Skip to comments.

China Unlocks Gold-Backed Yuan: The Dawn of a New Global Reserve EraYuan’s gold convertibility lets global trade bypass the dollar, accelerating a shift to a gold-anchored, multipolar financial order.

Silver Academy ^

| 18 Sep 25

| Silver Academy

Posted on 09/18/2025 8:41:37 PM PDT by delta7

Hong Kong’s push to become a global gold trading and reserve hub highlights a sharp contrast between real assets and endlessly printed fiat money. While the United States continues expanding its money supply — diluting purchasing power through debt-driven policies — China and now Hong Kong are moving in the opposite direction, stacking tangible wealth in the form of gold. By targeting storage capacity of over 2,000 tonnes within three years and rolling out tokenized gold investment tools, Hong Kong is positioning itself at the center of a new gold-based financial system.

Unlike dollars that can be created with a keystroke, gold holds centuries of trust as a store of value and hedge against inflation. Expanding RMB bond issuance further strengthens this pivot away from dollar-dependence. In short, while Washington leans on printing presses, Asia is quietly building a hard-asset foundation that wins global confidence in the long run.

Bank of China Billboard. Depicting the Gold backed Yuan.

The global financial system has reached a watershed moment: the US dollar's status as the world's uncontested reserve currency is rapidly eroding as nations urgently diversify away from US Treasuries and embrace gold as the ultimate reserve asset. In the wake of the weaponization of the dollar, especially after the 2022 sanctions on Russia, the world has woken up to the risks of holding dollar assets that can be frozen at a political whim. Consequently, central banks and sovereign wealth funds are dumping US debt and stacking gold at a record pace—a paradigm shift with immense consequences for US hegemony, international trade, and global power structures.

Sanctions, Weaponization, and the Spark of Exodus

The catalyst for this exodus was the US decision to freeze Russia's foreign reserves after its invasion of Ukraine in 2022. For decades, countries had used US Treasuries as risk-free reserves underpinning trade and economic stability. Suddenly, the message was clear: dollar reserves were only safe as long as the holder remained in Washington's good graces. This was not lost on other nations, especially those wary of US power or facing geopolitical friction.

As a result, the process of "de-dollarization" accelerated. Nations like India and China, along with scores of emerging markets, took dramatic steps to reduce their exposure to the dollar system, not out of theoretical opposition but hard-earned fear of being the next target.

Global Shift: From Treasuries to Gold

The scale of the shift is unprecedented. India, for example, slashed its US Treasury holdings by $15 billion in a single year, while boosting its gold reserves by nearly 40 tonnes in the same period. China, the world's second-largest economy, has consistently added to its gold reserves for more than ten months straight, now holding over 74 million ounces, while aggressively selling Treasuries and reducing exposure to dollar risk.

Chinese traders have flooded the Shanghai Futures Exchange vaults, setting records in gold inflows as economic and political uncertainty makes real assets like gold vastly more attractive than fiat promises from Washington. The implications are clear: for the first time in decades, gold is behaving as the world's alternate reserve asset, outshining both the dollar and US debt as the anchor of sovereign wealth.

Gold as the Untouchable Reserve

Unlike dollars or US bonds, gold cannot be sanctioned or frozen by any government. This makes it uniquely appealing, especially to countries often in Washington's crosshairs—Russia, Iran, Venezuela, and now even major emerging economies like India, Brazil, and South Africa. Gold is being used for trade settlement, wealth storage, and even as a backdoor way to circumvent the global reach of US sanctions.

The Pozsar-Glazyev Playbook, which envisions commodities like oil being traded for gold directly (rather than settled in dollars), is no longer just academic theory—it is being tested by Moscow, Beijing, and Delhi in real transactions. Imagine oil and gas, the lifeblood of the global economy, being priced in grams of gold rather than barrels of Brents or dollars. Should this model catch on, the ramifications for the dollar are seismic: a collapse in demand for US Treasuries, chronic fiscal deficits in Washington, and a power shift eastwards.

The Chinese Yuan: Quietly Backed by Gold

China's latest moves turbocharge this transformation. On June 26, 2025, the Shanghai Gold Exchange announced new gold trading contracts accessible offshore via Hong Kong, along with designated gold vaults that allow physical delivery and storage for international clients. This is not just a technical upgrade; it is a clear signal that the yuan is on its way to becoming, in effect, a gold-backed currency.

For the first time, surplus yuan from global trade can be instantly converted to physical gold, making the yuan not just a trade currency but a store of value—something previously reserved for the dollar. International counterparties, for years skeptical of the yuan's "closed market" status, now have unprecedented confidence that surplus yuan can always be redeemed for gold at market price through authorized Hong Kong vaults. This is monetary diplomacy with a quiet, devastating force: gold convertibility, without the fanfare or risk of a formal announcement.

The Internationalization of the Yuan

China's gold convertibility path has made the yuan a credible global trade unit—one that is overtaking the dollar in China's cross-border settlements (now at 52% versus 43% in dollars). As the yuan is used more for trade, debt issuance in yuan grows (Brazil, Egypt, and others have recently issued yuan-denominated debt), further embedding China's currency in the global system. This inexorable process makes de-dollarization a mathematical certainty, eroding the dollar's foundational place without the need for a grand Bretton Woods reset.

Implications: The End of an Era……

TOPICS:

KEYWORDS: 50centarmy; antiamericanism; antimaga; bloggers; fiftycentarmy; gold; ibtz; nevertrumpers; nevertrumpingtrolls; redchina; tds; theyrestillcommies; zot

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-51 next last

President Trump had better get busy auditing our Gold reserves, (as promised) , before it is to late. The world’s Wealth is rapidly shifting from the West to the East.

The world is losing their appetite for unbacked, debasing currencies, especially the USD. ( thanks Joe-weaponizing the dollar has many consequences).

1

posted on

09/18/2025 8:41:37 PM PDT

by

delta7

To: delta7

I knew this was why China had been cornering the Gold markets....Won’t be long before the Dollar is dead.

To: delta7

Good think China doesn’t have any debt.

3

posted on

09/18/2025 8:45:10 PM PDT

by

Uncle Miltie

(Right_In_Virginia’s 84% Plausibly Anti-Semitic posts put him at #1! Any challengers?)

To: All

Stack gold and silver while you still can.

4

posted on

09/18/2025 8:48:22 PM PDT

by

chud

To: delta7

of course they are moving away from US treasuries. When you run the deficit #s up, and Trump is guilty of this, you can expect ppl not to hold your debt. It aint rocket surgery,

To: delta7

2k tons sounds like a lot, but is not. It’s dense and heavy as hell.

6

posted on

09/18/2025 8:57:58 PM PDT

by

chiller

(Davey Crockett: "Be sure you're right. Then go ahead". (We'll go ahead))

To: delta7

> gold cannot be sanctioned or frozen by any government <

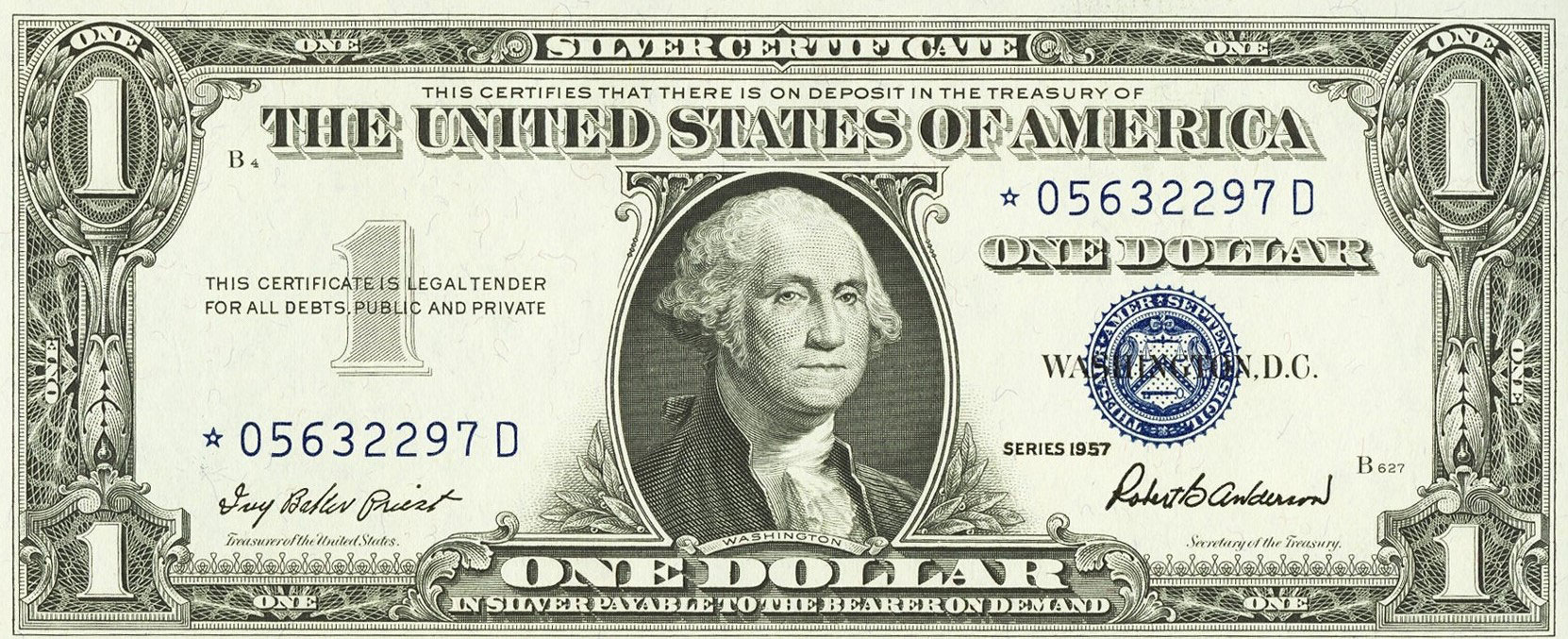

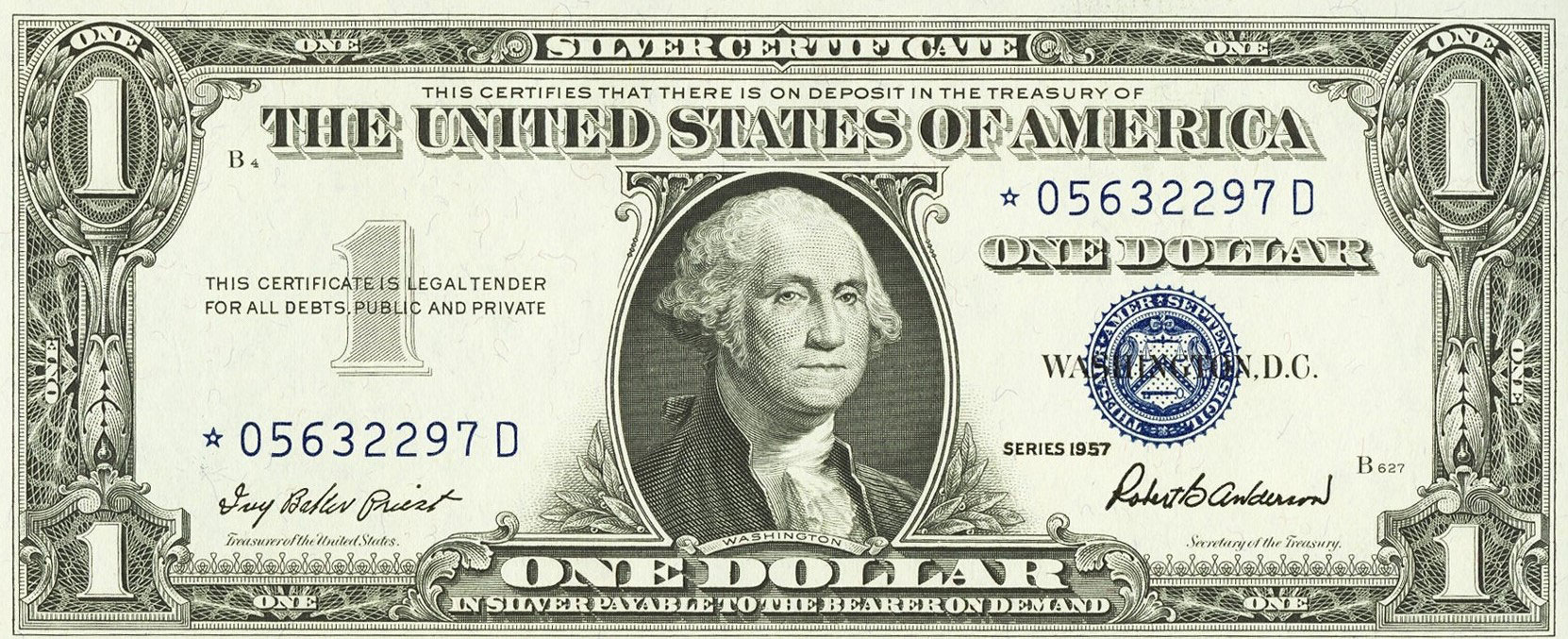

True. But couldn’t China simply cancel it’s gold-backed currency at any time? Just like how US silver certificates once could be redeemed in silver.

Then in 1968 the federal government stopped that. You could still hold silver certificates. But you could no longer redeem them for silver.

Notice what it says under the ONE DOLLAR.

7

posted on

09/18/2025 9:01:55 PM PDT

by

Leaning Right

(It's morning in America. Again.)

To: delta7

Trusting that the Chicoms will fairly manage anything is like trusting the Hussein/Biden Regime to honor the Founding Fathers.

Or like trusting the Clintons to honor their marriage vows.

To: dpetty121263

Your interest rates could triple to keep people buying your bonds.

The the deficits might be $6 trillion/yr.

9

posted on

09/18/2025 9:06:12 PM PDT

by

Jonty30

(Pornography feeds abortion. Abortion is Satan's ultimate effort to hurt God. )

To: delta7

So when will there be a gold backed Yuan? 10-20 years from now? And what percent gold backing will be very important. Will it be 20-30% gold backed? History is full of partially gold backed currencies that bit the dust. The Chinese are degenerate gamblers, they love to mess around with their 100% fiat currency.

“Switzerland’s Swiss franc was gold-backed at a statutory rate of about 40% until 1999, when the Swiss constitution was amended to remove the requirement and sever the official gold link.”

10

posted on

09/18/2025 9:09:33 PM PDT

by

dennisw

(There is no limit to human stupidity ||| Anarchism and Bureaucratism are two sides of the same coin)

To: delta7; dpetty121263; chud; Texas_Jarhead

The basic problem is that gold does not increase in direct proportion to economic activity. It is always a fraction of the need for something to serve as a medium of exchange, so you are always relying on some paper/electronics currency.

Of course, that does not mean the dollar is not in a world of hurt.

11

posted on

09/18/2025 9:13:44 PM PDT

by

Retain Mike

( Sat Cong)

To: Leaning Right

“True. But couldn’t China simply cancel it’s gold-backed currency at any time? Just like how US silver certificates once could be redeemed in silver.”

Nations canceling their gold backed currency happens all the time. History shows this to be true. And they always screw around with their gold backed currencies. They are never 100% gold backed. More like 30-40% gold backed.

12

posted on

09/18/2025 9:14:16 PM PDT

by

dennisw

(There is no limit to human stupidity ||| Anarchism and Bureaucratism are two sides of the same coin)

To: delta7

What ALL of us are doing is losing faith in Democrats, be they from the Americas, Chinese, Russian or European. Precious metals can’t feed you, faith in your fellow man can.

13

posted on

09/18/2025 9:16:10 PM PDT

by

rellic

(No such thing as a moderate Moslem or Democrat )

To: Leaning Right

True. But couldn’t China simply cancel its gold-backed currency at any time?—————

Highly unlikely with China ( SGE) now opening global Gold depositories world wide, Singapore, Dubai, etc. Their Yuan will be fully redeemable in Gold at worldwide locations.

The world wants physical Gold, not paper currencies which are declining severely in purchasing power…as witnessed by the world’s biggest money, the Central Banks, buying historic tons.

14

posted on

09/18/2025 9:28:18 PM PDT

by

delta7

To: delta7

Hey, another exciting opportunity for Putin Fanbois to invest in your Quisling Fund (QUIF)! Remember Putin Fanbois, its never too early to invest in the finest Chi-Com tungsten bars.

Oh wait, I mean gold bars, and totally not tungsten bars with a few microns of gold electroplated on.

15

posted on

09/18/2025 9:36:53 PM PDT

by

Pilsner

To: delta7

The Chinese leadership might be buying the gold for the time when they have to flee the country because they cant stop China’s collapse.

16

posted on

09/18/2025 9:37:36 PM PDT

by

Jonty30

(Pornography feeds abortion. Abortion is Satan's ultimate effort to hurt God. )

To: chiller

2k tons sounds like a lot, but is not. It’s dense and heavy as hell.

————

China has quietly acquired 40,000 tons over the last few years….to the US’s claimed 8,000 tons Trump has broken his promise of a U.S. Gold audit, which will have huge consequences.

“ Dense and heavy” is why it has been Wealth for 5,000 years. You can’t print it at will like paper currency.

17

posted on

09/18/2025 9:37:38 PM PDT

by

delta7

To: Jonty30

The Chinese leadership might be buying the gold for the time when they have to flee the country

—————-

“ He who has the gold makes the rules’”.

President Trump

Truth Social

20 April

That said, the reason for no Gold audit may, just may be the fact the U.S. holds MORE than 8,000 tons. Time will tell.

18

posted on

09/18/2025 9:43:07 PM PDT

by

delta7

To: delta7

That could be true, the US having more gold than reported.

19

posted on

09/18/2025 9:46:52 PM PDT

by

Jonty30

(Pornography feeds abortion. Abortion is Satan's ultimate effort to hurt God. )

To: delta7

We can believe China.

They never lie.

20

posted on

09/18/2025 9:50:44 PM PDT

by

lonestar67

(America is exceptional)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-51 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson