Skip to comments.

Kerry Raps Bush's National Sales Tax Quip

AP on Yahoo ^

| 8/12/04

| Nedra Pickler - AP

Posted on 08/12/2004 3:03:02 PM PDT by NormsRevenge

CARSON, Calif. - John Kerry (news - web sites) said Thursday that President Bush (news - web sites)'s musing about a national sales tax is an insult to financially struggling voters and would amount to "one of the largest tax increases on the middle class in American history."

The Democratic presidential nominee, during a speech at California State University, Dominguez Hills, tried to reverse partisan stereotypes by portraying the Republican president as the tax raiser and himself as a tax cutter.

Kerry said if Bush wants to create a national sales tax without increasing the deficit, people will end up paying at least 26 percent more for purchases on top of state and local sales taxes.

"We know exactly who that's going to hurt," Kerry said . "That's going to hurt small business. It's going to hurt jobs. It's going to hit the pocketbooks of those who need and deserve tax relief most in America."

Bush has suggested that overhauling the tax code would be a second-term priority if he is re-elected. While campaigning in Florida Tuesday, he said replacing the income tax with a federal sales tax is "an interesting idea that we ought to explore seriously."

Kerry seized on Bush's comments even as White House officials downplayed the idea and denied that any such plan is under consideration.

Kerry said Bush has failed to offer a plan for improving the economy in his second term. He said the president's tax cuts have resulted in a tax increase on the middle class because their state and local taxes have been increased to compensate for loss of revenue from the federal government. He said a national sales tax would only further burden the middle class.

"I call it one of the largest tax increases on the middle class in American history," Kerry said. "And this is coming from an administration that has offered almost no new ideas for our economy, and the few ideas that they have offered have only hurt middle class families. This new idea is no different."

Kerry repeatedly invoked the memory of better economic times under another Democratic president, Bill Clinton (news - web sites). He said Clinton's advisers were helping craft his economic plan and that he will be "a champion for the middle class" by cutting their taxes while lowering the deficit.

Kerry said he would offer tax breaks to help pay for health care premiums, child care and college tuition, paid for by repealing Bush's tax cuts for people earning more than $200,000 a year.

"They will go back to paying the same taxes they paid when Bill Clinton was president," Kerry said. "That was a time when every American rich got richer."

Bush campaign spokesman Steve Schmidt said Kerry cannot pay for his tax plan.

"John Kerry's numbers don't add up," Schmidt said. "He has spent his tax hike more times than anyone can keep track of."

He was also fighting Bush campaign's charge that Kerry has a long history of voting for higher taxes during his 19-year career in the Senate.

TOPICS: Business/Economy; Government; Politics/Elections

KEYWORDS: bush; fairtax; kerry; national; nrst; quip; raps; salestax; taxreform

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-138 next last

To: Your Nightmare

BTW, are economic papers even peer reviewed?

Certainly they are when the are published in recognized journals for the field specifically for that purpose.

You want to cite a "peer reviewed" study (not income tax hit pieces) that confirms your "conservative $800 billion cost of tax compliance"?

You will find them cite in James L. Payne's, Costly Returns.

http://www-hoover.stanford.edu/PRESSWEBSITE/FlatTax/notes.html

A comprehensive review of all the studies that attempt to measure the costs associated with the federal income tax appears in James L. Payne, Costly Returns: The Burdens of the U.S. Tax System (San Francisco: Institute for Contemporary Studies Press, 1993). Payne summarizes the estimates of compliance costs that appear in the following studies: Joel Slemrod and Nikki Sorum, "The Compliance Cost of the U.S. Individual Income Tax System," National Tax Journal 37 (December 1984): 462–65; Arthur D. Little, Inc., Development of Methodology for Estimating the Taxpayer Paperwork Burden (Washington, D.C.: Internal Revenue Service, 1988), pp. III–23; James T. Iocozzia and Garrick R. Shear, "Trends in Taxpayer Paperwork Burden," in Internal Revenue Service, Trend Analyses and Related Statistics, 1989 Update (Washington, D.C.: U.S. Government Printing Office, 1989), p. 56; Annual Reports of the commissioner of the Internal Revenue Service; and a variety of other IRS memoranda.

81

posted on

08/13/2004 9:38:31 AM PDT

by

ancient_geezer

(Equality, the French disease: Everyone is equal beneath the guillotine.)

To: ancient_geezer

The most recent paper reviewed in Costly Returns is 15 years old. Is there nothing more recent? Or is there and it doesn't agree with your claims?

Here's a hint: there is and it doesn't.

To: Helms

This is typical demon BS - do you remember how wet Willie took credit for Republican suggestions and innovations? His attitude was 'let the fools dig their own hole and fall in - but if it works, we'll take credit for it.'

83

posted on

08/13/2004 9:46:33 AM PDT

by

hardhead

(Unfathomable Paradox: A Destitute Lawyer)

To: Your Nightmare; Tax Government; Principled; kevkrom; ovrtaxt; ancient_geezer; Bigun; Taxman

"Notice how the real inclusive rates have to change when you modify the city rate? When you change that rate you change the "gross payment" and your 23% inclusive federal rate is now collecting 23% of a different amount than the other city. Also notice how easy it is to add the tax exclusive sales tax rates. It's the natural way to express the additive sales tax.

Again, using the tax inclusive rate for sales taxes is not a matter of preference, it's flat out wrong. Just as it would be wrong to use exclusive rates with an income tax (similar things would happen).

Y'all can be reasonable, realize the error, and make a change; or continue to hang on and go down with the "tax inclusive" ship. I really don't know why y'all are so insistent on the tax inclusive rate anyway."

-- Like I told you, the $100 number is hypothetical. The retailer simply raises prices t owhatever amount he feels he needs to cover his prices. It's taxing HIS sales, so the $72.50 number is irrelevant. This is if you look at it as a "single-layer VAT."

If you want to dig deeper, you'll see that what happened here is that state and local taxes taxed FEDTAX.

If the State and local authorities did not want to "tax taxes", then they would simply deduct "other taxes paid" before applying theirs, it can all be done on the retaier side. Again, all the buyer would see is the final price, and they would be told how much of it actually went to taxes.

By the way I see your tactic every time the FairTax comes up: Turn the dabate away from one on fundamentals to one based on abstract mathematics. I fall it for myself.

From now on I won't respond to your stupid inclusive-exclusive arguments. Ancient_geezer won't either. When you try and propagandize a new FReeper, we'll email them, clear it up, prevent the dabate from being poisoned.

To: Your Nightmare

Here's a hint: there is and it doesn't.

You want to cite the "peer reviewed paper? and provide a link to it?

So we can see what it includes for computation of compliance, litigation, research, planning, Evasion and avoidance, Disincentive to production, Disincentive cost of tax uncertainty ...

85

posted on

08/13/2004 9:56:52 AM PDT

by

ancient_geezer

(Equality, the French disease: Everyone is equal beneath the guillotine.)

To: balrog666

To name a few:

1) Payroll taxes - gone

2) Time and money spent on IRS crap - gone

3) Product not taxed until bought by consumer - Multi-tier tax structure from vendor company to consumer company vanishes

IRS crap - Hiring attorneys to interpret the new changes, hiring accountants to find all loopholes that you can benefit from, etc.

86

posted on

08/13/2004 10:01:37 AM PDT

by

Eagle of Liberty

(There are two Americas and one of them is severely losing)

To: johnfrink

And I just got a bonus which I paid more than 30% in on income taxes..

Why does it make more sense to tax production than consumption?

87

posted on

08/13/2004 10:11:44 AM PDT

by

N3WBI3

To: Kerretarded

To name a few Don't forget:

- Administering special "pre-tax" programs for employees such as 401k, medical savings accounts, child-care accounts

- Lost opportunity costs due to sheltering income and assets from taxes rather than investing them for growth

- Higher interest rates

- Lower net return on investment, making the business less attractive to additional investment

88

posted on

08/13/2004 10:13:15 AM PDT

by

kevkrom

(My handle is "kevkrom", and I approved this post.)

To: Remember_Salamis

Like I told you, the $100 number is hypothetical. The retailer simply raises prices t owhatever amount he feels he needs to cover his prices. It's taxing HIS sales, so the $72.50 number is irrelevant. This is if you look at it as a "single-layer VAT."

