Skip to comments.

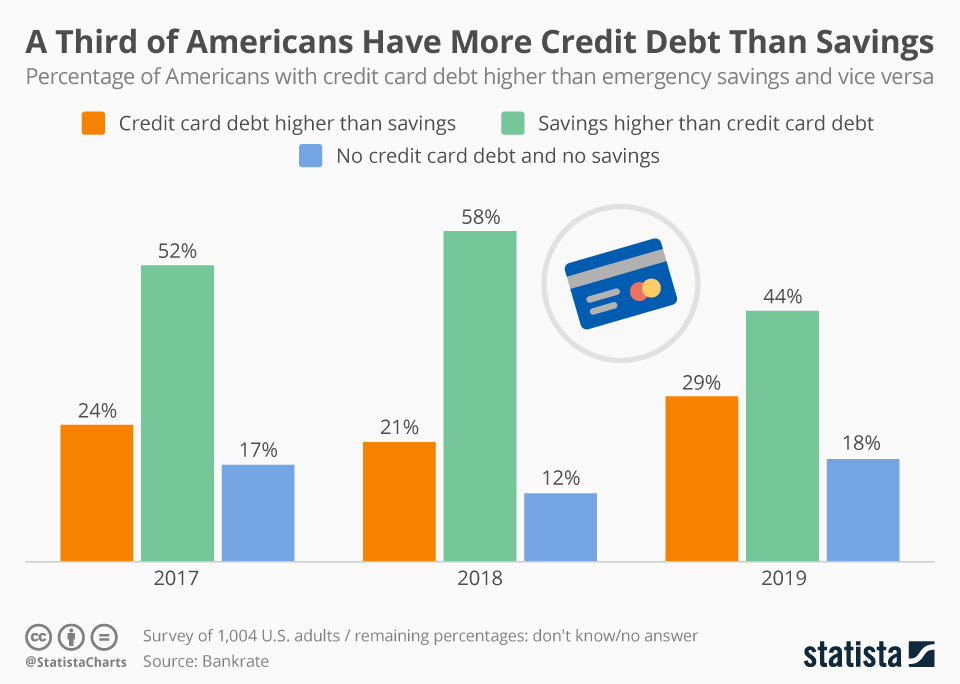

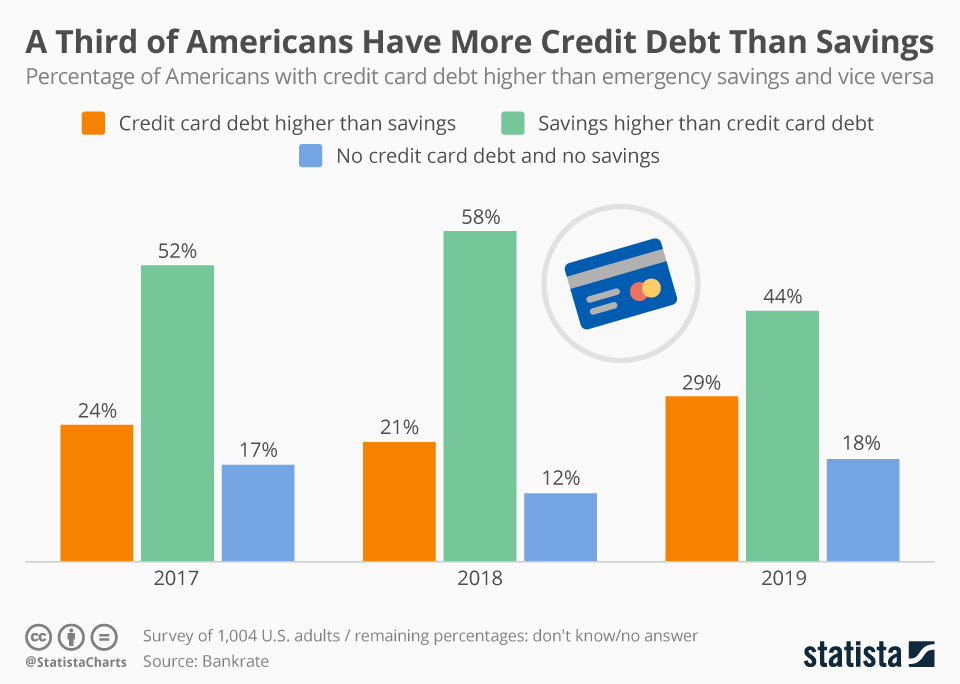

One Third of Americans Have More Credit Card Debt Than Savings

Statista ^

| 10/20/2025

| Anna Fleck

Posted on 10/20/2025 8:35:15 PM PDT by SeekAndFind

One in three Americans now have more credit card debt than emergency savings, according to the latest survey by financial services company Bankrate.

As Statista's Anna Flecks shows in the chart below, this is up ten percentage points from 2011, when the company first started polling the question.

Meanwhile, around 53 percent of respondents said that their savings were currently exceeding their credit card debt.

This is down two percentage points from the same time last year, but slightly up from 2011.

Around one in ten Americans are living paycheck-to-paycheck in 2025, not making any debt or saving up money.

You will find more infographics at Statista

Millennials were the most likely to say that they had tapped into their emergency savings over the past 12 months.

The most common uses for emergency savings among all groups were unplanned emergency expenses, such as car repairs or medical bills, followed by monthly bills, including rent and mortgages, followed by day-to-day expenses such as food.

TOPICS: Business/Economy; Society

KEYWORDS: creditcard; debt; savings

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

To: SeekAndFind

Maybe it’s because they’re stupid.

To: SeekAndFind

I guess the No Credit Card Debt and Savings was left off the graphic so as to not rub it in.

To: DIRTYSECRET

4

posted on

10/20/2025 8:42:16 PM PDT

by

dragnet2

(Diversion and evasion are tools of deceit)

To: DIRTYSECRET

I use my credit cards every month and pay them off every month.

Card issuers keep offering more credit, but I fon’t need or want it.

5

posted on

10/20/2025 8:48:48 PM PDT

by

Veto!

(Trump is Superman)

To: SeekAndFind

One man’s debt is another man’s asset.

Which one are you?

To: SeekAndFind

And some of us are living off the funds generated by our savings.

7

posted on

10/20/2025 8:55:42 PM PDT

by

glorgau

To: SeekAndFind

I pay off my debt with my credit card. As an old India professor said, “You don’t have to call it Deewoes. You can call it Chircles.”

8

posted on

10/20/2025 9:11:44 PM PDT

by

MtnClimber

(For photos of scenery, wildlife and climbing, click on my screen name for my FR home page.)

To: SeekAndFind

People have never been taught to budget and not impulse buy everything they lay their eyes on.

A little self-control could go a LONG way in resolving most of those issues.

9

posted on

10/20/2025 10:02:47 PM PDT

by

metmom

(He who testifies to these things says, “Surely I am coming soon." Amen. Come, Lord Jesus….)

To: SeekAndFind

10

posted on

10/20/2025 10:03:05 PM PDT

by

newzjunkey

(We need a better Trump than Trump in 2024... did we get it??)

To: newzjunkey

To: hole_n_one

I guess the No Credit Card Debt and Savings

was left off the graphic so as to not rub it in.I, too, caught that! But then I saw that they had simply subsumed that into "Savings higher than credit card debt."

Regards,

12

posted on

10/20/2025 10:16:28 PM PDT

by

alexander_busek

(Extraordinary claims require extraordinary evidence.)

To: DIRTYSECRET

I was caught in the quicksand of credit card debt. The amount between the monthly payments’ lowering of the amount owed and the maximum was all such a person has.

I feel sorry for anyone still in that horror.

13

posted on

10/20/2025 10:56:49 PM PDT

by

frank ballenger

(There's a battle outside and it's raging. It'll soon shake your windows and rattle your walls. )

To: SeekAndFind

14

posted on

10/20/2025 11:00:19 PM PDT

by

frank ballenger

(There's a battle outside and it's raging. It'll soon shake your windows and rattle your walls. )

To: SeekAndFind

Even if it’s just a dollar ahead versus a dollar behind, you sleep better a dollar ahead.

15

posted on

10/21/2025 3:12:54 AM PDT

by

BradyLS

(DO NOT FEED THE BEARS!)

To: SeekAndFind

And I’m betting that over half of these people are them Yogi

16

posted on

10/21/2025 3:35:05 AM PDT

by

albie

To: metmom

A little self-control could go a LONG way in resolving most of those issues.exactly

be able to separate your needs from your wants

17

posted on

10/21/2025 4:35:18 AM PDT

by

SisterK

(to do justly, to love mercy and to walk humbly)

To: metmom

A little self-control could go a LONG way in resolving most of those issues.exactly

be able to separate your needs from your wants

18

posted on

10/21/2025 4:35:19 AM PDT

by

SisterK

(to do justly, to love mercy and to walk humbly)

To: SeekAndFind

Not me. I just went through bankruptcy thanks to credit card debt. Now that I’m back at zero, I don’t find I need the plastic. Just have to be careful to stay out of hospitals and courtrooms.

19

posted on

10/21/2025 4:57:53 AM PDT

by

OrangeHoof

(Always spay or neuter your liberal.)

To: SeekAndFind

Seems to me Biden contributed the most for the multiplication of them.

20

posted on

10/21/2025 5:06:02 AM PDT

by

AZJeep

(sane )

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson