 'tax-inclusive' rate. Neither way is technically incorrect, it is just important to understand what is really being discussed. Remember this 30% tax-exclusive rate is only the federal portion of the tax, state sales tax will also be added in. With the elimination of federal reporting, states will have to replace their personal and corporate income receipts, with a sales tax. States collected nearly $500 Billion in 2003 through income tax and sales tax. With Personal Consumption at $7.76 Trillion in 2003, that is 6.4% in tax inclusive terms, which will add another 6.8% to the tax-exclusive rate. So if you buy $100 worth of goods, you will end of paying nearly $137 once State and Federal Sales tax.

2. Even 37% is not enough. One amazing fact when sales tax calculates their rate is that they assume 100% compliance. Everyone will cheerfully report every sale. There will be no under the table or black market sales. Also, no one will try to buy goods overseas to avoid this tax. This is pure fantasy. No one could believe any tax system will have perfect compliance and zero avoidance. The current income tax system has about a 15% tax-evasion rate. Conservatively, we could assume that the sales tax will have a similar tax evasion rate of 15% and a tax avoidance (like spending overseas) rate of 5%. With these more realistic assumptions, the tax rate would have to be bumped up to 44% to be revenue neutral. And these are very conservative assumption. Brookings Institute economist William Gale (National Retail Sales Tax, September, 2004) calculated that about a 60 percent sales tax would be required to be revenue neutral.

3. Fraudulent Calculations. Besides using ridiculous assumptions like 100% compliance, the sales tax economists create money out of thin air. Their paid for economists routinely double-count savings of their plan. The biggest one is being the $1.3 Trillion that individuals pay in taxes. Under the 30% Sales Tax bill, that money would end up in the pocket of individuals, and the proponents correctly tell you that take home pay will go up. But then the Sales Tax proponents go on to tell you that prices will go 25-33% to offset their 30% sales tax. Well if individuals are pocketing 67% of the taxes that are eliminated, how are businesses going to reduce prices very much? The sales tax eliminates about $650 Billion in taxes to businesses. Considering Americans consumers spend $8 Trillion on goods and services, that only allows for businesses to lower their costs by 8%. Once the 30% sales tax is added, the final end cost to the consumer will be 20% higher if the calculation were done honestly. Even allowing for a reasonable amount of savings in compliance costs to businesses under the sales tax system, prices would still shoot up 18-19%.

4. Millions must file. The Sales Tax supporters would have you believe that only retailers need to file under the Sales Tax. That simply is not true. In order to offer the 'low' 30% rate, the Sales Tax must tax services too. 'In 1993, 12,778,000 taxpayers filed individual returns with business income or losses, and another 1,919,000 filed farm returns. In addition, in 1992 the IRS received returns for 17,292,286 non-farm sole proprietorship businesses, 1,484,752 partnerships, and 3,868,004 corporations-all of which probably produced goods or services on which the sales tax would be levied. Thus the supposed simplicity of the sales tax turns out to be a mirage.' (Brookings Institution Policy Brief #31-March 1998) Thus over 35 million filers will still be subjected to reporting and audits, most of these are individuals. This doesn't even consider the 100 million of people who will still have their wages reported to the SSA. Also, all households must register every year with the 'sales tax administering authority' in order to receive your monthly tax rebate. Furthermore, individuals that buy things without sales tax, like overseas purchases, must submit monthly forms and payments to the government. Hardly the zero tax filings for individuals as the sales tax supporters claim.

5. Tax Evasion will skyrocket. 20 countries have tried a national sales tax, and 20 have switched to a value-added tax. These countries have gone on record and have flat out stated a retail tax of more then 12% is unworkable. People will avoid it, especially with the internet which makes it very easy for the common citizen to purchase goods from foreign sources. The fact that businesses to business sales are not taxed, makes it very tempting to buy personal stuff under a business name. It will take a mighty powerful and intrusive taxing authority to audit all business expensive to make sure. The sales tax rates we are talking about have never been successfully implemented in the history of the world, but it hasn't been for a lack of trying. "Many people would masquerade as businesses" to avoid the tax, says Robert Hall, an economist at the Hoover Institution. Gale reckons that evasion would be far higher than today 's estimated 15%.

6. Big Government gets Bigger. In the 20 countries where the national sales tax has been implemented, and in each case replaced by necessity by a Value-Added Tax, the amount of federal taxes quickly grew from about 20% of GDP, as currently in the US, to 40% and above of their GDP. Not a promising precedent.