And the retail store in Austin will have to list his prices as higher than a store across the street in Pflugerville. And if they want to advertise a price they will have to list prices for every tax district the ad goes to (definitely no national advertising). I'm sure they would really appreciate you simplifying things for them.

If the State and local authorities did not want to "tax taxes", then they would simply deduct "other taxes paid" before applying theirs, it can all be done on the retaier side.

Interesting. So they would figure the price exclusive of taxes and then figure a ... what shall we call it? ... a "tax exclusive" sales tax rate. They can then apply this "tax exclusive" sales tax rate to the "tax exclusive" price of the item. This does make sense. This "tax exclusive" sales tax rate is a very good idea. You should tell the AFT people about this idea. I think it's a winner.

By the way I see your tactic every time the FairTax comes up: Turn the dabate away from one on fundamentals to one based on abstract mathematics. I fall it for myself.

First, I didn't bring it up. Second, it's a critical flaw in your plan. Until you change it, it is one of the fundamentals of the debate.

From now on I won't respond to your stupid inclusive-exclusive arguments. Ancient_geezer won't either. When you try and propagandize a new FReeper, we'll email them, clear it up, prevent the dabate from being poisoned.

Nice tactic. When you are shown clearly how your plan is seriously flawed, don't refute, just end the discussion.

To: ancient_geezer

So we can see what it includes for computation of compliance, litigation, research, planning, Evasion and avoidance, Disincentive to production, Disincentive cost of tax uncertainty ...

While I preparing a list, maybe you could point us to the peer reviewed papers that justify you $800 billion number and include all this.

To: NormsRevenge

You missed the key point of the article... NO mention of Vietnam. Now that's big news... has this hit Drudge yet?

Comment #92 Removed by Moderator

To: Your Nightmare

Other FReepers are getting turned off by threads that devolve in obscure mathematical debates.

FreeRepublic is a board for politics and culture, not math.

So if your'e saying there's simply a math problem, are you saying that the effects of the FairTax on the economy are sound?

If so, great. The mathematics will be sorted out by the PhDs. What about the politics of it?

How do you see a NRST affecting the economy???

If your only beef with the NRST is the inclusive-exclusive debate, great! So if AFFT made you happy and quoted it in exclusive terms, you'd be a FairTax supporter? After all, you never bring up anything else.

Let's talk about the politics of it.

To: Kerretarded

1) Payroll taxes - gone Okay there's a 2% savings to the company.

2) Time and money spent on IRS crap - gone

Wrong. Payroll matters will still be reported to the SSA.

Profits and losses will still be tracked and reported.

3) Product not taxed until bought by consumer - Multi-tier tax structure from vendor company to consumer company vanishes

No change. Business-to-business transactions are not taxed now.

IRS crap - Hiring attorneys to interpret the new changes, hiring accountants to find all loopholes that you can benefit from, etc.

You don't think there will ever be loopholes in the NRST?

* Administering special "pre-tax" programs for employees such as 401k, medical savings accounts, child-care accounts

No change. Those are already established programs and are part of employee compensation.

* Lost opportunity costs due to sheltering income and assets from taxes rather than investing them for growth

No change. Only whom they are sheltered from will change.

* Higher interest rates

Utter crap. And only of interest to business when they borrow money.

* Lower net return on investment, making the business less attractive to additional investment

That will depend on what happens to sales and profits under the NRST.

94

posted on

08/13/2004 10:50:08 AM PDT

by

balrog666

(A public service post.)

To: NormsRevenge

So according to Kerry, lowering taxes is bad for the poor, and raising taxes is bad for the poor. Typical. Anybody got any waffle .jpg's they'd like to post ?

95

posted on

08/13/2004 10:51:39 AM PDT

by

BSunday

(Revelation 17:14)

To: Remember_Salamis

Other FReepers are getting turned off by threads that devolve in obscure mathematical debates.

The math is only obscure because you insist on using the incorrect way of expressing a sales tax. Express it the correct way and the math is very simple (if you can add and multiply).

As far as how the Fairtax would affect the economy, let's just say I find the FairTax supporter's guesstimations to be "overly optimistic."

To: Your Nightmare

You didn't answer my question. If HR 25, S 1493, and the folks at AFFT quoted it in exclusive terms, would you be on board???

By the way, here's AFFT's official answer to the inclusive-exclusive answer:

--------------------------------------------------

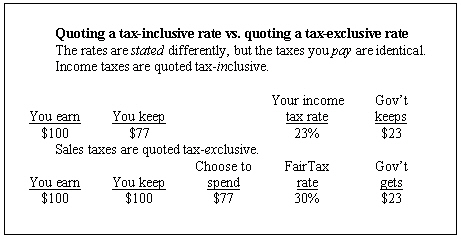

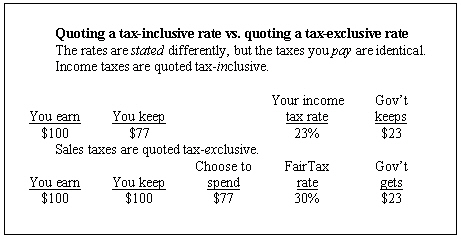

I know the FairTax rate is 23 percent when compared to current income taxes. What will the rate of the sales tax be at the retail counter? 30 percent. This issue is often confusing, so we explain more here.

When income tax rates are quoted, economists call that a tax-inclusive quote: “I paid 23 percent last year.” If that were the case, for $100 one earned, $23 went to Uncle Sam. Or, “I had to make $130 to have $100 to spend.” That’s a 23-percent tax-inclusive rate.

We choose to compare the FairTax to income taxes, quoting the rate the same way, because the FairTax replaces such taxes. That rate is 23 percent.

Sales taxes, on the other hand, are generally quoted tax-exclusive: “I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.” This rate, when programmed into a point-of-purchase terminal, is 30 percent.

Note that no matter which way it is quoted, the amount of tax is the same. Under an income tax rate of 23 percent, you have to earn $130 to spend $100.

Spend that same $100 under a sales tax, you pay that same $30, and the rate is quoted as 30 percent.

Perhaps the biggest difference between the two is under the income tax, controlling the amount of tax you pay is a complex nightmare. Under the FairTax, you may simply choose not to spend, or to spend less.

Figure 4: 23 percent tax-iunclusive vs. 30 percent tax-exclusive

To: Remember_Salamis

“I bought a $77 shirt and had to pay that same $23 in sales tax. This is a 30-percent sales tax.” Or, “I spent a dollar, 77¢ for the product and 23¢ in tax.”

Well they are wrong, aren't they (unless this purchase was made in one of the very few states without a sales tax).

To: Remember_Salamis

You didn't answer my question. If HR 25, S 1493, and the folks at AFFT quoted it in exclusive terms, would you be on board???

No.

To: balrog666

1) Payroll taxes - gone

Okay there's a 2% savings to the company.

Still a savings. That is like a RAT saying that we haven't found any WMD. Then you tell them that we have found dozens of shells of sarin. Then they say that you haven't found the "stockpiles".

2) Time and money spent on IRS crap - gone

Wrong. Payroll matters will still be reported to the SSA. Profits and losses will still be tracked and reported.

I am correct. Payroll matters may be reported but not taxed. Profits and losses will always be tracked. That is just good business sense. This is not tied to having to go through all of the BS with the IRS when running a small business.

3) Product not taxed until bought by consumer - Multi-tier tax structure from vendor company to consumer company vanishes

No change. Business-to-business transactions are not taxed now.

BULLS**t!!! Everything that a business buys to use for their subassembly is taxed. When that business sells their subassembly, it is taxed. When a business buys that subassembly to use for their subassembly, it is taxed. The final assembly price includes all of the previous taxes PLUS the final sales tax.

IRS crap - Hiring attorneys to interpret the new changes, hiring accountants to find all loopholes that you can benefit from, etc.

You don't think there will ever be loopholes in the NRST?

Name a theoretical loophole. Besides, the NRST would abolish the 16th Amendment, a very good thing, and would abolish the IRS, also a very good thing.

100

posted on

08/13/2004 12:01:28 PM PDT

by

Eagle of Liberty

(There are two Americas and one of them is severely losing)

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-138 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson