I would not lock in 20 years for 5%. I would at 8%. However I'm happy that you do. I remember higher inflation and the US debt and inability to control the budget is a risk.

Posted on 04/23/2025 4:20:02 PM PDT by Aquamarine

Is it a bond market crisis — or not? That is the question many investors are pondering at this moment of worrying moves.

"I wouldn't say it's a crisis," Charles Schwab (SCHW) chief fixed income strategist Kathy Jones told Yahoo Finance Executive Editor Brian Sozzi on Yahoo Finance's Opening Bid podcast (see the video above or listen below). "It's just different [this time]."

Jones has been closely studying the bond market for years, with a résumé that includes stints with Morgan Stanley (MS) and Citigroup (C). She has been at Charles Schwab for nearly 15 years.

During her tenure, markets have provided all kinds of moments that worry investors and speculators alike. "I've been doing this a very long time, and I've been through several crises," Jones said, citing the tech bubble burst in 2000 and the blowup of hedge fund Long-Term Capital Management as examples. "Every big event has its own unique qualities."

Bonds have traditionally been used for balancing portfolios or reducing investors' risk exposure to the stock market. Typically, when stock prices have gone down, bond prices go up. But both markets have proven to be a bit rockier lately, with stocks and bonds declining in tandem.

Often, woes around bonds turn to concerns about whether the US will default on its future debts, or if these moments might signal a deeper risk of recession.

(Excerpt) Read more at finance.yahoo.com ...

I am locked in at 5% interest in 20 years maturity Treasury bonds.

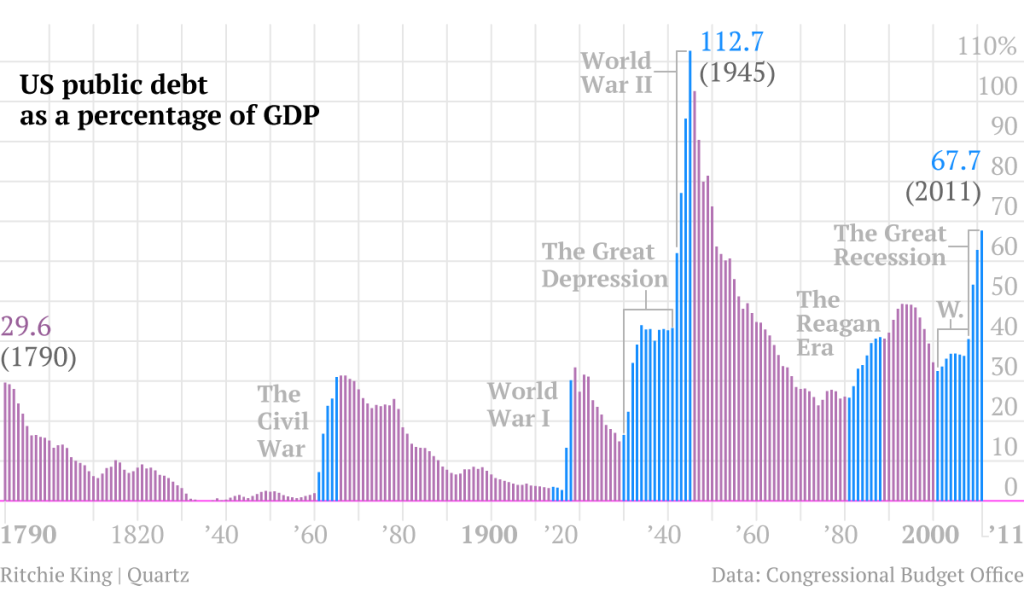

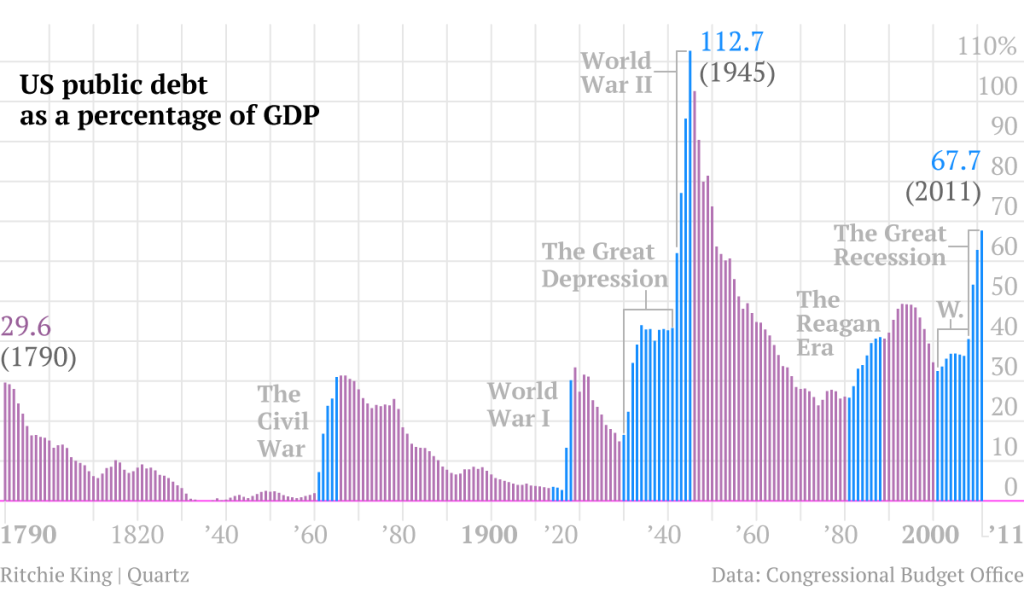

Well, interest rates have dropped a little bit since I purchased the bonds in open trade, so they are worth more than what I paid for them. I would love to lock in 8% but sriously, federal govt can no longer afford 8% interest rates to pay out on new issues. The national debt is at record levels. Currently they are paying out One Trillion/year to service the national debt already.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.