Skip to comments.

India’s Silver Grab Sends Shockwaves Through Global Markets—While Wall Street Fiddles with Fantasy StocksAs India corners

Silver academy ^

| 19 Sep 25

| Silver Academy

Posted on 09/20/2025 11:05:13 AM PDT by delta7

As India corners the world’s silver and China gobbles gold, Western investors pile into sky-high tech valuations—could one major move into silver send prices rocketing in the blink of an eye?……

The Great Silver Rush: Is India Outsmarting the World? India isn’t just importing silver—they’re scooping up every ounce they can find, pushing prices through the roof and sending a signal to global markets. Can anyone stop India’s relentless pursuit of “the people’s precious metal”? What do they know that Western investors ignore?

China’s Golden Appetite: Why Gold, Why Now? Just as India is flooding its vaults with silver, China is quietly amassing gold at a record pace. What game are these two giants playing—is silver fueling India’s industry while China prepares for currency wars with gold? Is it possible both are preparing for a new monetary era?

Silver: Where’s the Scrap? Why Are Investors Refusing to Sell? Every other price rally, India’s scrap dealers feast as silverware and jewelry pour in from profit-takers. Not this year—there’s barely a trickle. Are we witnessing a new mindset, where investors clutch silver as the asset of last resort? Will holding silver become the national sport?

ETF Frenzy: The Smart Money Floods Into Silver Silver ETFs in India are setting records, with inflows tripling as fast as gold’s. Are big players hedging chaos or simply chasing a once-in-a-generation rally? If smart money is flooding in, is this the sign that silver is finally taking center stage?

Wall Street’s Fantasy Island: Are Western Stock Valuations Just a Mirage? While India loads up on silver, Western investors drool over tech stocks like Nvidia and Microsoft—valued at nosebleed levels, sometimes 10 times annual profits, and carrying a $4 trillion market cap. Is Wall Street’s bubble destined to pop? And what happens when the massive flows seeking real value crash into silver’s tiny market?

Tick Tock: Could Meme Stock Cash Flee to Silver for Safety?…..

TOPICS: Business/Economy

KEYWORDS: silver; silvergrab

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Silver, the most undervalued physical asset on the planet….get ready, buckle in.

1

posted on

09/20/2025 11:05:13 AM PDT

by

delta7

To: delta7

I only have about 9 pounds.

2

posted on

09/20/2025 11:08:28 AM PDT

by

airborne

(Thank you Rush for helping me find FreeRepublic! )

To: delta7

My guess is they are tired of being threatened with dollar based sanctions.

3

posted on

09/20/2025 11:14:39 AM PDT

by

rottweiller_inc

(Lupus urbem intravit. Fulminis ictu vultures super turrem exanimat.)

To: delta7

India has always dealt in Silver, nothing new there.

To: delta7

Wall Street and the big banks are finally starting to recommend gold to their clients (after first securing big positions for themselves).

Get ready for the public to start pouring in to both silver and gold...

5

posted on

09/20/2025 11:17:47 AM PDT

by

chud

To: airborne

PM’s are measured in Troy ounces. Good you measure by weight and not in ever declining paper dollars…..it is taking more and more USD’s to buy a Troy ounce.

Silver Price Performance USD

Change Amount %

Today +1.28 +3.07%

30 Days +3.71 +9.73%

6 Months +8.34 +24.91%

1 Year +10.66 +34.23%

5 Year +17.05 +68.88%

20 Years +34.47 +469.67%

The average Joe can’t wrap his head around the fact USD’s and all paper currencies are rapidly declining….PM’s aren’t going up, the unit of measure ( USD’s) to buy is declining, rapidly.

6

posted on

09/20/2025 11:19:21 AM PDT

by

delta7

To: Captain Peter Blood

India has always dealt in Silver,

—————

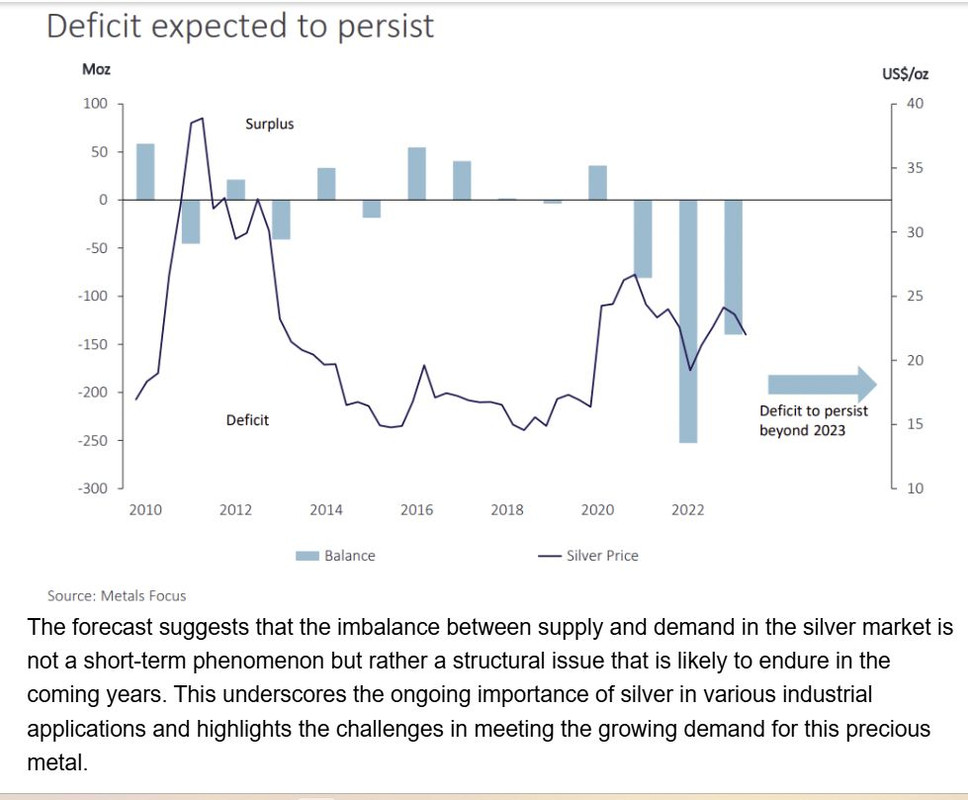

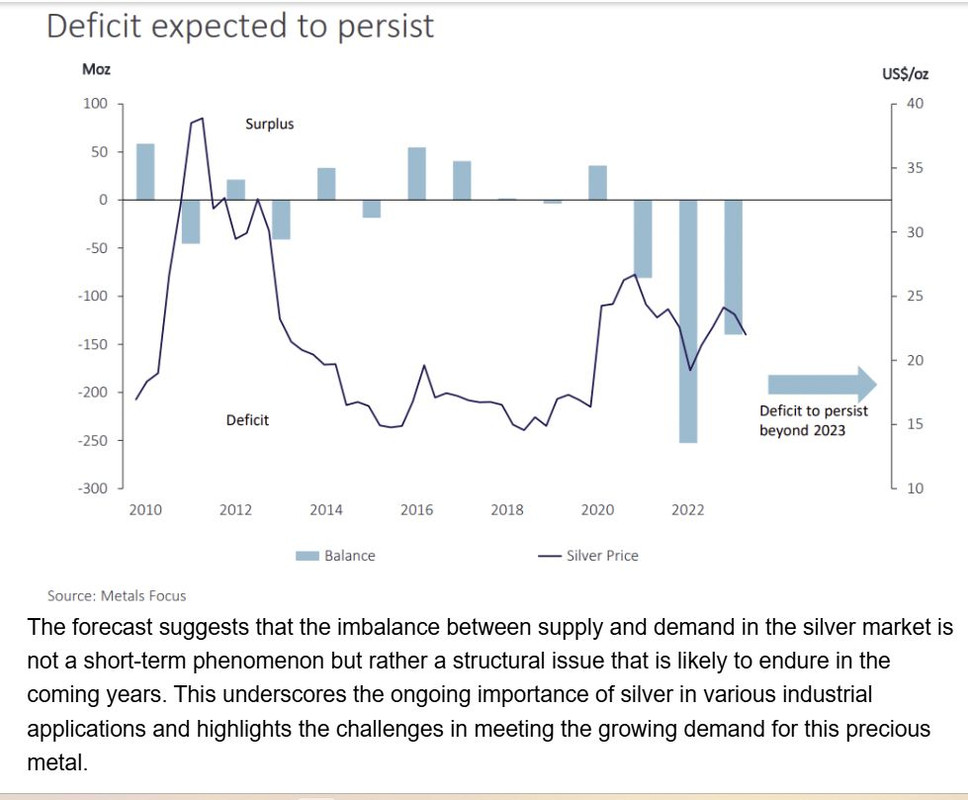

Never in such historical quantities…view the article’s graph….the canary in the coal mine.

7

posted on

09/20/2025 11:22:27 AM PDT

by

delta7

To: delta7

The Indians should talk to the Hunt brothers about that, if they weren’t dead now.

To: delta7

9

posted on

09/20/2025 11:26:17 AM PDT

by

delta7

To: chud

“Get ready for the public to start pouring in to both silver and gold...”

Where’s our audit of our gold reserves?

10

posted on

09/20/2025 11:27:46 AM PDT

by

dljordan

(The Rewards of Tolerance are Treachery and Betrayal)

To: delta7

11

posted on

09/20/2025 11:30:26 AM PDT

by

Varsity Flight

( "War by 🙏 the prophesies set before you." ) I Timothy 1:18. Nazarite warriors. 10.5.6.5 These Days)

To: delta7

Question, what is to stop the government from, as they have many times, confiscating the gold and silver the public is hoarding?

12

posted on

09/20/2025 11:38:41 AM PDT

by

Frank Drebin

(And don't ever let me catch you guys in America!)

To: Frank Drebin

In 1933, FDR took the gold, but not the silver. Silver remained, even in coinage. Until 1964, that is.

But, things are somewhat diff today - in 1933, they were strengthening and promoting the inflation of the FED and fiat. Today, there are so many signs of the inverse of that - changing the FOMC members, threatening Powell, audits off FED, audits of Ft Knox, exposure of the real motivations of the non-federal non-reserve federal reserve.

Besides, after the plandemic, the quaccines, J6, 2020 stolen election, etc, stackers will simply keep stacking in the face of any possible confiscation. They'll have their boats ready, packed with firearms AND PMs.

13

posted on

09/20/2025 11:58:03 AM PDT

by

C210N

(Mundus vult decipi, ergo decipiatur.)

To: delta7

PM’s aren’t going up, the unit of measure ( USD’s) to buy is declining... Well said!

People should consider that when EVERYTHING seems to be in a bubble (BTC, housing, DOW, S&P, NASDAQ, food prices, PMs), nothing is in a bubble. The only truth is that when the EVERYTHING bubble pops, like a game of musical chairs, the only viable chairs are real money - AU/AG. Everything else (BTC too) reverts to their intrinsic value. BTC/fiat/DOW/S&P/NASDAQ intrinsic value is $0. Real assets like property and land have a good deal of intrinsic value. AU/AG have the most, as everything, EVERYTHING, are derivatives of.

14

posted on

09/20/2025 12:03:52 PM PDT

by

C210N

(Mundus vult decipi, ergo decipiatur.)

To: delta7

It makes me wonder why people think bitcoin is a good investment.

15

posted on

09/20/2025 12:07:14 PM PDT

by

airborne

(Thank you Rush for helping me find FreeRepublic! )

To: airborne

Not to brag, but we have 55 lbs 😁

16

posted on

09/20/2025 12:43:38 PM PDT

by

Man from Oz

(Beneath all leftist intellect, a tyrant is lurking)

To: delta7

Throw in China's vast buying directly from the silver miners around the world (which quantities are unknown) along with the deficits, who knows where the price will go when companies start panic buying like they did with Rhodium some years back. As a perspective, 43 dollars today is the same as 4 dollars in 1964.

AI Overview

"The global silver market experienced a significant deficit of 148.9 million ounces in 2024, marking the fourth consecutive year that demand outpaced supply [1] [2] [3] [4]. This shortfall was primarily driven by record industrial demand, particularly from green economy applications and artificial intelligence-related technologies, despite a slight decline in overall silver demand due to weaker physical investment [1] [2] [5].."

To: Karl Spooner

To: Frank Drebin

Question, what is to stop the government from, as they have many times, confiscating the gold and silver the public is hoarding? An armed and much more belligerant portion of the populace that no longer worships the government. This isn't FDR's America.

19

posted on

09/20/2025 2:00:17 PM PDT

by

ChildOfThe60s

(If you can remember the 60s, you weren't really there)

To: Frank Drebin

Question, what is to stop the government from, as they have many times, confiscating the gold and silver the public is hoarding? An armed and much more belligerant portion of the populace that no longer worships the government. This isn't FDR's America.

20

posted on

09/20/2025 2:00:18 PM PDT

by

ChildOfThe60s

(If you can remember the 60s, you weren't really there)

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson