Posted on 10/27/2025 7:48:54 PM PDT by SeekAndFind

Quote of the week: “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair. “ - Sam Ewing

The ‘debasement trade’ has been gathering momentum all year, but it's really gathered momentum in the financial media lately. And then just to keep everyone on their toes, the gold price took a tumble on Tuesday.

So what is the debasement trade? Is it real, and should you be following it?

In this piece, we’ll unpack what debasement really means, why it’s driving markets today, and how to think about real assets, stocks, and strategies that can protect your portfolio when the value of the denominator itself starts to come into question.

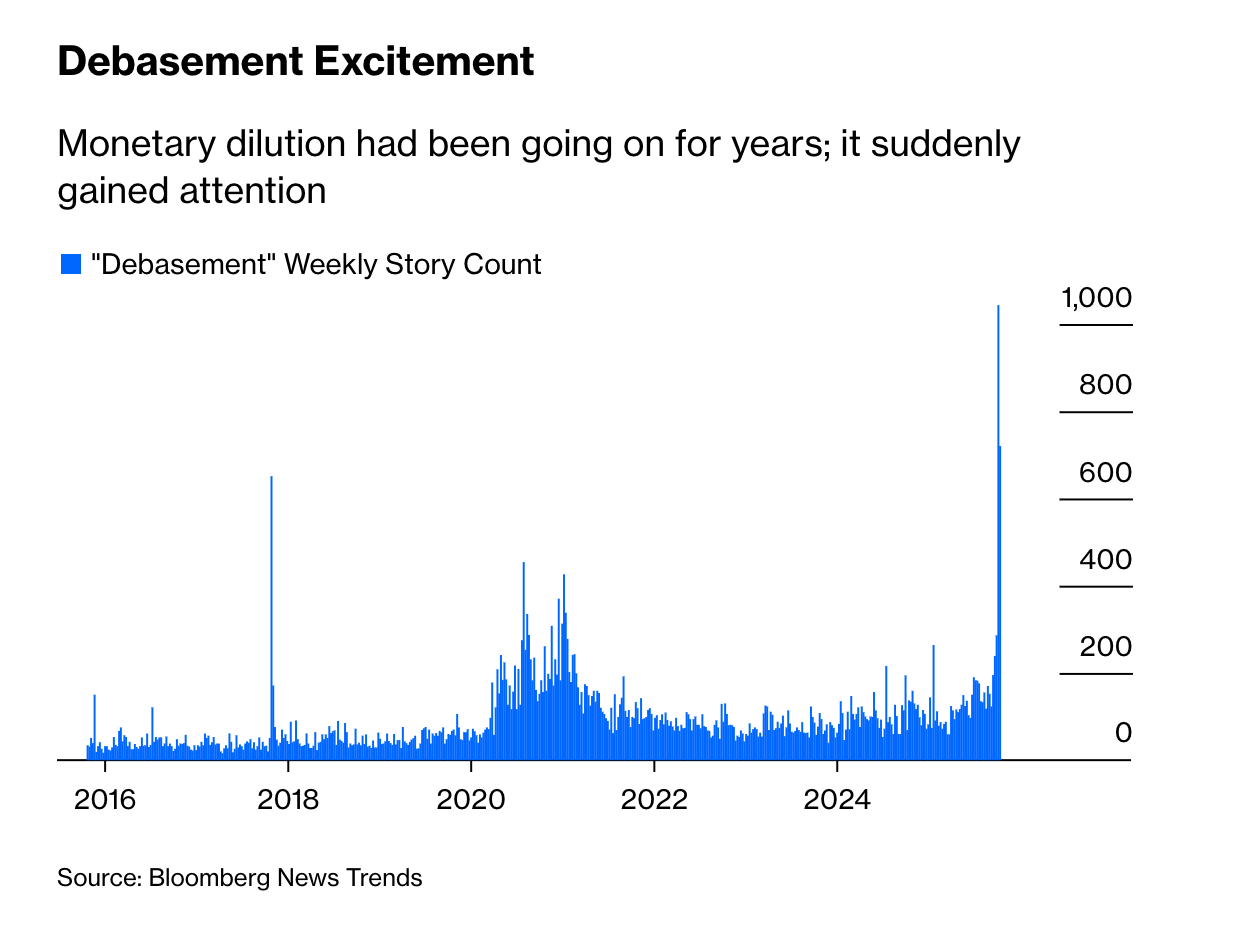

The term ‘debasement trade’ isn’t entirely new, but based on the number of stories mentioning the term, it’s been getting a lot more airtime and interest lately.

Source: Bloomberg Opinion Newsletter

Google search results display a similar trend. It isn’t a coincidence that mentions are closely correlated with the price of gold, silver, and bitcoin.

So, is everyone talking about the debasement trade because the gold price is flying? Or , is the gold price on fire because everyone’s banging on about debasement?

Let’s break it down.

Currency debasement refers to the devaluation of a currency . Yes, effectively the same as inflation, but debasement can be more deliberate.

Back in the old days, ruling monarchs would literally debase gold and silver coins by adding cheaper metals during minting. Or by simply minting smaller coins. The Roman Empire did “ coin clipping ”.

This allowed them to repay their debts “in full” - but not really. Adam Smith called it a ‘pretend payment’ in ‘The Wealth of Nations’ , published in 1776.

Modern debasement is the same idea, just with printers. It happens through:

The combination of deficit spending and inflation leads to an increase in nominal GDP (not real GDP). That means the debt to GDP ratio falls (or stays flat) - but what’s really happening is that the value of the debt is falling in real terms.

✨ In other words, the government repays the $100 you lent them, but you discover it doesn’t buy what it did when you first lent it to them.

With global debt at eye-watering levels (the U.S. is near 120% of GDP, Japan is over 260%), there’s an incentive to adopt this approach. The alternatives involve cutting costs or raising taxes, both of which are politically unpopular.

Donald Trump’s commitment to the Big Beautiful Bill and potentially inflationary policies has reinforced the view that this is where things are headed.

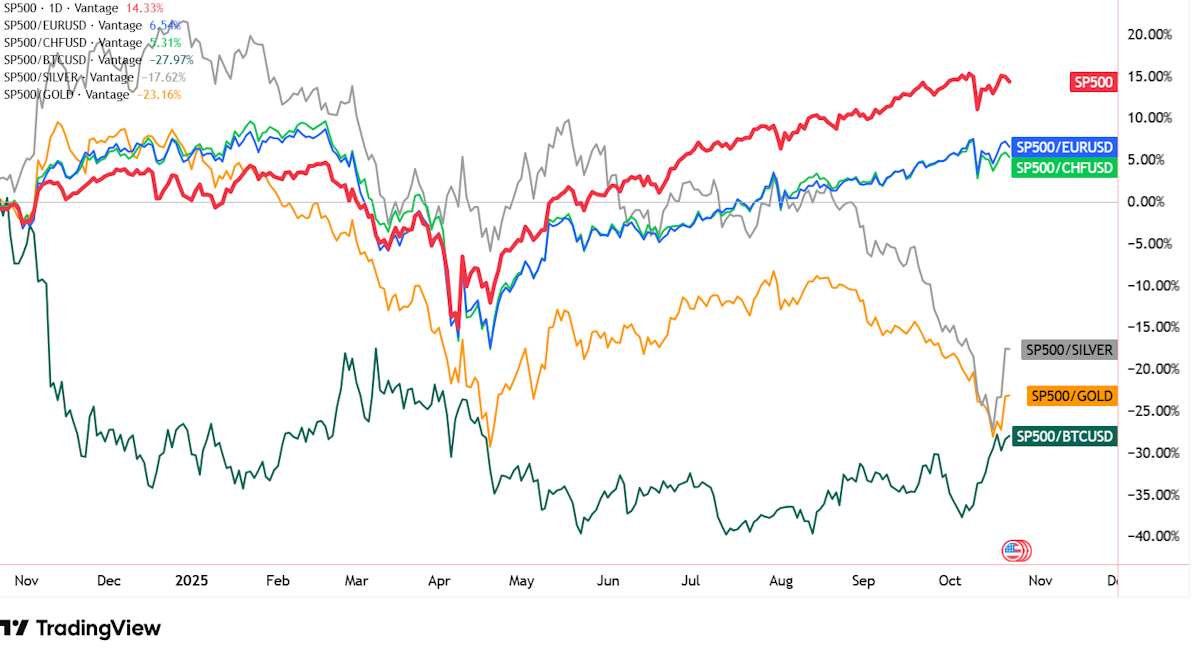

The S&P 500 index is up about 15% over the last year, which isn’t a bad return.

The thing is, though, if you measure that return in another currency , like the Euro or Swiss Franc, it’s only up about 5% .

Change your denominator to Gold, Silver or Bitcoin, and it’s actually down ~20%.

And, while the index is making new record highs ( in USD terms ), it’s still below the 2024 peak when measured by those other currencies and assets.

S&P 500 Index - TradingView

The jury is still out on whether the market is actually positioning for:

Keep in mind, the USD weakness has also been a result of global investors diversifying their equity portfolios , and expectations for rates to fall faster in the US than elsewhere.

The strength in Gold and Bitcoin is also at least partially due to specific catalysts, but more on those later.

Opinions about the future of fiat currencies compared to assets like Gold, Silver, and Bitcoin are widely divided. So here’s each side:

📈 The “Pro-Debasement” Arguments

📉 The “Skeptical” Arguments

US TIPS Breakeven Rates - Reuters

Another argument in the skeptical column is that gold has become a momentum trade.

That’s probably true regardless of whether the debasement argument is valid. The higher an asset’s price rises, the more buyers arrive, often with leverage and short time horizons.

So… There are still conflicting signals. It’s a powerful story, but keep in mind that many of the pundits on either side of the argument have strong biases.

Investors like Ray Dalio, who try to build “All-weather” portfolios that benefit no matter the season, advocate for having as much as 15% of your portfolio in gold for these exact reasons.

📄 Financial assets are assets that derive their value from claims on future cash flows.

🏗️ Real assets are physical, or tangible. Their value is derived from their utility and scarcity, rather than cash flows.

Owning real assets in a portfolio is really a hedge against currency debasement, rather than an investment to generate wealth. But a growing number of investors view real assets as an alternative, or a compliment to bonds, as a stabilizing component of a portfolio.

Gold and Silver are still the go-to real assets, but what are the others?

🪙 Metals and energy commodities :

⛏️ Commodity producers:

🧑🌾 Alternatives:

🏘️ Real Estate:

Okay, back to the shiny stuff.

On Tuesday, the gold price fell 6%, its biggest daily decline in over a decade . Silver and other precious metals followed it lower.

The correction was attributed to all sorts of things, including a possible easing of US/China hostility . Markets in India were also closed for Diwali, meaning slightly less liquidity from a key market for physical gold.

After Gold’s 55% year-to-date rally, a bit of volatility shouldn’t really come as a surprise.

In April, we covered the bull case for gold in detail. So what’s changed since then?

One of the key catalysts, the weaponization of the US dollar, hasn’t gone away, though. Gold still gives central banks more autonomy than USD assets that can be frozen (like after Russia’s invasion of Ukraine).

✨ The fact that gold has now surpassed US Treasuries in terms of central bank reserves globally tells us that they are increasingly valuing durability and neutrality over yield.

Source: Financial Times (chart above only goes to June 30, 2025, when the gold price was $3,286 per ounce. At today’s prices, it now surpasses US Treasuries)

So, the bull case for gold isn’t over, but with more speculative ownership, more volatility could be in store.

Gold, and at times, other real assets, can be an effective hedge against uncertainty, volatility, and inflation.

But when everyone’s talking about an asset, there’s every chance it’s owned by a lot of speculators via leveraged instruments . So, that’s probably not the best time to be piling in hand over fist.

If you think currency debasement is on the cards, dollar cost averaging , or accumulating on weakness , can be a good way to increase your exposure. But, there’s another way to hedge against inflation and currency debasement:

💪 Not all stocks are victims. Some are victors.

The key is pricing power : A company’s ability to raise prices without scaring away customers. This lets them pass on higher costs and protect their profits.

✨ Companies that provide essential goods and services, and have strong moats, can keep pace with inflation and compound their earnings over time.

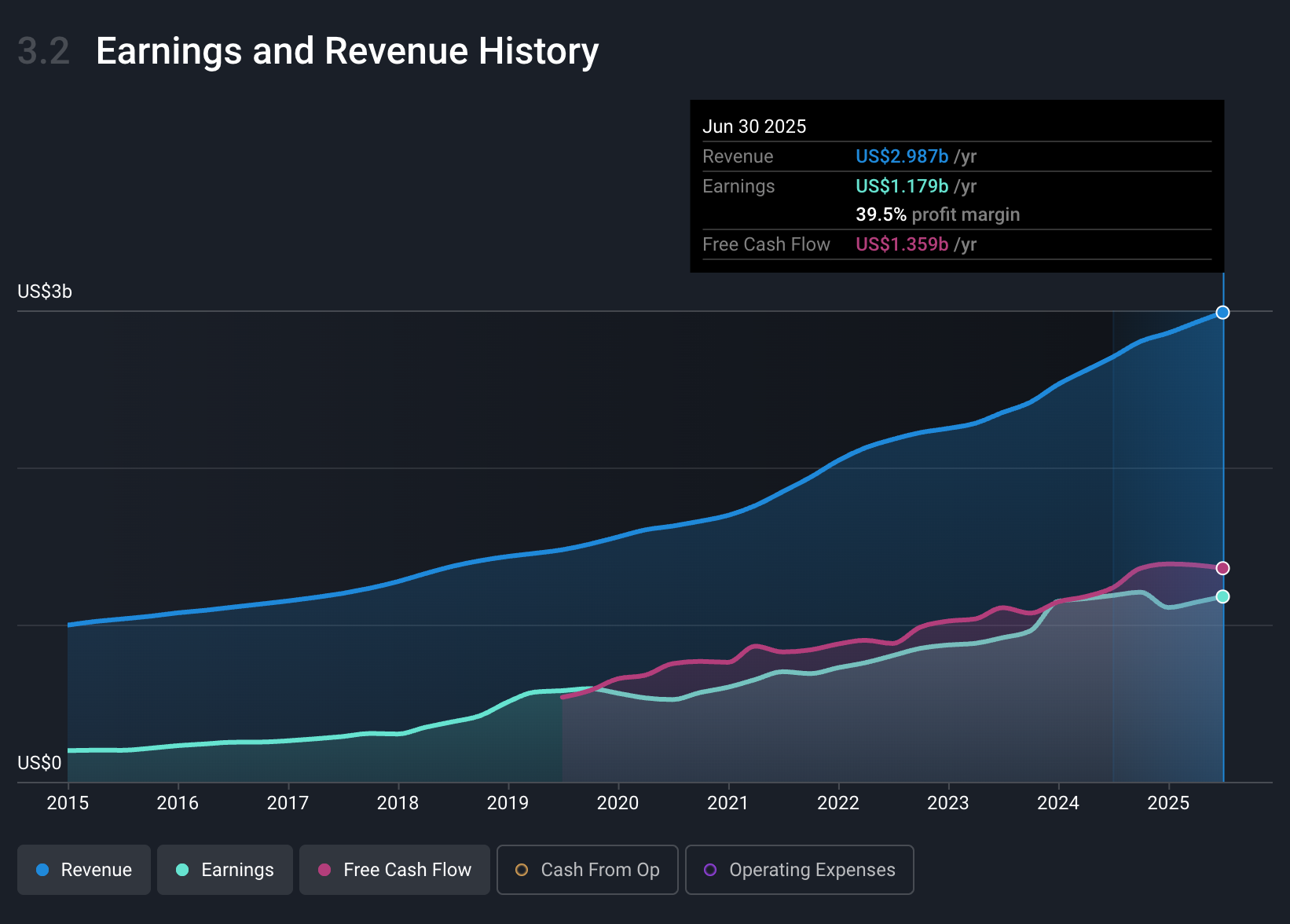

Look for leaders in growing industries (like MSCI below) that have monopoly-like positions.

MSCI Revenue, Earnings, and Cash Flow - Simply Wall St

Or in consumer-facing industries, companies that sell essential goods and services (eg, Procter and Gamble ). For consumer businesses, have a look at their margins in 2022 (when inflation spiked) and see if they managed to maintain their margins and whether revenue kept pace with inflation.

Seems like Proctor and Gamble was one of those businesses able to pull it off .

Didn’t we have 19% inflation under Biden? And no one gave a damn? I’m not saying we haven’t inflated our currency before buy the fact newspaper people who can’t do math are making a big deal out of this means it’s the new ‘hate Trump’ crap we’ve seen nonstop from democrats.

The advantage of being a reserve currency is that we CAN do this if we need to... and that’s a good thing.

Hopefully we won’t need to now that Trump is using tariffs and downsizing government waste... but it’s nice to know it’s out there if we need it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.