7. Underground Economy still not taxed. The NRST advocates falsely claim that the underground economy now will be taxed. Nothing could be further then the truth. Sure, when the money re-enters the legal economy the money is taxed, but that is true today. But will the drug dealers and prostitutes remit sales tax for their goods and services under the NRST? Absolutely not, this portion of the economy is still invisible to the tax collector and therefore not taxed. According to Bruce Bartlett, 'thus whatever revenue is gained when drug dealers spend their ill-gotten gains will be lost because no tax was collected on their drug sales.' (Bruce R. Bartlett, senior fellow, National Center for Policy, Analysis, November 5, 1997).

8. Lower and Middle Income pay more. Steven Sheffrin of UC Davis in a 1996 CPS brief says that a revue-neutral consumption tax even with a generous personal exemption shifts the tax burden to the lower to middle income households. A 1992 Congressional Budget Office study of consumption based tax concluded the consumption tax would decrease the tax on the wealthiest 20% by five percent, while hitting all other groups with a higher tax burden. The poorest quintile being hit the hardest with a 20% increase in tax and the 20-40% income quintile being hit with 9.3% increase in their effective tax rate. This is because the poorest spend a much higher percentage of their income each year and in many cases are even forced to borrow to keep up with their expenses. These numbers are much worst today as the federal tax liability for the bottom 20% has been greatly reduced through expansion of the earned income tax credit.

9. Elderly assets are unfairly burdened. While people currently working will get to keep more of their paycheck, people on fixed incomes will stay the same. Elderly, who have already worked and saved under the income tax system, will now be faced with paying additional high consumption taxes. This group of especially hard hit people, will not have the opportunity to earn tax-free wages, so all their already taxed wealth will be taxed again when they spend it. Come January 1, 2007, if someone's rent was $1000, they will owe an additional $300 in federal tax alone, and many without any additional source of income.

10. Government Taxes Itself. One amazing thing is under the Sale Tax is that government somehow raises money by taxing itself. Whereas this is an interesting way to reduce government, it is typical of the smoke and mirrors the fraudulent analysis of the so-called fair taxers use. Under the plan, the government is considered the consumer and most of it's purchases and employee salaries are taxable. So if the state of Alabama pays its clerk $30,000 in salary, it would be liable to pay the federal sales tax of $9000. The same applies to the federal government, but it pays itself. An interesting way to raise revenue, but it more fraud on their part. If government could truely tax itself, why not just put 100% sales tax on government and then no one else would have to pay taxes.

11. Auto and Housing Industry Hit Hard. As the luxury taxes have proven in the past, adding a large sales tax on item deters people from buying. In 1991, after the Democrats snuckered Bush Sr. into signing the Luxury Tax, Yacht retailers reported a 77 percent drop in sales that year, while boat builders estimated layoffs at 25,000. And that was only for a 10% tax! With new homes and autos having to compete against existing homes and used cars, paying the additional 30% sales tax will be hard to swallow for most consumers.

TOPICS: Business/Economy; Government; News/Current Events; Your Opinion/Questions

KEYWORDS: fairtax; incometax; irs; nrst; salestax; taxes; taxreform

Navigation: use the links below to view more comments.

first previous 1-20 ... 581-600, 601-620, 621-640 ... 1,241-1,246 next last

To: AzaleaCity5691

You simply ignore all the empirical data on consumption being more stable than income throughout history. Odd tactic.

To: FreedomCalls

Is THAT what the states do now with income/withholding taxes??

If so perhaps what you envision is reasonable; otherwise (and I've heard of no such instances of that happening) what you project is nonsense. Why would they suddenly start??

602

posted on

06/11/2005 6:52:33 PM PDT

by

pigdog

To: UnbelievingScumOnTheOtherSide; Blood of Tyrants

First, it's an N

RST. THere's a big difference. Second, the drug dealer will pay more of his taxes under the nrst.

Today, the drug dealer only pays a portion of his tax burden, the part embedded in prices (he pays none of his income tax nor any of his FICA.) But under the nrst, ones full tax burden is paid thru purchases for retail consumption...the drug dealer begins paying his full burden via consumption. Under the income tax, the dealer only pays a portion of his taxes, under the nrst the dealer pays all his taxes. Hence the drug dealer pays more tax under the nrst.

To: Principled

leprocy is hughly series -- nearly as bad as leprosy

To: expatpat

To: Principled

This analogy is hyperbole. First of all, we don't have terminal illness with the IT - more like toothache. If the possible side effects are that his gonads may fall off, he's right to turn down the sanke-oil medecine.

To: expatpat

To: expatpat

....and snake. I guess I'll have to type slower -- or use the spell checker.

To: Principled

But under the nrst, ones full tax burden is paid thru purchases for retail consumption...the drug dealer begins paying his full burden via consumption. Which is total crap, unless he remits sales tax on his gross receipts which he will not. Unless the sales tax captures this part of the economy the arguement is false.

To: AzaleaCity5691

Please go read #580 (again). I responded to your credit card question.

I've also asked you to read the bill which you have obviously not done - nor the extensive economic information of the FairTax website. Please do read those before continuing.

610

posted on

06/11/2005 7:27:58 PM PDT

by

pigdog

To: Always Right

That's not what ws said, Rongie. It was "... thru purchases for retail consumption ...".

Nothing was said about his illegal income. You SQL guys are always trying to dredge up illegal income to say "... see, see. it doesn't capture his illegal income ...". No one (EXCEPT YOUSE GUYS) ever said it did. Illegal income by definition isn't taxed directly under any tax system. In fact, that's why they call it illegal income.

The FairTax does capture tax revenue from the illegal income when it is spent for retail consumption on taxable items.

611

posted on

06/11/2005 7:35:28 PM PDT

by

pigdog

To: Principled; Fido969

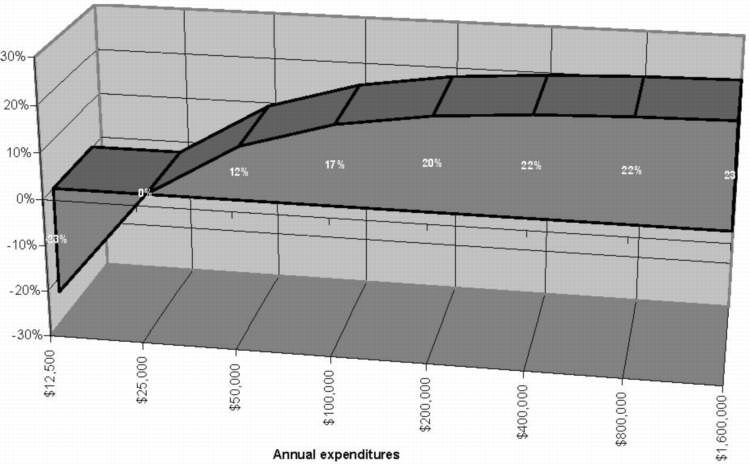

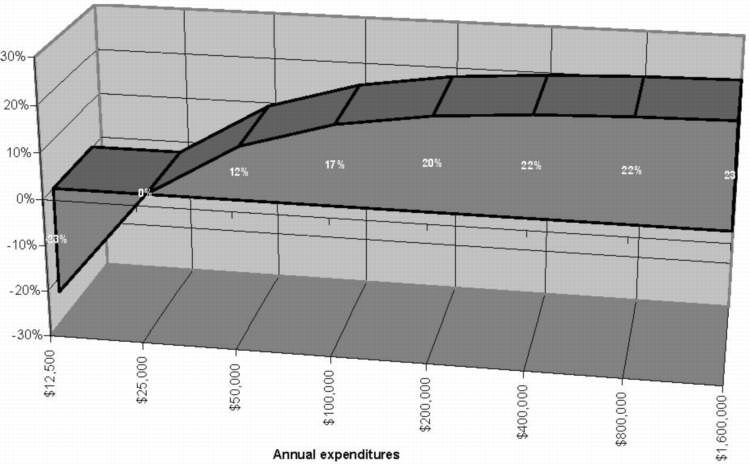

You could give to charity and pay less tax... maybe ancient_geezer would post a graph illustrating effective rates by $ spent...?

Ohhh, I suppose that might be possible ;O)

Refer FairTax FAQ #45:

Figure 5: Annual expenditures vs. FairTax effective tax rates, for a family of four

612

posted on

06/11/2005 7:40:11 PM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Principled

That is what I have been trying to get across to "Always Right". Plus, I do believe that the drug dealer, having no legal job, would not get a monthly rebate check, either.

613

posted on

06/11/2005 7:45:37 PM PDT

by

Blood of Tyrants

(G-d is not a Republican. But Satan is definitely a Democrat.)

To: Principled; ancient_geezer; Always Right; All

Today, the drug dealer only pays a portion of his tax burden, the part embedded in prices (he pays none of his income tax nor any of his FICA.) Which brings up a point. I haven't been following this thread to any great degree so if you guys have addressed this earlier, my apologies. Under the NRST, how do we determine SS benefits? Currently, the benefits accrue based on money paid in from earned income. A drug dealer who reports no earned income has accumulated no SS benefits. Under a NRST he/she will be entitled. How will it be determined?

614

posted on

06/11/2005 7:45:44 PM PDT

by

groanup

(our children sleep soundly, thank-you armed forces)

To: justshutupandtakeit

Not true, jsuati!! The 23% tax inclusive will be on every receipt you get for a purchase under the FairTax.

It is clearly spelled out as tax inclusive along with the price of the thing itself and the amont of the tax as well as the tax-inclusive rate.

615

posted on

06/11/2005 7:58:03 PM PDT

by

pigdog

To: groanup

Under the NRST, how do we determine SS benefits?

By reporting wage income to the Social Security Administration, as is required under the Title II of the Social Security Act.

Currently, the benefits accrue based on money paid in from earned income.

Strictly speaking they don't, they accrue on the basis of reporting of wages only, not by taxes paid.

The tax that is collected actually is paid into general revenues, from which is made an annual appropriation for Social Security Accounting under 42 USC 401 on the basis of total reported wagebase.

Specifically benefits are based on reported wages for the individual however.

A drug dealer who reports no earned income has accumulated no SS benefits.

Under a NRST he/she will be entitled.

Only if they have an SSN & report wages or "self-employment?" earnings to the Social Security Administration.

Wage earnings are reported to SSA by employers, or by self-employment reports to the SSA for benefits purposes.

H.R.25

Fair Tax Act of 2005 (Introduced in House)

http://thomas.loc.gov/cgi-bin/query/z?c109:H.R.25:

`CHAPTER 9--ADDITIONAL MATTERS `SEC. 903. WAGES TO BE REPORTED TO SOCIAL SECURITY ADMINISTRATION.

`(a) In General- Employers shall submit such information to the Social Security Administration as is required by the Social Security Administration to calculate Social Security benefits under title II of the Social Security Act, including wages paid, in a form prescribed by the Secretary. A copy of the employer submission to the Social Security Administration relating to each employee shall be provided to each employee by the employer. `(b) Wages- For purposes of this section, the term `wages' means all cash remuneration for employment (including tips to an employee by third parties provided that the employer or employee maintains records documenting such tips) including self-employment income; except that such term shall not include--

`(1) any insurance benefits received (including death benefits); `(2) pension or annuity benefits received; `(3) tips received by an employee over $5,000 per year; and `(4) benefits received under a government entitlement program (including Social Security benefits and unemployment compensation benefits).

`(c) Self-Employment Income- For purposes of subsection (b), the term `self-employment income' means gross payments received for taxable property or services minus the sum of--

`(1) gross payments made for taxable property or services (without regard to whether tax was paid pursuant to section 101 on such taxable property or services), and `(2) wages paid by the self-employed person to employees of the self-employed person.

|

616

posted on

06/11/2005 8:05:10 PM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Your Nightmare

It's not a wash at all. Many drug purchases are made with stolen money, not earned income and so your argument fails.

In fact, you have no basis for the statement at all since it is just as likely as not that the John & drug buyer paid little or no in the way of income taxes. That asumption is equally as valid as to the flight of fancy you came up with.

Under that assumption none of the 4 paid much or any income taxes so the government got nothing whereas with the FairTax they will derive much more tax revenue. There is no "wash".

617

posted on

06/11/2005 8:06:21 PM PDT

by

pigdog

To: Blood of Tyrants

Plus, I do believe that the drug dealer, having no legal job, would not get a monthly rebate check, either.

Actually he could qualify for a monthly rebate check if he has a SSN and is willing to provide an address to government send the check to. At a $180/month I suspect most will forgo the benefit of giving government an address for something that will be taken away from them if found guilty of a crime and incarcerated. Folks in jail don't collect it.

618

posted on

06/11/2005 8:17:20 PM PDT

by

ancient_geezer

(Don't reform it, Replace it!!)

To: Always Right

"This utopia promised by the Sales Tax faithful is no different than the disasters promised by the fear-mongering global warmers. It's all based on unrealistic assumptions and faulty computer modeling rigged to produce the desired result." It's called the 'foot in the door.'

Just like the "introductory rate" of a variable interest mortgage, which is usually at least a full point below the rate that would be generated by the formula in the contract. A national sales tax would be a disaster for our economy, and a huge reduction in our personal freedom.

.

619

posted on

06/11/2005 8:32:06 PM PDT

by

editor-surveyor

(The Lord has given us President Bush; let's now turn this nation back to him)

To: ancient_geezer

620

posted on

06/11/2005 9:00:49 PM PDT

by

groanup

(our children sleep soundly, thank-you armed forces)

Navigation: use the links below to view more comments.

first previous 1-20 ... 581-600, 601-620, 621-640 ... 1,241-1,246 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson