Posted on 10/10/2025 9:22:37 PM PDT by SeekAndFind

If there are two issues that dominate America’s online discourse, they’re the soaring cost of housing and the even steeper price of staying healthy.

The U.S. pours almost $13,000 per person into healthcare, yet average life expectancy is below nearly every other high-income nation.

It’s a study of contrasts.

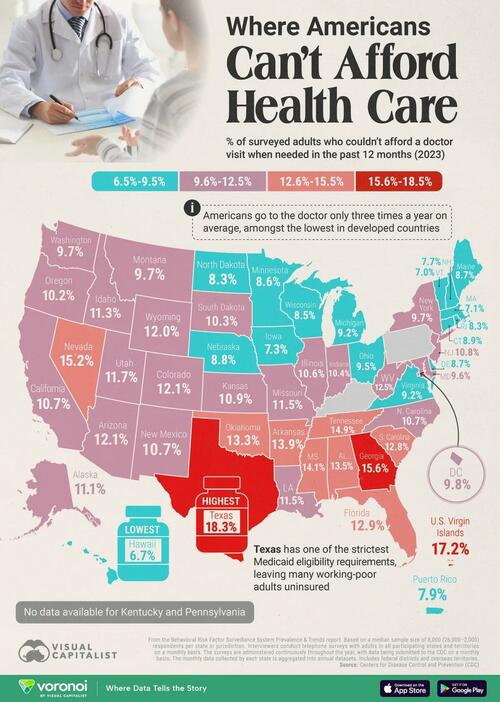

As Visual Capitalist's Pallavi Rao notes, the country boasts of state of the art facilities and cutting edge research, while nearly 10% of Americans can’t afford healthcare.

This number comes from Centers for Disease Control and Prevention’s Behavioral Risk Factor Surveillance System (BRFSS) data that lists the share of surveyed adults who skipped seeing a doctor in 2023 because it simply cost too much.

In the map and article below we break down the varying trends per state.

ℹ️ Note: Source figures unavailable for Kentucky and Pennsylvania.

Texas leads the nation in not being able to afford healthcare. More than 18% of surveyed adults said skipped a doctor’s visit due to cost, far above the 10.6% U.S. median.

| Year | Top revenue company in the U.S. | Annual revenue of the top company (USD, billions) |

|---|---|---|

| 1955 | General Motors | $9.8 |

| 1956 | General Motors | $12.4 |

| 1957 | General Motors | $10.8 |

| 1958 | General Motors | $11.0 |

| 1959 | General Motors | $9.5 |

| 1960 | General Motors | $11.2 |

| 1961 | General Motors | $12.7 |

| 1962 | General Motors | $11.4 |

| 1963 | General Motors | $14.6 |

| 1964 | General Motors | $16.5 |

| 1965 | General Motors | $17.0 |

| 1966 | General Motors | $20.7 |

| 1967 | General Motors | $20.2 |

| 1968 | General Motors | $20.0 |

| 1969 | General Motors | $22.8 |

| 1970 | General Motors | $24.3 |

| 1971 | General Motors | $18.8 |

| 1972 | General Motors | $28.3 |

| 1973 | General Motors | $30.4 |

| 1974 | General Motors | $35.8 |

| 1975 | Exxon Mobil | $42.1 |

| 1976 | Exxon Mobil | $44.9 |

| 1977 | Exxon Mobil | $48.6 |

| 1978 | General Motors | $55.0 |

| 1979 | General Motors | $63.2 |

| 1980 | Exxon Mobil | $79.1 |

| 1981 | Exxon Mobil | $103.1 |

| 1982 | Exxon Mobil | $108.1 |

| 1983 | Exxon Mobil | $97.2 |

| 1984 | Exxon Mobil | $88.6 |

| 1985 | Exxon Mobil | $90.9 |

| 1986 | General Motors | $96.4 |

| 1987 | General Motors | $102.8 |

| 1988 | General Motors | $101.8 |

| 1989 | General Motors | $121.1 |

| 1990 | General Motors | $127.0 |

| 1991 | General Motors | $125.1 |

| 1992 | General Motors | $123.8 |

| 1993 | General Motors | $132.8 |

| 1994 | General Motors | $133.6 |

| 1995 | General Motors | $155.0 |

| 1996 | General Motors | $168.8 |

| 1997 | General Motors | $168.4 |

| 1998 | General Motors | $178.2 |

| 1999 | General Motors | $161.3 |

| 2000 | General Motors | $189.1 |

| 2001 | Exxon Mobil | $210.4 |

| 2002 | Walmart | $219.8 |

| 2003 | Walmart | $246.5 |

| 2004 | Walmart | $258.7 |

| 2005 | Walmart | $288.2 |

| 2006 | Exxon Mobil | $339.9 |

| 2007 | Walmart | $351.1 |

| 2008 | Walmart | $378.8 |

| 2009 | Exxon Mobil | $442.9 |

| 2010 | Walmart | $408.2 |

| 2011 | Walmart | $421.8 |

| 2012 | Exxon Mobil | $452.9 |

| 2013 | Walmart | $469.2 |

| 2014 | Walmart | $476.3 |

| 2015 | Walmart | $485.7 |

| 2016 | Walmart | $482.1 |

| 2017 | Walmart | $485.9 |

| 2018 | Walmart | $500.3 |

| 2019 | Walmart | $514.4 |

| 2020 | Walmart | $524.0 |

| 2021 | Walmart | $559.2 |

| 2022 | Walmart | $572.8 |

| 2023 | Walmart | $611.3 |

| 2024 | Walmart | $648.1 |

| 2025 | Walmart | $681.0 |

Closely following are the U.S. Virgin Islands (17.2%), Georgia (15.6%), and Nevada (15.2%).

However the map shows a clear clustering of the worst rates.

Eight of the top 10 jurisdictions with the highest cost-related avoidance are in the South. This underlines how lower average incomes and higher uninsured rates compound affordability challenges.

ℹ️ Related: See the most recent data for average incomes by state.

Policymakers in these states have also been slower to expand Medicaid, a factor that researchers link to higher out-of-pocket burdens for residents.

For example, Texas has one of the strictest Medicaid eligibility requirements. Adults under 65 who aren’t disabled or raising a child are ineligible for Medicaid regardless of how low their income is, per Healthinsurance.org.

Even parents can only qualify if their household income is extremely low. This would make it impossible for parents to hold even part-time jobs, as they will lose health coverage if their earnings rise above the threshold.

ℹ️ Related: Texas has a 13% poverty rate, 11th-highest in the country.

At the other end of the spectrum, Hawaii (6.7%), Vermont (7.0%), and Massachusetts (7.1%) report the lowest shares of adults dodging care for financial reasons.

In Massachusetts’ case, a legacy of near-universal coverage dating back to its 2006 healthcare reform was a model for the Affordable Care Act.

Interestingly, high-cost-of-living states like New York and California sit close to the national median, suggesting that robust insurance networks can offset other cost pressures.

ℹ️ Related: Californians and New Yorkers have the lowest purchasing power in the U.S.

With the federal Medicaid continuous-coverage provision now expired, analysts expect affordability gaps to widen unless state safety nets expand.

If you enjoyed today’s post, check out How Often People Go to the Doctor, by Country on Voronoi, the new app from Visual Capitalist.

From my health care proposal:

AFFORDABILITY

Silver plans would be limited to a maximum deductible of three times the Medicare Part A amount [2025: $1676].

I would also make bronze plans low cost by having co-insurance up to $10,000 at up to 50% with the policy upfront amount paid up front to the insurance company by the insured. Policy percentages would normally be 20% and based on the Medicare amounts unless contractually specified otherwise. Policy percentages might be less for certain things and contractually capped by time periods, by say 50% of the upfront amount the first three months of the calendar year, 60% the first six months of the calendar year, 70% the first eleven months of the calendar year and the whole amount the whole calendar year. If and how an upfront amount would get invested would be subject to contract. Unused amounts of upfront money would be refunded after each policy is closed out. A policy would not be closed out until the time allowed for claim submission has expired.

I would also make copper plans low cost by only covering Part A scope items plus what Part B would pay for any general or regional anesthesia surgery. These would be like the Blue Cross/Blue Shield plans of my youth.

I would allow Federal PPACA exchanges to offer Interstate Class Drug Plans,

exempt from state control that cover under contract at the time of policy issue at least:

1. 80% of all FDA-approved recombinant drugs by key active entity

2. 80% of all key FDA breakthrough chemical active entities under patent as of January 1 of the coverage year

used in a drug approved by the FDA by August 1 prior

3. 80% of all key chemical active entities under patent as of January 1 of the coverage year

used in a drug approved by the FDA by August 1 prior

4. 90% of all WHO “essential” drugs

This system would allow for genuine negotiation between drug plans and drug companies. Drug plans would have an incentive to try to buy drugs from drug companies and drug companies would have an incentive to make deals to make sales.

In-plan drugs would be supplied at on an all-the doctors prescribe basis. The co-pays would be roughly equal to mere manufacturing cost. Out-of-plan drugs need not be covered at all.

The new bronze, copper and Interstate Class Drug Plans are meant for higher income folks and would not be PPACA subsidy eligible.

“good health insurance”

MRI room - MRIs $50

Please select the scan you want from the screen.

Please select where you would like the images sent.

Enter your e-mail address to have images sent to your e-mail.

Please put your stuff including all metal in a locker and then step into the metal detector room.

Now crawl into the MRI.

Yell ‘five’ and the scan will begin in five seconds.

“good health insurance”

Bro, you want an ultrasound scan? $25, including a reading by my certified lady friend and a flash drive loaded with the imaging.

People seem to me to be fatter than just a few years ago.

My flight from San Diego had six heavies who waited for boarding in wheelchairs. At first I thought it was just a California problem, but I’ve noticed an increase in Florida too.

Doctors might be able to confirm my observation.

Junk food has been around a long time.

“video...long”

Bellies are not the only things in need of reduction.

“insurance for Americans between 55 and 65”

Americans might retire at age 55, live overseas until age 65 and rent out their house on a 10-year lease.

The rental income might be enough to qualify for highly subsidized PPACA coverage. Emergency foreign coverage could be bought.

170 days in Ireland, 170 days in the UK, 170 days in France, 170 days in Israel, etc.

It’s not only an affordability issue; there’s also the surprise billing risk.

Nearly every other high-income nation is more homogenous than the USA. Remove from the average life expectancy the populations of "victim classes,"

e.g., illegal aliens, hispanics, and blacks, and the life expectancy dramatically rises.

The data is based on surveys asking persons if they experienced health care they could not afford in the last month.

Most people do not like to answer surveys, which immediately reduces who will answer the survey. After that, and acknowledging that, just how scientific is the survey, and therefor how accurate are the results??

I work in the facilities / engineering department at a large university/med-center. The amount of money wasted boggles the mind. Wall-to-wall vice presidents, assistant vice presidents, executive directors, directors, deputy directors, administrators….i need a dozen signatures to get a construction project approved and funded. Eight of these people are paid $300K or better.

This does not mean less care if available per capita, but that the pop. has less to spend. Top 5 states with the most Michelin-starred restaurants. California 85

New York 68

Florida 26

Washington, D.C. 24

Illinois

this will probably be the one and only time it happens, but my work health insurance will be 1700 a month. I went full Medicare, A,B, D and G and will save me a bunch of money even if it’s forcing my wife to get her own.

Our system is broken because all the hangers ons in this country have loaded our system down. This forces the now seasoned citizens who have paid in all this time to foot the bill further, which is total bullshit.

Me on Medicare and my wife having to get her own is going to run is roughly around 1000 and change. Compared to my work insurance for both going up to 1700.

Now I will have to wait and see how this effects my taxes since my work medical plan is a before tax plan.

I got one for my son through the ACA. $65 a month because he doesn’t get paid much.

The Medicare prescription plans SUCKS!

The *donut hole* of almost no coverage for prescription meds is an abomination.

We’ve found Good RX to be the best option outside of that, so because we are FORCED to have a prescription plan on Medicare, we went with the absolute cheapest and don’t use it.

I guess I’ll be finding out soon enough. We use GoodRx time to time. So far I don’t have any bank breaking scripts.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.